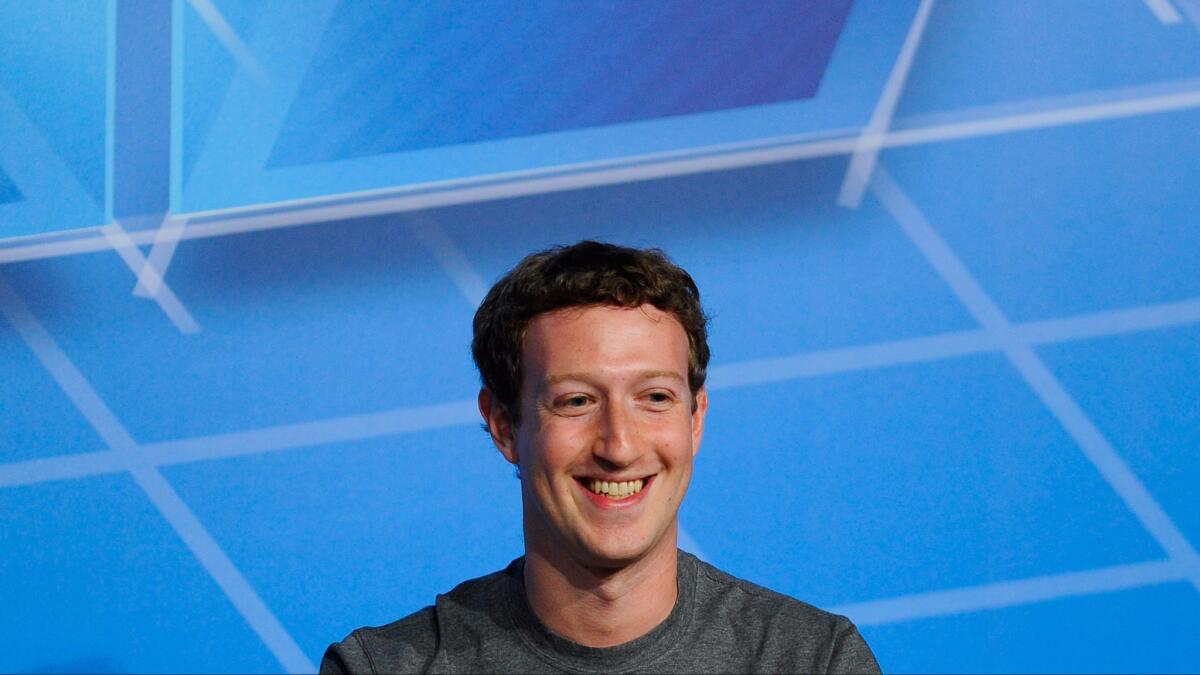

Facebook shareholders approve stock shift that keeps Mark Zuckerberg in control

Facebook Inc. investors approved a proposal to issue 5.7 billion shares of Class C stock during the company’s annual shareholder meeting Monday.

The move is intended to ensure Chief Executive Mark Zuckerberg will maintain control of the social media giant he co-founded. Zuckerberg, who said he plans to donate a substantial amount of Facebook shares, will now be able to do so without diluting his voting power.

The shift gives current shareholders a 3 for 1 stock split, which means for every share of Class A or B stock an investor owns, Facebook will offer them two Class C shares as a one-time dividend. Class C stock does not come with shareholder voting power.

“I plan on being involved in and running Facebook for a very long time,” Zuckerberg told investors in attendance, which led to a round of applause.

In addition to the Class C stock issuance, shareholders voted to reelect Facebook’s board of directors, including Peter Thiel, the PayPal co-founder who secretly bankrolled wrestler Hulk Hogan’s lawsuit against Gawker Media.

Facebook shares finished the day up 35 cents, or 0.31%, to $113.37.

MORE BUSINESS NEWS

Millions eligible for free tickets through Ticketmaster

White-collar crime: How the feds blundered by indicting PG&E for a fatal gas explosion

Why the idea of ‘Brexit’ — Britain’s exit from the European Union — is shaking up markets worldwide

UPDATES:

2:08 p.m.: This article was updated with Facebook’s stock price after the close of markets.

12:16 p.m.: This article has been updated with additional details.

This article was originally published at 11:54 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.