Despite exploding smartphones, customers are likely to stick with Samsung

Samsung Electronics Co. asked retailers Monday to halt the sale of replacement models of a popular smartphone, extending the unwanted spotlight on the world’s most popular phone maker.

But neither exploding Galaxy Note 7 devices nor just as dangerous replacements are likely to steer customers away, analysts said.

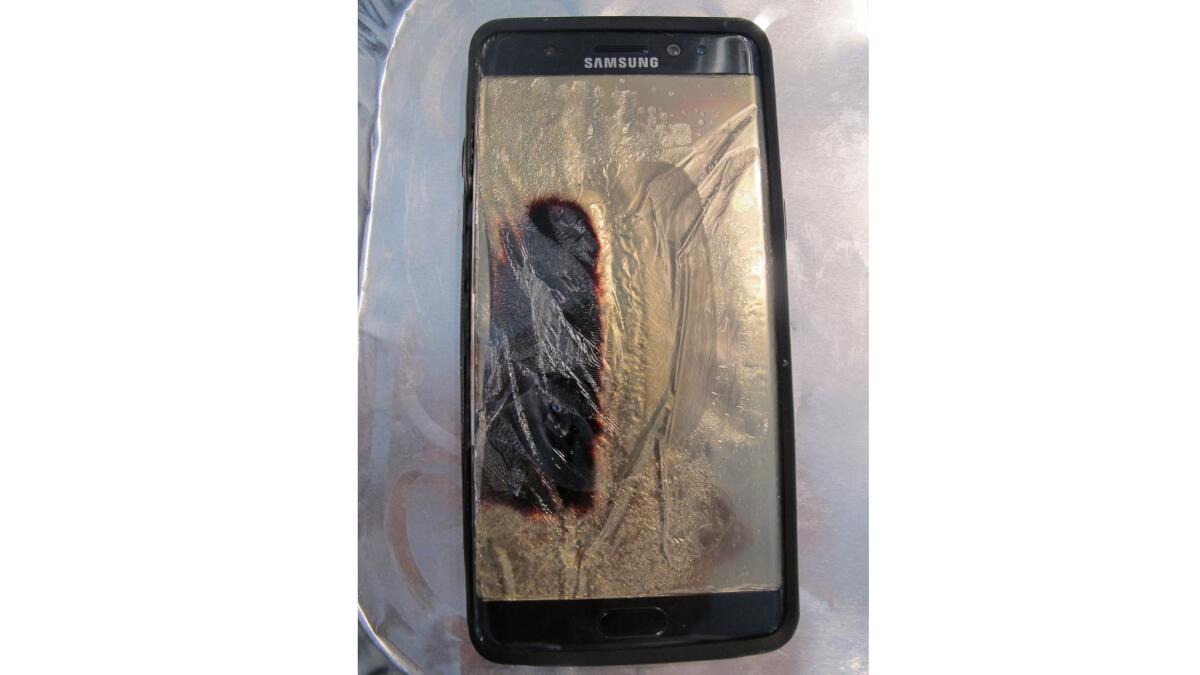

More than a month of headlines and warnings at airports have spotlighted how the phone’s battery can malfunction, causing a fiery blast and unusable charred remains.

The news only got worse last week, with reports of devices that were hastily rolled out as a fix blowing up too. On Monday, the South Korean company announced plans to ask retailers to pull both the original and replacement Note 7 off store shelves and adjust production for now.

Yet despite the ongoing issues, the millions of people who bought or planned to buy a Note 7 are sticking with Samsung, giving the electronics giant the chance to come out of the troubles with just as many users as it did before, smartphone industry experts said.

With the help of discounts and promotions that will cut into Samsung’s revenue, shoppers largely are opting for unaffected Galaxy S7 or older Note models, said Ryan Reith, program vice president for research firm IDC, citing conversations with mobile service providers and retailers. Samsung sells about 80 models across the world at any given time, giving consumers a huge range of alternatives, he said. The Note model makes up just 10% of Samsung’s shipments, he estimated.

Other reasons people aren’t switching include rival brands’ declining prominence and the difficulty associated with switching to Apple’s iPhone. HTC and LG offer comparable devices, but Samsung has blown past them by virtue of heavy marketing, superior interfaces and customer service.

Apple has been picking off users in emerging markets, but in countries with long-established cellphone services, such as the U.S., not even a major scare is likely to prompt a mass exodus to the iPhone — which runs a different operating system than Samsung devices.

“It’s a big psychological shift,” said Tuong Nguyen, principal research analyst at consulting firm Gartner. “If your automatic car brakes down, you’re not going to suddenly shift to a stick shift.”

About one-third of the smartphones that left factories during this year’s second quarter came from Samsung and Apple, according to IDC.

After those leading vendors, the next three are Chinese brands Huawei, Oppo and Vivo, which represented just one-fifth of shipments. Such companies have an advantage at home, the world’s largest cellphone market. But they’re relatively unknown, if available at all, in other countries. Samsung, by comparison, spends billions of dollars a year on marketing to get its name ingrained in people’s heads throughout the world.

“It takes a lot more than ambition to get people to move from a known brand to a start-up brand,” Reith said. “Those guys do great, low-cost devices. But what those guys don’t do is invest in marketing. In developed markets, people are attracted to brands they know.”

New players still could emerge. Chinese phone brands Xiaomi, Meizu and LeEco are among those eyeing a bigger presence in the West. And they could find takers by trying to match the top brands in features but selling at a significantly lower price.

Xiaomi’s Mi 5s, which features a fingerprint sensor and a speedy processor, goes for about $260. The company, which just launched a video streaming device in the U.S. called the Mi Box, said it will eventually bring a smartphone to U.S. consumers.

“It’s just a question of when,” Hugo Barra, vice president of Xiaomi Global, said in an interview Monday in Los Angeles. “Irrespective of what’s happened recently [with Samsung], there’s a pretty strong opportunity for us in the U.S. for smartphones.”

LeEco is expected to launch several devices for the U.S. at an event next week in San Francisco. Data recently leaked on a company website indicated high-end smartphones would cost about $300 — less than half the cost of iPhone and Galaxy devices.

Google is in the midst of rolling out its new Pixel smartphone, but even the widely known Internet company may remain too much of a bit player in hardware to poach many Samsung customers.

Still, one big variable hangs over Samsung: How fast can the South Korean conglomerate move on? Mobile industry experts have called on Samsung to permanently stop production of the Note 7 and trash what’s already made.

Such action could bring an end to the pre-boarding warnings at airports to power down the Note 7, lest it explode mid-air. Giving up on the Note 7 also could hurt Samsung shares, which plummeted after initial reports of explosions last month. They had been rebounding until Monday, when the company disclosed it was “adjusting” Note 7 production for at least a month.

But the company can bounce back again if it ably reassures the public about the safety of other its devices, including refrigerators and washing machines, analysts said.

Nguyen said no cellphone maker has dealt with as large of a recall as Samsung is now. Apple has been able to get past smaller issues with malfunctioning antennas and bending screens. But Apple commands stronger loyalty than Samsung does from consumers.

“In that sense, it’s hard to say how big of an impact Samsung will take,” Nguyen said. “It depends on how they can react and handle the issues this time around and how consumers will digest that information.”

Twitter: @peard33

Times staff writer David Pierson contributed to this report.

ALSO

Millennials aren’t big spenders or risk-takers, and that’s going to reshape the economy

Twitter’s stock slumps again as buyout interest reportedly cools

Hospitals in California would have to report superbug infections under planned legislation