Behind Black Friday’s crowds lie stories of consumers squeezed by inflation

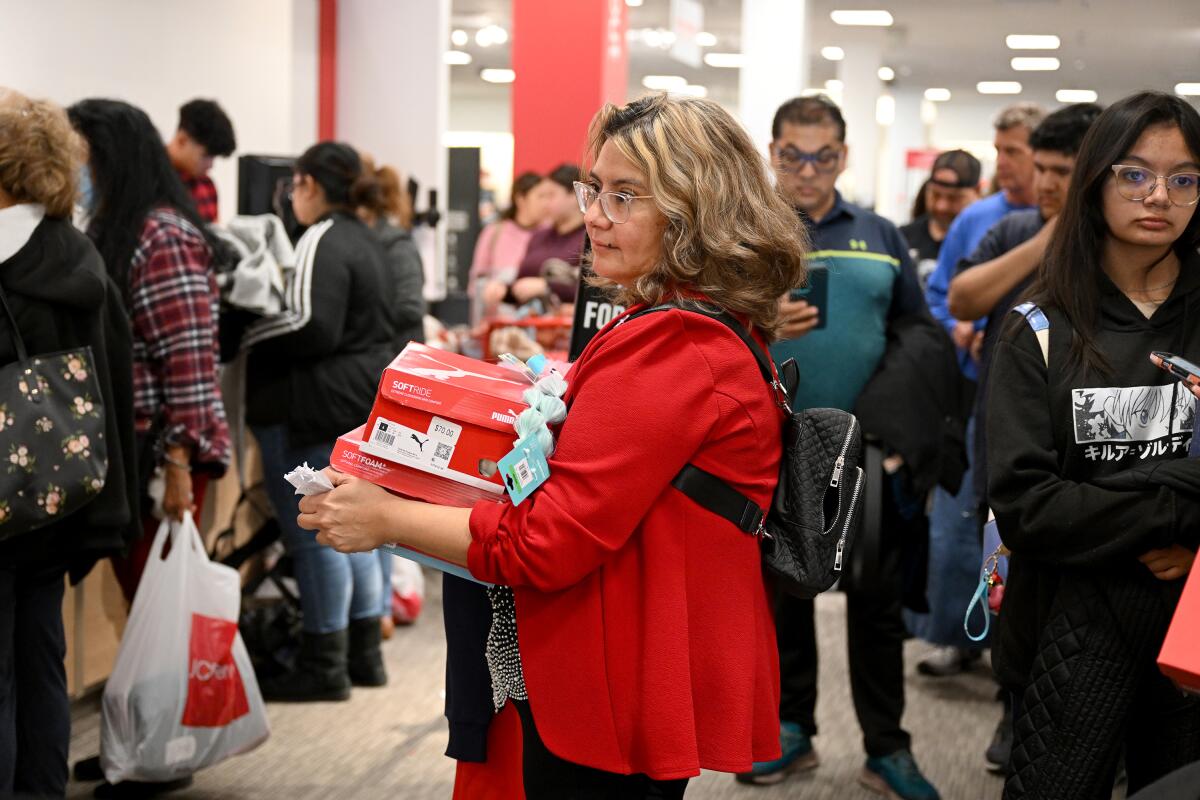

Months of punishing inflation have pushed East Hollywood resident Diane Roque to economize by canceling her family’s cable subscription and prioritizing cooking at home. Now high prices are making her take a more economical approach to her holiday shopping.

For Roque, Black Friday shopping is a 12-year tradition, and she was out at the Glendale Galleria navigating the crowds with her husband and two daughters in tow. This year, she said, she told her daughters: “If you want to buy something, here’s the budget for it. Anything else, no.”

“One has to be smarter in making choices — weighing things from the needs and the wants and what’s worth spending your money on,” said Roque, 37.

Athough the day’s annual frenzied mall mobs had faded even before the pandemic with the growth of e-commerce and ever-earlier holiday promotions, shoppers hungry for deals after months of inflation’s relentless squeeze hit retailers in force Friday, particularly at lower-priced spots such as outlet malls and discount stores.

At Walmart in Burbank, around 70 people were in line five minutes before Friday’s 6 a.m. opening. Once the doors opened, the store’s security slowly ushered shoppers in, a few people at a time, irritating some in line who were eager to snap up specials before they were sold out.

By 9 a.m., the Citadel Outlets in Commerce were jam-packed. Some pushed strollers that doubled as shopping carts, while others lugged suitcases.

Long Beach resident Rosa Acevedo, 33, limited herself to spending $300 on gifts this year, and came in under budget with the help of discounts at the Disney and Timberland stores. Inflation has hit her family hard, she said.

Her Black Friday was a success, “as long as we’re shopping for him,” Acevedo said, pointing to her 7-year-old son.

Despite evidence showing that shoppers recently have pulled back, data from consumer surveys indicate that overall spending is expected to hit unprecedented levels this holiday season.

U.S. consumers, buoyed by a robust labor market, have demonstrated unexpected resilience even as they contend with stubborn inflation.

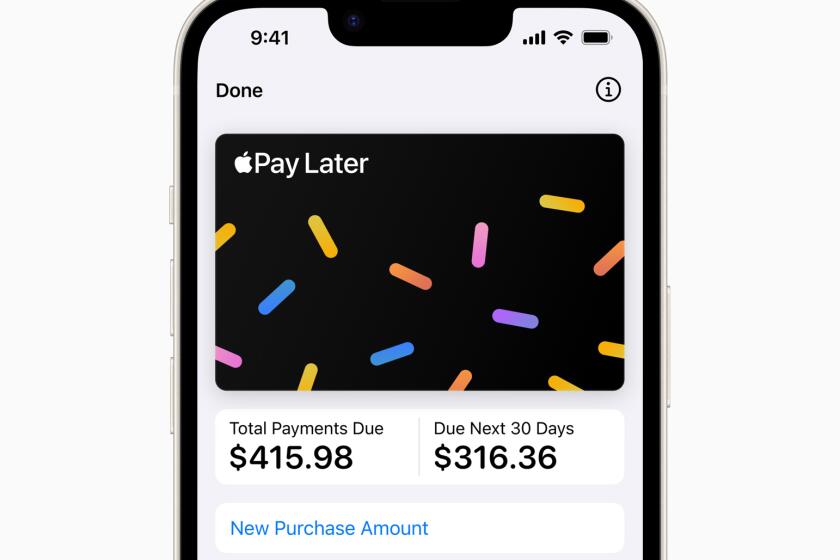

But to pull off this spending feat, a significant number of shoppers are expected to rely on savings, credit cards or buy-now-pay-later plans to fund their holiday spending this year.

“They might buy fewer gifts because things are more expensive, but we expect spending to be up,” said George Noceti, a wealth advisor at Morgan Stanley.

Consumers’ resilience in the face of high inflation is expected to continue through the holiday season with retail sales expected to top a $957 billion, a record amount.

The National Retail Federation predicted that in-person and online holiday spending would be up 3% to 4% from last year, reaching record levels between $957.3 billion and $966.6 billion. The increase in spending is predicted to slow from last year’s 5.4% boost, according to the trade group’s data.

On Thanksgiving Day, with most stores closed, shoppers turned to their computers, spending $5.6 billion online Thursday, up 5.5% from last year and nearly twice as much as the $2.87 billion that was spent on the same day in 2017, according to the latest Adobe Analytics figures. Nearly 60% of purchases were made with a mobile device, an all-time high.

“Now it’s very online-focused, and we’re really looking to see the online velocity surge on the major days like Black Friday and Cyber Monday,” said Vivek Pandya, lead analyst at Adobe Digital Insights. In line with recent years, e-commerce sites were expected to be inundated on Black Friday and Cyber Monday.

A Deloitte holiday survey indicated that clothing, electronics and toys would be some of the most popular categories for holiday gifts nationwide this year. But in Los Angeles, the top category this year is projected to be gift cards, which could be a sign of economic distress, said Rebecca Lohrey, a retail analyst at Deloitte.

Because shoppers pick the exact amount they’re spending, “it definitely looks like a sign to us that people are trying to stay in budget,” Lohrey said.

Black Friday may not be the bellwether of the holiday shopping season that it once was, but overall retail sales during the season remain an important gauge of consumer health and a key source of retailer profits. Consumer spending on goods and services accounts for nearly 70% of the nation’s economic activity.

There has been a shift in consumer behavior as holiday sales now roll out in

the weeks before Black Friday. MainPlace Mall in Santa Ana has not returned to the hustle and bustle it had on Black Fridays before the pandemic, said Cory Sams, the mall’s general manager.

“They’re stretching out the deals to hit earlier than just the day of Black Friday, so sales the week prior were even higher than the week of Thanksgiving last year,” he said. “It’s a different model of holiday sales now.”

Given the precarious situation of many consumers, retailers know they demand major discounts — and will hold out for the best deals. But those who rely on savings, credit cards and other pay-later programs to finance their holiday purchases carry the risk of added interest and other costs.

Many retailers offer buy-now-pay-later plans. And buy-now-pay-later apps — backed by companies including Afterpay, Klarna and Affirm — often let users split their final bill into four interest-free payments, an attractive alternative to credit cards, which carry an average interest rate of more than 19%, according to November data from Bankrate.

In an age of increased isolation and loneliness, some Americans see skipping self-checkout as a path toward connection.

“The consumer is bargain hunting this year,” said Mrin Nayak, a managing director and partner leading holiday research at Boston Consulting Group. “They are looking for deals to counter inflation, and they are looking to make sure that they’re shopping at places that give them really differential value versus the rest of the year.”

The latest Adobe Analytics figures show that in the days leading up to Black Friday, retailers were already marking down products in popular categories: Electronics, appliances, toys and apparel were discounted on average more than 20%.

“I think because we’re seeing this level of discounting that we’re profiling across these categories, it’s helping keep consumers incentivized to spend this season,” Pandya said. “But we’re expecting the discounts to get bigger and better on these major days between Black Friday and Cyber Monday.”

Some shoppers at bricks-and-mortar stores were disappointed with the lack of good deals on Friday. Standing outside the Garage Clothing store at the Glendale Galleria with a PacSun bag at his feet, Brandon Kim, 24, of Koreatown was ready to call it a day.

Kim had anticipated buying more at the mall, but he changed plans upon arriving. “The deals are the same as they are every year,” he said. “All the items that you want aren’t usually on sale.”

On top of that, he doesn’t like large crowds. “I don’t really want to be here right now,” he said.

Consumers are being selective, with many options at their fingertips. Albert Reynolds, 61, was running nonholiday errands and stopped by the Best Buy on Pico Boulevard in the Sawtelle neighborhood around 7 a.m. to check another task off of his list: buying a pair of Sony wired earbuds.

Reynolds said he’s always hunting for the best deals, checking prices and reviews online before purchasing a product. On previous Black Fridays, he bought a Samsung tablet and a microwave, he said. But this year, he left the store empty-handed just 10 minutes after arriving.

Best Buy didn’t stock the exact model of earbuds he wanted. He’ll likely buy them from Amazon, he said.

Even though his shopping trip wasn’t fruitful, Reynolds still respects the institution of Black Friday.

“I like the idea that if you really wanted something, you could get it at a great price, but there’s nothing I’ve really been after so much,” he said. These days, he added, Black Friday also seems “less focused on just this one day.”

High-end malls were also busy on Black Friday, but customers were looking for holiday fun more than doorbuster sales.

South Coast Plaza this year saw the biggest Black Friday crowds since the pandemic, said Debra Gunn Downing, the mall’s executive director for marketing.

“Many people come to South Coast Plaza after Thanksgiving, whether they plan to shop or not,” Downing said. “It’s more than a shopping experience. It’s the ambience.”

Short lines formed in front of luxury boutiques like Chanel, Dior and Hermès at South Coast on Friday afternoon, although the stores weren’t having holiday sales.

Gaetano Laplaca, 65, came to the mall not for Black Friday deals, but to spend his $350 credit at Hermès.

“I just came to use my credit here, and [on] the chance that there was some sale going on,” he said.

At Westfield Century City in L.A.’s Westside, shoppers perused the stores against a backdrop of Christmas tunes as fake snow rained down. Many had armfuls of bags, or carried coffee cups or smoothie bowls.

Lily Rodriguez, 44, has being trying to cut back on spending, but said it’s a challenge in the current economic climate.

“Everything’s a lot more expensive this season, so maybe [I’ll spend] more today” than planned, she said. So far, Rodriguez had bought a robe, which was 25% off, and a Chanel cologne, which was 15% off, from Bloomingdale’s for her boyfriend.

Apple announced Apple Pay Later, the latest entrant in the increasingly crowded “buy now, pay later” space. Is it “free money”? Not quite. Here’s what personal finance experts say.

Although retail sales and consumer confidence fell in October, people are feeling different about the holidays.

“We’re seeing disproportionately more optimism as it relates to holiday shopping versus regular day-to-day and regular discretionary shopping,” said Boston Consulting Group’s Nayak.

Some who were out on Friday were less interested in deals than in participating in what has become a cherished ritual.

Running on little sleep, Jade Mendez, 20, and Miguel Reyes, 18, waited outside Walmart in Burbank in the early morning, continuing a family tradition.

The siblings were first in line at 5 a.m., as they had been in years past, huddled together, shivering in their pajamas. They chose the Burbank Walmart because of its proximity to other shops, including Sephora, Target and Best Buy, which they were planning to hit after Walmart.

This year, they brought along their younger sister Misell Reyes, 16, hoping to get her a reasonably priced pair of Apple AirPods.

Although Black Friday no longer features the deeply discounted big-ticket items that once drew the family, these annual shopping excursions have become a custom for the siblings, and they still show up year after year.

“In the past, people were actually saving money from large discounts on TVs and electronics,” Mendez said. “That’s what I wanted to see, but you’re not going to see that anywhere anymore.”

Miguel Reyes agreed. He said he didn’t anticipate Black Friday shopping for the best deals, but to make memories.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.