Column: Is Elon Musk trying to destroy bitcoin over environmental concerns?

For anyone still wondering why bitcoin lost nearly 8% of its value in the blink of an eye Sunday and has slid even more on Monday, we have two words of explanation: Elon Musk.

Since Feb. 8, when Tesla, his electric-car company, announced that it had bought $1.5 billion in the vaporous cryptocurrency, the price of bitcoin has risen and fallen in step with Musk’s further pronouncements.

Bitcoin rose when Tesla said it would start taking bitcoin in payment for its cars. It fell Wednesday, when Musk said those deals were off — an announcement that helped lop about about $10,000, or nearly 20%, from bitcoin’s price in the space of 12 hours.

We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.

— Elon Musk

Bitcoin fell again Sunday when Musk seemed to hint, in a Twitter exchange with a noted bitcoin bull, that Tesla had sold its bitcoin holdings. Then it rose (though not enough to make up the losses) when he tweeted later Sunday “to clarify speculation” that Tesla had not sold any of its bitcoin.

Is there any wonder that the bitcoin community has come to feel, in the words of Danyaal Rashid, an analyst at GlobalData, that Musk “has too much influence over prices”?

The fear is that his relentless whipsawing of prices is bad for the reputation of bitcoin and other cryptoassets as well. “People may lose faith in these cryptocurrencies as one Tweet from Musk can radically change the price — quashing any idea that there are any real fundamentals at play,” Rashid wrote.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

That’s true, but it shouldn’t be overlooked that Musk’s Wednesday reversal on bitcoin purchases of Tesla vehicles linked his decision to one of the real downsides of bitcoin — the stupendous consumption of energy, much of it generated by fossil fuels, by computers engaged in bitcoin “mining.”

In his announcement, Musk referred to the “rapidly increasing use of fossil fuels for Bitcoin mining and transactions,” which obviously is at odds with his depiction of Tesla as a bulwark against fossil fuel-driven climate change.

It’s proper to point out here that Musk’s will-he-or-won’t-he tweets and his corporate policies related to bitcoin don’t appear to have any economic rationale. (“He is messing with us,” is the judgment of Matt Levine of Bloomberg.)

Has any era given birth to more dubious investment mechanisms than today?

If he’s truly concerned about bitcoin’s environmental footprint, he’s rather late to the game, especially if he’s implying that he just learned about it. That’s because the issue has been known about and widely discussed for a few years, at least.

So let’s take a look at that issue and what, if anything, Elon Musk can do about it.

Bitcoins are theoretically produced through the solving of an increasingly abstruse computer riddle, requiring ever increasing computing power to solve. The process is known as mining. Successful miners are awarded a supply of bitcoins, which will top out permanently at 21 million; about 18.7 million have already been “mined,” so the frenzy for mining the last few is intensifying.

The amount of energy to run the mining computers is often compared to consumption by whole countries — over the last year, I’ve seen Austria, the Philippines, New Zealand, Ukraine and Argentina invoked.

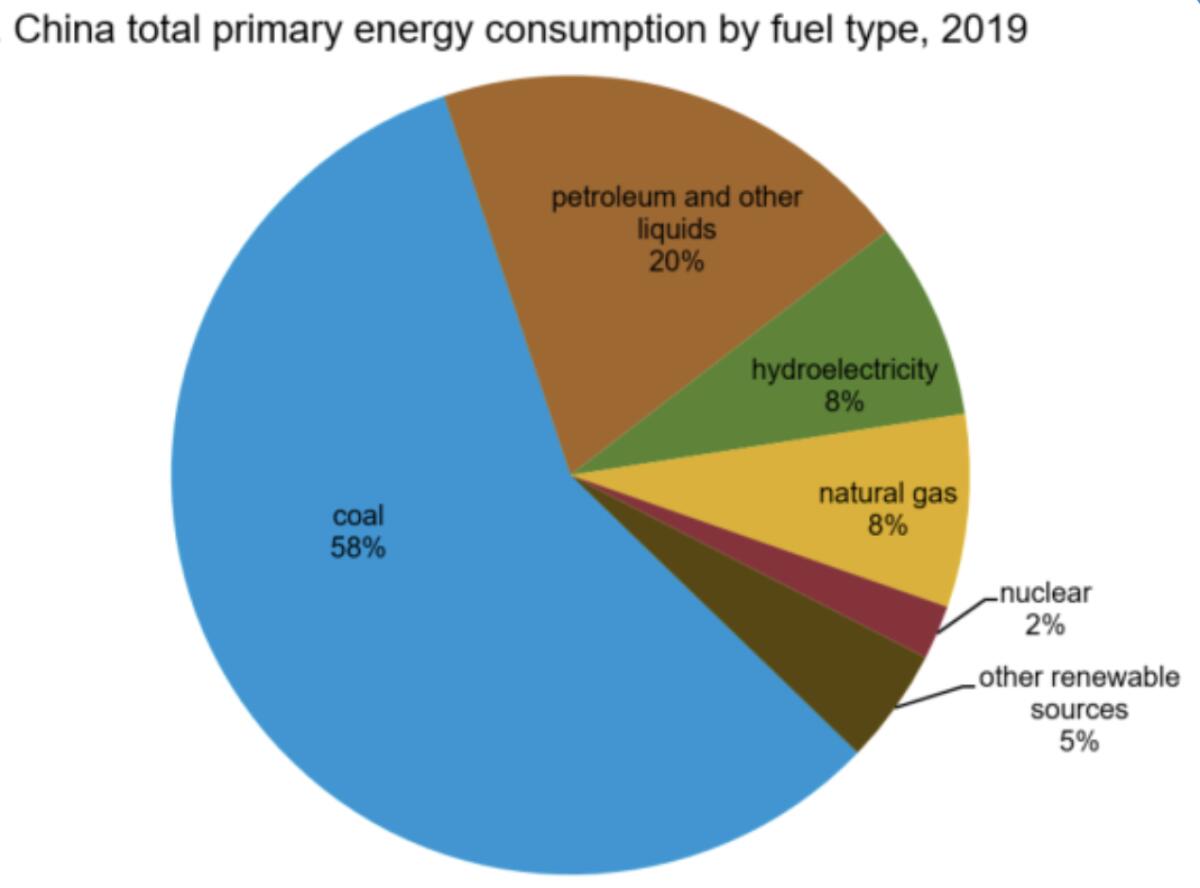

But it’s not simply the level of consumption, but the source of the energy that concerns environmentalists. An estimated 65% of all bitcoin mining occurs in China, where the electric grid is massively polluting. About 86% of China’s energy consumption comes from nonrenewable sources, including 58% from coal (the worst-polluting source), 20% from oil and 8% from natural gas.

All told, according to the Sierra Club, carbon dioxide produced by bitcoin mining could increase global temperatures by 2 degrees Celsius over 30 years. That would have a devastating effect on the environment, causing widespread extinctions, the destruction of forests and the collapse of the ocean ecosystem.

In reversing Tesla’s decision to accept bitcoin as payment for its cars, Musk said the company would resume “as soon as mining transitions to more sustainable energy.” That’s obviously a long way off.

Musk said, “We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

Tesla is making a $1.5-billion investment in the cryptocurrency bitcoin. That’s more than Tesla has spent on R&D in any of the last three years.

That could be a reasonable goal, since bitcoin’s energy consumption of 707 kilowatt-hours per transaction is more than 10 times that of the runner-up, ethereum, at 62.56 kilowatt-hours. Others use even less, including cardano, dogecoin and XRP. Indeed, Musk’s tweet may have been a subtle promotion of dogecoin, a cryptocurrency that was launched as a parody of bitcoin but has since taken on a life of its own, due in part to Musk’s talking it up.

Weaning the crypto market from bitcoin is also a tall order, however. Among the ever-proliferating universe of cryptocurrencies, bitcoin remains king of the hill. Even at its reduced value, bitcoin’s market capitalization of nearly $794 billion handily outstrips that of ethereum, at $367 billion. Cardano ($64 billion), dogecoin ($61.6 billion) and XRP ($52 billion) are runners-up in market capitalization, and a host of even more obscure cryptocurrencies such as chainlink, stellar and TRON are even further behind.

All those values, of course, are largely conjectural, since cryptocurrencies don’t represent even a theoretical call on assets of value, unlike government-backed currencies. They’re worth only what a bidder is willing to pay for them, with no floor in price.

It’s true that anyone who held bitcoin, among other such assets, over time has reaped a windfall, since bitcoin’s price has risen about 343% since a year ago, when it was trading at $9,724. On the other hand, holding onto one’s bitcoin stake has required intestinal fortitude, since the last year also has featured some nauseating plunges: At its current price, bitcoin has lost one-third of its value since one month ago, when it traded at $63,347.

The nature of Musk’s interest in bitcoin, dogecoin or any other cryptocurrency remains mysterious. Even when Tesla said it would accept bitcoin in payment, the company didn’t make such transactions particularly easy.

Who needs bitcoin? Not you.

Customers had to make their payments within 30 minutes of making a deal, or the bitcoin price would expire and they’d have to start over. Tesla warned that if you made a mistake — say by entering the wrong recipient code in your bitcoin account and Tesla never got the money, it’s your problem.

That’s because bitcoin transactions are designed to be irrevocable for any reason; supposedly this is a virtue of bitcoin, but not if you have legitimate grounds to reverse a deal. It isn’t clear how many Tesla buyers paid in bitcoin — a few people claimed on Twitter to have done so, but the company hasn’t verified those reports.

As for Tesla’s $1.5-billion bitcoin hoard, that never made much sense in terms of the company’s profit-and-loss statement. In disclosing the investment in February, Tesla said its bitcoin would be carried on its books as “indefinite-lived intangible assets.”

According to accounting rules, those assets must be evaluated every quarter; Tesla will have to report a loss any time the value of its bitcoin falls below its purchase price. But Tesla isn’t permitted to recognize a gain, even if the price rises, unless and until it sells its bitcoin.

Obviously, this unbalances the bitcoin accounting toward a loss. If bitcoin rises, Tesla could sell its bitcoin at any time and recognize the gain. But given how much bitcoin fell on speculation that Musk had sold, his tweeting about bitcoin places him in a potential conflict of interest, since he can effectively manipulate bitcoin’s price with his words, positive or negative.

I wrote at the time of Tesla’s announced purchase that its investment could be almost as much of a risk for bitcoin holders as it is for Tesla. “Bitcoin fans better pray that Musk doesn’t cool on the crypto,” I wrote then. We’ve now seen that phenomenon in action.

So what’s Musk’s endgame? Possibly his goal is to undermine interest in bitcoin by spotlighting its environmental impact. Perhaps his contradictory tweets over the last few days are aimed at propping up the price long enough for Tesla to dump its stake.

Or perhaps, as Bloomberg’s Levine suggested, he’s just messing with our heads in that way he has. Whatever the case, he’s proved that bitcoin, much less other cryptocurrencies, are assets that smart investors should steer clear of.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.