PG&E emerges from bankruptcy

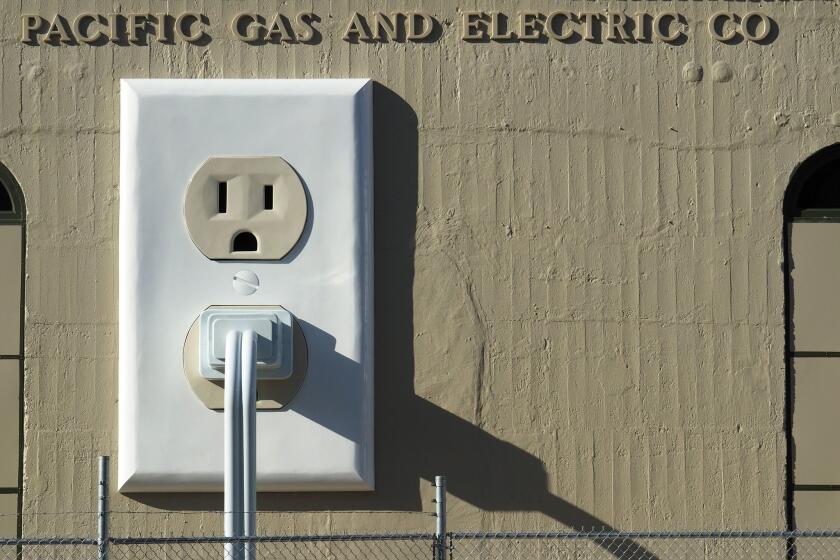

Nearly a year and a half after collapsing under $30 billion in liabilities from wildfires sparked by its equipment, PG&E Corp. has emerged from the biggest utility bankruptcy in U.S. history.

The California power giant said Wednesday that it had completed its restructuring and exited Chapter 11.

Now PG&E is left to fend for itself as a new wildfire season is already underway. Critics say the company has yet to fully address the daunting operational challenges it faces, even after overhauling its board and pledging to submit to more state oversight and divide operations into regional units to focus more on safety.

“This is an important milestone, but our work is far from over,” PG&E’s interim Chief Executive Bill Smith said in the statement. “Our emergence from Chapter 11 marks just the beginning of PG&E’s next era — as a fundamentally improved company and the safe, reliable utility that our customers, communities and California deserve.”

As Pacific Gas & Electric exits bankruptcy, it’s not clear there’s anything fundamentally different about the California utility.

The company says it has taken great strides toward rectifying its problems and putting itself on course to deliver safe, clean power to California for years to come.

“PG&E is committed to emerging from Chapter 11 as a fundamentally improved and transformed utility that meets the highest safety, governance, and operational standards,” former CEO Bill Johnson said in a June 20 statement.

One of PG&E’s next moves will be searching for a new chief executive to permanently replace Johnson, who was hired to steer the company through bankruptcy and announced in April that he’d retire June 30.

The company also plans to sell its downtown San Francisco headquarters and move to Oakland.

PG&E filed for Chapter 11 in late January 2019 after its power lines started some of the worst blazes in California history. They included the Camp Fire, which destroyed the town of Paradise and killed more than 80 people. The company pleaded guilty on June 16 to 84 counts of involuntary manslaughter. State regulators fined PG&E $1.9 billion in connection with the blazes.

The utility, founded more than a century ago, is paying $25.5 billion to cover damage claims it resolved in bankruptcy through settlements with fire victims, insurers and local government agencies. It is funding the reorganization with $9 billion it raised through equity offerings and more than $13 billion in the debt markets.

The company exits Chapter 11 having nearly doubled its debt to almost $40 billion, raising concerns about its financial durability and its ability to make an estimated $40 billion in investments required to fireproof its grid. In the meantime, the utility will need to resort to intentionally shutting off power to keep its lines from igniting fires during windstorms.

If PG&E gets into trouble again, California has the option to take the utility over as part of an agreement with the state to back its reorganization plan.

One advantage PG&E will have is a state fund established to help utilities cover liabilities from future fires linked to their equipment.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.