How an L.A. indie bookstore’s GoFundMe inspired a small business lifeline

On a Tuesday morning in September, Raymond Wurwand was in his Southern California home sipping tea and reading the newspaper when he happened upon a story about struggling independent bookstores. The print headline read: “Spine-tingling bookstore woes: Some shops, including Diesel, are turning to fundraising to survive. Shelve 2020 as horror.”

He turned to his wife, Jane Wurwand, and said: “We’ve got to do something.”

In partnership with Pacific Community Ventures and TMC Community Capital, the owners of skin-care company Dermalogica decided to launch Found/L.A. Small Business Recovery Fund, a $1-million grant program to help small minority-owned businesses in Los Angeles County stay open during the pandemic. Among the eligibility requirements: Applicants must own at least 50% of a brick-and-mortar shop, employ fewer than 20 people, and provide evidence of profitability before the pandemic. The Wurwands received 2,430 applications for the first round of grants — from restaurants, salons and cafes as well as gyms, retail stores and day-care centers. Ten were randomly selected. Applications for the second cycle open Jan. 11.

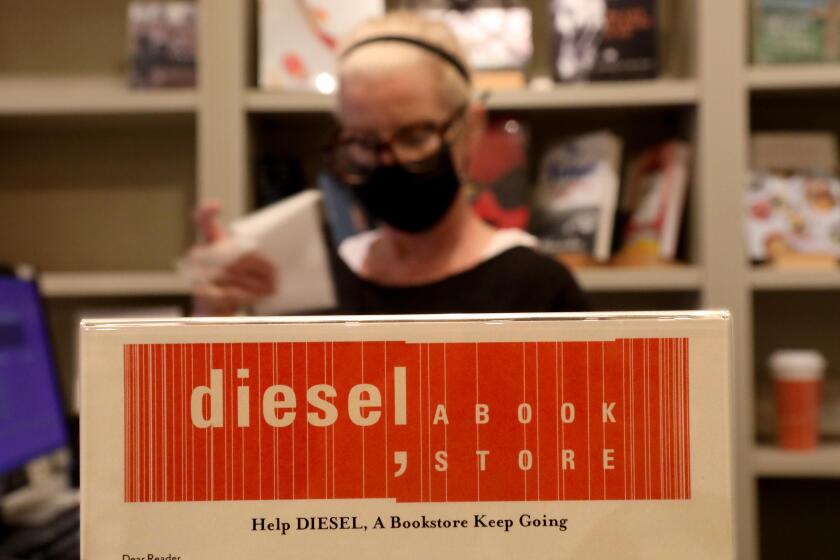

“We built Dermalogica through selling to small salons, so we built our business through selling to small entrepreneurs who have been devastated by COVID-19,” said Jane in a recent Zoom interview. “So as we read the piece, we realized that could’ve been our story, but we’ve been extremely fortunate. Our salons were exactly like Diesel,” she said. Diesel, a Bookstore, with locations in Del Mar and Brentwood, is one of many businesses that have made public pleas for support. “That’s who employs the neighborhood.”

Beloved L.A. bookstores like Diesel are turning to fundraising platforms to survive the financial blows dealt by COVID-19.

The longtime philanthropists typically offer minority businesses micro-loans through their Wurwand Foundation, but Diesel’s pandemic struggle put into sharp focus the need for direct, no-strings assistance — some small businesses just can’t take on any more debt.

Some 7,500 businesses in L.A. have permanently closed since March 1, according to a local economic impact report published by Yelp in September — the largest number of closures in any U.S. metropolitan area. Stores and restaurants represent the bulk of closures, with owners of color disproportionally affected. A university study published in May found that 41% of Black-owned businesses across the country shut down between February and April. The number of shops owned by Latinos, Asians, immigrants and women dropped 32%, 26%, 36% and 25%, respectively.

These closures are what worry Jane Wurwand. “The thing I’m fearful the most of after this is, when we lift our heads and look around our communities and neighborhoods, I think we’re going to see a lot missing, and we have to rebuild our main streets in our neighborhoods because otherwise we just don’t have a point of connection,” she said. “I want to live near the local bookstore and the local salon. I don’t want to live next door to the Amazon warehouse.”

One new beneficiary, Rice and Noodle, has been holding on by a thread this year.

Lunch sales at the tiny Thai and Vietnamese restaurant fell by more than 60% after offices in the area closed. Owner Kwan Chotikulthanachai, 43, was forced to lay off all her employees. She hasn’t been able to pay full rent since May, and she didn’t qualify for Paycheck Protection Program or economic injury disaster loans. Cleaning and sanitizing supplies have added more costs. But with her partner and chef, Son Ongjampa, she’s managed to hang on, her 8-year-old son, Hugo, and 6-month-old baby, Ethan, at her side.

When she found out Monday night via email that she would receive a $5,000 grant, she cried.

“I was so happy,” Chotikulthanachai said tearfully in a phone interview Wednesday. “It’s like I won the lottery.” Hugo joyously jumped and screamed. She called her mother in Thailand — who cried, too.

“I’m working so hard,” she said. “This time has been incredibly difficult, but I cannot give up. I don’t want to close my restaurant.”

Owning a business has been a dream for Chotikulthanachai. She grew up in the restaurant world in Bangkok, where her mother ran her own place. She opened Rice and Noodle in 2018 with the help of family, and hopes someday to hand it down to her son. “I cannot let my family fail with me.”

Adrianna Cruz-Ocampo also sighed with relief this week. The owner of U-Frame-It Gallery, a custom frame shop with locations in Tarzana and North Hollywood, closed her store for four months at the start of the pandemic. Sales dropped up to 50% after movie and television studios shut down, stripping her of a reliable source of revenue. She received PPP and Small Business Administration loans, but the latter money was sent to the wrong person; she doesn’t have the funds, but she’s getting invoiced for payments.

Through it all, she kept her employees on the payroll, building cabinets, tables and other pieces to organize the store while the doors remained closed to the public.

Cruz-Ocampo, 55, kept working, too, despite fears of contracting the virus. She has scleroderma, an autoimmune disease that makes her vulnerable to severe complications from COVID-19.

On Tuesday morning, while she was getting ready for work in the bathroom of her Northridge home, Cruz-Ocampo opened an email: “Congratulations on the L.A. Small Business Recovery Fund,” it read. “U-Frame-It Inc. has been awarded a FOUND/LA Recovery Grant for the amount of $22,500.”

She screamed.

“I’ve been behind on rent, and this will help me keep my employees,” she said in a phone interview. “This is like a bridge, a lifeline, to get through a very, very hard year. This is a blessing.”

Cruz-Ocampo left Colombia for the U.S. with her family when she was 9. After getting her associate’s degree in business administration from Pierce College, she bought the frame shop in the 1980s with savings and a business loan. She opened a second location in Tarzana in 2000.

“It’s like a Christmas present, a huge Christmas present,” said Cruz-Ocampo. “It makes me feel something good about this Christmas. As bad as it’s been, it’s ending really well.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.