Bernie Madoff’s lawyer has some advice for FTX’s Sam Bankman-Fried: Shut up

The lawyer who represented Bernie Madoff has this advice for Sam Bankman-Fried: Shut up.

Enough with this whole media apology tour, said Ira Sorkin, lead defense lawyer for Madoff, late mastermind of one of the greatest Ponzi schemes of all time.

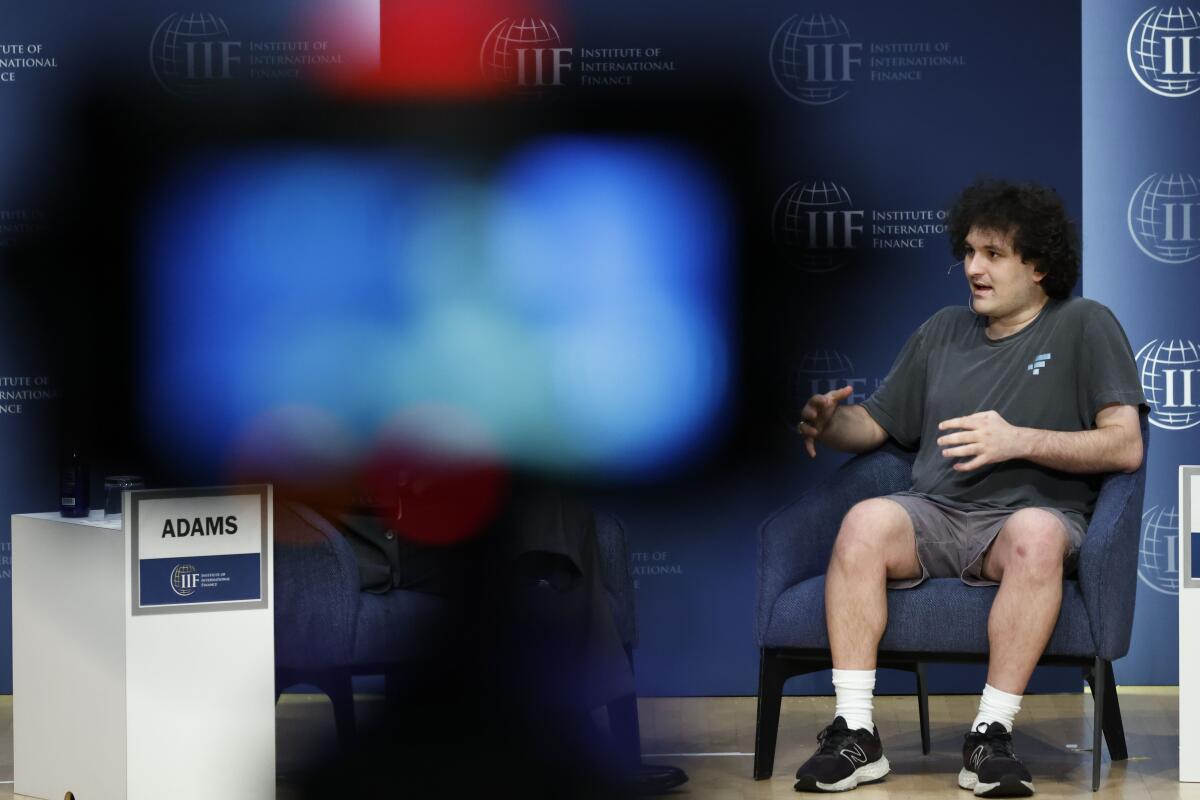

As authorities sift through the wreckage of FTX, Bankman-Fried’s collapsed crypto empire, the man known as SBF has been talking to just about everyone, including the New York Times and the ABC talk show “Good Morning America.”

Again and again, he’s denied intentionally commingling client money or trying to swindle anyone. Federal authorities are investigating exactly that. Neither FTX, Alameda Research nor any of the former top executives involved have been accused of any wrongdoing by U.S. authorities.

It was just a big screw-up, Bankman-Fried told Bloomberg Businessweek.

Men are allowed to disregard their appearance in ways women cannot if we wish to get hired, let alone get billions in start-up cash.

Sorkin said Bankman-Fried should listen to his lawyers and immediately stop talking. Anyone who’s watched “Law & Order” knows that.

“That’s the first order of business: Don’t talk,” Sorkin said. “You’re not going to sway the public. The only people that are going to listen to what you have to say are regulators and prosecutors.”

Bankman-Fried conceded this week that the publicity blitz flew in the face of legal advice but said he had a “duty to explain what happened.” Before an hourlong interview with the New York Times’ DealBook on Wednesday and a “Good Morning America” segment on Thursday, he agreed to a video interview with Axios and a Twitter conversation published by Vox.

“Sometimes clients believe they are smarter than their lawyers. This guy is 30 years old, and he is not smarter than his lawyers,” Sorkin said. “They should be telling him every five minutes to shut up, but sometimes clients don’t listen.”

Representatives for Bankman-Fried and FTX didn’t immediately respond to a request for comment.

Sam Bankman-Fried’s $16-billion fortune was always a myth. The mystery is why venture firms and the financial press thought it existed.

Bankman-Fried, the son of law professors, has said he’s speaking against his lawyers’ advice. Earlier today, FTX sought to clarify that Bankman-Fried does not speak on its behalf. Legal experts have said he may simply be testing out an it-was-all-a-big-mistake defense.

Renato Mariotti, a former federal prosecutor, said investigators are surely taking note. Anything Bankman-Fried says can be used against him in court, he said.

“Here is a man who appears to be responsible for many people losing their life savings,” said Mariotti, a lawyer at Bryan Cave Leighton Paisner.

“How can someone make that worse? Lock himself into not only one but various versions of a story,” Mariotti said, adding that he expects to see some of these interviews played in court.

Bankman-Fried’s apparent willingness to keep talking was welcomed by a prominent figure in Washington on Friday: Rep. Maxine Waters (D-Los Angeles). She’s asked Bankman-Fried to appear before the House Financial Services Committee on Dec. 13.

“We appreciate that you’ve been candid in your discussions about what happened at FTX,” Waters tweeted.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.