Column: Freelancers fear California’s new gig worker law will wipe them out

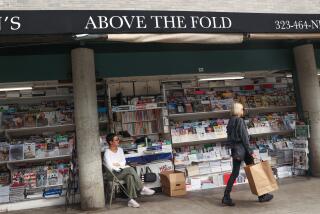

John Conroy’s first glimmer of California’s new approach to freelance journalists came last fall, when an editor at a travel publication that provided a large share of his income abruptly informed him that its parent company would cease using California-based freelancers.

“That cost me several thousand dollars of much-needed income,” says the Los Angeles writer, 67. He’s making do, barely, on Social Security benefits and savings, but otherwise is “hanging on by my fingernails.”

Freelance writers and photographers in California are in a panic that Conroy’s case is the canary in the coal mine that signals a sharp contraction in their opportunities for work.

AB 5 simply makes it unattractive to hire writers from California.

— David Swanson, travel writer from San Diego

The initial blow — and the trigger for the employer’s decision in Conroy’s case — was the California Supreme Court’s so-called Dynamex decision of 2018, which tightened the rules for when a worker must be considered a company’s employee rather than an independent contractor. But what’s generated more angst among the freelancers in journalism is Assembly Bill 5, a statute enacted this year that codified the Dynamex decision and expanded its reach.

AB 5 specifically exempts about a dozen work categories from its provisions, such as doctors, accountants, fishermen, stockbrokers and travel agents. But not journalists. Writers and photographers who submit more than 35 published works per year to a publisher must be treated as an employee of that publisher.

In practical terms, that means the publisher must deduct Social Security and Medicare taxes from the contributor’s fees and contribute to workers’ compensation and unemployment insurance on his or her behalf, among other responsibilities. On the writer’s side, employment status makes it harder to take tax deductions for home offices, travel and equipment.

It was clear almost from the first that the California Supreme Court, in a ruling in April 2018, threw the business models of Uber and Lyft companies for a loop.

Although every employer located in California is subject to the law, freelancers fear that AB 5 will discourage more employers from out of state from hiring Californians to avoid the paperwork and legal liabilities implicit in the law.

They may have a point. Gig economy ride-hailing firms such as Uber and Lyft — the most prominent targets of AB 5 — have no choice but to employ California drivers if they want to participate in the lucrative California market. (Uber says Los Angeles and the Bay Area are two of its three largest U.S. markets.) That’s not true of the writing trade, which often can be pursued from anywhere.

“If I’m a publisher from out of state,” says David Swanson, a San Diego writer who is the outgoing president of the Society of American Travel Writers, “and I have a choice of hiring a writer from California to do a job, or somebody from Colorado or Texas or Canada or India — and I’d have no chance of being sued — who do you think I’m going to hire? AB 5 simply makes it unattractive to hire writers from California.”

Concerns about the impact of AB 5, which goes into effect on Jan. 1, have been percolating for months. But anxiety seemed to surge over the weekend, after an article in the Hollywood Reporter painted an especially dire picture of its consequences.

The harvest was a series of bitter exchanges on Twitter aimed at the bill’s author, Assemblywoman Lorena Gonzalez (D-San Diego), including a tweet from Yashar Ali, a contributor to HuffPost and other publications, accusing Gonzalez of launching “a direct attack on press freedoms with her bill.”

Uber, Lyft and Doordash will spend $90 million to undercut a California employment law.

That’s a wildly overwrought accusation that overlooks the clear virtues of AB 5, as well as the difficulties inherent in trying to draft a remedy to the well-documented abuses suffered by freelance writers and photographers at the hands of publishers unfettered by workplace standards.

One issue underscored by the controversy over freelancers is the wide variability of industries and jobs covered by AB 5. Uber and Lyft are wealthy (albeit unprofitable) companies that treat drivers as independent contractors, not employees. The Dynamex ruling and AB 5 arguably grant every driver workplace and wage protections as employees.

The news business, however, is shrinking, suffering mass layoffs and stagnant wages, but also still employs many full- and part-time staffers. AB 5’s advocates in that industry see the law as a tool at least to preserve those jobs against waves of outsourcing. But the law’s critics say that it’s naive to expect those employers to put large numbers of freelancers on staff to meet its requirements.

“Newspapers are laying off staff, including entire photography staffs, and newspapers are going out of business,” says Mickey Osterreicher, general counsel for the National Press Photographers Assn. “Even though the best intentions here are to create more employees with benefits, that’s not going to happen. Publications are not going to be hiring people.”

With bills to protect employment rights, student athlete pay, abortion services and renters, the 2019 California Legislature turned in a very progressive record.

Dynamex and AB 5 may have had some positive effect in the news business, but it’s spotty. After the court ruling, The Times transitioned about 30 freelancers to full-time staff positions. The ruling and law also gave The Times’ union negotiators some leverage in crafting provisions in a tentative contract governing freelancer use in the future, specifying situations in which freelancers can be assigned and in some cases limiting the duration of their assignments.

As it happens, just after Times employees voted to unionize in early 2018, indications emerged that its then-owner was creating a “shadow” newsroom of non-staff, non-union freelancers. The then-publisher of The Times, Ross Levinsohn, recently surfaced as a member of the management team at Sports Illustrated, where dozens of staff members are being laid off to make way for a cadre of freelancers.

Smaller newspapers and websites may not have much flexibility to put freelancers on staff. “The use of freelancers allows a small weekly or community publication to provide diverse voices,” says Jim Ewert, general counsel of the California Newspaper Publishers Assn., which includes large metropolitan dailies and small local newspapers among its members. Ewart says that industry estimates place the cost of converting a freelancer to a staff position, even for a brief part-time assignment, at as much as 30%, chiefly in taxes and regulatory fees.

The issues about AB 5 raised by freelancers may also point to the limitations of states trying to enact wide-ranging social legislation on their own. Laws like California’s are under consideration in New York and Illinois, and Massachusetts started clamping down on the misclassification of employees as independent contractors in 1990. But these rules would be more effective if enacted at the federal level, to prevent employers from evading them by shopping for workers in other states.

Trump’s evisceration of labor protections will continue under Labor Department nominee Scalia

Exploitation is rife in freelancing, especially for writers and photographers in the early stages of a career. The abuses include late payments and nonpayment of fees and the misclassification of those doing staff-level work as independent contractors. In one notable 2011 case, an AFL-CIO-affliliated writers union won a $365,000 court judgment against a textbook subcontractor that had stiffed 36 writers, editors and designers after the project ended. (The company went out of business and never paid up.)

But defining a freelancer’s work routine isn’t easy. Some contribute occasional pieces to myriad publishers, some are regular content providers to only a handful of sources. Some contribute short squibs as often as several times a day; others, deeply reported investigations or features a few times a year. Among travel writers, Swanson told me, “no two of us have the same business model, so creating a carve-out that covers all of us is a fool’s errand.”

That difficulty became evident during the drafting of AB 5, when Gonzalez met several times with a coalition of freelancer groups. She was willing to offer a partial exemption to writers and photographers, but the question was where to set the line. Gonzalez initially suggested exempting those who contributed 25 or fewer submissions per year to any given publisher, on the grounds that twice-a-month work seemed reasonably to fall below the level of a full- or part-time employee.

The freelancers made a counteroffer of 52 submissions. Gonzalez says she thought that was too high. “If you’re working for someone one day a week, you’re working part time.” Gonzalez essentially split the difference in settling on 35, but agreed that repeated submissions on a single topic or multiple submissions produced in covering a single event, such as San Diego’s annual Comic-Con entertainment conference or a political convention, could be bundled together as a single submission.

“The writers we were dealing with said, ‘We want more, but basically, OK,’” Gonzalez recalls. But that may overstate the degree of assent. Says Randy Dotinga, a San Diego writer and a leader of the coalition: “It was pretty clear that we didn’t get what we wanted. We wanted 52.”

As streaming takes over the entertainment production world, musicians are being left behind.

As it turned out, freelance writers and photographers are the only workers covered by the law whose status as employees is judged quantitatively — that is, by the number of pieces produced. No one involved in the negotiations was able to come up with a more acceptable metric. Gonzalez rejected the idea of basing the exemption on a freelancer’s proportion of income from a given source; California labor law, she maintains, is traditionally aimed at employers, placing the burdens of record-keeping and compliance on them, not their workers.

“I don’t know what a better idea would be,” Dotinga told me.

In any case, Gonzalez points out that the freelancer provision in AB 5 aimed to provide workers some relief from the Dynamex decision, not to place a cap on their activities. Based on the ruling, freelance writers and photographers might have been deemed employees regardless of their productivity; the law at least carved out a safe harbor for 35 submissions or less for any publisher.

How much blacklisting of California freelancers is happening or may develop in the future remains unclear. The most commonly cited example is that of Northstar Travel Media, the New Jersey-based publisher of travel trade journals that issued the blanket ban experienced by Conroy. (His publisher converted him to part-time staff status, but that still means a cutback in his earnings.) Northstar didn’t respond to requests for comment. Other freelancers have noticed online want ads instructing Californians not to apply, but none appears to have been placed by journalism enterprises.

Gonzalez says she’s open to revising AB 5 to address freelancers’ concerns. “I’m willing to talk about raising the number of submissions, sure,” she told me. “That’s the easiest discussion to have.” But any change wouldn’t take effect before Jan. 1, 2021.

As for providing a blanket exemption for all journalists, “that’s really tough,” she says. “This was a bill reacting to a Supreme Court decision that was so broad it [applied to] every single worker. There would have been no exemption for freelance writers at all.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.