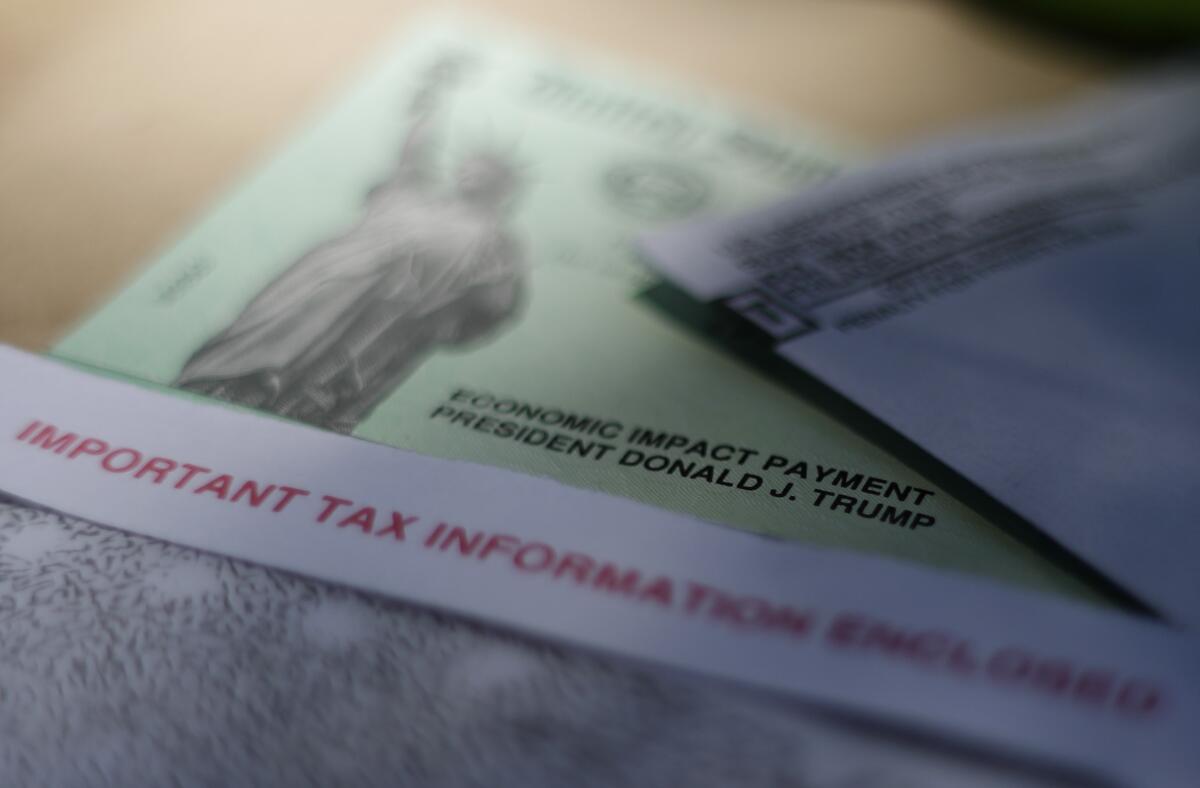

The IRS is finally staffing up. Here’s how to get your coronavirus stimulus money

Dear Liz: We do not make enough income to file tax returns, so we used the IRS site to apply for our economic stimulus payment ($1,700 for one adult and one teenage child). We received a response email stating our information was received successfully by the IRS several weeks ago. We included our bank deposit information for a fast direct deposit but the money has not arrived and we hear that the government ran out of money. We are desperate. What can we do or who can we speak with about this delay?

Answer: The government did not run out of money, and at a minimum you should be able to file a tax return next year to get your stimulus payment as a refundable credit. Since you need the money now, though, you should follow up with the IRS.

The IRS has reopened the general taxpayer helpline that was shuttered because of the coronavirus pandemic, but it has also added thousands of phone reps to a special hotline to deal with stimulus payment problems: (800) 919-9835. That’s the number you should call to inquire about your payment.

(Previous columns have dealt with people’s refunds being held up because the IRS didn’t have enough workers to open its mail. Tax processing centers are reopening, but it will take awhile to work through the backlog. You can check the status of a refund through the “Where’s My Refund?” tool on the IRS site or by calling (800) 829-1954.)

Tapping IRA creates a taxing problem

Dear Liz: I took $250,000 out of my retirement account in 2019 to set up five 529 accounts for my young grandchildren. As a result, my federal and state tax bills are $80,000. I’ll need to take that money out of my IRA. Will I keep having to pay large tax bills in order to pay for that one-time large withdrawal?

Answer: While your heart was in the right place, your money wasn’t. Withdrawals from IRAs are taxable, and such a large withdrawal almost certainly pushed you into a much higher tax bracket. If you had consulted a financial planner or a tax pro, they would have advised you to either fund the 529s from a non-retirement account or to make smaller withdrawals over several years to avoid such a big tax hit.

If you continue to tap your IRA, you will continue to owe taxes on the money you withdraw. The $80,000 will incur state and federal taxes. If you again pay the tax bill on the $80,000 using your IRA, you’ll owe taxes on that money as well, and so on.

You may not think that’s fair, but the reason your IRA is taxable now is because you got a tax deduction when you made the original contributions, and the money has been growing tax deferred in the meantime. Eventually, the government wants to get paid back for those tax breaks.

The ups and downs of reverse mortgages

Dear Liz: I have been a reverse mortgage specialist for the last 12 years and had some thoughts about the writer who complained that the $40,000 she initially borrowed had grown to a debt of $189,000, or more than her home was worth.

Using a compound interest calculator, it would take about 16.5 years for the debt to grow that large. The borrower would have lived in their home for all that time without making payments toward the debt, although they were still responsible for taxes, insurance and maintaining the property. They can stay in the home for as long as it’s their principal residence. Once they leave the home, the lender will sell the home and receive the difference between the sales price and the loan balance from the government insurance program that everyone with a reverse mortgage pays into. Otherwise, no lender would take out this loan for a potentially long term and risk losing money in the end. Maybe it was a good deal.

Answer: Possibly, but she regretted the decision anyway. She took out a reverse mortgage at a time of financial hardship and now wishes she hadn’t.

People facing financial crises often develop tunnel vision and grab at solutions without thinking through the future costs of their decisions. (The excellent book “Scarcity: Why Having Too Little Means So Much” by Sendhil Mullainathan and Eldar Shafir explains the science of why that happens.)

Advertising for these loans can gloss over the downsides, such as potentially not being able to tap your equity later, when you may need it more. Reverse mortgages can be a good solution for some seniors but certainly not all of them.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.