Column: Why an auto workers strike should have your support

A few aspects of the ongoing labor-management dispute in the automobile industry are different from previous negotiations.

Under the leadership of President Shawn Fain, the United Auto Workers union is negotiating simultaneously with all of the Big Three automakers — General Motors, Ford and Stellantis, maker of Chryslers and Jeeps, among other brands — instead of choosing one as the principal counterparty and letting it set the standard for the other two to follow.

Then there’s the underlying issue of the industry’s transition from gas-fueled to electric vehicles, and its clear intention to base the factories for the latter in nonunion states, posing a real threat to union membership.

We have been absolutely clear that the switch to electric engine jobs, battery production and other EV manufacturing cannot become a race to the bottom.

— UAW President Shawn Fain

But a few things haven’t changed. For one thing, economic issues — wages, health and pension benefits, job security and so on — are at the center of the contract negotiations.

For another, the framing in the media and among politicians treats this contract negotiation as one in which the union is making outrageous demands and management is trying desperately to hold the line.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

This is the oldest of chestnuts in the depiction of labor-management relations. The New Yorker’s great press critic, A.J. Liebling, observed during a New York newspaper strike in 1963 that “the employer, in strike stories, always ‘offers,’ and the union ‘demands.’”

The stories never say that the employer “‘demands’ that the union men agree to work for a two-bit raise; the union never ‘offers’ to accept more.” The reason, Liebling conjectured, is that “‘demand,’ in English, is an arrogant word; ‘offer,’ a large, generous one.”

The same slant has crept into coverage of the current talks, possibly because of a long-ingrained reflex among reporters and editors. “The United Auto Workers union is bending on its pay-increase demands,” the Wall Street Journal wrote Monday, referring to what it might otherwise have referred to as a change in the union’s offer to accept a 30% pay increase over four years, down from 40%.

By the same token, a strike is consistently described as a unilateral action threatened by the union. Here’s the Detroit Free Press, reporting on the possible economic toll of $5.6 billion over 10 days in the case of “a strike against the three Detroit automakers by 143,000 United Auto Workers members.”

Hundreds of workers have died from extreme heat, but business lobbyists insist government rules aren’t necessary. Workers’ best hope for protection: unions.

Yet of course there are two sides of the table in this negotiation. The strike could just as easily be described as one provoked by the Big Three auto manufacturers by their refusing to meet the UAW’s, er, offer.

Adam Johnson of the Lever pinpoints an especially egregious example of media slant from NBC News, which reported that a strike “could mean car prices will soar even higher.” Never mind that the most direct impact of the contract talks will be on 146,000 workers, who could end up with better wages, benefits and job security, even if they might have to sacrifice pay while off the job. (A UAW strike fund provides $500 a week after the eighth day of a strike.).

It’s proper to note that the negotiation deadline of Thursday at 11:59 p.m. is not arbitrary, but marks the expiration of the current contract. The companies are in effect demanding that their workers stay on the job after expiration, and the union has — as is its right — refused the demand.

This framing is a PR gift to the automakers. That’s especially so because the inconvenience and economic pain from a strike will be localized, concentrated in the Midwest, where most of the 146,000 unionized workers of the Big Three live and work. Most Americans won’t feel it and probably haven’t paid much attention.

That’s different from the case of the United Parcel Service contract talks earlier this summer. Millions of Americans from coast to coast had regular contact with UPS drivers, relied on them for deliveries, had a feel for how hard they worked amid the stifling heat inside their non-air-conditioned trucks, and thus had reason to examine management’s position critically. UPS as a company couldn’t depend on public support for taking a hard line against the workers.

The situation may be different for the auto industry. The $5.6-billion impact estimated from a 10-day strike wouldn’t count for much — just over two hundredths of a percent of a national economy estimated at $23.32 trillion. Even if it lasted a whole year, that metric would work out to a drag of less than 1% on national gross domestic product.

The main reason is that the auto industry and the U.S. economy have come a long way from the 1950s, when GM President Charles E. Wilson could say, “For years I thought what was good for our country was good for General Motors, and vice versa.” (The quote is typically reduced, inaccurately to a rather more arrogant-sounding: “What’s good for GM is good for America.”)

The U.S. economy has diversified beyond raw manufacturing since then, and the footprint of the auto industry itself as a component of the manufacturing sector has shrunk. Domestic production peaked in 1999 at more than 13 million vehicles, compared with 10.1 million last year.

Strikes against Starbucks stores get all the publicity, but a mass strike by UPS workers could be the turning point for American labor.

As economist Joseph Brusuelas points out, since the 1950s the U.S. has seen “the growing economic importance of the service sector, the rise of the technology industry and the financialization of the broader American economy,” all factors in reducing the economic impact of an automotive stoppage.

In the most notable auto strike of the postwar years, the 113-day strike against GM in 1945-46, some 320,000 autoworkers downed tools when the U.S. labor force comprised more than 40 million workers. Today it’s 166 million. Union membership overall has struggled with a long-term decline — down from a peak of 33.4% of the workforce in 1945 to about 10% now, composed of 33% in the public sector and only about 6% in the private sector.

In the 1945-46 strike, the UAW sought a raise of 30% and obtained an increase of 17.5%. That was also the strike that established the UAW strategy, crafted by its president, Walter Reuther, of maximizing pressure on a single company (in that case, GM) to establish a benchmark contract.

It’s true that an extended strike would have significant local and sector effects. It might push Michigan, an auto manufacturing hub, into recession, and could force layoffs of workers in the steel, glass and electronics industries.

What’s seldom mentioned in coverage of the contract talks — except by the UAW — is their corporate financial context. The Big Three as a group have not been this financially flush in nearly a decade. GM and Stellantis notched combined profits of $25.7 billion last year (Ford booked a nearly $2-billion loss, largely from writing down its investments in EV and autonomous vehicle firms). The three companies have reported combined profits of about $20 billion in the first half of this year, which ended June 30.

The three have been generous in passing profits on to shareholders through stock buybacks. GM has repurchased more than $3 billion in shares since mid-2022 and issued dividends to shareholders of $397 million last year. Ford made buybacks of nearly $500 million and paid dividends of about $2 billion last year, and Stellantis paid out about $4.36 billion to shareholders last year and has announced a $1.6-billion buyback program for this year.

Yet the idea persists that the UAW’s contract stance is the governing factor in the effect of a work stoppage. An op-ed a few days ago in Politico by the editor of an automotive magazine took the UAW to task for resisting the industry’s transition to EVs and therefore, he implied, exacerbating the climate crisis.

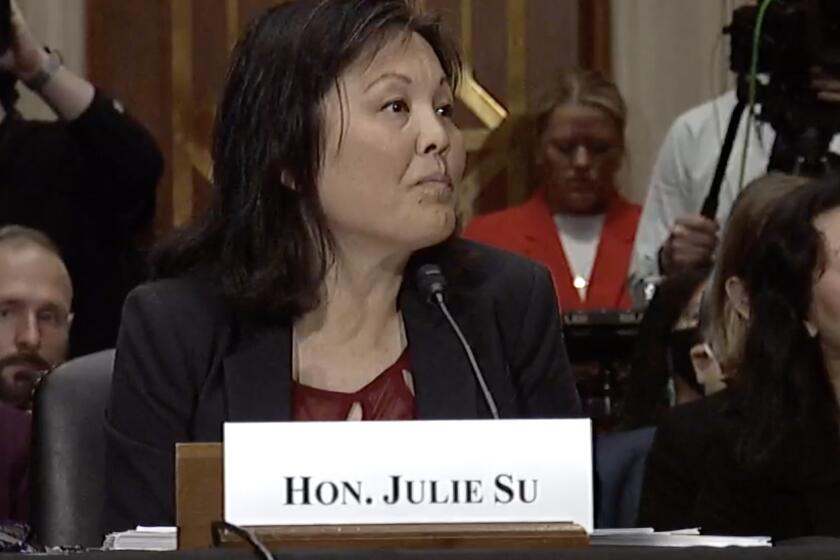

Julie Su’s accomplishments make her a spectacularly qualified nominee for Labor secretary. That’s exactly why Republicans — and some Democrats — will do their best to block her confirmation.

The author paid lip service to the UAW’s concern that the automakers are conniving to use the EV transition to undermine union membership, but the trend deserves more than lip service. The automakers have taken steps to site their EV battery plants in Indiana, Kentucky and Tennessee. All three are right-to-work (that is, anti-union) states.

The UAW is also painfully aware that building an EV requires only two-thirds as much labor as does a conventional gas-fueled car, largely because it has fewer moving parts to forge and assemble.

But that doesn’t mean it’s against electric vehicles. As labor historian Erik Loomis observes, the reason the UAW is concerned about the EV transition “is not an antipathy to electric cars. The union doesn’t care what kind of cars it makes. It wants union-made cars.”

By that token, the transition isn’t being hobbled by the UAW, but by auto managements that think they can create a nonunion workforce on the EV side without the union catching on.

As it happens, the UAW successfully organized a plant that manufactures batteries for GM vehicles in Ohio (not a right-to-work state), and obtained a 25% raise for 1,100 workers there just a couple weeks ago. But the prospect of further flight of manufacturing facilities to southern anti-union states has motivated the union’s drive for safeguards against plant closings in the North and Midwest.

“We have been absolutely clear that the switch to electric engine jobs, battery production and other EV manufacturing cannot become a race to the bottom,” Fain said in June, after the Biden administration granted Ford a generous $9.2-billion loan to build the battery plants in Kentucky and Tennessee.

Fain flayed the White House for failing to attach to the loan safeguards to protect existing jobs. “These companies are extremely profitable and will continue to make money hand over fist whether they’re selling combustion engines or EVs,” he said. “Yet the workers get a smaller and smaller piece of the pie.”

Fain pointed out that in recent years, GM closed its Lordstown, Ohio, plant and replaced those jobs in a battery plant in Indiana “with jobs that pay half of what workers made at the previous Lordstown plant.”

We know how this story will unfold, at least in the next day or two. The companies, sitting on increased profits, will plead poverty and maintain that the UAW’s demands will have vast, harmful effects on the economy and the environment. The union will press for better wages and working conditions for members who have seen their numbers, wages and benefits whittled away for years, just like those of millions of others in the American job force.

Meanwhile, the managerial class and its shills in the political elite will wring their hands about how uppity the workers have become since the outset of the pandemic, and how undeserving they are of a living wage. Which side will you be on?

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.