Column: California’s tax system needs to be overhauled. Making changes to Proposition 13 won’t do it

SACRAMENTO — Proposition 15 is arguably the most significant state measure on the Nov. 3 ballot.

And that’s saying a lot because Californians will be voting on several very significant measures.

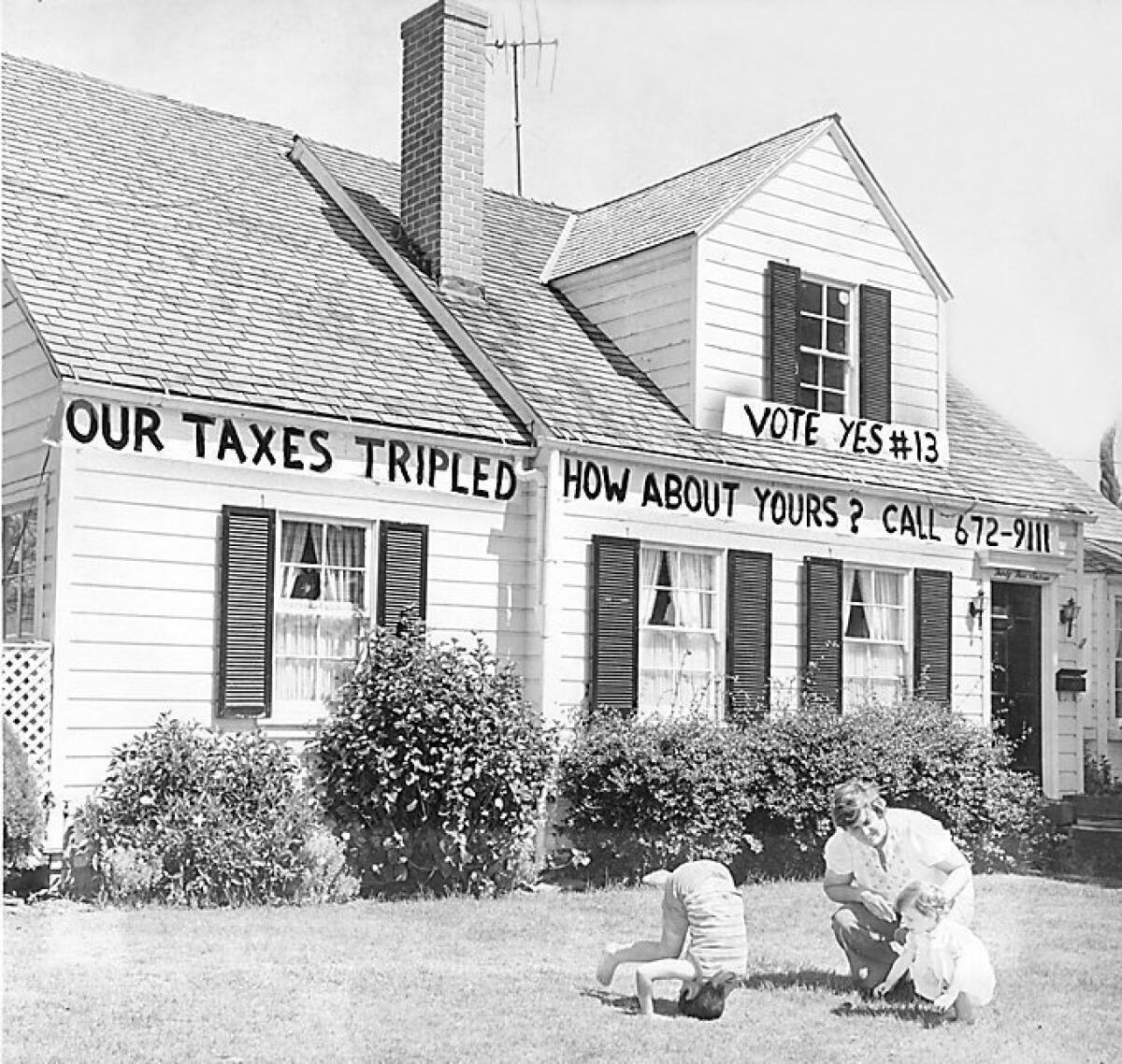

With Proposition 15, voters are being asked to partially repeal a historic 1978 property tax cut that triggered a nationwide anti-tax revolt.

That revered initiative, Proposition 13, has always been considered untouchable — the third rail of California politics. But labor unions, led by one representing schoolteachers, are trying to roll back part of it. Their effort is supported by tax-seeking big city mayors, including Eric Garcetti of Los Angeles.

Proposition 13 passed in a landslide because homeowners were angry that their property taxes were constantly soaring as home values skyrocketed. Some retired seniors were being taxed out of their homes.

Howard Jarvis, an apartment owners’ lobbyist, skillfully capitalized on the anger, promoting the initiative that dramatically lowered taxes on all real estate — residential, commercial and industrial. The political establishment hated the measure. The people loved it.

Proposition 13 capped tax rates at 1% of assessed value and limited annual assessment increases to 2%. Moreover, property could be reassessed only at market value when it was sold.

If Proposition 15 passes, it would increase property taxes for businesses and corporations in California, undoing some tax breaks introduced by Proposition 13 in 1978.

But many business property owners, especially large corporations, gamed the system so their holdings rarely changed hands completely — only by bits and pieces at a time. That way they almost never got reassessed at market value.

Property tax revenue substantially fell off for local governments and schools. They turned to state government for bailouts and got them. But the price was loss of some local control to Sacramento.

Proposition 15’s backers didn’t dare mess with residential property owners. That would be political suicide. So, Proposition 15 exempts residential real estate.

Agriculture land is exempt, too, although not necessarily property improvements — such as orchards, vineyards, barns and irrigation systems. The California Farm Bureau Federation is opposed.

Proposition 15’s target is commercial and industrial property. It would be reassessed every three years at current market value.

Property would be exempt if its owner’s total commercial real estate holdings in California were worth less than $3 million. Note: This isn’t the same as exempting one piece of property if its value is less than $3 million. The owner’s entire commercial real estate holdings couldn’t exceed $3 million.

Businesses with 50 or fewer full-time employees no longer would have to pay personal property taxes on equipment. For larger businesses, the first $500,000 worth of equipment would be exempt.

The net annual tax boost when the initiative would be fully implemented in 2025 would range from $6.5 billion to $11.5 billion, the state Legislative Analyst‘s Office estimates.

A plurality of the poll’s likely voters — 49% — said they favor Proposition 15, which would overhaul 1978’s landmark Proposition 13

The increased tax revenue would be split this way: 60% to local governments — cities, counties and special districts — and 40% to K-12 schools and community colleges.

In Sacramento speak, Proposition 15 is a “split-roll” measure because it would create separate tax rolls for residential and commercial-industrial properties. That has long been a dream of Democratic politicians.

It’s “long-overdue reform,” Gov. Gavin Newsom said in endorsing the measure last month. “It’s consistent with California’s progressive fiscal values…. It will fund essential services such as public schools and public safety.”

It’s a big-bucks brawl between two powerful traditional rivals: labor — mainly the California Teachers Assn. and Service Employees International Union — and business. They could wind up spending close to $100 million between them,

Polls show a close vote.

A recent statewide survey by the UC Berkeley Institute of Governmental Studies found likely voters favored the proposition by 49% to 34%, with 17% undecided.

“The chances for passage are fairly decent,” said the pollster, Mark DiCamillo.

Another poll of likely voters by the Public Policy Institute of California showed Proposition 15 ahead by 51% to 40%, with 9% undecided. Democrats were in strong support, Republicans in heavy opposition and independents equally divided.

“We’re dealing with a very complicated issue,” PPIC President Mark Baldassare said. “People wonder about the unintended consequences. They worry about the risks. That’s why we have only a slim majority….

“In every poll ever done, most voters continue to believe that Prop. 13 is a good thing.”

Larry Grisolano, the Proposition 15 campaign strategist, says two major news events may help the measure.

One is the New York Times investigative report that President Trump has been a longtime, serious tax evader — maybe a cheat.

“That reminds people we’ve got a system where most taxpayers are doing their part, but corporations are avoiding taxes,” Grisolano says. “That’s part of the appeal of the split roll.”

The second Proposition 15 helper is the calamitous wildfire season, the strategist says. Voters are reminded that local fire departments need to be better prepared for emergencies, and this requires lots more money.

But Rob Lapsley, president of the California Business Roundtable, argues that with the COVID-19 pandemic and subsequent deep recession, “now is absolutely the worst time to enact the largest property tax increase in California history.”

“Small businesses are struggling to survive, trying to get reestablished,” Lapsley says. “If this thing passes, many people will not even try to reopen. Just forget it.”

Anyway, he adds, “the last thing California needs is another tax increase.”

Agreed.

What California really needs is a complete overhaul of its ludicrously outdated tax system. Proposition 15 doesn’t do it.

After he was elected, Newsom ambitiously talked about perhaps reaching a “grand bargain” on tax reform. But he did nothing. Next year, he should surprise us and try.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.