Column: The Tucker Carlson mystery: How does his show survive without major advertisers?

It used to be that the economics of television were pretty straightforward: Broadcasters sold advertising to sponsors, who were willing to pay more to hawk their wares on the highest-rated programs.

The biggest shows and stars attracted the classiest advertisers — luxury car makers, popular consumer products, brokerages and banks.

Things have obviously changed radically, or how else could one explain the phenomenon of Tucker Carlson?

We have a moral obligation to admit the world’s poor, they tell us, even if it makes our own country poorer, and dirtier, and more divided.

— Tucker Carlson, 2018

Carlson is the undisputed star of Fox News Channel. In the April Nielsen ratings he trounced all other cable news programming, with an average audience of more than 3 million viewers. His “Tucker Carlson Tonight” also finished first in the sought-after 25-to-54 age segment, averaging 523,000 viewers.

Yet the advertising lineup of Carlson’s show displays virtually no class at all. Judging from my viewing of the program on a couple of recent evenings, it comprises one advertiser that has attracted a regulatory complaint, another dinged for alleged ineffectiveness, a few others selling products for geriatrics that one would more expect to see on daytime TV or in predawn hours, and a few other minor consumer products.

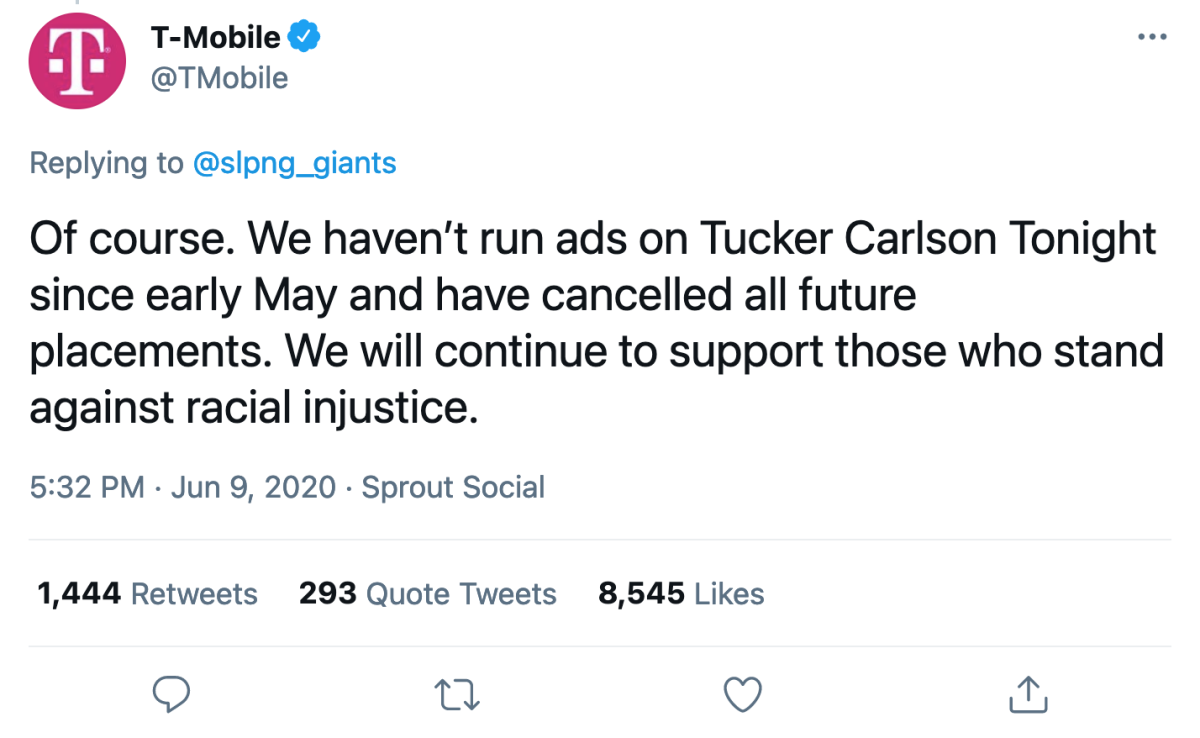

A couple of years ago, while Carlson’s rank on Fox News was on the rise but before he reached his current peak, his advertisers included Disney, T-Mobile, Lexus and the brokerage TD Ameritrade. None is an advertiser any longer.

It’s proper to ask what Fox Corp., his employer, gets out of the relationship. But Fox plainly thinks it gets something of value, for Carlson’s contract is reportedly worth $10 million a year.

Carlson has become the most prominent face of right-wing politics on cable. He has attacked immigrants and immigration in the most offensive terms and openly voiced racist talking points.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

He ridicules anti-pandemic measures such as social distancing and mask-wearing. On his program a few days ago, he counseled viewers to harass anyone they saw wearing a mask outdoors, and to call the police or “child protective services” on parents if their children are seen wearing masks at play.

Masks are “signifiers of shame and submission,” he said, blaming mask rules on “power-drunk politicians.”

The decline in interest from major advertisers in Carlson’s show has built over time. Variety reported in 2019 that ad spending on “Tucker Carlson Tonight” had crashed in 2018 by 47.8%, to $48.3 million from about $92.7 million in 2017.

Though it’s hard to know exactly what prompted that decline — and Fox claimed the figures were inaccurate — it happened around the time that Carlson was hitting the anti-immigrant theme hard. In December 2018 he declared, “We have a moral obligation to admit the world’s poor, they tell us, even if it makes our own country poorer, and dirtier, and more divided.”

First-rank sponsors continued to flee as Carlson’s pitch to right-wing viewers became ever more febrile. Now that he has become the leading spokesman on cable news for white supremacy, with side dishes of noxious anti-masking and anti-vaccination commentary, it’s perhaps fortunate for him that there are no more front-line sponsors to lose.

Fox has been cagey about Carlson’s advertising, though not about his popularity. “Despite an onslaught of politically motivated criticism, ‘Tucker Carlson Tonight’ remains the highest rated cable show in America,” the network told me by email. Ad revenue on the show has been “rising in each of the past three quarters,” the network said.

Conventional wisdom holds that even divisive television figures can survive controversy as long as they bring in the bucks. When that flow is stemmed, career trouble often has followed.

OMB nominee Neera Tanden is being keelhauled by conservatives for incivility on Twitter. Where have they been for four years?

The shrinkage of former Fox News star Bill O’Reilly’s sponsor base, including the loss of Mercedes-Benz, is thought to have hastened his departure in 2017 (though O’Reilly was accused of such a long list of offenses against morality, taste and his own Fox News co-workers that it’s impossible to identify the last straw). The big beneficiary of O’Reilly’s fall may have been Carlson, who inherited much of his audience.

So let’s take a romp through the Tucker Carlson advertising landscape. These figures are based on his evening shows Tuesday and Wednesday and afternoon show Thursday this week. (All times Pacific.)

Carlson’s biggest advertiser Tuesday, in terms of minutes of airtime, was Tucker Carlson. About five minutes of the more than 21 total minutes of advertising were devoted to promoting a program he’s done for Fox Nation, his company’s streaming service, evidently devoted to portraying Chicago as a community beset by unrelenting mayhem.

Another big advertiser was Fox itself, which placed 2 minutes and 15 seconds on Tuesday and 5 minutes, 15 seconds on Wednesday of ads promoting its own programs and Tubi, a streaming service Fox owns.

In the news business we call these “house ads.” They’re typically placed to fill ad space that hasn’t been sold to paying customers. In the TV business they’re more common because there’s a greater respect for cross-promotion. But it’s a safe bet that if Disney or T-Mobile wanted those ad slots, they’d get them.

The largest paying advertiser on Tucker Carlson appears to be MyPillow.com, the direct sales bedding firm whose owner, Mike Lindell, has been among the most feverish supporters of ex-President Trump and his debunked claims of a rigged election.

According to the analytics service Tvrev, Lindell’s ads were second only to Fox News house ads in the number of airings on the show in the last week of March, accounting for nearly 20% of ad minutes. On Tuesday and Wednesday, the two-minute MyPillow commercials were the only ones clocking in at more than a minute each on both shows. (A commercial for an oxygen backpack for seniors and the infirm also lasted two minutes on Tuesday.)

Some of the lineup occupied the commercial spectrum within a few notches on either side of infomercials. One prominent sponsor is Balance of Nature, a marketer of nutritional supplements. Balance of Nature and its proprietor, a former chiropractor named Douglas Howard — who is featured in the ads — were the target of a Food and Drug Administration enforcement action in 2019.

President Trump’s permanent Twitter ban will provoke an examination of the platform’s power, but it’s exaggerated.

The FDA informed Howard by letter that although the company claimed that its products were “safe and effective” for the treatment of diabetes and could be used to treat asthma, multiple sclerosis and other diseases, the products “are not generally recognized as safe and effective” for those purposes.

That made them illegally misbranded drugs, the FDA said. The agency further found that the firm hadn’t done enough to make sure that its third-party manufacturing contractors met production standards that would ensure that the products weren’t adulterated.

We couldn’t determine how the FDA action turned out. But the commercials aired on Carlson’s show lack the overt claims that the agency complained about.

Another recurrent advertiser Tuesday and Wednesday was Focus Factor, the maker of a supplement that claims to improve the memory. Consumer Reports took a look at this product in 2011 and pointed out that many of its ingredients could be found in a multivitamin for $1 a month, while Focus Factor could cost as much as $80 a month.

The evidence is “pretty meager” that any of the ingredients can improve cognition, CR said: “Our experts recommend you forget this memory supplement.”

Other advertisers make you wonder who constitutes the core audience of “Tucker Carlson Tonight.” There’s the WaxRx ear wax removal system and Fungi-Nail. (That ad boasts, “Say goodbye to toe fungus!”)

We couldn’t swear that these products wouldn’t be of use to somebody, but they don’t seem to address the same target market as, say, Lexus or TD Ameritrade.

The Fox News advertising chief, Jeff Collins, told Advertising Age last May that the cable channel generally had seen “an influx of younger-skewing advertisers.”

That doesn’t seem to be heavily reflected in Carlson’s sponsorship, which included not only the oxygen devices and cognition supplements but pitches for Medicare Advantage plans, which aren’t open to applicants younger than 65. The pitchman is ex-NFL quarterback Joe Namath, 77, whose football career ended 44 years ago, before most members of that younger-skewing audience supposedly sought by advertisers were even born.

Thursday’s pitches included nostrums for prostate enlargement and joint pain and a pill dispenser, not generally a young person’s needs.

At this stage, it appears that Carlson’s audience draw may be more important to Fox than his advertising. It’s not at all clear that Fox has lost advertisers, as opposed to Carlson himself. “All national ads and revenue from Carlson’s show have moved to other [Fox] programs,” the network asserted last June.

Then there are the economics of Fox as a cable offering. The network earns far more in fees from cable operators carrying its content than from advertising — $1.9 billion from cable fees in the last six months of 2020, according to its financial disclosures, compared with $740 million from advertising.

Advertising, however, grew by 25% in that period compared with a year earlier, while cable fees were flat. In the last three months of the year, in fact, cable fees declined, a sign of the trend toward cord-cutting by viewers who prefer to subscribe to video content piecemeal rather than through cable bundles.

Carlson appears to have developed an affinity with Lachlan Murdoch, the Fox CEO and son of Fox kingpin Rupert Murdoch. Signs of that emerged in mid-April, when the Anti-Defamation League called on Fox to fire Carlson.

On April 8, the ADL said in a letter to Fox News CEO Suzanne Scott, Carlson “disgustingly gave an impassioned defense of the white supremacist ‘great replacement theory,’ the hateful notion that the white race is in danger of being ‘replaced’ by a rising tide of non-whites.”

It was Lachlan Murdoch who responded, claiming that “Mr. Carlson decried and rejected replacement theory. As Mr. Carlson himself stated during the guest interview: ‘White replacement theory? No, no, this is a voting rights question.’”

The ADL didn’t bite. “Mr. Carlson’s attempt to at first dismiss this theory, while in the very next breath endorsing it under cover of ‘a voting rights question,’ does not give him free license to invoke a white supremacist trope,” its CEO, Jonathan A. Greenblatt, wrote in a second letter.

Though he brings the company criticism and controversy, Carlson’s audience might more than make up for it. Carlson may be viewed as an instrument to build up Fox’s presence in streaming media; witness the heavy promotion of his Fox Nation programming.

He also could be a key to an effort by Fox News to retain its grip on a right-wing, low-information audience in the face of challenges by outfits such as OAN, even further to the right.

Lachlan Murdoch, to be fair, says he doesn’t worry about those rivals on the right. America is a center-right country, he told Wall Street analysts in February. “We don’t need to go further right,” he said. “All our significant competitors are to the far left.” Yet does Carlson’s veer into the far-right fever swamp really fit that strategy?

Carlson’s rise has inspired something of a parlor game in the media, based on the question of how low he can go before he’s more of a drag than a boon to Fox News. No one can tell today where the limit is, only that we’ll know it when we see it. At least we hope so.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.