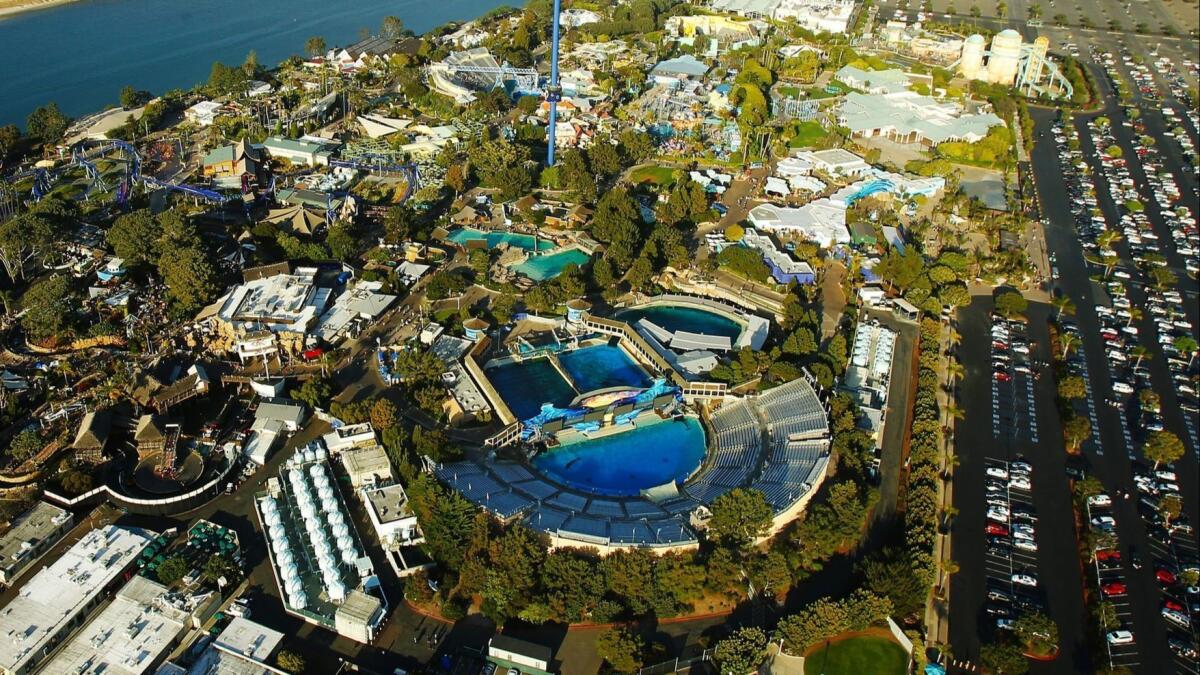

SeaWorld backs out of deal for hotel at San Diego park

Nine months after signing a deal to bring a SeaWorld-branded hotel to the San Diego theme park, SeaWorld Entertainment Inc. has decided to abandon the effort.

In a quarterly report released Tuesday, the Florida-based company said that in September it decided to not proceed with the San Diego project and “terminated the agreement” with San Diego-based Evans Hotels.

As part of that termination, SeaWorld said it recorded a loss of $2.8 million in expenses and fees.

The mention in the SeaWorld report was the first time it became publicly known that the company was no longer interested in the project.

A day earlier, SeaWorld Interim Chief Executive John Reilly was asked by an analyst during its quarterly earnings call about the company’s interest in hotel development. Reilly’s response suggested that hotels for now are not a near-term priority.

“Longer term, I’d say, we still believe lodging is a priority for us,” he said. “However, and as we look at this revamped capital strategy, we have done some realigning of our strategic priorities to make sure that … attendance-driving attractions in our parks are a top priority.”

SeaWorld spokesman Travis Claytor declined to elaborate beyond the disclosure in the company’s quarterly report.

Evans Hotels, which already has two Mission Bay resorts near the marine park — the Bahia and Catamaran — called the SeaWorld decision disappointing.

Meanwhile, SeaWorld has been experiencing a rebound in attendance and revenue after years of steady declines since the 2013 release of the anti-captivity documentary “Blackfish.”

The revival of the business parallels the debut of more high-profile park attractions, most notably thrill rides such as the Electric Eel coaster that made its debut in San Diego this year.

The move to develop hotels within the SeaWorld parks — similar to what Disney and Universal have done at many of their resorts — originated with former Chief Executive Joel Manby, who resigned this year. The agreement formalized by SeaWorld was struck a month before Manby left the company.

“I’ve argued for years that theme parks should do more hotel building,” said Martin Lewison, an assistant business professor at Farmingdale State College in New York who has advised amusement parks in the United States and Europe. “But it is a diversification, and there certainly is a philosophy in business that diversification can be dangerous because it can prevent focus and takes your eye off your core business.”

Legoland California has seen considerable success with the two themed hotels it has developed on the Carlsbad resort.

Even as SeaWorld continues to release upbeat reports about its financial performance, yet another rumor emerged this week about a possible sale of the company.

SeaWorld has declined to comment on a Facebook post by blogger ThemedReality that Six Flags Entertainment Corp. is in talks to buy all or a portion of the company.

The blog post, which notes that the information comes from individuals with “intimate knowledge of the dealings between the two companies,” cautions that there is no guarantee a deal will be consummated.

Claytor said Wednesday that the company will not comment on speculation or rumors.

Rumors of a possible sale have surfaced before, most notably last year when Legoland California owner Merlin Entertainments was said to be exploring a possible purchase. Days later, the UK-based company denied being engaged in any such talks.

“I’ve heard Disney rumors, Universal rumors, and now Six Flags is the most recent rumor, which generated a lot of chatter on various Facebook pages where people are either supporting or decrying the idea,” Lewison said. “Of course, the issue is: Is the company for sale, and does Six Flags have the wherewithal to acquire SeaWorld Entertainment? Right now, there are too many what-ifs. As far as anyone knows, it’s a rumor, but a compelling rumor.”

Weisberg writes for the San Diego Union-Tribune.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.