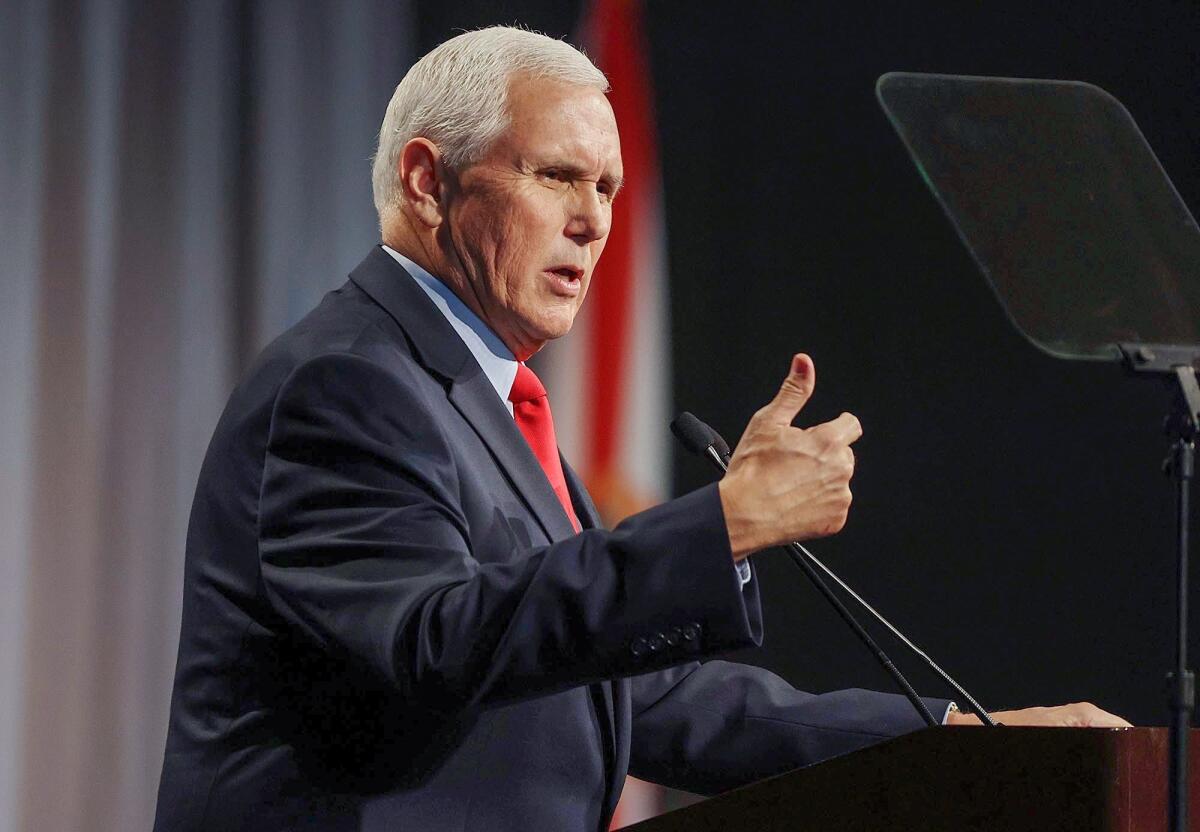

Pence rips ESG investing as injecting left-wing politics into business

Former Vice President Mike Pence criticized investor-activist campaigns to force companies such as Exxon Mobil Corp. to follow socially conscious investing principles, saying they elevate left-wing goals over the interests of businesses and their employees.

Pence, a potential 2024 Republican presidential candidate, delivered an energy policy speech Tuesday in Houston and called for states such as Texas to “rein in” the push for employee pension funds to use environmental, social and governance principles in investing.

The former vice president cited activist investor Engine No. 1, which was backed by firms including BlackRock Inc. last year as it mounted a successful proxy campaign that led to the replacement of three directors on Exxon’s board. “Those three are now working to undermine the company from the inside,” Pence said.

ESG investing — the use of environmental, social and governance factors in decision making — has become one of the hottest areas in finance in recent years, with the global market adding as much as $40 trillion in assets, according to estimates from Bloomberg Intelligence.

Yet the strategy has drawn the ire of lawmakers in some states. Officials in Utah and West Virginia have pressed S&P Global Ratings to scrap a system that scores states based on their ESG-related credentials. In Texas, officials are asking finance firms to disclose their climate policies, including whether they’re limiting business with energy companies.

Elon Musk says ESG investments are ‘the devil incarnate.’ Andrew Steel says they’re just misunderstood.

Finance was always meant to facilitate investment and spur economic growth that benefits the entire U.S., Pence said. But President Biden and government regulators are “weaponizing the financial system to do the exact opposite,” including through “capricious new ESG regulations that allow left-wing radicals to destroy American energy producers from within.”

Similar accusations have been circulating in Texas for some time, but Pence’s comments are among the most aggressive yet. The growth of ESG investing has pushed some of Wall Street’s biggest investors to become much more active in proxy campaigns.

But the notion that such campaigns hurt companies is unproven, especially in Exxon’s case. Engine No. 1’s success came from persuading large shareholders that an improved climate strategy would also help the oil giant’s financial returns.

After the vote, Chairman and Chief Executive Darren Woods quickly made peace with the three new directors and announced a series of green measures, including eliminating emissions from its operations by mid-century and locking in lower spending on fossil fuels. Buoyed by higher oil prices, Exxon’s stock is up 36% in the last year.

GOP lawmakers and powerful industry groups, including the U.S. Chamber of Commerce, have opposed increased activity by financial watchdogs on ESG issues during the Biden administration, even as the White House has called for increased oil and gas production to help reduce fuel prices.

Biden has also made fighting climate change a centerpiece of his presidency, and last year ordered regulators to develop stronger plans for measuring and mitigating the risks climate change poses to the financial system.

One proposal by the Securities and Exchange Commission would require businesses to reveal the risks a warming planet poses to their operations when they file regulatory statements.

Bloomberg writers Saijel Kishan and Jennifer A. Dlouhy contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.