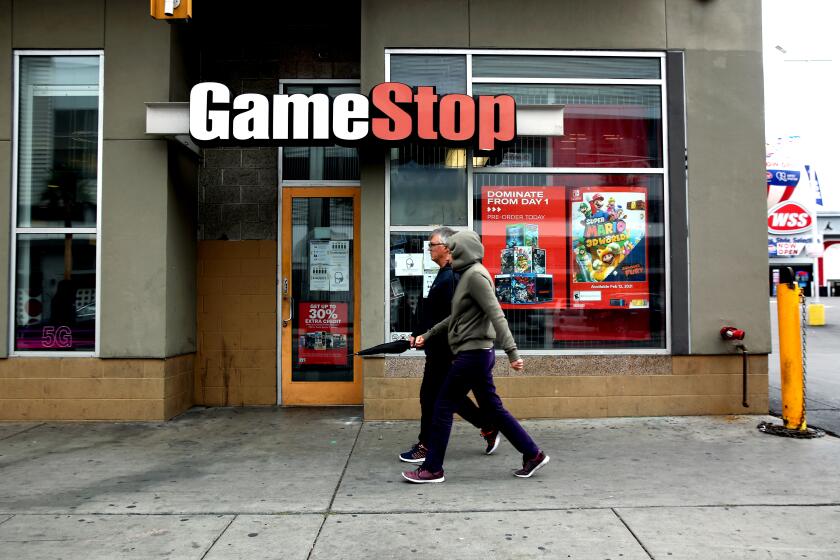

GameStop stock price briefly doubles again as Reddit-fueled roller coaster rages on

GameStop Corp.’s stock price extended its sudden resurgence Thursday as retail traders piled back into the stock after cues from a cryptic Twitter message and a short-seller report.

The video game retailer, whose stock briefly doubled in price midday, ended the day with a gain of 19% to $108.73 a share — the highest price since Feb. 1. This comes after it more than doubled in the final 90 minutes of trading Wednesday. Other favorites of traders populating Reddit forums also soared, having fallen far from the highs of last month’s buying frenzy.

“Most people who go to a casino, even if they end up losing, will return as long as they had a win streak at some point. With GameStop, they are back,” said Craig Birk, chief investment officer at Personal Capital.

Some were just in it for the money. Others saw a chance to stick it to Wall Street. Between them, they made GameStop the latest symbol of chaotic internet-fueled change.

Analysts cited a tweet by activist investor and GameStop board member Ryan Cohen posted shortly before the stock started surging Wednesday, suggesting Reddit traders may see it as a message to resume buying. A report from Citron Research provided a further catalyst by suggesting GameStop purchase Esports Entertainment Group Inc. to pivot away from its declining retail business.

GameStop’s wild ride added about $4.4 billion in market value over two days as bouts of volatility led to trading halts across Reddit-favorite stocks. GameStop shares were halted at least four times in early trading. Koss Corp. and Express Inc. experienced at least one halt each.

Some favorites of traders held on to smaller gains while others ended the day lower amid bouts of volatility. AMC Entertainment Holdings Inc., which had jumped 59% in the first three days of the week, ended the day down 8.8%. Koss nearly doubled in price Thursday, then trimmed the gains, ending the day up 16.8%.

Citron’s suggestion on the potential for GameStop to purchase Esports also drew attention to the online gambling company. The short seller set a price target of $50 for Esports shares, which jumped as much as 39% to $24.48 — their highest price since November 2017 — before trimming their rally, ending the day with a gain of 5.3%.

GameStop’s surge this week was initially spurred by a final-hour rally Wednesday that brought the stock its biggest advance since Jan. 29, the day Robinhood Markets restricted trading in it and 49 other stocks at the height of the frenzy.

MGM Studios has acquired film rights to ‘The Antisocial Network,’ author Ben Mezrich’s proposed book documenting last week’s Reddit stock market revolution.

The sudden revival in left-for-dead stocks recalled an episode last month that captured the attention of Wall Street, regulators and eventually Congress, as members of Reddit’s WallStreetBets forum egged on retail hordes in an attempt to take on professional short sellers.

Various explanations circulated as to what spurred the rallies Wednesday. The GameStop frenzy came after Bloomberg News reported late Tuesday that Chief Financial Officer Jim Bell was pushed out in a disagreement over strategy to make way for an executive more in line with the vision of activist investor Cohen, the co-founder of online pet food retailer Chewy.com. The addition of Cohen to GameStop’s board in early January underpinned the first flurry of moves in the stock after capturing the attention of WallStreetBets.

According to Neil Wilson, chief market analyst for Markets.com, the sudden surge in GameStop late Wednesday might have been triggered by a tweet from Cohen, who posted a picture of a McDonald’s Corp. ice cream about two hours before the close of regular trading.

“Does it signal Cohen will fix the company the way McDonald’s finally fixed its ice cream machines?” Wilson wrote in a note. “Or could it be even more cryptic and related to a new website that tells you in real time whether your local McDonald’s has a functioning ice cream machine? Who knows, stranger things have happened. It looks like the Reddit crowd are at it again.”

If after-tax profits from a stock bubble are greatly reduced, hair-trigger traders will gravitate to Las Vegas, where they belong.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.