Column: Silicon Valley VCs wanted to believe SBF’s lies. Now they want you to believe their excuses

Sequoia Capital wants you to know that it was “deliberately misled and lied to” by convicted cryptocurrency scam artist Sam Bankman-Fried during the discussions that led to its $213.5-million investment in Bankman-Fried’s firm, FTX, last year.

That’s an extraordinary admission, given that Sequoia is one of Silicon Valley’s oldest and largest venture investing firms, with an estimated $28.3 billion in assets under management. Yet that’s what Sequoia partner Alfred Lin, who was involved in advancing the FTX investment, asserted following Bankman-Fried’s conviction on seven fraud counts Thursday.

“Today’s swift and unanimous verdict confirms what we already knew,” Lin tweeted that day: “that SBF misled and deceived so many, from customers and employees to business partners and investors, including myself and Sequoia.”

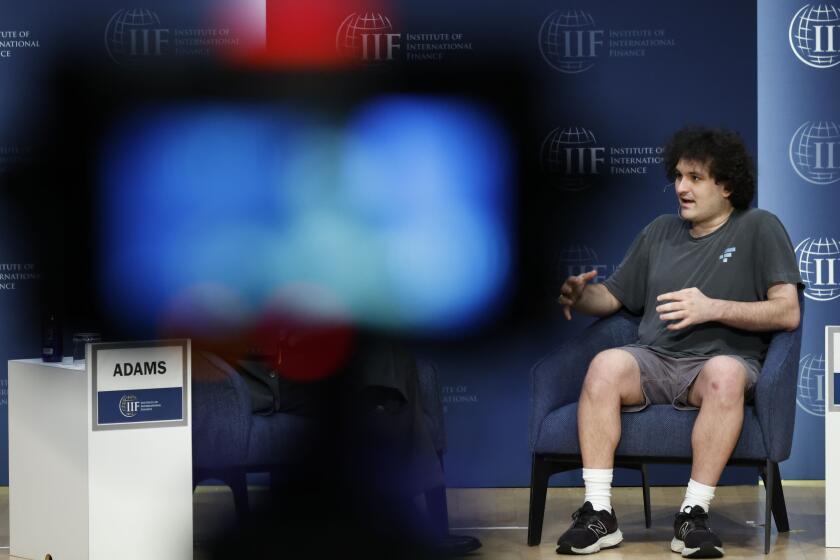

It’s hard to understand how people who sell themselves as the most sophisticated financial investors in the United States could be so thoroughly fooled by a guy in cargo shorts.

— Dennis Kelleher, Better Markets

It may be tempting to think that the Bankman-Fried verdict put the FTX saga to rest. But that would be a mistake. For one thing, Bankman-Fried won’t be sentenced until March, and also may face yet another trial next year, on federal charges including bank fraud and bribery.

What’s more important is examining how Bankman-Fried managed to gull the nation’s ostensibly most sophisticated investors into bankrolling his firm — which, as testimony at his trial and discoveries by FTX’s post-bankruptcy chief executive have shown, was built on quicksand.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Sequoia was not alone. Public pension funds in Alaska, Washington State and Ontario, Canada, had direct or indirect investments in FTX. So did respected money managers and venture investment firms such as BlackRock, Tiger Global Management, Lightspeed and Softbank.

There’s scant evidence that any of them performed the due diligence — a focused inquiry into a prospective investment — that would have exposed the discrepancies between Bankman-Fried’s claims about his firm’s operations and the reality.

It’s not merely that these investors were snowed by Bankman-Fried’s unique variety of what the veteran and vigilant short-seller James Chanos calls “techno-gibberish”; it’s that something spurred them to plunge without looking. To some extent it may have been “FOMO,” or “fear of missing out.”

But it also reflected the torrent of capital that was flowing into the investment firms when interest rates were scraping bottom starting with the onset of the pandemic in March 2020. That condition lasted about two years.

Sam Bankman-Fried’s $16-billion fortune was always a myth. The mystery is why venture firms and the financial press thought it existed.

“FTX is Exhibit A on how venture capital standards were eroded in a world of easy money,” says Dennis M. Kelleher, co-founder and CEO of Better Markets, a consumer and investor advocacy nonprofit. “The spigots opened and the VC guys were just handing out money with almost no due diligence, because money sitting uninvested is ‘bad’ so you have to get it out the door.”

The investors were seduced, he says, by the potential to generate massive profits from a business model based on what Kelleher says was tantamount to taking advantage of customers, which could last as long as no one looked too closely under the hood.

These investors may have thought they were protected by the notion that, in the venture world, 9 out of 10 investments go bust, but the 10th is such a big hit that it covers all the other losses. “That doesn’t mean that you shouldn’t do aggressive due diligence on all 10,” Kelleher told me.

Sequoia’s Lin tweeted Friday that “immediately after FTX collapsed, we extensively reviewed our due diligence process and evaluated our 18-month working relationship with SBF. We concluded that we had been deliberately misled and lied to.”

How much due diligence did Sequoia actually perform? In a letter to its investors on Nov. 9, 2022 — as FTX was beginning to crater — the firm asserted that it does “extensive research and thorough diligence on every investment we make,” and had conducted “a rigorous diligence process” before making its initial investment of $150 million. That same day, it said it was marking the value of its FTX holding to zero. Two days later, FTX declared bankruptcy.

Sequoia’s description of its due diligence doesn’t comport with a version reported in a slavishly adoring article about Bankman-Fried it had commissioned from a freelance writer and posted on its website.

According to that article, Sequoia’s interest in FTX originated in the summer of 2021, when FTX was raising money from investors for a funding round that ultimately brought in more than $420 million. Lin and another partner organized a “last-minute Zoom call” for others at Sequoia and Bankman-Fried at 4 p.m. on a Friday afternoon in July.

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

The partners were enthralled. “‘I LOVE THIS FOUNDER,’ one typed,” according to the article. “We were incredibly impressed,” one of the call organizers related. “It was one of those your-hair-is-blown-back type of meetings.” They were even more impressed, bizarrely, upon learning that during the call he was playing “League of Legends,” a video game.

It’s possible that Sequoia made further inquiries before investing; the funding round was not closed until Oct. 21.

But that only raises the issue of why Sequoia didn’t detect “the red flags flying in every direction” around FTX, Kelleher says — or detected and ignored them. “It’s hard to understand how people who sell themselves as the most sophisticated financial investors in the United States could be so thoroughly fooled by a guy in cargo shorts playing a game during an interview.”

It doesn’t appear that Sequoia or the other investors asked the fundamental questions about FTX that would have revealed its feet of clay.

“Sequoia could have said, ‘Can we talk to your risk officer?’ The answer would have been, ‘We don’t have one of those.’ They could have said, ‘Could we talk to your CFO [chief financial officer]’ The answer would have been, ‘We don’t have one of those.’ There are no difficult, deep questions here, just screamingly obvious questions that would have and should have set off alarm bells.”

According to a Silicon Valley adage, venture funding is “expensive money, but smart money” — venture firms demand outsized stakes in a startup in return for their investments, but make up for it by providing their connections and the wisdom born of their experience. (By contrast, public-markets investment is said to be “cheap money, but dumb money.”)

No evidence exists that Bankman-Fried sought the operational assistance of his venture investors. Instead, they seemed to have invested because they wanted to get in on the ground floor of the next big thing. Crypto was then still new enough that Bankman-Fried could convince investors that he had discovered the secret of how to profit from this novel asset class by giving the trading of it a veneer of old-school stability.

“FTX has aimed to combine the best practices of the traditional financial system with the best from the digital asset ecosystem,” he said in Congressional testimony in February 2022. He was in the driver’s seat all the way.

Not everyone was taken in. When Bankman-Fried came to Capitol Hill on May 11, 2022, to propose what he called a “safe and conservative” regulatory model that would foster “competition and innovation” in U.S. financial markets, existing futures exchanges pushed back.

Column: Shame, suicide attempts, ‘financial death’ — the devastating toll of a crypto firm’s failure

Customers of the bankrupt Celsius reveal how the cryptocurrency firm’s collapse upended their lives.

Terrence A. Duffy, the CEO of CME Group, the world’s largest financial derivatives marketplace, warned a House committee that Bankman-Fried’s model was a lightweight regulatory regime that would “inject significant systemic risk into the U.S. financial system.” Lawmakers dismissed the concerns of his and other commodities executives as merely those of futures exchanges fearful of a new competitor.

But that wasn’t true of Kelleher, who sounded the alarm loud and clear as an independent financial watchdog. Bankman-Fried came to see Kelleher on May 3 with the goal of persuading Kelleher to support his proposal. Kelleher wasn’t buying, even though FTX offered his nonprofit a $1-million donation.

He informed Bankman-Fried that he saw his regulatory scheme as “a dramatic and radical proposal that eliminated customer, investor and financial protections that have worked for decades,” while legalizing glaring conflicts of interest that were not permitted in the securities and commodities markets, Kelleher told me. “If that’s your business model, you’re a financial predator. It’s just that simple.”

When Kelleher asked Bankman-Fried what would happen to protection for retail investment customers, Bankman-Fried claimed that he didn’t see retail investors as his target market — he was aiming for institutional investors.

Kelleher didn’t buy that either — not with FTX’s spending on a commercial during the 2022 Super Bowl, and on naming rights to the Miami Heat’s basketball arena, and on endorsements by Tom Brady and his then-wife, Giselle Bundchen, and to place its insignia on the uniforms of Major League Baseball umpires. Those deals were all manifestly designed to lure ordinary investors into the confusing and perilous crypto market.

The shame of the FTX saga, in Kelleher’s view, is that it illustrates how venture investors are content to obliterate hundreds of millions of dollars in capital, by investing it in a ripoff with tempting profits, crowding out “more durable, more valuable and more sustainably beneficial companies and ideas.”

Will this happen again? You bet it will. Was Sequoia really “deliberately misled and lied to” by Sam Bankman-Fried? Don’t make me laugh. Whatever Bankman-Fried’s intent may have been, Sequoia played in his sandbox willingly, drooling for perfidious profits every step of the way.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.