WASHINGTON — More than 3.8 million laid-off workers applied for unemployment benefits last week as the U.S. economy slid further into a crisis that is becoming the most devastating since the 1930s.

Roughly 30.3 million people have now filed for jobless aid in the six weeks since the coronavirus outbreak began forcing millions of employers to close their doors and slash their workforces. That is more people than live in the New York and Chicago metropolitan areas combined, and it’s by far the worst string of layoffs on record. It adds up to more than 1 in 6 American workers.

With more employers cutting payrolls to save money, economists have forecast that the unemployment rate for April could go as high as 20%. That would be the highest rate since it reached 25% during the Great Depression.

1/82

Socially distanced bikers and walkers, against a backdrop of the Queen Mary, make their way along pedestrian and beach bike path on the first day that Long Beach reopened the path on Monday May 11, 2020. The city of Long Beach eased a few of its public health restrictions, allowing under certain guidelines the reopening of pedestrian and beach bike paths, tennis centers and courts. Beach bathrooms are also reopening, but the parking lots and beaches still remain closed. (Genaro Molina/Los Angeles Times)

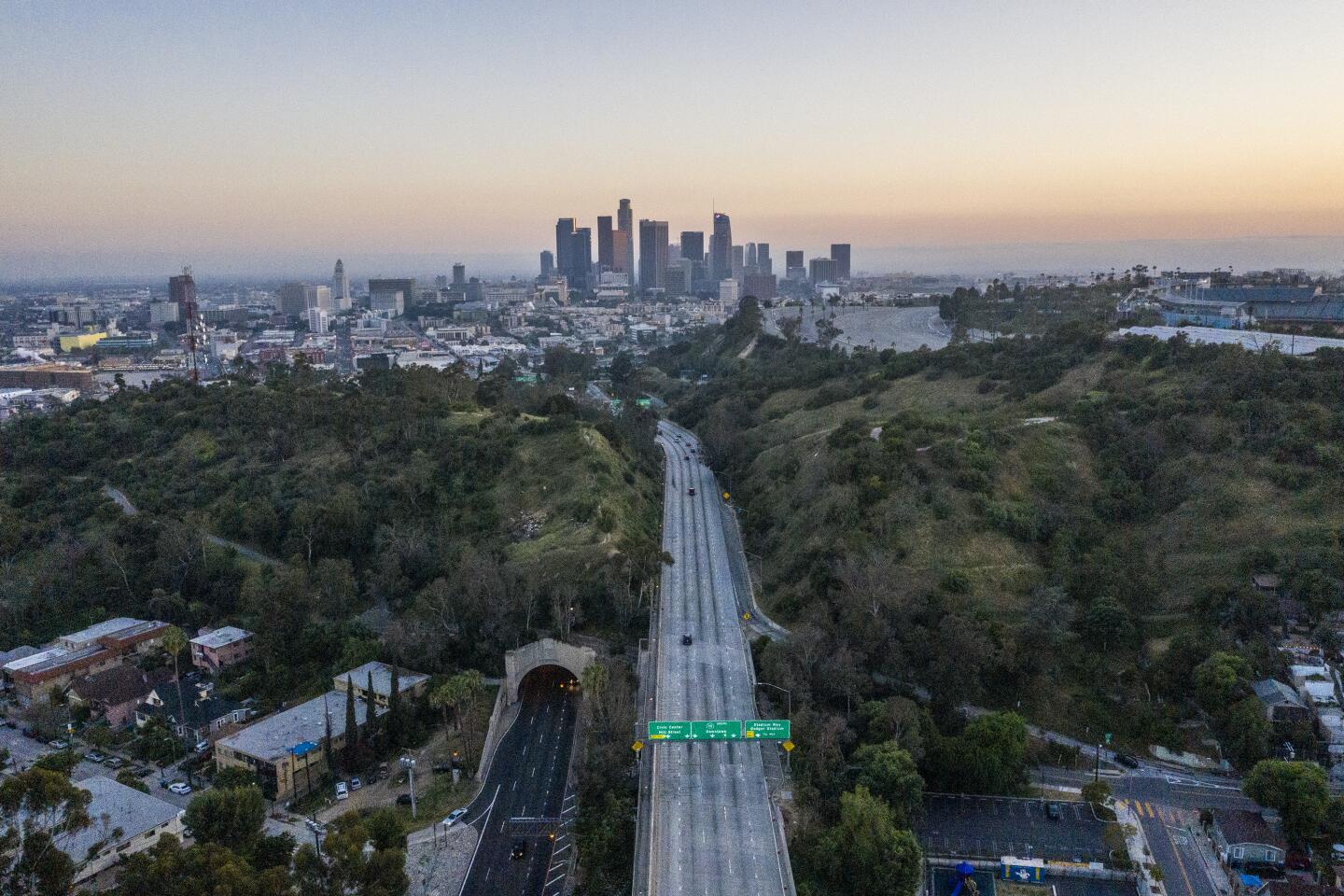

2/82

Traffic remains light on the southbound 110 Freeway headed toward downtown Los Angeles on April 28. (Robert Gauthier / Los Angeles Times)

3/82

Dominique Barrett, center, known as “King Vader” to his 2.4 million TikTok followers, prepares to shoot a video on April 30 in Glendora. (Dania Maxwell / Los Angeles Times)

4/82

Cody Purcell of Redondo Beach rides a wave, glowing from the bioluminescence, in Hermosa Beach, CA, after midnight Friday morning, May 8. (Jay L. Clendenin/Los Angeles Times)

5/82

Friends play spikeball, a game perfect for social distancing on an open but restricted San Buenaventura State Beach. (Brian van der Brug / Los Angeles Times)

6/82

The majority of golfers are wearing masks while hitting balls on the driving range at Van Buren Executive Golf Course in Riverside. (Gina Ferazzi / Los Angeles Times)

7/82

Beaches including Harbor Cove Beach were open but beachgoers were not supposed to be sitting on the sand. (Brian van der Brug / Los Angeles Times)

8/82

Tango instructor Yelizaveta Nersesova leads a Zoom tango event from her Los Angeles home April 27 that brought together hundreds of dancers from around the world. (Jason Armond / Los Angeles Times)

9/82

Grocery store workers, joined by United Food and Commercial Workers International Union Local 770 representatives and community members, hold a rally in support of strict social distancing on May 1 at a Ralphs store in Hollywood where 19 employees have tested positive for COVID-19. (Kent Nishimura / Los Angeles Times)

10/82

Mostly masked commuters keep their distance from one another on a Metro bus in downtown Los Angeles on April 29. (Gabriella Angotti-Jones / Los Angeles Times)

11/82

Gregory Kuhl, 69, heads home after a shopping trip in Hollywood on April 28. Big cracks in the street, cars parked in driveways blocking sidewalks and uneven pavement levels make navigating his route difficult. (Dania Maxwell / Los Angeles Times)

12/82

Tenants and their supporters from across Los Angeles gather at city hall to call on L.A. Mayor Eric Garcetti, the L.A. City Council and California Gov. Gavin Newsom to cancel rent and mortgage payments during the COVID-19 crisis. (Luis Sinco / Los Angeles Times)

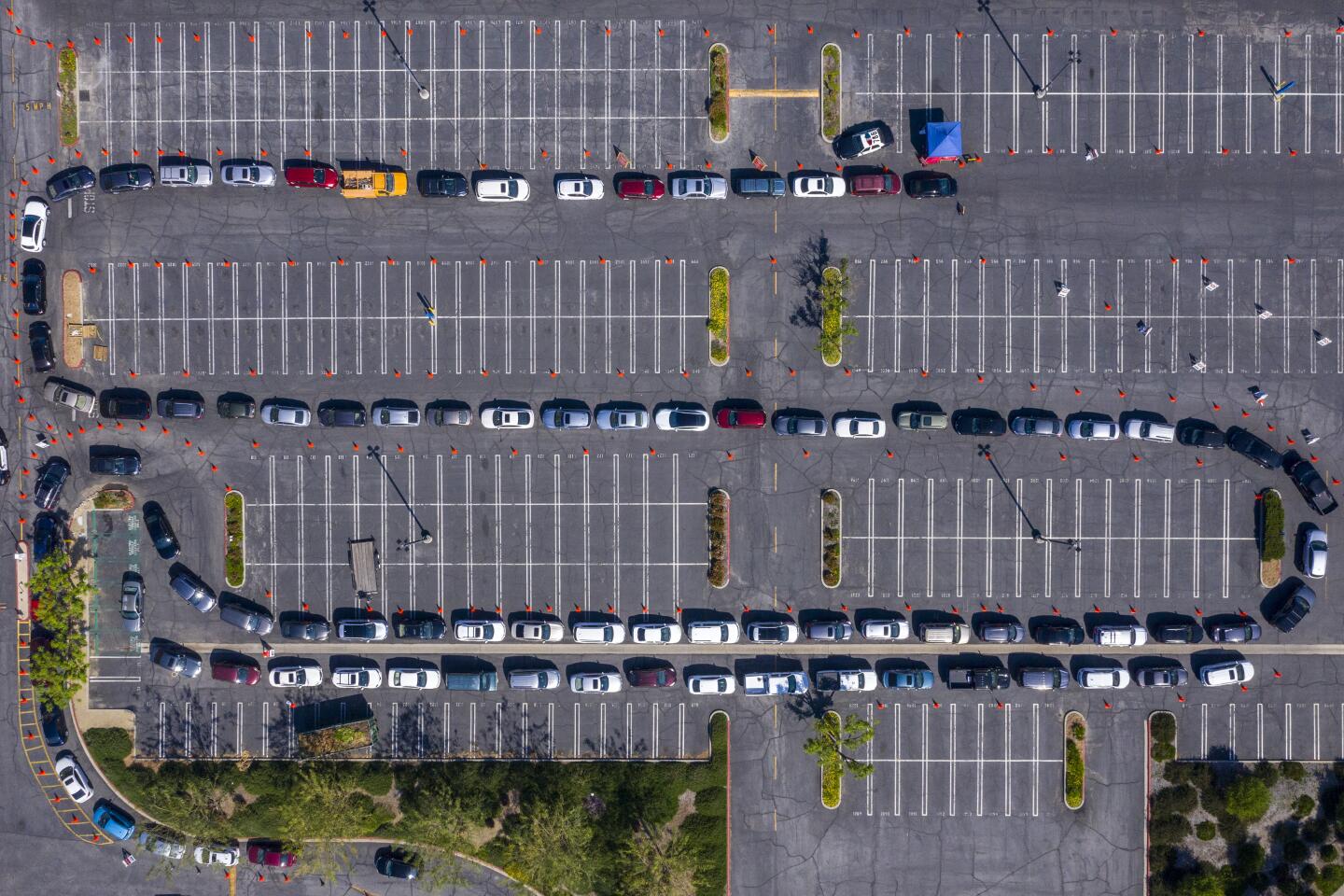

13/82

Aerial view of over 100 vehicles lined up at the West Valley COVID-19 testing center at Warner Center in Woodland Hills. (Brian van der Brug / Los Angeles Times)

14/82

Senior Mason Wise, left, helps his sister, Mackenzie, a sophomore, clean out her PE locker at El Camino Real Charter High School in Woodland Hills. School officials were allowing no more than five students at a time on campus to take home their belongings. (Brian van der Brug / Los Angeles Times)

15/82

Shuttered storefront businesses in the garment district of Los Angeles. California’s unemployment rate has skyrocketed since the statewide coronavirus shutdown took effect. (Luis Sinco / Los Angeles Times)

16/82

Healthcare workers celebrate as Claudia Martinez is discharged from the ICU after she recovered from COVID-19 at Scripps Mercy Hospital in Chula Vista. (Marcus Yam / Los Angeles Times)

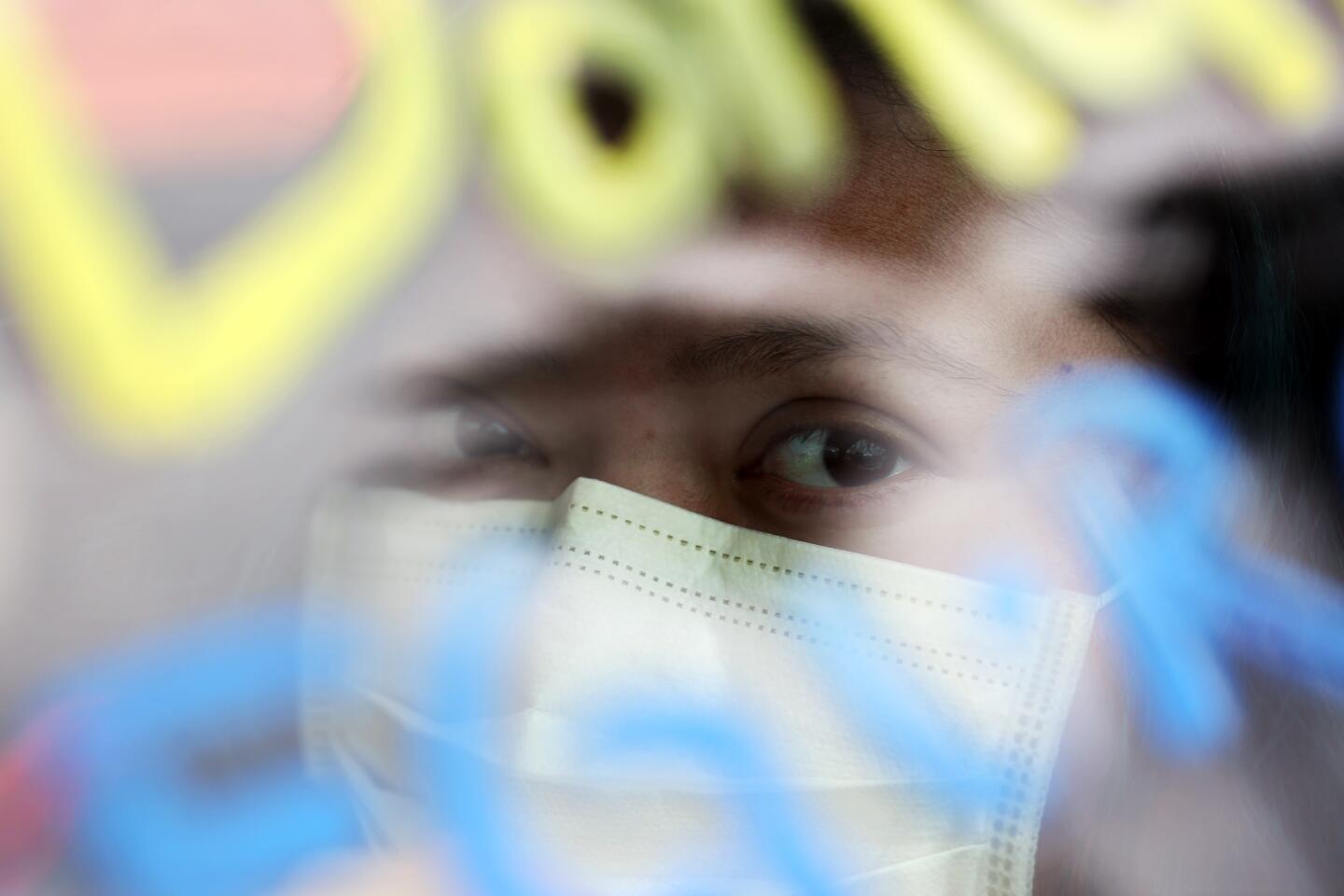

17/82

Carson residents Kaeli Burks, 3, left, and her cousin Bailey Watson, 5, look out the window of their car after their mothers helped them with self-testing at a new drive-up testing site for COVID-19 in Carson. Free COVID-19 testing is available to all city residents thanks to a partnership between the city and US Health Fairs. (Genaro Molina / Los Angeles Times)

18/82

Norm and Tracy Kahn enjoy eating dinner outside on a small cafe table sitting in blue chairs on their side yard during the coronavirus pandemic on April 27 in Riverside. “During this pandemic, eating outside offers us an opportunity to change surrounding and appreciate the calmness of being outdoors among trees, scents from nature and the sounds of birds,” she said. Also adding, “Mixing up where we eat puts variety into our days and takes away the sameness of feeling trapped at home.” (Gina Ferazzi / Los Angeles Times)

19/82

Ronald Reagan UCLA Medical Center nurses carry supplies outside the hospital. (Robert Gauthier / Los Angeles Times)

20/82

Tom Sean Foley pauses on a walk with his kids, Cathelen Claire, “C.C.,” 3, and Timothy Joseph, 4, to take a photo in front of the “Love Wall,” mural by artist Curtis Kulig, outside of Smashbox Studios in Culver City. (Jay L. Clendenin / Los Angeles Times)

21/82

Protesters stand along Mission Blvd. in Pacific Beach during A Day of Liberty rally on April 26. The protesters were against the government shutdown due to the coronavirus. (K.C. Alfred / San Diego Union-Tribune)

22/82

People make orders at a food truck along Shoreline Avenue in Long Beach. (Luis Sinco / Los Angeles Times)

23/82

Medical staff, wearing protective gear, work inside a COVID-19 isolation area inside the emergency department at Los Angeles County-USC Medical Center in Los Angeles, where patients with the virus are being treated. (Mel Melcon / Los Angeles Times)

24/82

Neighbors practice social distancing while enjoying the nice weather near The Strand in Hermosa Beach. (Gabriella Angotti-Jones / Los Angeles Times)

25/82

Counter-protesters attend a protest to call on state and local officials to reopen the economy in downtown Los Angeles. (Christina House / Los Angeles Times)

26/82

A group of protesters cheer on cars during a vehicle caravan protest to call on state and local officials to reopen the economy in downtown Los Angeles. (Christina House / Los Angeles Times)

27/82

Cedar Mountain Post Acute Rehabilitation staff member Navi Cavaltera waters a flower pot put up by the community to show their support for the nursing staff of the facility in Yucaipa. Eighteen of 20 coronavirus-related deaths in Yucaipa were residents of the skilled nursing facility. (Irfan Khan / Los Angeles Times)

28/82

A pedestrian wearing a protective mask passes a mural on a store on Melrose Avenue in the Fairfax district of Los Angeles. (Allen J. Schaben / Los Angeles Times)

29/82

Jonte Florence, a freestyle dancer, does a handstand on a mostly empty Hollywood Walk of Fame. Florence said he normally performs for hundreds of tourists along the busy street. (Allen J. Schaben / Los Angeles Times)

30/82

The Tyrannosaurus rex overlooking the intersection of Hollywood Boulevard and Highland Avenue wears a protective mask while practicing social distancing. (Allen J. Schaben / Los Angeles Times)

31/82

Businesses are shuttered and pedestrians are few and far between on Hollywood Boulevard. (Allen J. Schaben / Los Angeles Times)

32/82

Daniel Rogerson wears a vintage military gas mask while riding a bike along the beach path in Santa Monica, which is closed to enforce social distancing because of the coronavirus pandemic. (Luis Sinco / Los Angeles Times)

33/82

A face mask seller in colorful dress appears to be part of a mural behind a bus stop on Soto Street in Los Angeles. (Irfan Khan / Los Angeles Times)

34/82

Life around Cesar E. Chavez Boulevard and Soto Street has slowed down as California officials extended stay-at-home orders into May and residents entered Easter weekend with unprecedented limits on their movements. (Irfan Khan / Los Angeles Times)

35/82

UC Irvine Medical Center health care workers return their gratitude as about 25 Orange County first responder vehicles participate in a drive-by parade of gratitude as they battle COVID-19 at the hospital. (Allen J. Schaben / Los Angeles Times)

36/82

Billy Budd, 55, of Hollywood, walks along Hollywood Boulevard with a protective face covering. Budd is a scenic artist for movies and television who is currently out of work due to the coronavirus outbreak. (Mel Melcon / Los Angeles Times)

37/82

Stuart Reyes and his sister, Stephanie, sell masks for $5 each on the 3000 block of West Century Boulevard in Inglewood. Stuart Reyes said he is selling masks to support his mother. (Irfan Khan / Los Angeles Times)

38/82

A jogger runs on a closed trail past dozens of pieces of caution tape, torn off by hikers and mountain bikers at El Escorpion Canyon Park in West Hills. (Brian van der Brug / Los Angeles Times)

39/82

Alex Herron and nurse Mercy Pineda at a blood drive sponsored by USC athletics and the American Red Cross at USC’s Galen Center. (Genaro Molina / Los Angeles Times)

40/82

Los Angeles City Hall displays blue lights to show support for healthcare workers and first responders. (Gary Coronado / Los Angeles Times)

41/82

After being indoors for several days because of rainy weather and coronavirus stay-at-home orders, Olivia Jacobs, 4, and her mom, Cia Jacobs, enjoy a warm and sunny afternoon making chalk drawings on the sidewalk in front of their home in West Hills. (Brian van der Brug / Los Angeles Times)

42/82

An Oceanview Plaza security guard sports a whimsical mask while on patrol. (Robert Gauthier / Los Angeles Times)

43/82

Jacob De Wilde, left, and Lesli Lytle load a car with food during a food distribution organized to mark Good Friday. (Irfan Khan / Los Angeles Times)

44/82

As a late season storm continues to make its way across the Southland, a young basketball player dribbles along an alley through an Elysian Park neighborhood in Los Angeles. (Kent Nishimura / Los Angeles Times)

45/82

People are silhouetted in a window of an apartment building in Hollywood, where a stay-at-home order remains in effect to help curb the spread of the coronavirus. (Luis Sinco / Los Angeles Times)

46/82

The Wilshire Grand Center display blue lights and a heart to show support for healthcare workers and first responders. (Gary Coronado / Los Angeles Times)

47/82

Women wear masks as they stroll along Highland Avenue in Hollywood. Wearing masks while outdoors is mandatory in the city of Los Angeles. (Luis Sinco / Los Angeles Times)

48/82

Patients are removed from Magnolia Rehabilitation and Nursing Center after 39 tested positive for the coronavirus and nursing staff was not showing up to work. (Gina Ferazzi / Los Angeles Times)

49/82

A specimen is turned in at the new mobile testing site for people with symptoms of the coronavirus at Charles R. Drew University of Medicine and Science in South Los Angeles. (Christina House / Los Angeles Times)

50/82

Hippie Kitchen in Los Angeles hands out food, water and toiletries to homeless people and residents of skid row. Additionally, masks were offered to help reduce the spread of the coronavirus. (Myung J. Chun / Los Angeles Times)

51/82

Nurses pose for a fun photo during a break in drive-through public testing for the coronavirus at Arrowhead Regional Medical Center in Colton. (Irfan Khan / Los Angeles Times)

52/82

A woman shows a notice from her doctor that allows her to obtain a test for coronavirus at a new drive-up testing site in a parking lot at the South Bay Galleria in Redondo Beach. (Genaro Molina / Los Angeles Times)

53/82

A person who wishes to remain anonymous strikes from her car to support McDonald’s employees who are demanding the company cover healthcare costs of any worker or immediate family member who gets sick from COVID-19 in Los Angeles. (Dania Maxwell / Los Angeles Times)

54/82

Cassidy Roosen, with Beach Cities Health District, holds up a sign that says, “We’re All in This Together,” while waiting to direct cars at a drive-through, appointment-only coronavirus testing location at the South Bay Galleria in Redondo Beach. (Jay L. Clendenin / Los Angeles Times)

55/82

Grace Carter, 15, of Riverside, practices a dance routine at home after dance classes and school were canceled. She has to use the Zoom app on her iPhone to practice with her dance group. “It’s hard,” she said. “My bedroom is a smaller space. I miss all my friends at the studio.” (Gina Ferazzi / Los Angeles Times)

56/82

A man works from his home in Long Beach. (Marcus Yam / Los Angeles Times)

57/82

A San Bernardino County healthcare worker takes a sample at a coronavirus drive-through testing site at the county fairgrounds in Victorville. (Irfan Khan / Los Angeles Times)

58/82

A Metro general service employee disinfects a bench in Boyle Heights. (Gary Coronado / Los Angeles Times)

59/82

A runner jogs past the Pottery Barn in Pasadena. Some businesses in the area have boarded up their stores. (Al Seib / Los Angeles Times)

60/82

Raquel Lezama and daughter Monica Ramos collect meals for their family at Manual Arts High School. Lezama was laid off from her $17.76-an-hour job at a Beverly Hills hotel. (Al Seib / Los Angeles Times)

61/82

The Iron City Tavern in San Pedro tries an incentive to lure takeout customers. (Carolyn Cole / Los Angeles Times)

62/82

Healthcare workers gather outside UCLA Ronald Reagan Medical Center to call for further action from the federal government in response to the COVID-19 outbreak. (Robert Gauthier / Los Angeles Times)

63/82

Kristen Edgerle, of Victorville, collects information from a blood donor before drawing blood at The Richard Nixon Presidential Library blood drive during the coronavirus pandemic in Yorba Linda. (Jason Armond / Los Angeles Times)

64/82

Shauna Jin, of Los Angeles, with her dog, Bodhi, practices social distancing with John Kiss, of Los Angeles, at the entrance of Runyon Canyon Park in Los Angeles. (Gary Coronado / Los Angeles Times)

65/82

A lending library had some additional useful items, including a roll of toilet paper and cans of beans and corn, in a Hermosa Beach neighborhood. (Jay L. Clendenin / Los Angeles Times)

66/82

Protesters drive by the Getty House, the home of L.A. Mayor Eric Garcetti, in Hancock Park. Tenant advocates are demanding a total moratorium on evictions during the coronavirus crisis. (Wally Skalij / Los Angeles Times)

67/82

Venice residents Emily Berry and Gavin Kelley take a break at Venice Beach. Berry, a cocktail waitress at Enterprise Fish Co., lost her job due to the coronavirus outbreak. Kelley, a manager at a performing arts school with a focus on music, said that he still has a job and that classes at the school will resume online this coming Monday. (Mel Melcon / Los Angeles Times)

68/82

The JW Marriott at L.A. Live is sharing a message of hope with red lights in 34 windows, creating a 19-story display on the hotel’s north side. (Gary Coronado / Los Angeles Times)

69/82

Juan Diaz Jr., a lifelong Dodgers fan, prays that the season will start by May in front of Dodger Stadium on what would have been opening day. (Mel Melcon / Los Angeles Times)

70/82

Hayley, CEO and founder of Love My Neighbor Foundation, right, dances with Crystal Armster, 51, while she and her colleagues continue to feed the homeless on skid row amid the pandemic. (Genaro Molina / Los Angeles Times)

71/82

A masked passenger on a Metro bus in downtown Los Angeles. (Wally Skalij / Los Angeles Times)

72/82

Dede Oneal waits for a coronavirus test at the Crenshaw Christian Center in South Los Angeles. (Genaro Molina / Los Angeles Times)

73/82

A man in a mask passes a closed restaurant along Spring Street in downtown Los Angeles. (Wally Skalij / Los Angeles Times)

74/82

Artist Corie Mattie paints a mural on the side of a pop-up store as a man takes a picture in West Hollywood. (Wally Skalij / Los Angeles Times)

75/82

Medical assistant Zoila Villalta works with Rosie Boston, 32, of Glendale, who is donating blood for her first time at L.A. Care Health Plan downtown. (Al Seib / Los Angeles Times)

76/82

A couple wait for a bus outside the Petersen Automotive Museum in Los Angeles. (Luis Sinco / Los Angeles Times)

77/82

With all Los Angeles schools closed until further notice, LAUSD buses sit idle in Gardena. (Brian van der Brug / Los Angeles Times)

78/82

A lone traveler makes his way to catch a flight in Tom Bradley International Terminal. (Genaro Molina / Los Angeles Times)

79/82

Denise Young looks on as her daughter, Allison, 9, a fourth-grader at EARThS (Environmental Academy of Research Technology and Earth Sciences) Magnet School in Newbury Park, receives a Chromebook. (Mel Melcon / Los Angeles Times)

80/82

Hollywood Boulevard is devoid of the usual crowds. (Brian van der Brug / Los Angeles Times)

81/82

Michael Ray, 11, plays before a movie at the Paramount Drive-In. (Wally Skalij / Los Angeles Times)

82/82

Isabella Leader, 15, counts how many flags have been left for World War II veteran Lt. Col. Sam Sachs who was celebrating his 105th birthday at the Mom & Dad’s House, an assisted living facility, in Lakewood. Lt. Col. Sachs appealed to the public for birthday cards after the coronavirus pandemic forced the cancellation of a big celebration and wound up receiving thousands, including a letter and photo from President Trump. (Genaro Molina / Los Angeles Times)

This week, the government estimated that the economy shrank at a 4.8% annual rate in the first three months of this year, the sharpest quarterly drop since the 2008 financial crisis. Yet the picture is likely to grow far worse: The economy is expected to contract in the April-June quarter by as much as 40% at an annual rate. No previous quarter has been anywhere near as weak since the government began keeping such records after World War II.

As businesses across the country have shut down and laid off tens of millions of workers, the economy has sunk into a near-paralysis in just a few weeks. Factories, hotels, restaurants, department stores, movie theaters and many small businesses are shuttered. Home sales are falling. Households are slashing spending. Consumer confidence is sinking.

With some signs that the viral outbreak may have plateaued at least in certain areas of the country, a few governors have taken tentative steps to begin reopening their economies. But surveys show that a large majority of Americans remain wary of returning to shopping, traveling and other normal economic activity. That suggests that many industries will struggle with diminished revenue for weeks or months to come and might be unable to rehire laid-off workers.

The Economic Policy Institute has calculated that about 70% of people who have filed for unemployment benefits since the virus struck have been approved. Applications from the rest may still be pending, or they might have been turned down. Some applicants may not have earned enough money in their previous jobs to qualify for unemployment benefits.

Thursday’s figures also showed that states have approved the benefit applications of nearly 18 million people. This figure is much lower than the total number of people who have sought unemployment aid since the virus struck, in part because it lags behind by one week. And not everyone who applies for benefits manages to receive them.

Americans’ confidence in the economy and in their future incomes has plunged, a sentiment that could slow the rebound once more states and cities allow businesses to open. Many consumers, whose spending drives the bulk of the economy, may be slow to begin shopping, traveling and eating out. Some will likely remain too fearful of contracting the virus. And local and state officials are likely to maintain limits on the number of people who can congregate in certain places at any one time.

Consumer confidence, as measured by the Conference Board, has plummeted to a six-year low, and its measure of how Americans regard the current economy fell by a record amount.

Nearly a fifth of Americans expect their incomes to fall in the next six months, the Conference Board found, the worst such reading in more than seven years. That reinforced the belief that Americans will remain cautious in their spending for months to come.