Lockheed to buy Aerojet Rocketdyne for $4.4 billion, expanding its space footprint

Lockheed Martin Corp. is expanding its foray into futuristic space travel and missile defense by acquiring supplier Aerojet Rocketdyne Holdings Inc. in a deal valued at $4.4 billion, targeting higher sales and more savings in an environment of tightening defense budgets.

As part of the transaction, Aerojet declared a $5 per share special dividend, to be paid March 24, to holders of record as of March 10. The payment of that special dividend will adjust the $56 per share consideration to be paid by Lockheed Martin, according to a statement Sunday.

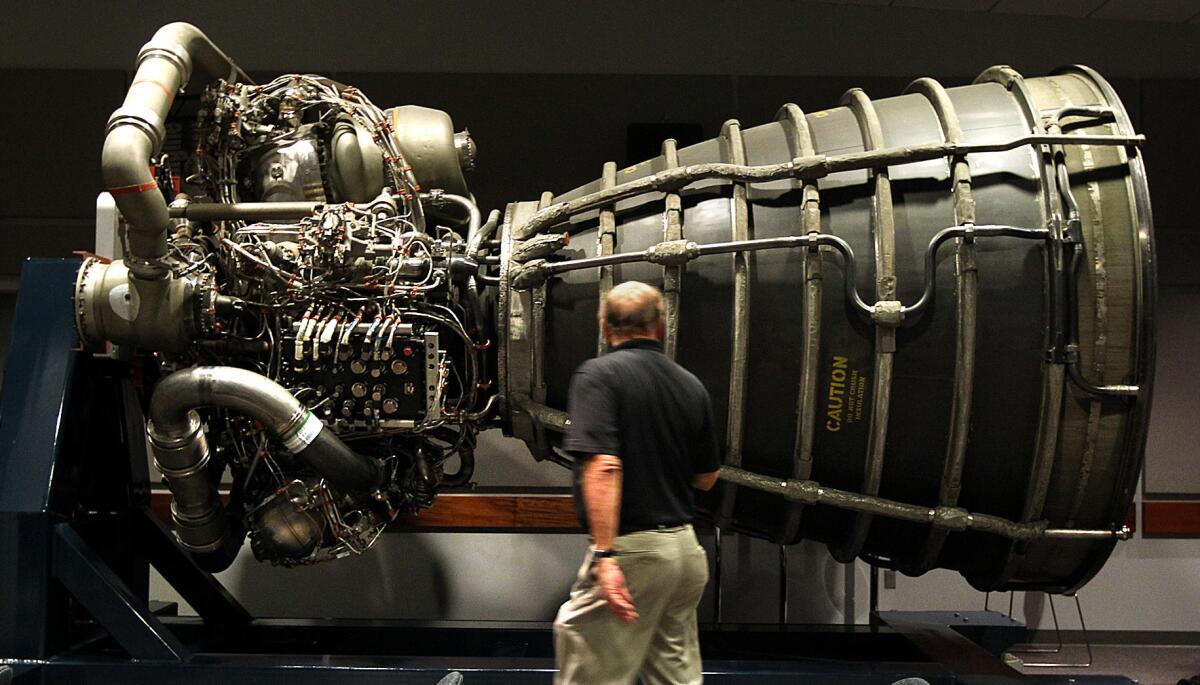

At $51, Lockheed will be buying Aerojet at a 21% premium over the stock’s Friday closing price. Lockheed Chief Executive Jim Taiclet stepped into the top job this year with a reputation as a dealmaker, and the company had a stockpile of cash. With Aerojet, he’s picking up a key U.S. supplier of propulsion systems for missiles, rockets and other space and defense applications.

The consolidation is likely to face scrutiny from key customers, such as the U.S. Defense Department and NASA. Another uncertainty is the reaction of competitors, such as Boeing Co. and Raytheon Technologies Corp., that rely on Aerojet’s motors for their own hypersonics and missile products.

President Trump championed the creation of the Space Force, but he has done little to ensure it has the funding, staffing and authority to succeed.

It’s not clear how defense and antitrust officials “will view this deal, especially in a new administration, but we could imagine pushback from others in industry, such as Raytheon or Boeing,” Seth Seifman, an analyst at JPMorgan Chase & Co., said in a note to customers.

Aerojet shares soared $10.73, or 25.5%, to $52.77. Lockheed shares slipped $6.68, or 1.8%, to $349.35, leaving the world’s largest defense contractor with a market value of nearly $98 billion. Aerojet shares had declined 7.9% this year through Dec. 18 while Lockheed had dropped 8.6%. A Standard & Poor’s index of U.S. aerospace and defense companies tumbled 18% over the same period.

Lockheed has been scouting for acquisitions. In January, the company said it was flush with cash and open to deals as Raytheon Co. prepared to combine with United Technologies Corp. to create a powerhouse in aerospace and defense.

During Lockheed’s October earnings call, Taiclet said the company would be active but “very, very prudent” in its drive to “bring in the technologies faster into the company that we think are going to be crucial for the future.”

The Aerojet transaction is expected to close in the second half of 2021 after getting regulatory approvals and a nod from Aerojet’s shareholders.

At the end of last week, Aerojet’s stock was trading at 25 times expected earnings, compared with 16 times for Lockheed.

Lockheed’s space division is its third-largest business, contributing 18% of the company’s 2019 revenue. Lockheed competes with Elon Musk’s SpaceX for U.S. government rocket launches through the United Launch Alliance, its joint venture with Boeing.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.