COVID changed how we spend money. With California reopening, will we change back?

More than a year ago, fear of the coming pandemic turned the business world on its head. Consumer behavior veered sharply: Restaurants and hotels were quiet, lines formed outside grocery stores and toilet paper was suddenly in short supply.

Now, as California eases COVID-19 restrictions, we’ll begin to see whether these changes in consumer behavior endure or if they too will fade.

Projections vary depending on where you look and whom you ask.

As certain hallmarks of the pre-pandemic business world return, including conferences and rush-hour traffic, some believe consumers are hurrying to get back to the way things were — and make up for lost time.

In a phenomenon dubbed “revenge shopping,” shoppers have begun “spending exorbitant money on items and experiences that they felt they were deprived of last year,” such as clothes, dining and travel, Kristen Gall, president of the online shopping and rewards company Rakuten, told The Times in an email.

On the other hand, market research firm NeilsenIQ said in a recent report, “some consumers have developed homebody mentalities that will linger for the foreseeable future.”

Here’s how COVID-19 changed the way we spend money — and how in some ways we’re not changing back.

Some pandemic-wrought changes to the business world seem lasting. (Work from home? Yes, thank you.) Others not so much. Here’s our guide to the new normal.

COVID-19 supplies

Switching from producing spirits to making industrial-size vats of hand sanitizer didn’t merely keep Santa Ana’s Blinking Owl Distillery in business. The desperation gambit also brought in enough revenue to pay for a kitchen serving what co-founder Robin Christenson likes to call “posh bar bites.”

“It was absolutely the wildest ride, but it was a quick one,” she said. “We did over a million dollars in sales in a very short amount of time, between April and probably September. And then it definitely dropped off after that. There was plenty of hand sanitizer on the market.”

Ditto that for mask sales at Los Angeles Apparel, a casualwear manufacturer that sold millions of washable cloth masks to both institutional and retail customers. Owner Dov Charney noticed sales started falling sharply a few months ago. “It was like a meteoric ride and it crashed,” said Charney, who figures he still has a couple of hundred thousand masks in stock with sales slowing to a trickle.

The experience has not been unique. U.S. sales of hand sanitizer fell 83% in May compared with a year earlier, according to NielsenIQ data. Mask sales were off 62% — not surprising as vaccination rates have risen and fears of catching COVID-19 by touching surfaces have subsided.

Still, the pandemic has altered people’s habits. A spokesperson for Gojo Industries, the maker of Purell, said sales of the popular sanitizer remain above pre-pandemic levels as people maintain higher personal hygiene standards, something the company expects will remain so for the “foreseeable future.”

— Laurence Darmiento

With California’s economy reopening, rent in Los Angeles and other big cities is beginning to rise.

Retail

After a year-plus of shopping from the couch — with a wide variety of items, including sweatpants, surgical masks and single-serving cocktails, delivered straight to socially distanced stoops — many Americans are ready to go back into stores.

But the one-click economy is unlikely to decline along with the pandemic, industry watchers predict. “Online spending figures for May show … monthly sales closing 151% higher than they were a year ago,” the online fraud protection firm Signifyd wrote in a recent report, adding that an e-commerce boom “unlike any in the history of retail” is ongoing.

Some of the sectors in which Signifyd has seen particular growth — alcohol, marijuana, luxury goods — suggest America’s much-heralded “hot vax summer” is partially responsible.

Pent-up demand, pandemic savings, back-to-office mandates -- experts say it will all add up to a historic wave of people leaving their jobs.

And as weddings, funerals and in-person meetings return, online fashion retailers can expect heightened demand for outfits a step above the athleisure and loungewear that characterized many a pandemic Zoom call.

E-commerce giant Shopify reported a more hesitant outlook in its first-quarter 2021 financial results. As the pandemic winds down, the company said it expects some consumer spending to move back offline. But Shopify said it expects revenues from internet commerce to continue to grow rapidly through the rest of this year — though at a slower pace than in 2020.

— Brian Contreras

Dining

After pandemic restrictions flipped the table on dining out, how many people will resume their old restaurant routines?

Already, foot traffic has increased at Los Angeles restaurants, with a 141% increase in visits since Jan. 1, according to marketing firm Zenreach. Statewide, restaurant visits are up 127%.

Some pandemic habits seem likely to linger. Delivery and curbside pickup may continue to make up a greater portion of restaurants’ orders.

“Online third-party delivery is probably the biggest disrupter in the restaurant model in decades,” said Jot Condie, president of the California Restaurant Assn. trade group. “The pandemic was certainly an accelerant.”

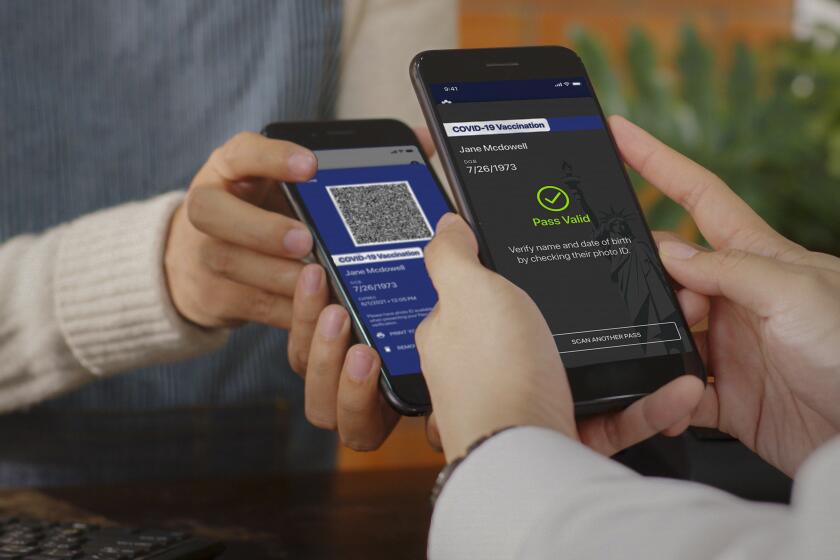

The federal government isn’t willing to make a digital pass or app that attests to a person’s vaccination status. Several companies are trying to fill the void.

At MeeMa’s in Long Beach, takeout wasn’t part of the original plan. But when the breakfast spot opened last summer, that was one of the few ways it could serve customers. The popularity of takeout led to an expansion of the menu and its to-go-friendly items such as burritos and sandwiches.

If takeout is what the people want, restaurateur Miguel Perez says, MeeMa’s will keep providing it. “We felt that the community really embraced us,” Perez said. “They knew what the place was about.”

— Samantha Masunaga

Grocery delivery

The pandemic ignited the app-based delivery industry, as shoppers had new reason to order meals and groceries delivered to their doorsteps.

Instacart, which lost upward of $300 million in 2019, reported its first-ever profit in April 2020. Uber saw a 166% increase in delivery bookings year over year in the first quarter of 2021.

There are signs, however, that demand has peaked and is now waning.

Restaurant delivery firm DoorDash said it has already started to see negative effects on “new consumer growth, order rates, and average order value.” The drop wasn’t as bad as expected, the company said, in part because of government stimulus checks. But DoorDash warns that those numbers may drop further as states loosen restrictions.

Grocery delivery is also starting to slow, according to Bloomberg’s Second Measure, a data analytics company that analyzes consumer transactions. Instacart’s sales, for instance, were down 21% in April 2021 from a year earlier, though they remain more than 300% higher than before the pandemic.

One lasting change might be curbside pickup, which is expected to become a permanent fixture at many retailers.

— Johana Bhuiyan

Streaming and entertainment

When people look back on how the pandemic changed the streaming business, the bizarre journey of the Kevin Hart show “Die Hart” will be a helpful case study.

It premiered last year on the ill-fated Quibi, before the subscription service for bite-size videos shut down. The action-comedy then found a new home on Roku’s free, ad-supported service, where it’s described as a hit, at least by the device maker’s opaque standards.

During the pandemic, demand for content surged so much that an obscure show orphaned by one service could become another’s marquee success.

If anything, there are too many places to watch new shows and movies — more than 300 streaming services and transactional video-on-demand platforms in the U.S., according to Parks Associates research. Disney+, which launched a few months before the pandemic, is now widely considered Netflix’s primary rival. Both services experienced a surge in sign-ups during lockdowns. The pace of new sign-ups has since slowed but not dipped, even with HBO Max, Peacock, Paramount+ and Discovery+ now in the fray. There are streamers for horror fans, film buffs, Christians, Middle America and every other niche you could imagine. There’s even a streamer that cobbles together movies and shows from the most obscure services on the market.

A recent United Talent Agency study, based on a survey of 1,000 consumers, found that 56% of respondents added at least one subscription streaming service during the COVID-19 crisis.

More than two-thirds said they plan to continue spending more time consuming entertainment than they did before the pandemic.

But analysts are beginning to diagnose consumers with “decision fatigue” and “subscription fatigue.” Those symptoms could be exacerbated as movie theaters, concert venues and theme parks reopen. However, the viewing habits picked up during the pandemic are probably here to stay.

— Ryan Faughnder

Alcohol and cannabis

When the pandemic took hold, sharing joints was out — and individual mini-joints were in. Californians stocked up on wine, beer and especially hard liquor.

As COVID-19 recedes in the U.S., projections from the cannabis and alcohol industries fit the nation’s “Roaring ’20s” rebound that economists are predicting. For pot, “it’s the Roaring 420s,” said David Downs, a senior editor at Leafly, a cannabis marketplace platform.

Cannabis taxable sales in California rose to $3.54 billion last year from $2.96 billion in 2019, and the trend continues, according to BDSA, a leading cannabis market research firm. Sales in April were 40% higher than a year earlier.

Unlike many other retailers that had to close in the spring of 2020, dispensaries were deemed essential businesses and stayed open. That helped “legitimize the industry,” BDSA analyst Kelly Neilsen said.

The pandemic accelerated several industry trends. Pickup, drive-through and home delivery expanded. Brisk online sales for delivery and pickup continue, Downs said.

With alcohol, Californians went big on the hard stuff — and cocktails proved especially popular.

Sales of spirits such as gin, scotch and tequila surged nearly 24% in California stores in 2020 compared with 2019. People rushed to stock up on alcohol from grocery and liquor stores when the COVID-19 pandemic shut down restaurants and bars. Wine sales jumped nearly 16%, and beer sales rose more than 8%, according to NielsenIQ.

Expanded delivery and pickup services fed the boom. Direct-to-consumer shipping, allowed in-state for wine for more than three decades, became legal for spirits too.

Spirits grabbed market share from wine and beer: Ready-to-drink cocktails grew the fastest of any category, a trend expected to continue. “While many consumers got adventuresome and began making exotic cocktails at home, others wanted the convenience of premixed cocktails,” said David Ozgo, a Distilled Spirits Council economist.

Store sales are falling as businesses reopen and more Americans have been vaccinated. In the first five months of this year, spirit sales were down nearly 2%, wine down nearly 5% and beer down nearly 7% compared with the same period last year, according to NeilsenIQ.

Still, store sales of alcohol remain above what they were pre-pandemic.

— Margot Roosevelt

Virtual healthcare

The pandemic ushered in an era of widespread telehealth.

Cedars-Sinai Medical Center, for example, said that it had only 930 virtual visits with patients in the year leading up to the pandemic. Since March of last year, it has racked up 312,000.

At Keck Medicine of USC, 22% of patient visits will be virtual this month, said Smitha Ravipudi, chief executive of USC Care and Ambulatory Care Services. The hospital expects that to ebb in the future, leveling off at about 15%, she said.

The “huge explosion in the use of telehealth” has been “really key to keeping patients connected” to their healthcare providers, said Shira Hollander, senior associate director for policy development for the American Hospital Assn.

If patients saw virtual appointments as just something to endure, the trend could vanish again as COVID-19 concerns ease.

But three-quarters of those surveyed last spring by McKinsey expressed high satisfaction with their telehealth experiences. Some people even feel their doctors pay more attention to them during video calls, Dr. Jessica Dudley and Iyue Sung of Press Ganey, a company that surveys hospital patients, wrote in the Harvard Business Review.

Now there’s the matter of fine-tuning. A next step for the medical field, Hollander said, will be to evaluate “which services are best suited to virtual delivery and which maybe should go back to being in person.”

— Andrew Mendez

Travel

In the few years before the pandemic struck, the nation’s most popular tourism destinations such as Los Angeles, New York and Orlando, Fla., were reporting record numbers of visitors, particularly among big-spending international travelers.

The country’s airlines were so profitable — thanks to low fuel costs and steadily increasing passenger numbers — that the chief executive of American Airlines predicted his company would never lose money again.

Then the industry collapsed.

The crash of the travel and tourism industries in 2020 has been more devastating than the combined effects of the Sept. 11 terrorist attacks and the 2007-08 recession. After all, who could be comfortable cramming into an airline cabin or a hotel elevator with complete strangers while a fatal virus was circulating?

Travel and tourism has slowly started to return, but industry experts predict it will take two or three years before the visitor numbers and profits return to pre-pandemic levels. For now, most of California’s tourism spending comes from in-state visitors, who favor road trips to national parks over flights to out-of-state destinations.

More than 78,000 people flew through Los Angeles International Airport the Friday before Memorial Day this year — the biggest day since the pandemic began, according to airport officials. But that was still down more than 35% from the comparable day in 2019.

Several Los Angeles County hotels have either closed permanently or temporarily or changed ownership over the last year, with thousands of workers being furloughed. But hotel occupancy rates in the county are slowly climbing again, reaching 62% in April, up from only 43% in July 2020. Hotel occupancy rates on weekends have reached 70% or higher for the last several weeks, according to the Los Angeles Tourism and Convention Board.

Southern California card clubs were forced to close for about eight months before local officials allowed the businesses to operate in tents in their parking lots to meet pandemic protocols. Starting Tuesday, most of the card tables are expected to move indoors. Patrons who have been vaccinated will be allowed to enter the casinos without a mask, but casino operators are not likely to insist on proof of a vaccine, said Rudy Bermudez, executive director of the California Cities Gaming Authority, a coalition of cities that are home to card clubs.

— Hugo Martín

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.