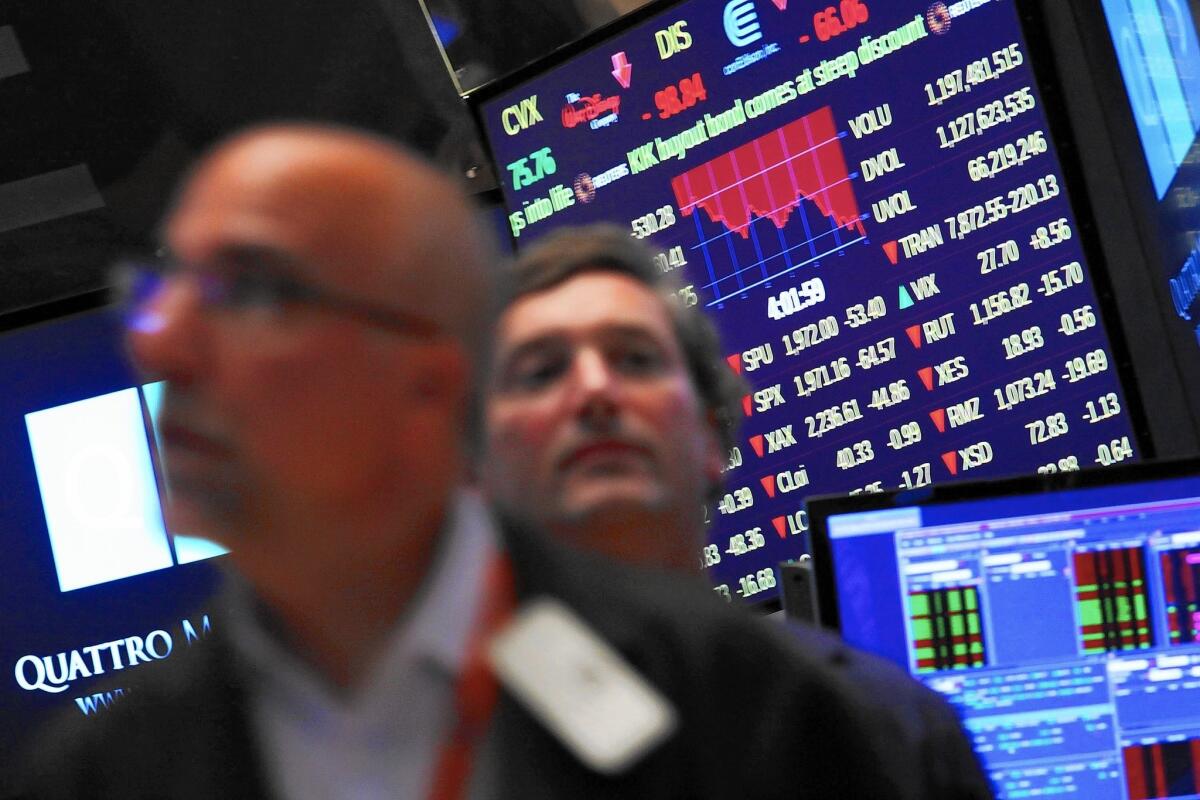

Stock market’s bumpy ride isn’t over, experts say

Wall Street’s wild week ended with relative calm, but no trader or money manager is betting the lull will last.

In one of the stock market’s most chaotic periods in years, the benchmark Standard & Poor’s 500 first plunged 11.2% in just six sessions stretching into last week, then roared back 6.4% over the next two days before ending little changed Friday.

The Dow Jones average of 30 industrials plunged a stunning 1,000 points one day, then soared 1,000 points over only two days.

And the ride will probably stay rocky for a while, many veteran market watchers predict. “It wouldn’t surprise me to see many days in the next few weeks where we have more triple-digit moves [in the Dow] in both directions,” said Jeff Clark, a trading analyst at Stansberry Research.

No one can predict, of course, whether the market’s next sustained move is up or down. Bear markets — a drop of 20% or more from the market’s peak — are rare. But experts don’t expect a quick recovery from the market’s recent plunge, despite its head-turning rally last week.

“In the 11 times since World War II that the market fell by 5% or more in August, it continued to fall in September 80% of the time, and did so an average of 4%,” said Sam Stovall, U.S. equity strategist at S&P Capital IQ.

And it can be tough to see a longer-term trend develop. After stocks tumbled early in 2008, for instance, they staged a recovery in the spring before the depth of the problems in the financial and housing markets became clear and sent stocks plummeting in the fall.

Even in down markets some industry sectors perform better than others, and that was true last week within the S&P 500’s sectors.

Tech, energy and “consumer discretionary” stock sectors, including automakers such as Ford Motor Co., home builders such as Lennar Corp. and retailers such as Amazon.com, finished with gains.

But that sector and others were punished so badly earlier in the month that all 10 sectors joined the S&P 500 index in the red for the month to date.

“The sectors that held up best — as Capt. Renault from ‘Casablanca’ said — were the usual suspects,” Stovall said.

They included so-called defensive sectors such as telecom, consumer staples and utilities whose products and services remain in demand even as global economies and markets are abruptly shifting, he said.

The consumer staples sector includes food and beverage stocks such as PepsiCo Inc. and personal-products firms such as Kimberly-Clark Corp.

“When times are challenging, it’s usually those defensive areas that fare well,” Stovall said.

Individual investors typically are cautioned against trying to time the market, because invariably they bail out when prices are low and return after prices already have rallied.

One alternative is to rebalance their portfolios with these types of defensive stocks — so that they stay invested and won’t lose out on all the gains if the market rises, analysts said.

Utilities showed the smallest loss, 2.1%, among the sectors for the month so far. That’s partly because many of those stocks already had dropped back this year after a strong 2014, said Joe DeSantis, a chief investment officer at Fidelity Investments.

Utilities in the S&P 500 include Rosemead-based Edison International, parent of Southern California Edison, and San Diego-based Sempra Energy.

Last week, as the market snapped back from its earlier rout, “those sectors that did the best were those that had taken it on the chin the most: technology, energy and the financial stocks,” Stovall said. The tech-stock sector includes Apple Inc., Intel Corp. and Qualcomm Inc.

Utilities remain a good defensive play when “you have a really unstable market,” partly because many utilities offer attractive dividend yields, DeSantis said.

But no sector could escape the market’s recent turbulence. The market’s initial plunge, coming after stocks had enjoyed a bull run over most of the last six years, pushed the S&P 500 and other major averages into a “correction,” or a drop of 10% or more.

Although the market erased a good part of that decline Wednesday and Thursday, analysts warned that the impact of a correction on stock prices — and investors’ psyches — doesn’t vanish quickly and more volatility is almost certain.

“There’s been technical damage done to the market,” said Stansberry Research’s Clark. “It would be silly to think we’re going to run up again to all-time highs all of a sudden.

“It’s as though you’re sitting in a calm pool of water and somebody jumps in; it takes a while to settle,” he said.

The market’s rebound was encouraging, “but I wouldn’t interpret it as saying, ‘We’ve hit the bottom, it’s off to the races and we can forget about the ugliness of earlier this month,’” said David Dietze, president of Point View Wealth Management in Summit, N.J.

The two main issues are China’s slowing economy and uncertainty as to whether the Federal Reserve will start lifting its benchmark U.S. interest rate, currently near zero, starting next month.

Recent gains in several areas of the U.S. economy indicate the central bank might go ahead and raise rates. But amid China’s woes and the financial markets’ turbulence, some speculate that the Fed will continue to wait.

Sectors less influenced, at least for now, by China and the market’s wild swings are another defensive way to stay invested, analysts said.

Oppenheimer & Co. likes several stocks in the consumer-discretionary sector, such as Home Depot Inc. and Best Buy Co., because U.S. economic trends mainly “tend to drive [consumer] spending” at those stores.

But regardless of whether it’s China or other pressures weighing on the market, “it typically takes five months for the correction to bottom and four months to get back to break-even,” Stovall said.

“We’ve really only been in this correction for about three months because [the S&P 500] peaked on May 21,” he said. “It’s not going to be over any time soon.”

[email protected]

Twitter: @PeltzLATimes

ALSO:

Obama to rename Mt. McKinley as Denali

Taxpayers have never paid more for public worker pensions, but it’s still not enough

Kentucky clerk who opposes same-sex marriage turns to Supreme Court for help

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.