Less than 1 in 4 workers has gone back to the office as businesses plot a wider reopening

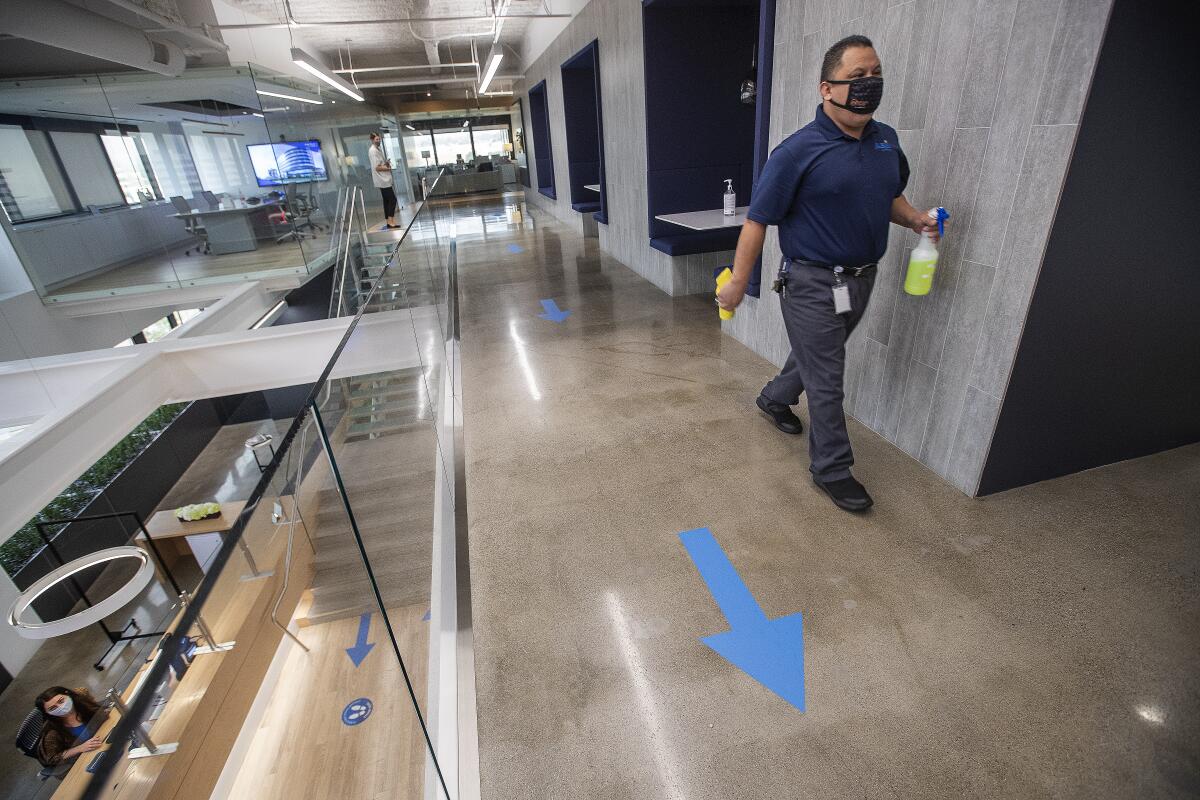

People had started showing up to the office again in greater numbers but fled for home as the recent coronavirus surge shook the region, fresh data show.

Still, employers and landlords are betting that workers will want to return as vaccinations increase and virus fears recede, even though demand to rent space in Los Angeles office buildings continues to shrink.

“By the stats, it’s not that encouraging,” said broker Todd Doney of real estate services company CBRE. “We certainly have work ahead of us to get through this.... But when the governor announced no more COVID restrictions on June 15, that’s light at the end of the tunnel for me.”

An average of 24% of employees in 10 major U.S. cities were back to the office as of April 7, down nearly a full percentage point from the week before, according to Kastle Systems, which provides key-card entry systems used by many companies and tracks patterns of workers’ card swipes.

In Los Angeles, the average at Kastle’s 148 buildings was 22.1%. Like the national average, it took a significant dip during the winter COVID-19 surge but had been rising again before the latest virus resurgence. Although beneath the U.S. average, L.A.’s offices were more full than those in five other cities tracked by Kastle, including San Jose at 16.7% and San Francisco at 13.4%.

As employees were trickling back to some offices, other workplaces were turning off the lights and turning over the keys.

Overall non-rented office space in Los Angeles County reached 17.2% in the first quarter, the highest vacancy level since early 2012, CBRE reported. That reflected a net loss of 1.6 million square feet of leased space, nearly matching the worst quarterly loss during the Great Recession.

Signings of office leases have been falling for about a year as companies sent employees home to work or laid them off in the face of a sharp economic downturn spurred by the virus. Many tenants reduced their office footprints as their leases rolled over, while others put their unused space on the market for sublease.

In March, slightly more than half of homes sold for over the asking price across Los Angeles. In some spots, the share was even bigger.

Tenants looking to get some money for offices they were not using had 7.3 million square feet available for sublease in the first quarter, about 15% of the total space available for rent — high by historical standards.

The number of leases being signed remained low, as tenants avoided long-term decisions in favor of short-term renewals when their leases expired.

Despite the economic headwinds, the average monthly asking rate climbed slightly to $3.90 per square foot in the first quarter, reflecting higher-quality space coming available and the reluctance of landlords to drop their rates. Instead, landlords offered tenants inducements such as months of free rent or generous allowances to build out their offices.

Uber, Google, Facebook and Microsoft are among the companies that have reopened offices or are on the verge of doing so, according to media reports. And recent surveys have shown that many companies and their workers are eager or at least willing to get back to the office.

A February survey commissioned by software company Eden Workplace found 85% of office workers are looking forward to being back at work, with many of them saying they miss socializing with their colleagues. A customer poll by marketing data provider ZoomInfo in February found that more than half plan to be back in the office by June, with information technology firms leading the way.

The worry for landlords is how much space tenants think they need going forward and whether they still want to work in city centers that many can reach only by long commutes.

It is a given among industry observers that remote work has been normalized to the point that white-collar companies will commonly allow their employees to work from home a few days a week in the future. Some workers may no longer have to come to the office at all.

That’s a substantial change in the office world from previous recessions, which also produced dramatic cutbacks in space leasing as companies went under or contracted their staffs. Recovery from this downturn will look different as companies reevaluate their needs.

The philanthropic company of Facebook founder Mark Zuckerberg and wife Priscilla Chan is spending millions to help South Los Angeles landlords.

A big unknown is how businesses will configure their office space in a post-pandemic world.

Will companies need less room if people are working at home sometimes, or must they have a devoted desk waiting for each worker when they do come in? Will workers still be seated close to one another as they have been in many offices in recent years, or must they have more elbow room to feel safe from viruses?

“Most of our tenants are making some changes to their physical office layouts,” landlord Bert Dezzutti said, but the long-term effects of those changes on building occupancy “haven’t sorted themselves out yet.”

Flexible work schedules “are here to stay,” said Dezzutti, head of Southern California operations for Brookfield Properties, the dominant office landlord in downtown Los Angeles. Many bosses, nevertheless, remain keen on preserving the office footprints they have.

A recent survey by consulting firm KPMG found that only 17% of chief executives are looking to downsize their office space as a result of the pandemic, a steep drop from August, when 69% said they planned to shrink their offices.

Before they return to the office, though, the majority of CEOs would like to see more than 50% of the general population vaccinated. They especially want to see their own employees get inoculated against COVID-19 — 90% of bosses said they are considering asking employees to report to them when they have been vaccinated, which may guide decisions on when companies return to their offices.

For the last six months or so, tenants in Brookfield’s high-rises have been using about 12% to 16% of their space, Dezzutti said. He expects that number to climb now that local officials have doubled the size of the office population allowed for nonessential businesses to 50% as part of easing COVID-19 restrictions.

Doney predicted that many companies will reduce the size of their offices in the future as remote labor becomes routine, but that they will return to working together for the most part.

“As more people get vaccinated and get more comfortable, they will do more things, including going to the office,” he said. “Zoom meetings are terrific, but sometimes that magic occurs in person before a meeting starts or after it ends.”

Working from home will become the norm for many employees even after the pandemic ends. But prepare for a pay cut.

People will come back to the office over the summer, he said, but the return will be substantial after Labor Day when the working-age population is largely inoculated and children are back in school.

An autumn renaissance of office attendance is also expected by Kastle Systems Chairman Mark Ein.

“You’re going to see an increase of some magnitude starting at the beginning of the summer,” Ein said. Then, “barring something unforeseen, there should be a huge surge coming back in the fall when virtually everyone is vaccinated.”

Cities where workers commute more by car than by public transit tend to have the most people in the office these days, Ein said. Offices in Houston and Dallas are the fullest in the country at close to 40% occupied.

Having COVID-19 shots will become mandatory for many, he said, potentially enforced by voiding the key cards of the unprotected.

“There are going to be a lot of companies who are going to decide that they only want people to come back to the office who are vaccinated,” Ein said.

Human beings have not been fundamentally changed by the coronavirus, Dezzutti said, and will again seek one another’s company in busy metropolises.

“In history, there has been no pandemic or plague or natural disaster that’s killed off the city,” he said. “Our need to live and work in urban clusters, and the concentration of people and economic activity that occurs there, is just too strong.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.