Column: No, Joe Biden isn’t secretly planning to cut your Social Security

Advocates for Social Security and other social insurance programs never let their guard down against threats to the programs and their beneficiaries.

On the whole, this is a good thing, for conservatives long have had their knives out for the programs and they’re not above dressing up their lupine plots in sheep’s clothing — as fiscal “fixes,” say — or pleading that so-called entitlements are sapping the national budget.

During the last presidential campaign, the crosshairs of suspicion were trained on Joe Biden. His decades-long Senate record was dredged for signs of softness on Social Security and found wanting — especially by Vermont Sen. Bernie Sanders, who was running against him for the Democratic presidential nomination.

The Democrats really ran on [Social Security] expansion, so it would be very hard for them to go with one of these grand bargains behind closed doors.

— Nancy Altman, Social Security Works

Biden “can’t hide 40 years of working with Republicans to cut Social Security,” Sanders has asserted, as in this March 7 tweet.

More recently, skepticism about Biden’s record has been transferred to progressive policy expert Neera Tanden, his pick for director of the Office of Management and Budget. Tanden’s record has been scoured, turning up signs of her ostensible softness on Social Security.

If one examines whether these criticisms are warranted, one quickly finds that the answer is no.

First, let’s examine Biden’s proposals on Social Security as they are now, not 40 years ago.

Biden proposes shoring up the program’s finances by applying the payroll tax to wage and salary income above a $400,000 threshold. Currently the tax of 12.4%, shared equally by employees and employers, is capped at a lower wage adjusted annually for inflation — the cap will be $142,800 in 2021.

The threshold Biden proposes won’t be inflation-adjusted. The goal would be to shrink the tax-free gap between $142,800 and $400,000 over the coming decades and, ultimately, to eliminate it entirely.

Biden also would implement a minimum retirement benefit for the lowest-income workers and augment benefits for those 85 and older, a cohort that often faces higher medical expenses. He would enhance benefits for surviving spouses, a long-overdue change that would primarily help women.

He would eliminate the so-called GPO/WEP offset, a widely detested calculation that slashes benefits for workers who spent part of their career in public service jobs that weren’t covered by Social Security, such as teachers.

Biden also has ruled out any effort to privatize Social Security, as was proposed by George W. Bush, or to turn it into a “means tested” program.

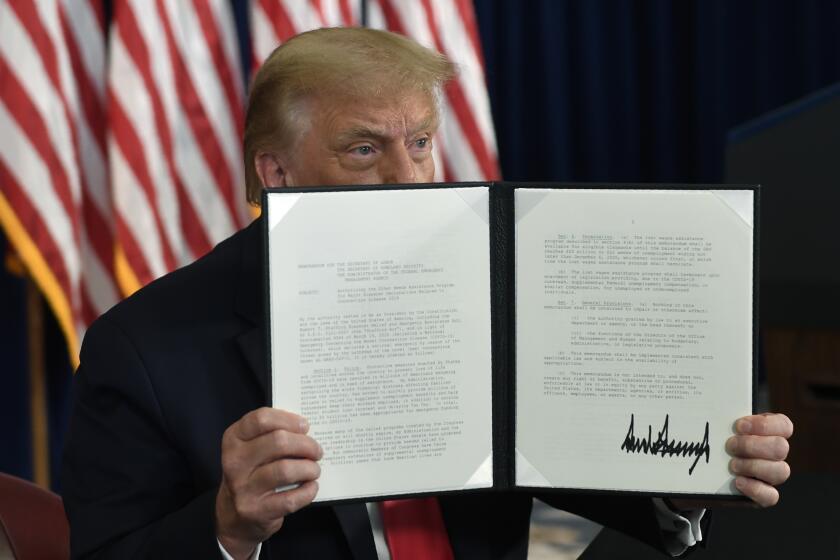

Trump’s payroll tax deferral is a mortal threat to Social Security.

All these proposals are well within the progressive and Democratic Party mainstream. “The Democrats have good expansion plans for Social Security,” says Nancy Altman, president of the advocacy group Social Security Works.

The criticism of Biden’s past record is focused largely on his participation in bipartisan negotiations to cut the federal budget deficit in the mid-1980s. Part of the plan was to freeze federal spending for a year, including the elimination of the Social Security cost-of-living increase for a year. Biden mentioned the cost-of-living freeze in a floor speech in 1984.

That moment has led to concerns that a President Biden might yet try to reach a “grand bargain” with Republicans on budget cuts that would encompass cuts to Social Security benefits.

Altman, as vigilant a sentry against covert attacks on the program as one could hope to find in the U.S. of A., says she isn’t especially concerned that such a deal is in the cards.

“The Democrats really ran on expansion, so it would be very hard for them to go with one of these grand bargains behind closed doors,” she told me. “I don’t think Biden could even get Democrats in Congress to go along even if he wanted to do it, and I don’t think that’s going to be his inclination.”

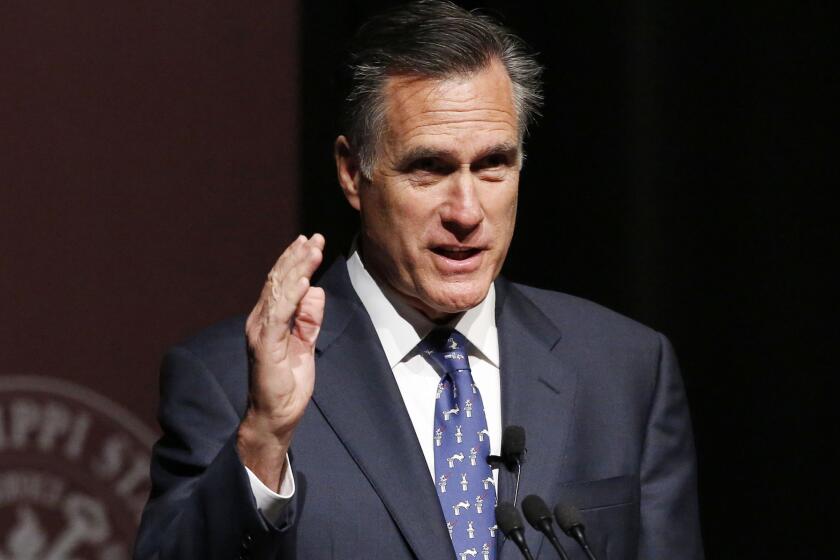

The old nervousness about Biden has now been transferred to Tanden, president of the Center for American Progress, a solidly liberal think tank.

Tanden’s experience in Washington policy-making is unassailable, with stints at the Department of Health and Human Services and as an advisor to the Clinton and Obama administrations and Hillary Clinton’s presidential campaign.

Social Security advocates are universally opposed to the measure, which they see as an expression of longtime conservative hostility to the program.

Republicans evidently view Tanden as an easy target among Biden’s Cabinet choices. Their point of attack seems to be her presence on Twitter, where she is known for her fierce and sometimes intemperate attacks on conservatives and defenses of progressive values.

Obviously criticizing a political figure for her tweets is an absurd position, given the crass and vulgar sewage that has been poured into the social media platform on an hourly basis from President Trump, with almost zero pushback from the same GOP officeholders now wringing their hands over Tanden’s lack of politesse.

From the left, however, the brief against Tanden is that she’s insufficiently sound on protecting Social Security. This would be a bum rap, even if it were not grotesquely exaggerated in attack pieces such as one recently published in Jacobin, a self-described socialist magazine.

The piece was headlined, “Joe Biden’s Neera Tanden Pick Is Even Worse Than You Thought.” Its central charge was that Tanden had supported a change in Social Security’s inflation index to the so-called chained CPI, which would provide for slower inflation adjustments than the traditional Consumer Price Index.

It’s true that moving to the chained CPI would, on average, reduce the inflation protection for Social Security benefits. I’ve written about the proposal many times, always negatively.

In 2017, I described it as a “stealth” benefit cut. That’s because it produces a lower inflation rate than the traditional CPI by an average of about 0.3% a year. The difference in cost-of-living increases would be almost invisible in the near term, but would accumulate over time, so that the shortfall would be 3% after 10 years and 6% after 20.

The chained CPI was part of a package of 11 Social Security reforms that the Center for American Progress issued in December 2010.

The other pieces of the package included a minimum benefit so that no Social Security recipient would live in poverty, a 5% increase for Americans reaching age 85, better benefits for surviving spouses and divorcees, a caregiver credit for people who spent years raising families or caring for relatives, spousal benefits for same-sex couples, elimination of the payroll tax cap, and allowing Social Security to invest some of its reserves in the stock market rather than only in treasury securities. The Center for American Progress also proposed a modest change in the benefit formula that would slow the growth of initial benefits for the wealthiest recipients.

Almost all those proposals were 100% within the mainstream of liberal and Democratic Party orthodoxy in 2010 and remain so today. Many are incorporated in Democratic legislative proposals, such as the Social Security 2100 Act introduced by Rep. John Larson (D-Conn.). Obviously, many are part of the Biden platform.

By my calculation, the center’s proposals pencil out at 10 to 1 on the progressive side, with the chained CPI the only outlier. The chained CPI, however, was deemed acceptable by other progressive policy groups at the time, on the condition that it be part of comprehensive progressive fiscal reforms.

Trump demands to cripple Social Security as his price for a COVID-19 rescue bill

The Center on Budget and Policy Priorities, for instance, said the chained CPI might work if and only if it were applied broadly, including to the income tax (by slowing the inflation-indexing of tax brackets and other elements of the tax code, the change would create a modest tax increase for wealthier taxpayers); if it were accompanied by a benefit increase for older retirees; and if Supplemental Security Income, or SSI, which serves the nation’s poorest seniors and disabled persons, was exempted.

No one was willing to agree to such conditions, so the chained CPI soon lost its luster.

Tanden later acknowledged that the chained CPI would reduce costs for Social Security, which is undeniable, but called it “a policy I disagree with.”

“The attacks on Tanden have really not been fair,” Altman says. She points out that “2010 was a different world — we’d had decades of propaganda that the sky is falling and we can’t afford Social Security, across the political spectrum.”

Since then, she added, “there has been a sea change. Most of those who endorsed austerity since then have changed their position — by 2013, Tanden and the Center for American Progress were off the austerity bandwagon.” Instead, they’ve been at the forefront on pushing back against cuts to discretionary federal programs that have been pushed by Trump.

It’s crucial to remember that fiscal policy isn’t made in a vacuum. Republicans will be on the other side of the table. Indeed, if the Georgia senatorial runoff election on Jan. 5 goes their way, the GOP will remain in control of the Senate.

And the Republicans have made no secret of their intentions to cut Social Security and Medicare benefits, in the name of deficit reduction, when they can. In this environment, ginning up reasons to doubt the incoming administration’s commitment to Social Security is counterproductive.

Anything is possible in the rough-and-tumble of legislative bargaining, of course. But it’s highly unlikely that the Democratic establishment would countenance any drive for benefit cuts now. And it won’t hurt to have a determined policy expert protecting Biden’s flank. The more sharp-tongued, the better.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.