What happens when CEOs return? History has some lessons for Bob Iger and Disney

There’s something to be said about a known quantity, particularly when it comes to chief executives.

It worked for Apple, when the then-floundering computer company turned to its ousted co-founder Steve Jobs. Jobs reshaped the company and built it into a tech titan.

It worked for Starbucks, when the coffee chain brought back Howard Schultz and sales increased.

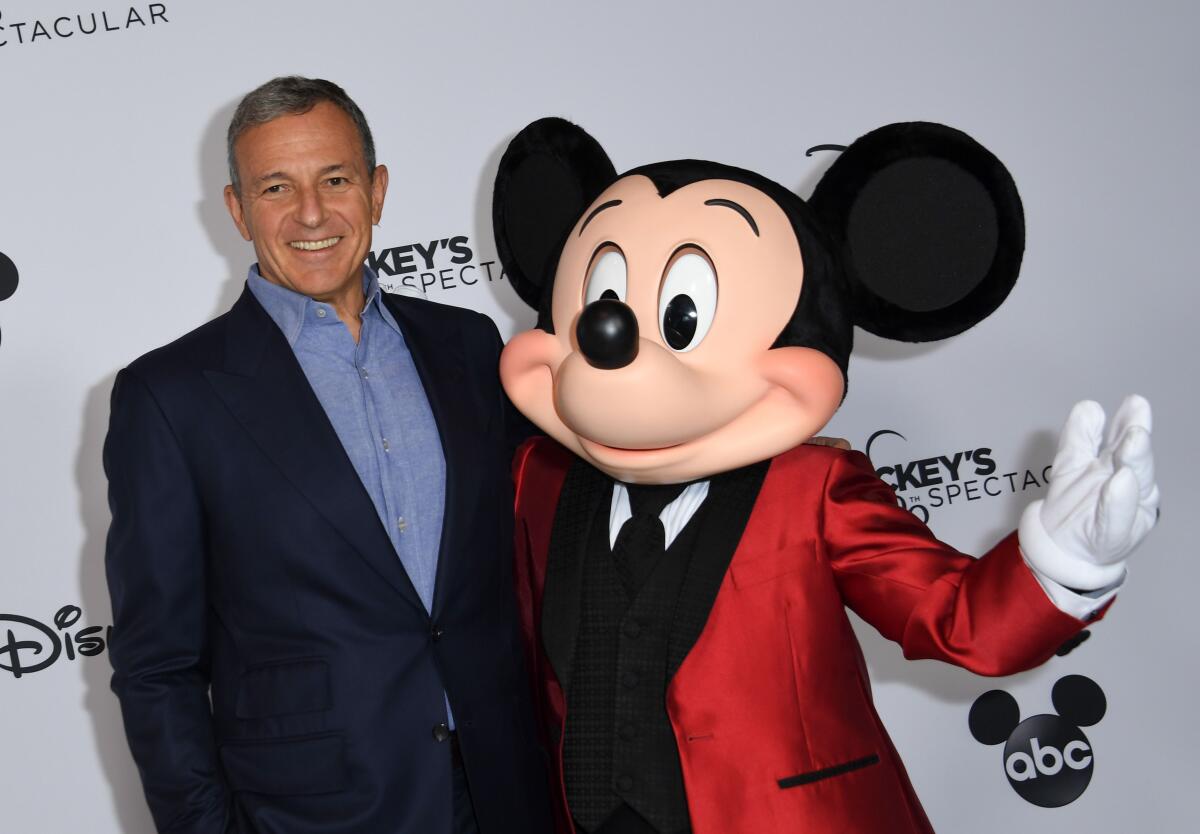

But will the strategy of a so-called boomerang CEO work for Walt Disney Co.? On Sunday, the company’s board announced that former Chief Executive Bob Iger will be returning to lead the company for a two-year stint.

Not all returning CEOs do better the second time around. On average, companies that brought back a boomerang CEO had worse yearly stock performance — 10.1% lower — compared with those with CEOs on their first go-round, according to a 2020 study published in the MIT Sloan Management Review.

Reasons can include changes to the industry and the company itself since the CEO left. If a CEO has been gone for a lengthy period, it can mean coming back to a whole new company than the one they left, said Travis Howell, assistant professor of strategy at UC Irvine, who was a co-author of the 2020 study.

In other words, past success is not necessarily predictive of future success.

“In most other boomerang cases, I would say it’s not the best strategy,” Howell said.

But, he said, “Iger is actually set up better than most boomerang CEOs. He hasn’t been gone that long. He still has some trust with stakeholders.”

Iger served as CEO for 15 years before stepping down in 2020. He served as the company’s executive chairman until last year, when he retired. Under his leadership, Disney acquired Pixar Animation Studios, Marvel Entertainment and Lucasfilm, leading to big gains.

Disney shares closed at $97.58, up 5.8%, on Monday. That stock market reaction indicates investors are pleased with the change and think Iger will make a difference, said Craig Garthwaite, professor of strategy at the Kellogg School of Management at Northwestern University.

“I don’t think it’s going to be a magical solution, though,” he said.

Iger, like other boomerang CEOs, will face new problems that weren’t present during his last stint. For one, making the company’s Disney+ streaming service profitable. Streaming is turning out to be a much more difficult and competitive business than Disney originally thought, and Iger will have to focus much of his attention there, Garthwaite said.

Iger’s success is “going to rise and fall by what they’re able to do with Disney+,” he said. “As you think about what is success here for Disney+, it’s both evaluating it as a stand-alone entity and its contribution to total firm profitability.”

Also, Iger will probably face questions about the succession plan that put now-former CEO Bob Chapek in charge — and the new plan he’s expected to enact. Bringing back a former CEO can raise questions about a failure of succession planning or a poor job doing it, according to the 2020 study.

“Bringing back a CEO is kind of like calling back a plumber,” said Howell of UC Irvine. “You need them to come back, but you kind of have this resentment that they should have done the job right the first time.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.