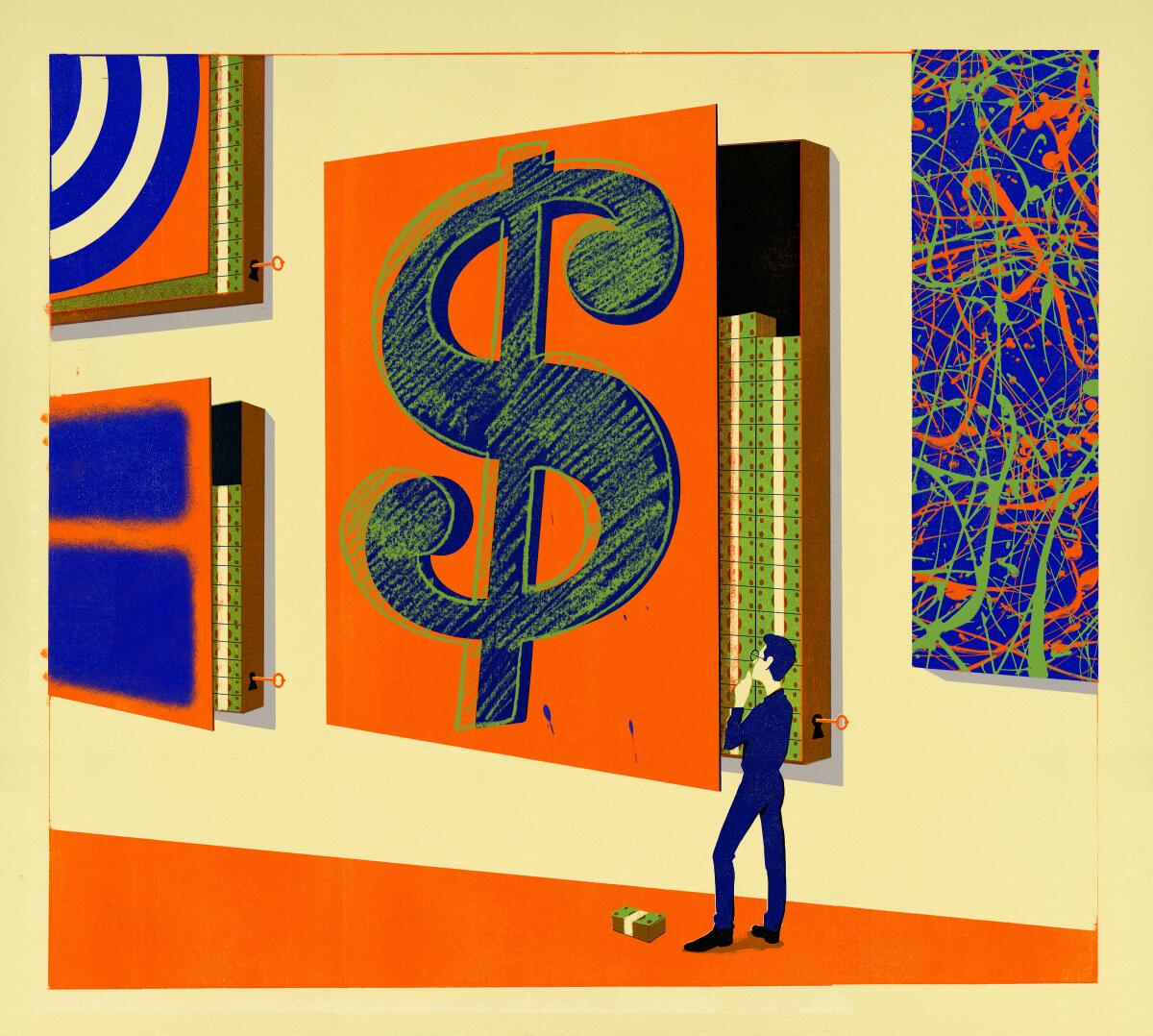

How the rich get spending money: Locking fine art in storage and borrowing against it

There’s a small but distinguished art collection in New York featuring an eclectic array of works.

It includes pieces by abstract expressionist Mark Rothko, realist painter Andrew Wyeth and Edwardian-era portraitist John Singer Sargent. Its holdings rotate, with past appearances from American modernist Georgia O’Keeffe and Colombian painter and sculptor Fernando Botero.

But the collection can’t be seen in any gallery or on the walls of any private home. That’s because it’s locked away in three climate-controlled warehouses in crates, tilt meters attached to better make sure the works are not unduly jostled.

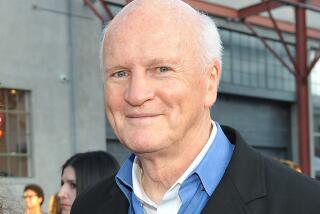

Welcome to the multimillion-dollar collection of Art Lending Fund LLC, a Westwood investment fund that doesn’t own the works but has a secured a lien against each piece in case the owner can’t pay up. That’s because the art serves as collateral in exchange for loans from the fund run by Los Angeles money manager Alan Snyder.

You give him your fine art, and he’ll lend you money, starting at $500,000 and going up from there. It’ll cost you, but do with it what you want.

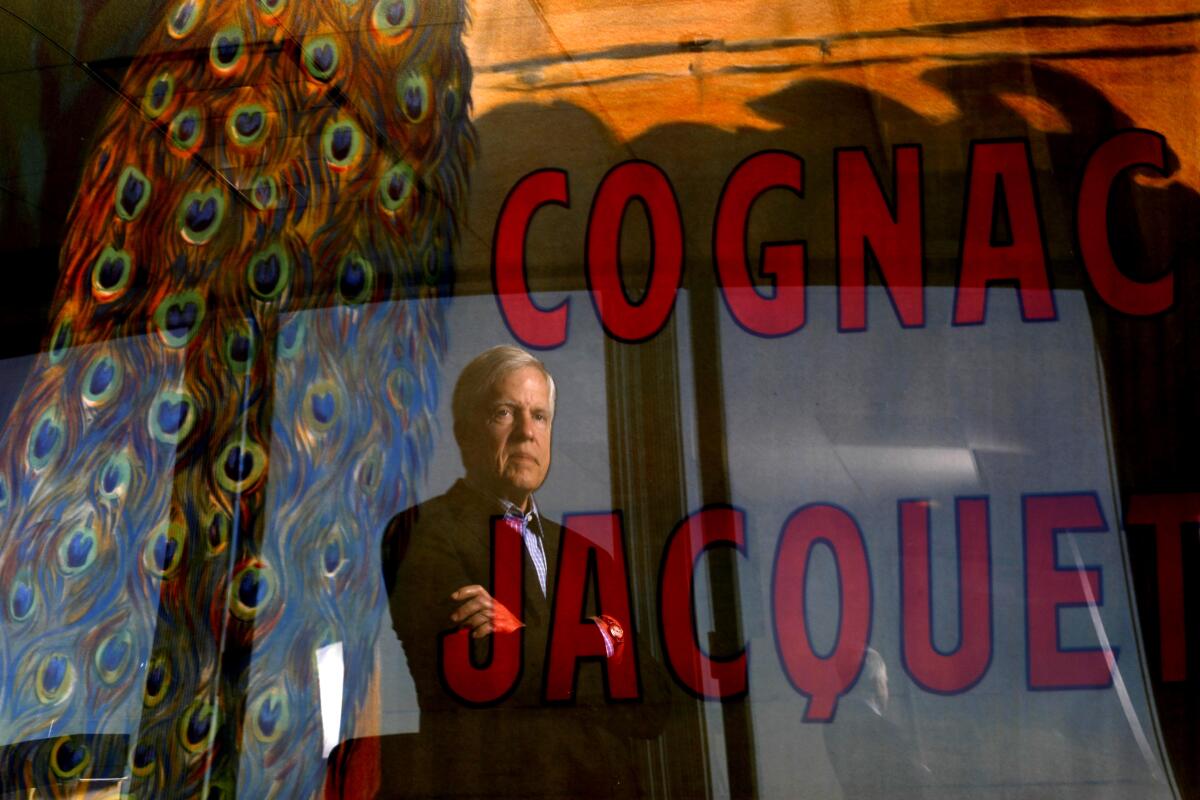

Snyder, 73, runs a boutique money-management business called Shinnecock Partners out of an unassuming Wilshire Boulevard office and broke out his art lending fund as a separate investment opportunity a few months ago. His wealthy clients give him the money, he lends it out to those who are rich in art but short on cash. That was, after he became convinced art-secured lending was what he terms a “Jesus Christ Superstar” investment — high yield, safe and not locked up for years.

Our kinds of customers, they would do things like they would buy a sports team. They would use it to buy something that was income producing that would cover the interest and the payments.

— Jeffrey Deitch, gallerist and former Citibank executive

That decision made Snyder one of the latest entrants in a growing but volatile corner of the art market, where the mingling of fine art and big money is attracting more and more financial players looking for an angle.

After years of postwar growth in an art market that has weathered cyclical ups and down, this decade’s explosion of wealth has flooded the market with billions of dollars, bidding up the value of marquee and contemporary artists such as Willem de Kooning, Andy Warhol and Rothko, whose works can sell for the tens of millions.

Museum-quality collections held by private equity titans and hedge fund managers now serve as collateral for lines of credit worth hundreds of millions of dollars from private banks. New boutique lenders such as Snyder are making smaller loans to collectors of means and those who have just gotten lucky by picking the right art.

“I say to myself, to people, to investors, ‘Look, you can never take yourselves too seriously. What are we? We are a high-end pawn shop,’” says Snyder, a Harvard MBA with a shock of gray hair.

It’s hard to entirely dismiss Snyder’s quip.

His loans are a notch above high-end pawn shops who serve collectors in a pinch for lesser sums, but his art-lending business has the essential hallmarks of a pawn transaction: You’re not getting your hands on your property until the loan is repaid and, if you can’t, kiss the art goodbye. Yet he exudes old money, from his preppy red, pinstripe dress shirt to the Shinnecock name, inspired by a former house on Shinnecock Bay in the Hamptons.

So how does an investment manager who spent years on Wall Street find his way into art-secured lending? He says he has a nose for “nichey-based lending, off the beaten path, places that need capital” and he’s not kidding. Although his resume includes a stint at Dean Witter, he favors “alternative investments,” such as the time Shinnecock participated in a deal selling parts of disassembled commercial jets back to airlines. It worked out well, he said.

Art-secured lending has been around for years but has matured since the financial crisis, even if it represents only a tiny fraction of the $250 trillion in debt held worldwide after a decade-long lending binge driven by low interest rates. There were an estimated $17 billion to $20 billion in art-secured loans outstanding in the world in 2017, a 13% jump from 2016, according to a 2017 Deloitte report on art and finance.

The analysis cites multiple factors for the growth, such as increasingly sophisticated lenders with access to better underwriting data. But what’s really propelling it all is the art market itself.

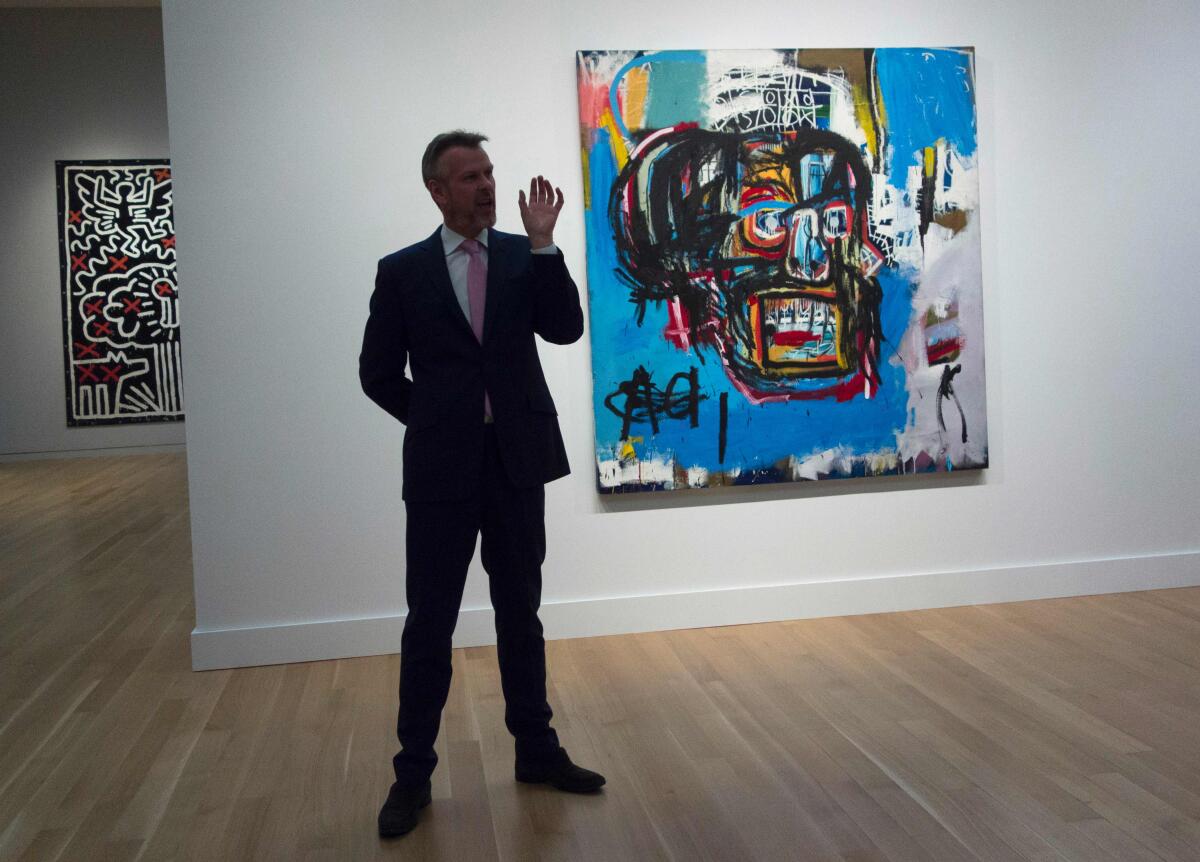

“I like to tell people when I got involved first in the early ’70s it was hardly a market, it was a community. It became a real market. Now I think you can fairly call it an industry,” says gallerist Jeffrey Deitch, a former chief of L.A.’s Museum of Contemporary Art.

Deitch was around when Jean-Michel Basquiat was scrawling graffiti on the bombed out streets of the Lower East Side in the 1970s before he rocketed to fame as the enfant terrible of the art world. Two years ago, one of the late artist’s works sold for $111 million to a Japanese collector. Today, the Manhattan neighborhood is gentrifying and big consumer brands such as Gucci have gotten wise to the appeal of graffiti artists, hiring them to paint street murals advertising their wares hoping they’ll go viral on Instagram.

In our money-obsessed culture, that kind of growth can be tracked, in the same manner as housing prices, stocks and soy futures. The art market has experienced a compound annual growth rate of 8.8% from 1950 to 2018, according to Sotheby’s Mei Moses Art Indices, which tracks repeat sales of individual artworks. The metric reflects the steady growth in U.S. and European wealth, as well as newly minted ultra high-net worth collectors who have entered the market from Russia, China, the Middle East and other emerging economies.

In 2018, global art sales rose 6% to $67.4 billion, with a single Amedeo Modigliani nude going for $157 million. It was the second straight year the market has risen after a 2016 dip prompted by fears of a slowdown in the Chinese economy. It also was evidence of the market’s recovery since the financial crisis, when sales plummeted over a third to $39.5 billion in 2009.

“With the tremendous growth in wealth globally, obviously the art market has risen as well, and the value of things — and especially the most prized, rarest things — have gone up tremendously,” said Richard Varney, a New York fine arts advisor to old families with extensive art collections. “There is a like a feeding frenzy for those things.”

Deitch helped start what he calls the first professional art advisory service and dedicated art-lending department for a major international bank while at Citibank from 1979 to 1988 — the era of leveraged buyouts and greed is good.

“One of the things that marks the maturity of this market is you can borrow against art. You can leverage it the way you can leverage other assets,” said Deitch, who has an MBA from Harvard. “Our kinds of customers, they would do things like they would buy a sports team. They would use it to buy something that was income producing that would cover the interest and the payments.”

Deitch says confidentiality rules prevent him from discussing the size of those loans, but this much is certain: that calculus hasn’t changed and today’s loans are gargantuan.

Bank of America’s private bank, which provides white-glove financial services to wealthy clients, offers art-secured loans that might start at $5 million for a collection appraised at $10 million, and rise all the way up to $1 billion for business titans with vast collections, said Evan Beard, national art services executive at Bank of America Private Wealth Management.

“What happens over time is that the art loan grows as their collection grows,” said Beard, who boasts that the bank is the world’s largest art-secured lender, with several billion dollars of outstanding loans. The majority are backed by Impressionist, Modern, postwar and contemporary artists, with the bank preferring any individual work have an appraised value of at least $100,000.

Loan proceeds can be put into other investments paying a higher return, allowing borrowers to avoid the tax hit of a sale. “They want to unlock their capital from the art to redeploy into other parts of their financial life,” Beard said.

Think of the loans — structured as “interest only revolving lines of credit” — as credit cards with gigantic limits that, Beard said, can be used to snap up a company or “pay a signing bonus” to a top free agent.

The loans come with relatively low interest rates a few points above an international benchmark rate now sitting a little above 2%, reflecting the low risk associated with ultra-wealthy clients. “It’s been a very nice business driver for the bank,” Beard said.

Being the client of a private bank has other advantages besides low interest rates on mega sums. The bank appraises and obtains a collateral interest in the art but doesn’t sock it in a warehouse, trusting its wealthy clients will make good on their loans. So that Pollock can still hang on the walls of a Bel-Air mansion or be exhibited at a museum. (The Getty says it has received a handful of such collateralized works for exhibitions since 2011 but declined to provide details.)

Despite the amounts of money changing hands — or maybe because of it — the identities of big art-secured loan borrowers are typically shrouded in secrecy, with exceptions. Hedge fund manager Michael Steinhardt pledged Picassos and other fine art to help finance his acquisition of the American Stock Exchange Building in New York in 2011. Steven Cohen, another billionaire hedge fund manager, reportedly received an art-secured loan from Morgan Stanley a few years ago.

Some artists such as the late Andy Warhol and pop sculptor Jeff Koons have thrived on the volatile admixture that media, celebrity and Wall Street money brings to the art world. But feminist artist Barbara Kruger said the fact that artworks are being turned into financial instruments is irrelevant to the creative impulse of most artists, who can’t live off their work anyway.

“Almost none do. However, also in this time, everything is monetized.… Everything you touch. Everything you own,” she said. “That’s just the way it is.”

All that unlocked capital sloshing around the art market has left an opening for Snyder, who competes with the financing arms of auction houses and other boutiques. Still, it’s not a business for a by-the-book lender.

For all Snyder’s blue-blooded East Coast patina, he’s been a financial trailblazer. After a traditional start on Wall Street, he went on to found an online auto insurance brokerage at the dawn of the internet age, Answer Financial, now owned by Allstate.

And in the world of wealth management where conventional is the safe bet, he’s not afraid to be unconventional. It slips out in conversation and is intentionally played up in his quirky investment newsletter. One missive last year, “Bang, Oops, Another Down,” quoted both the King James Bible and former Dallas Cowboys quarterback Don Meredith. He admits only to a modest art collection at his home in the exclusive MountainGate community in the Santa Monica Mountains.

But when the subject is making money for his clients, Snyder isn’t joking. He’ll charge you 9% to 11% a year (interest paid upfront), make sure his fund is listed on the insurance policy and stick you with the expenses of transporting your art to the warehouse and storing it there. Possessing the art — he takes pleasure in saying — “warms my black heart the most.” And, he’ll extract a legally binding personal financial guarantee allowing him to seize other assets if the sale of the art doesn’t cover what’s owed on the loan in the event of a default. It’s what he calls the “belt and suspenders” approach.

That’s assuming he does business with you at all. Shinnecock has made 15 art-secured loans but avoids deals involving Middle Eastern art, given the area’s history of looted antiquities subject to government claims. Background checks are performed on borrowers and their businesses to weed out the litigious and deadbeats. And the artwork has to have a certificate of authenticity, a clean provenance and pass muster with professional appraisers who establish the collateral value based on prior sales — a subjective process the borrower doesn’t always agree with.

Like most art-secured lenders, Snyder lends a maximum of half the appraised value of the art to protect against any sudden downturn in the market or in a particular artist. In this notoriously fickle industry, it doesn’t take long for a hot artist to fall out of favor. The fund limits caps loans it makes itself without co-investors at $1.5 million to limit exposure to any single borrower or artist.

Snyder has recently been considering a deal backed by an El Greco sculpture worth $5 million.

The target market is gallery owners who need inventory financing and wealthy collectors without private banking services who might want to indulge themselves with more art — or have more prosaic concerns. Snyder describes one potential borrower as a guy “who had a big tax bill and said, ‘Geez, I don’t want to sell anything, but I’ve got to pay the tax.’”

Snyder said he has been the largest investor in the fund while 25 others have bought in, with a minimum investment set at $100,000, well below the $500,000 minimum of a typical hedge fund. “You don’t have to be Richard Branson,” he says proudly.

San Francisco tax attorney Richard Greene, a collector and former president of the San Francisco Museum of Modern Art, is an investor. He met Snyder less than a year ago through a mutual friend and decided the deal was too good to pass up, given how banks might pay just over 2% for a two- or three-year deposit.

“If you can get a return of around 8%, and it’s highly secured and there’s a market for it, that’s a pretty enticing return,” he said.

Of course, there is no such thing as 100% certainty in the lending world. Snyder hasn’t had an arts-secured loan default yet, but he says frankly that “just means someday we will.”

Several things convinced him, though, to get into the business, including Mei Moses data showing the art market fell at most 25.5% during its most severe modern downturn in 1990, when the Japanese economy began a long slide. The index fell 21.9% after the 2008 financial crisis, far less than the Standard & Poor’s 500 index.

Yet time and time again in the financial industry, even the most sophisticated investors with the most advanced metrics can miss the big picture. There has been some turbulence in the sector, including a report that one prominent boutique art-secured lender recently stopped making loans. And even the biggest collectors can get into financial trouble. In Portugal, three banks have been seeking to seize the prized modern art collection of Portuguese businessman José Berardo. The art, much of which is on display in Lisbon, was put up as collateral for debts totaling about $1 billion, the Guardian reported.

“It’s not that everything is brilliant and great,” said Adriano Picinati di Torcello, who heads the art and finance practice for Deloitte. “It’s still a niche business.”

But with all the expensive art hanging on walls from Los Angeles to Paris to Hong Kong, no one expects art-secured lending to disappear. Snyder said that with careful underwriting he can avoid losses and take advantage of what he expects will be a growing market. It’s estimated that only 1% of fine art held by collectors has been leveraged, while the total estimated value of art held by ultra-high-net-worth collectors is $1.62 trillion.

Still, fears are growing about a global slowdown even as the U.S. economic expansion breaks records, though Snyder doesn’t appear perturbed by the prospect. You might even say he relishes it.

So far, he hasn’t done much marketing and has largely relied on word of mouth to grow the business. But his fund is structured to accept as many as 2,000 investors, and he thinks he can take the $12.5 million in assets under management up to as much as $250 million. Shinnecock just launched a retail website, artlending.com, which will provide a source of borrowers for the fund, as well as for investment partners willing to make riskier loans.

Pressed whether he expects to make even more loans to cash-hungry collectors should the economy slow, Snyder hesitates briefly, then comes out with it: “In a nutshell, yes.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.