Berkshire Hathaway to shake up real estate franchise landscape

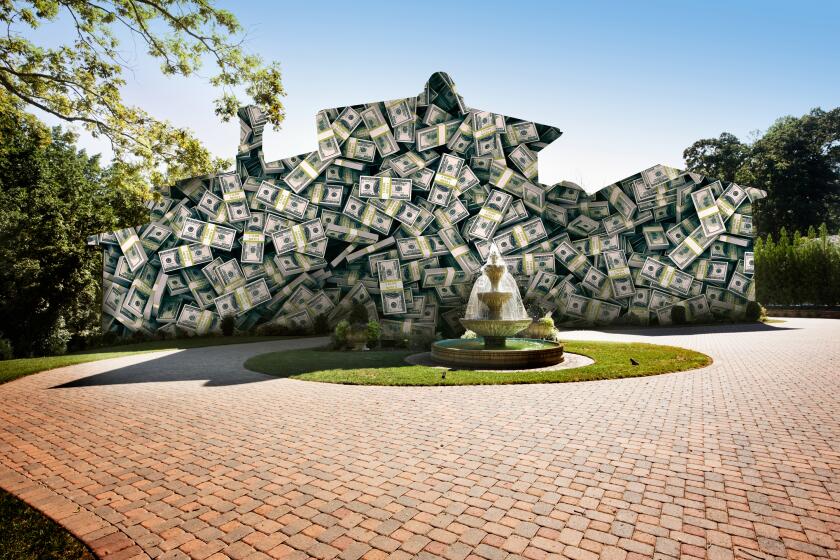

A new real estate franchise under the fabled Berkshire Hathaway brand marks its official launch this month.

The name Berkshire Hathaway adds some mustard to an otherwise bland real estate landscape. After all, the conglomerate is one of the world’s most admired companies, according to Forbes, with Warren Buffet — widely considered the most successful investor of the 20th century — at its head.

But it may surprise you to know that the National Assn. of Realtors counts 32 national and regional franchise brands in operation across the land. And that does not include the handful of start-ups that seem to pop up every year and then fade away.

Another surprise, perhaps, is that only slightly more than half the nation’s realty agents work under a franchise banner. The rest — 41%, according to NAR’s latest membership profile — choose to remain independent.

At the same time, 84% of all real estate firms are independent, NAR reports. The rest are franchises or subsidiaries of national or regional firms. The reason: Most realty firms are one- or two-office shops with only a handful of agents, whereas the franchises are larger offices with more agents.

There are good reasons to join a franchise, for both the brokers whose names are on the door as well as the agents who hang their shingles on the wall.

Banners such as Century 21, Re/Max and others give a business instant recognition. Branding is a way to define who you are, according to the experts, and allows real estate brokers to say, “We are different from the rest of the pack.”

That’s why many newly minted brokers who are just starting their companies decide to affiliate with a franchise. Even though it may cost thousands of dollars to join, working under the Coldwell Banker or Realty Executives label gives them an immediate identification that they would otherwise have to spend years building.

A brand like ERA or Keller Williams also gives brokers a certain edge in recruiting. New agents and industry veterans alike often decide to work under a national trademark to receive the training, leads and other benefits the nationals have to offer. And in real estate, unlike, say, McDonald’s and numerous other franchises, brokers are free to run their businesses as they like (within certain parameters).

But even independent brokers have a brand, and their agents do too. They communicate their lineage, trust, expertise and other qualifications through their signs, business cards and marketing materials.

At the same time, the company an agent works for doesn’t seem to hold much sway with clients. According to NAR’s latest profile of buyers and sellers, just 3% picked an agent because he or she was associated with a particular shop or franchise.

More important factors include honesty (24%), reputation (21%), friend or family member (15%), knowledge of the neighborhood (12%) and a caring personality (9%). Of the other less material reasons, including timely responses and accessibility, only the agent’s professional designation was less important than the agent’s company.

So what does Berkshire Hathaway HomeServices bring to the already crowded realty landscape?

The name has “a huge reputation,” says Earl Lee, the industry veteran who heads HSF Affiliates, the Irvine company that operates the Berkshire Hathaway HomeServices, Prudential and Real Living networks. “It promises integrity, trust and competence.”

As Lee sees it, “consumers today are looking for someone they can trust. They want to know they are working with an organization that stands behind its agents. And the strength of Berkshire Hathaway’s reputation of integrity and financial stability is behind everything we do.”

The company doesn’t expect to be the largest, but it does expect to be the best, says Lee, attracting the most qualified companies and agents. Certainly, it will hit the ground running.

Already more than two dozen brokerages affiliated with the Prudential Real Estate brand have agreed to transition to Berkshire Hathaway, including the three that will “go live” this month: Prudential California Realty, Prudential Connecticut Realty and Prudential Florida Realty.

Other brokerages — including Fox & Roach Realtors, a chain based in Philadelphia with some 4,000 agents that the Berkshire Hathaway HomeServices brand purchased in August — will make the official switch in the coming weeks. “It’s happening, and it’s happening fast,” said HSF spokesman Kevin Ostler.

Here are some other facts and figures about real estate franchises from NAR:

•The oldest is Real Estate One, which began franchising in 1971. The company, based in Southfield, Mich., has 74 offices under its wing with 1,622 agents.

•The newest is United Real Estate of Kansas City, Mo., which launched this year and has seven offices and 1,025 agents.

•Keller Williams is the largest in terms of agents, with some 83,000 sales associates in 662 offices. Coldwell Banker is a close second with 82,000 agents, though it has more offices, with nearly 2,300.

•Century 21 is the largest in terms of offices, with 2,500.

•Re/Max agents sell the most houses, according to marketing research specialists at the MMR Strategy Group, followed by Coldwell Banker, Keller Williams, Century 21 and Prudential Real Estate.

NAR doesn’t keep count anymore, but in 2009 it listed NRT, the parent of Coldwell Banker, ERA and Southeby’s International, the leader in “sides” with nearly 275,000. A listing is considered one side; a sale, another. Home Services of America had nearly 124,000 sides in 2009, followed by Long and Foster Real Estate with almost 70,000.

Distributed by Universal Uclick for United Feature Syndicate.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.