Lost in space: They paid $100,000 to ride on Xcor’s space plane. Now they want their money back

The first sign of trouble was the ever-extended launch date.

One customer of space tourism firm Xcor Aerospace Inc. thought his flight would come in 2011. Nael Hamameh expected 2015 to be the year he would finally achieve his childhood dream of going to space, having paid Xcor $100,000 for a ticket.

For the record:

9:05 a.m. Jan. 2, 2019A previous version of this story misspelled Sabine Daniels van der Sluis’ last name.

But 2015 came and went. After hearing no word of progress, Hamameh asked for a refund. Xcor told him it would try to find someone else to buy his ticket by the end of 2017, but at the least, he would receive $35,000. Then, it all came crashing down in November 2017, when Xcor filed for Chapter 7 bankruptcy.

The story of Xcor and its ticket holders — 282 of them, as of the most recent count — is a cautionary tale for the space tourism age. In purchasing tickets for a brief bout of weightlessness at the fringes of space, would-be astronauts are placing the ultimate speculative bet. None of the space vehicles developed by the two major players, Virgin Galactic and Blue Origin, are fully operational yet. But some tourism firms have collected money upfront; Virgin Galactic’s price is as much as $250,000.

In the case of Xcor, the bet came up snake eyes. Its aspiring astronauts have been left grounded, wondering whether they’ll get a portion of their ticket price back.

Steve Jones, 43, applied to be a creditor in Xcor’s bankruptcy case but has since learned he would not receive any funds. The ticket holder hired a lawyer, David Keesling, about a year and a half ago. Keesling said in an interview in November that there is “some slim” chance that funds could be recovered, but the number of entities involved in the case complicates the process.

“Is there a possibility? Sure,” Keesling said. “Is there a probability? I can’t tell you today that it is; I can’t tell you that it’s not. It’s easy to file a lawsuit. It’s not necessarily easy to collect.”

Jones, a commercial pilot who lives in Tulsa, Okla., said scraping together the money for the Xcor ticket was a sacrifice. “I live in an apartment. I don’t drive the newest car,” he said. “That’s a lot of money. You’re talking kids’ college or buying a house.”

Hamameh, 37, said news of Xcor’s bankruptcy was disheartening. “I was very disappointed, but not because of the money,” said Hamameh, the chief executive of a French internet start-up. “Because of the dream that will never come true.”

90 seconds of weightlessness

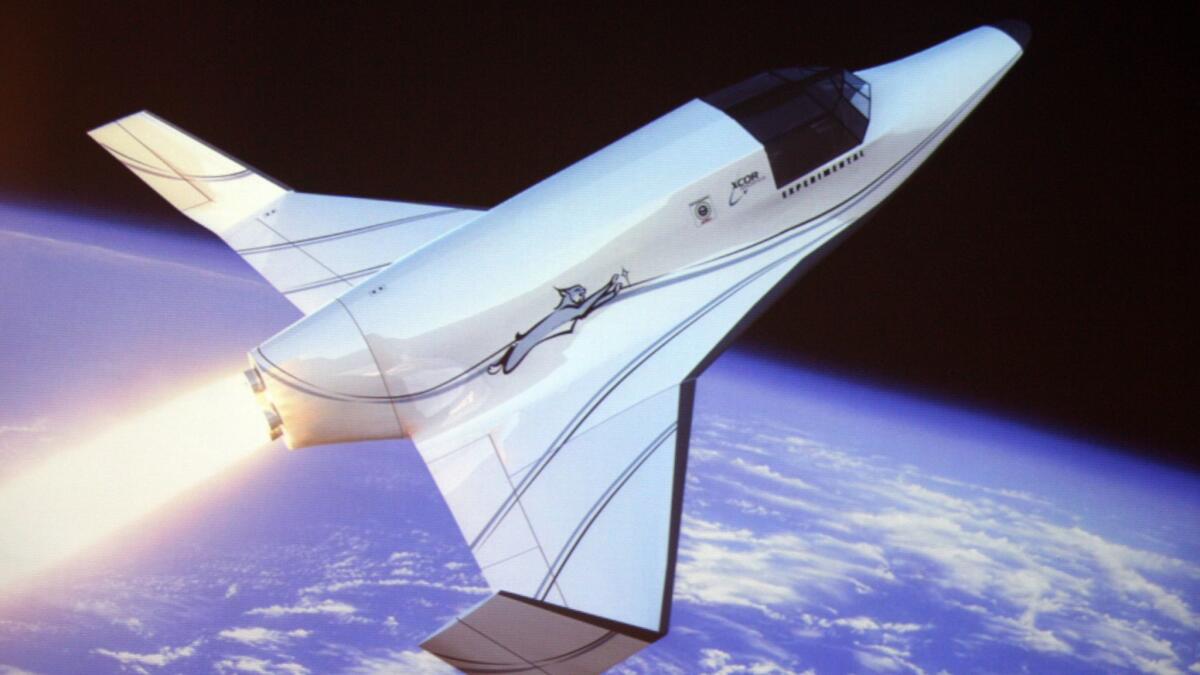

When Xcor unveiled its plans for the two-seat Lynx space plane in 2008 at a press conference in Beverly Hills, company officials estimated flight tests would begin in 2010. They said the vehicle could eventually fly tourists to space up to four times a day. Flights would reach an altitude of about 38 miles above the Earth — below the height that the U.S. military and Federal Aviation Administration consider to be the edge of space, but high enough that passengers would feel 90 seconds of weightlessness.

The Mojave-based company was founded by Jeff Greason, Aleta Jackson, Doug Jones and Dan DeLong, who had worked together at a now-defunct reusable rocket company. That company had planned to send a 63-foot-tall, thumb-shaped vehicle to space that would return to Earth via a giant propeller.

Xcor eventually raised at least $19.2 million, according to Crunchbase, a platform that tracks fundraising. Customers who wanted to be among the first 100 people to ride the Lynx paid $100,000 upfront, while others who chose to wait could pay in installments.

By 2011, NASA lent the firm a measure of credibility when it announced its intent to hire Xcor to carry experiments into space. At the time, the company was seen as the main competitor to British billionaire Richard Branson’s Virgin Galactic, which had also set up shop at the Mojave Air and Space Port.

The companies took very different approaches to the challenge of reaching space. Virgin Galactic uses a twin-fuselage carrier aircraft to hoist a space plane known as SpaceShipTwo up to a high altitude; it releases the smaller craft, which ignites its own rocket motor to blast into space. Earlier this month, the company reached space with its SpaceShipTwo vehicle for the first time on a test flight.

Using another vehicle or booster to propel a crew craft to space is considered a “much more traditional approach,” said Sonya McMullen, assistant professor of aeronautics at Embry-Riddle Aeronautical University. But Xcor would have the Lynx climb all the way up under its own power.

“They really took the hard technological approach to the same problem,” McMullen said.

Looking good ‘on paper’

As development proceeded on the Lynx, the company wooed potential customers.

A major draw for Cyril Bennis, 70, was the private flight, with just him and a pilot. Virgin Galactic’s space plane can seat eight people, including the two pilots.

Bennis has wanted to go to space since meeting NASA astronaut John Glenn as a child in Ireland. He did some training on his own, including experiencing G-forces at the commercial National Aerospace Training and Research Center outside Philadelphia to make sure he could handle the trip. Then in 2008, he paid the $100,000 ticket price.

“The vision Xcor had at that time, obviously on paper, looked very good,” said Bennis, a retired resident of Stratford-upon-Avon in the U.K., who served as that city’s mayor and worked in the hotel business. “It had good, established people around it.”

Bennis and other would-be space tourists trekked to Mojave several times to visit the company’s Lynx production facility, view prototypes and chat with staff. On one particular trip, the group underwent jet fighter training, which Bennis described as “a great thrill.”

“We were never any wiser,” he said. “There was never any doubt in our minds … any inkling that there was a problem within the company.”

But behind the scenes, Xcor was finding it had underestimated the complexity of the Lynx’s development and the funding needed to pull it off.

“I think we had a really good ship,” recalled Dale Amon, a former senior engineer at Xcor responsible for working on the electronics, data and software in the Lynx’s cockpit. But “things always take longer and cost more than you expect, so you have to keep fundraising until you’re done.”

Greason, Xcor’s CEO, was replaced in 2015 by Jay Gibson, a former Beechcraft Corp. executive who had previously served as assistant secretary of the U.S. Air Force. A year later, the company shelved Lynx development and turned its focus to a contract to build an upper-stage rocket engine for United Launch Alliance, a joint venture of Boeing Co. and Lockheed Martin Corp. that launches national security satellites for the U.S. government. That was the company’s most promising near-term source of revenue. That same year, Xcor laid off about half of its 50- to 60-person workforce, including Amon.

In January 2017, Xcor executives sent a letter to ticket holders, pledging the delay “in no way diminishes our will and actions to finish building the Lynx and start the flight test phase.”

“For now, we are unable to share a reasonable time frame for your anticipated space flight,” wrote Gibson and Tom Burbage, president of the board of directors.

This rankled Hamameh, the French internet entrepreneur. He purchased his Xcor ticket using a significant amount of funds reaped from the sale of his social media marketing agency. Even before the January letter, he was pushing the company for a refund.

“I said, ‘Guys, it has been one year late; you are making no progress,’” Hamameh said.

Search for a white knight

Xcor was counting on funds from the ULA contract, but that ran out abruptly. Without mentioning ULA by name, Gibson told a Senate committee hearing last year that Xcor had thought it had a funding commitment from the prime contractor on a propulsion project through the year and beyond. But Xcor was told the contract was terminated with less than 30 days’ notice, Gibson said during his confirmation hearing to be deputy chief management officer of the Defense Department.

Gibson left Xcor in June 2017, less than two weeks after his nomination was announced. Xcor board member Michael Blum was named acting chief executive. Gibson was later promoted to chief management officer at the Pentagon but resigned in November. The Wall Street Journal reported prior to Gibson’s resignation that he was forced out for a “lack of performance.” An attempt to reach him through LinkedIn was unsuccessful.

In July 2017, Blum sent an email to the aspiring space tourists, saying in the “coming weeks and months, we hope to share the news of new partners and capital sources to support our business.”

But on his third or fourth day on the job, Blum said, he was forced to terminate all remaining employees. The company had run out of money and was unable to make payroll due to the loss of the ULA contract. An early Xcor customer himself, Blum insists a customer liaison representative was in touch with him regularly throughout 2016 and into the next year, making the January 2017 letter a disappointment but “no surprise.”

“I had held out hope that a white knight could be found, even in a distressed sale of the company,” he said in a LinkedIn message in October. “This did not materialize.”

A dream grounded

News of the bankruptcy devastated Sabine Daniels van der Sluis, 39, an Amsterdam resident who won an Xcor ticket through a contest sponsored by a shopping rewards program. To prepare for her trip, she had been strapped into a motion-training simulator in the Netherlands for about three minutes to experience the type of G-forces she would encounter in space. A subsequent medical check proclaimed her good to go. She thought she would fly by 2014.

“This was a prize of a million lifetime opportunities,” she said. “I work part time, and I thought, well, if I do go to space … I was trying to maybe give lectures in schools or try to do something with it.”

After the bankruptcy filing, some Xcor customers asked what had happened to the $35,000 that was part of their deposits but supposed to be kept separate in an escrow account and refunded in the event of an incident like the bankruptcy. A number were unsuccessful in connecting with or getting answers from Intertrust Group, the organization they said oversaw those escrow accounts.

A spokesman for Intertrust Group, a corporate management group based in the Netherlands, said in an email that “when there is an escrow agreement in place, Intertrust will execute according to what’s been defined in that escrow agreement.” The spokesman said he could not provide any further detail.

U.S. Chapter 7 bankruptcy trustee Jeffrey Vetter referred questions about the Xcor customers’ escrow accounts to the Justice Department. A Justice Department spokeswoman said in a November email that information about the escrow accounts was “not of the public record in this pending matter.”

Ticket holder Milan Karki, 41, did receive $34,500 from the escrow account. He reached out to Intertrust in May and received the funds in September, after Intertrust said there was an escrow account with his name. He purchased his ticket in 2013.

“I had lost hope,” said the New York resident and management consultant. He’s using the funds to buy property for his parents in their homeland of Nepal.

Bennis plans to go to Amsterdam to meet Intertrust officials face-to-face and get answers on behalf of the group.

“It was felt the plug was pulled, and we were left to our own devices,” he said.

Bennis and Jones have not given up hope of achieving spaceflight. Each talks about trying to get a spot on a future Blue Origin suborbital flight.

“I think the technology that has come forward, and [with the] extraordinary amount of talented people who are working behind the scenes, there’s got to be a future in suborbital space,” Bennis said. “I want it to come in my lifetime.”

Twitter: @smasunaga

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.