23andMe sells $300-million stake to GlaxoSmithKline and will help develop drugs

With over 5 million customers, genetic testing firm 23andMe sits on a trove of human data it believes can help drugmakers develop treatments more efficiently in an industry where 90% of medicines on trial never reach market.

The Silicon Valley startup now has a major partner and investment to tap that potential: It announced Wednesday that it sold a $300-million stake to British pharmaceutical giant GlaxoSmithKline Plc.

The two companies agreed to a four-year deal to develop new drugs and more quickly identify patients for clinical studies through 23andMe’s customers, 80% of whom agreed to share their personal information for research.

“By working with GSK, we believe we will accelerate the development of breakthroughs. Our genetic research — powered by millions of customers who have agreed to contribute — combined with GSK’s expertise in drug discovery and development, gives us the best chance for success,” 23andMe Chief Executive Anne Wojcicki said in a blog post.

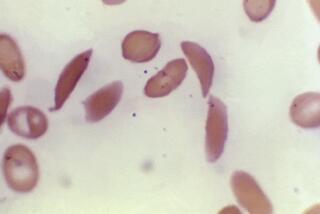

23andMe is best known for its saliva test to determine a person’s ancestry and potential health risks. The company is one of the bigger names in the quickly growing field of consumer genetic testing that has resulted in unusual discoveries such as the identity of the Golden State Killer suspect.

Last year, the Food and Drug Administration deemed the company’s tests accurate enough to sell reports that show customers whether they have a greater genetic risk of developing certain diseases and conditions. The FDA had previously warned 23andMe about sending health reports because it lacked the agency’s approval.

Founded in 2006, the company has garnered investment from major venture firms including Sequoia Capital and Google Ventures. The company declined to disclose its valuation.

One of the first things 23andMe plans to do with Glaxo is recruit patients to help the British company test its new treatment for Parkinson’s disease. The treatment, which is in preclinical development, inhibits a gene called LRRK2 that’s a contributor to the illness. 23andMe customers with defined LRRK2 mutations will be asked to participate in the trial.

Glaxo is trying to catch up with its rivals when it comes to research. Last year, it ranked No. 11 among 13 big pharma companies in a Bloomberg Intelligence analysis measuring research-and-development returns, and investors have expressed concern about its ability to boost productivity while also funding its dividend.

By buying a stake in 23andMe, Glaxo is addressing “a major issue for the pharma industry, which is the fact that there’s this incredibly low probability for success” among potential drugs, CEO Emma Walmsley told reporters. The deal could be “transformational” in making the process more efficient, she said.

As costs of finding and testing drugs increase and successes become harder to achieve, more drugmakers are streamlining their research and development. Novartis CEO Vas Narasimhan has set a course to cut the failure rate for new products and boost efficiency with projects such as an operations center to predict enrollment and evaluate costs of clinical trials in real time.

AstraZeneca has said that overhauling its research strategy improved productivity fourfold from 2012 through 2016. And like Glaxo, Roche Holding has tapped into the promise that the Human Genome Project made possible 15 years ago with the first human DNA sequence: Roche bought Foundation Medicine and its technology for testing cancers to find ways to treat them.

Glaxo also announced a restructuring program that will cost about $2.2 billion over a period that ends in 2021. It’s expected to deliver annual savings of about $530 million during that time — money that will be reinvested in R&D and used for commercial support of new products.

The agreement with 23andMe “could substantially change the cost it takes to develop drugs, or put differently, we could develop twice as many drugs for the same amount of money,” said Glaxo’s chief science officer, Hal Barron. “We see it as critical to our future strategy.”

The two companies also could work together on programs 23andMe has initiated in areas including immunology, cancer, heart disease, skin disorders and liver disease, according to Richard Scheller, who joined the startup in 2015 as chief science officer. 23andMe announced its ambitions to translate that information into new drugs three years ago.

A key dilemma for the pharmaceutical industry is that only 1 in 10 of the treatments that start in early-stage testing make it all the way to patients, according to Barron. Average costs to bring a new medicine to market surged to almost $2 billion in 2017, while big pharma companies have seen returns on R&D spending plunge, Deloitte estimates.

“The idea of pursuing genetically validated targets provides us with an opportunity to have a significantly higher probability of success,” Barron said. “It also helps with pace. We’ll be able to do programs faster. So it will help with two or three of the biggest challenges facing our industry.”

Paton writes for Bloomberg News.

[email protected] | Follow me @dhpierson