How to avoid the No. 1 text message scam putting your money at risk

The Federal Trade Commission recently revealed the most reported text message scam: bank impersonations.

Reports of bank impersonations by text in 2022 jumped to 20 times the number reported in 2019. Consumers reported a loss of more than $330 million to text message scams in 2022, the FTC said. And cash that’s lost because of bank fraud or scams isn’t covered by the Federal Deposit Insurance Corp. or National Credit Union Administration.

Banks are a safe place to keep your money, but there are still a few basic but important precautions you can take to ensure you don’t fall for a bank-impersonation text scam. Here’s how to protect your money from text message scams impersonating your financial institution.

Don’t make money moves under pressure

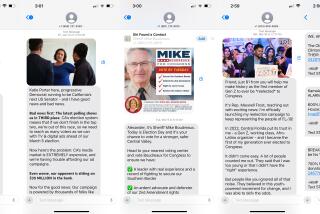

Text message scammers will try to make you feel like action is required immediately — at the risk of losing your money. It may come as an urgent message warning you to call or click on a link because of alleged suspicious activity.

“Any type of pressure tactic is not legitimate — that is not your bank,” said Paul Benda, senior vice president of operational risk and cybersecurity at the American Bankers Assn. As with any decision about your finances, avoid taking actions when you feel scared, stressed out or pressured.

Older adults have lost billions to scam artists who use phones and computers to break, enter and steal. Thefts targeting seniors are big business.

Don’t click on links from an unsolicited text

If you receive a text message you’re not expecting, be wary — especially if it looks like it might be from your bank.

In a recent poll by security experts at Security.org, 66% of respondents said that they had received a suspicious text from someone they didn’t know, and about 20% clicked on links texted from strangers, which is never advisable. “Look at any type of unsolicited communication very cautiously,” Benda said.

Major banks were popular choices for scammers to impersonate in 2022, with FTC data showing the most common scam text messages claimed to be from Bank of America, Wells Fargo, Chase and Citibank.

Don’t call a phone number that’s texted to you

Just as you shouldn’t click on a link texted to you from someone you don’t know, don’t click on or dial a phone number you receive in a text. Instead, find the official phone number for your bank by going to its website or mobile app. Initiate contact with your financial institution at its official phone number to ensure you’re talking to a legitimate representative, and verify whether there actually is an issue.

“Making that phone call can be the difference between getting scammed versus not getting scammed,” said Tremaine Wills, a financial advisor and founder of Mind Over Money, a financial literacy company in Newport News, Va.

One particular kind of text scam resulted in a median loss of $3,000 in 2022, according to the FTC: a text from someone impersonating your bank, instructing you to reply with a “Yes” or “No” to confirm or deny a suspicious transaction. Once you replied, the scammer would call you under the guise of helping you. Their ultimate goal was to fraudulently transfer money out of your account or obtain personal information such as a Social Security number.

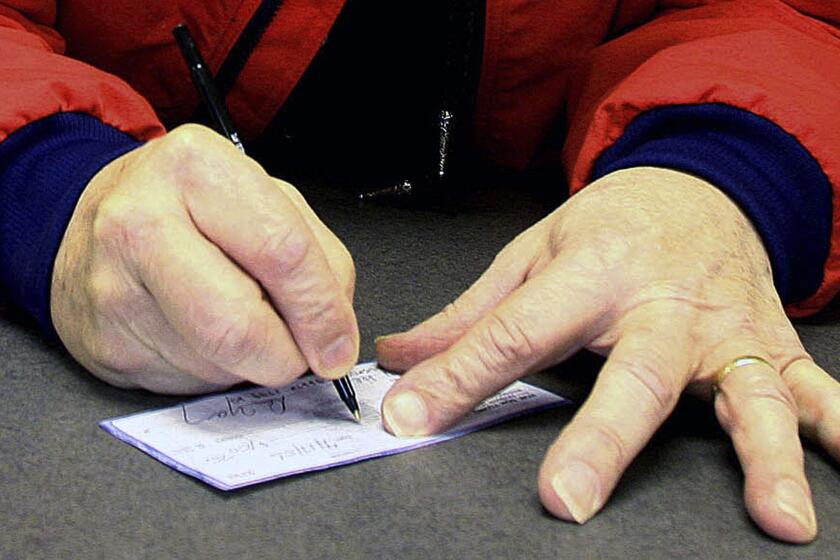

Check fraud tied to mail theft is surging nationwide. There are things you can do to protect yourself.

What if you’re scammed?

If you should happen to fall for a text scammer impersonating your bank, there are a few critical steps to take.

First, alert your bank to the incident and get its help in making sure no more money leaves your account fraudulently. Next, report the scam to local law enforcement. Those first two actions are key for trying to recover any cash that was wrongfully taken from your account.

Finally, file a complaint with the FTC at ReportFraud.ftc.gov and report the instance to the Federal Bureau of Investigation’s Internet Crime Complaint Center. The FTC also recommends that you forward suspicious text messages to 7726, which helps wireless providers identify and intercept similar text messages. You can also report and block suspicious text messages within your messaging app.

Having a good idea of your account activity is a key part of protecting your money from scams.

“Have a regular practice of knowing what’s going on with your account,” Wills said, then you might be more likely to be alarmed by a text message claiming to be from your bank.

Sarreal writes for personal finance site NerdWallet. This article was distributed by the Associated Press.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.