Job losses from coronavirus are already devastating Southern California

In the working-class city of Pico Rivera, Melanie Santos, 26, made ends meet as a substitute math teacher for $120 a day and had an occasional gig dishing food-truck chicken wings.

Thirty-seven miles away, in a leafy Pacific Palisades enclave, Louise Sandy, 52, ran a one-woman business baking custom-designed cakes for birthdays and baby showers that sell for as much as $800 each.

Now the two women have something in common: Both have seen their work evaporate in the coronavirus tsunami that has engulfed California’s economy.

Workers across vast swaths of the Golden State’s labor market are feeling the pain. Wealthy, poor and levels in between. Young, old and middle-age.

Some are in free fall. Others have safety nets. But for all, the losses are sudden and staggering.

“Honestly, none of us in this generation have ever been through anything like this,” said Santos, who doesn’t know how long she can pay for her half of the condo mortgage she shares with her mom. “We can’t process it.”

Sandy can fall back on her husband’s marketing job but, nonetheless, laments the collapse of a hands-on business painstakingly built over seven years.

“I’ve had six cancellations in two days,” she said. “A complete loss of income. It’s like in wartime. No one wants to risk birthday parties. Nobody is ordering cake.”

Economists are scrambling to make sense of the catastrophic effects of COVID-19, and forecasters are putting out numbers while admitting they could easily be wrong.

A widely cited Goldman Sachs outlook suggests the U.S. economy could contract by 1.25% in the first half of this year. That would imply more than 3 million lost jobs, Josh Bivens, director of research at the Economic Policy Institute, wrote in a paper this week, but “we have no real idea how quickly the economy might recover.”

A Marist poll for NPR and PBS, conducted March 13 and 14, found that 18% of the adults surveyed had already been laid off or had their work hours reduced. Among those earning less than $50,000 a year, it was 25%.

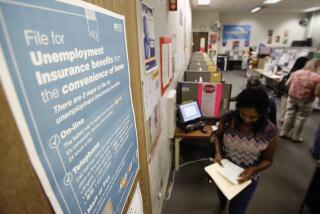

California is seeing skyrocketing claims for unemployment benefits. Gov. Gavin Newsom said Wednesday that the state averages 2,000 unemployment applications a day. Although official figures haven’t been released yet, Newsom said the state received 80,000 applications on Tuesday.

At the beginning of the year, Golden State jobs were still expanding at a healthy rate, faster than in the nation as a whole. California unemployment was a record-low 3.9%. But now, given California’s extensive tourist and transpacific transportation industries, UCLA Anderson Forecast economists predict a recession slightly more severe than the nation’s. California’s jobless rate will rise to 6.3% by year’s end and will average 6.6% in 2021, they suggest.

California’s nearly $50-billion agricultural industry is bracing for a potential labor shortfall that could hinder efforts to maintain the nation’s fresh food supply amid the widening coronavirus outbreak.

More than 280,000 payroll jobs could be lost, with leisure, hospitality and transportation sectors accounting for more than one-third of those, they predict. But they add, “If the pandemic is much worse than assumed, this forecast will be too optimistic.”

Legislation signed by President Trump on Wednesday will presumably help, but it is too early to know how much. The measure offers free coronavirus testing and expands sick leave for Americans. But it excludes workers at companies with more than 500 employees from the paid-sick-leave mandate and allows exemptions for businesses with fewer than 50 workers.

Meanwhile, hundreds of thousands of jobs may already be gone.

An online survey of Los Angeles Times readers has drawn scores of responses, many of them anguished, from workers in a wide array of occupations.

The Burbank dog sitter who lost all his clients when they canceled cruises and other trips.

The out-of-work Los Angeles audio engineer who lived “paycheck to paycheck” and now said, “we have two rolls of toilet paper left.”

The Laemmle Theatres manager, a cancer survivor, who lost her $16.50-an-hour job and had no health insurance.

The minimum-wage-plus-tips bartender in Pleasanton who’s been left “sweating the bills” and switching to food delivery.

The NBCUniversal location manager who, after a canceled show, was “contacting my banks and lenders to halt or reduce payments.”

California’s $145-billion annual travel economy is staggering. Rob Hermansen, 31, had that most L.A. of jobs: standing with a microphone on the upper deck of a bus, touting attractions such as the La Brea Tar Pits and Paramount Studios to gaggles of tourists. But last week, Big Bus Tours LA let him go from the $18.50-an-hour position, along with some 20 other guides.

Hermansen’s health insurance lasts only until the end of the month. With his severance, he can pay the $1,350 a month for his studio apartment for a couple of months. He’ll look for a job, “but now there is nothing hiring, I’d imagine, in the hospitality industry,” he said.

The nation’s largest port is hurting. That may be a leading indicator of the pain that’s in store for Southern California and the U.S. economy as businesses hunker down to deal with the rapidly expanding new coronavirus.

Sporting and cultural events businesses have collapsed. Scott Pearlman, 38, was set to get a raise at his $18-an-hour sales job for Barry’s Ticket Service. But on March 13, the Calabasas company furloughed 29 of its 42 workers, including sales staff, and reduced hours for others.

“We were about to go into the playoffs with the best Lakers team we’ve had in the seven years I’ve been with the company,” he said. “We were poised to have a tremendous year. Then this comes out from underneath us.”

Pearlman knows unemployment benefits won’t make him whole. He is studying for a real estate license. A friend who is adding a room to his tattoo parlor has offered some hours “pounding nails or cleaning up.” And he is holding on to the hope he will eventually return to a job he loved.

“They said I’ll be back whenever they get the boat rolling again,” he said. “But who knows when that’s going to be.”

Across the economy, labor union members are by and large faring better than nonunion workers. At the Los Angeles Unified School District, with 78,000 employees — the vast majority of them union members — teachers are supposed to provide “distance learning” with campuses closed, but all workers will be paid, even those who aren’t on the job.

Unionized pilots for major airlines are being offered partial pay and medical benefits while on leave, and unionized flight attendants can take unpaid leave but still keep their health insurance.

At Marriott’s W Hotel in Westwood, Elmer Saravia, 39, was afraid last week he would be laid off from his $22-an-hour housekeeping job. “I won’t be able to pay my rent or my water, power, gas, phone, food,” he said.

But a few days later, when Marriott announced it would furlough “tens of thousands” of employees nationwide, Saravia learned that, with 18 years of seniority, “due to my union — Unite Here Local 11 — I was able to get a full schedule with four days.”

Unite Here has secured health benefits through September at no cost for about 7,000 furloughed hotel workers in Southern California, said Kurt Petersen, co-president of Local 11. If a hotel closes because of a bankruptcy or foreclosure, he said, union contracts require that employees forced out of work must be rehired at their original salary when the hotel reopens.

But few of the millions of retail and restaurant workers are unionized, and many are working poor who cannot afford to take unpaid time off.

“You can’t tell the store cashier to work from home,” said economist Jesse Rothstein, director of UC Berkeley’s Institute for Research on Labor and Employment. “You can’t tell the food service worker to work from home. They can’t live for a couple months without income.”

The most vulnerable workers are independent contractors. They are not classified as employees under labor law and are thus not eligible for unemployment benefits, or even for the three days of paid sick leave that California requires businesses to offer.

California employers may dislike the new law on independent contractors, but they’re devising a host of strategies to comply.

That hole in the safety net came into stark relief after a 2018 California Supreme Court decision on worker misclassification, and it was addressed by a new law, Assembly Bill 5, which took effect in January. The law, aimed at requiring at least 1 million contractors to be reclassified as employees, is being challenged in court by the trucking industry, a coalition of freelance writers and photographers, and tech platforms such as Uber and Postmates.

Scott Brio, 37, worked as audiovisual director for Halcyon nightclub in San Francisco, running the light show as DJs spun records and revelers danced. He is now out of work, as bars and nightclubs have closed. “As an independent contractor, I don’t have healthcare or unemployment benefits, and I live in one of the world’s most expensive cities,” he said. “I’m more afraid of [losing] my car and the room in my house than I am the virus at this point.”

Many self-employed workers are also on the ropes. Bryan Cuan-Garcia, 31, was all set to work lights and audio at the now-delayed Coachella Valley Music and Arts Festival, among other jobs. “I went from having about 25 gigs a month for the next four months to not having a single day on the calendar,” he said.

The wave of event cancellations has meant a six-figure hit to his business, which brings on subcontractors as needed. He doesn’t see the event industry rebounding anytime soon. To save money, Cuan-Garcia is giving up his $2,000-a-month Hollywood apartment and moving to Florida, where he owns a condo with an $875 monthly mortgage.

If the layoffs are devastating to workers, they are also painful for their bosses.

Kari Hoole is a project management director for Code Four, a Huntington Beach design and events agency that organizes the Great Pacific Airshow and the Orange County Blossom Festival, as well as concerts, corporate meetings and trade shows. All its jobs have been canceled through May.

With several million dollars in evaporated business, the company terminated nine of its 54 workers and furloughed 21. Friday, the day she had to break the bad news, “I didn’t wear mascara,” Hoole said. “I cried when I told each of my hardworking team members they were on furlough. The owner cried and tried to give us an inspiring speech about keeping on.”

In the meantime, she said, the laid-off workers can apply for unemployment benefits, and “we are still paying for health insurance for those in our plan for as long as we are able to.”

In Berkeley, Peter Boutros Kamel, 71, owner of Model Shoe, a retail and repair shop, said he had stopped paying six of his nine workers. Sales are down 85%, and small businesses all around him are collapsing, including a Thai noodle restaurant next door.

“I’ve been 22 years in business and haven’t asked anyone for one dime,” Kamel said, adding that he’s not expecting or even wanting government help.

“The best option is for everybody to pray,” he told a reporter. “This is a very bad situation, my friend. We need to pray, and pray deeply.”

Times staff writers Hugo Martin and Russ Mitchell contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.