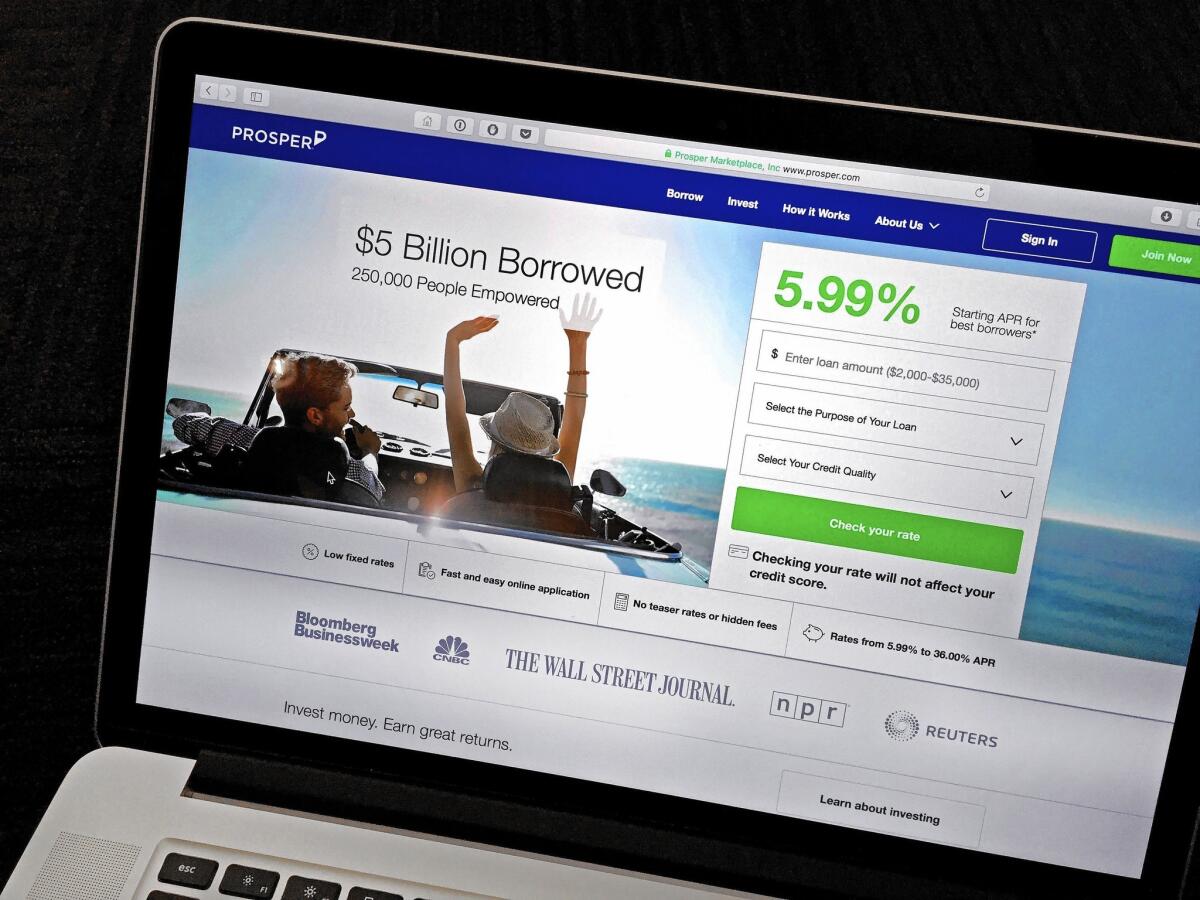

Online lenders need more oversight, Treasury report finds

Online lenders require more federal oversight, according to a Treasury Department report released Tuesday as the rapidly growing industry faced increasing concerns about the quality of its loans.

While offering opportunities for consumers and particularly small businesses to gain greater access to credit, online lending poses risks that require “ongoing monitoring,” the report said.

A chief concern is that the industry, which matches borrowers with investors willing to lend money in online marketplaces, has developed during a period of record low interest rates and other favorable credit conditions.

See more of our top stories on Facebook >>

It’s unclear how online lenders will handle rising interest rates and tighter credit, the report said.

“This industry remains untested through a complete credit cycle,” Antonio Weiss, counselor to Treasury Secretary Jacob J. Lew, told reporters in releasing the 45-page report.

“As this industry matures, online marketplace lenders should consider policies that minimize risks to borrowers and increase investor confidence throughout the credit cycle,” he said.

Online lenders have run into difficulty in recent months amid concerns about the quality of their loans. Ratings agencies have warned about rising delinquencies, which have made it harder for online lenders to find the money they need to make loans.

On Monday, the young industry’s biggest firm, Lending Club, announced the resignation of its chief executive after problems with the sale of loans this year to an investor.

SIGN UP for the free California Inc. business newsletter >>

Among the report’s recommendations is legislation to extend to small businesses some federal protections already provided to consumer borrowers in the online lending marketplace. The report also called for creation of a private-sector registry to track data on loans, their performance and other industry information.

“There is a clear need for greater transparency in the market for borrowers and investors,” Weiss said.

An additional concern is the use of algorithms by online lenders to determine the credit-worthiness of borrowers.

“While new models may expedite credit assessments and reduce costs, they also carry the risk of disparate impact in credit outcomes and the potential for fair lending violations,” Weiss said.

“In other words, just because a lending decision was made by an algorithm doesn’t mean it was fair or unbiased,” he said.

The report recommended federal officials form a working group among agencies with responsibility for monitoring online lending activities, including Treasury, the Consumer Financial Protection Bureau and the Federal Trade Commission.

Treasury began seeking public comment in July on the online lending industry as it grows. Morgan Stanley has estimated marketplace loan originations grew from $1 billion in 2010 to $10 billion in 2014.

The Treasury report estimated that online loan originations could reach $90 billion by 2020.

Public interest groups urged Treasury to take steps to ensure consumers are treated fairly and that online firms comply with fair lending laws.

But a bipartisan group of House members wrote to Lew this month warning of “hastily drawn conclusions” that would lead to new regulations for small business online lending. The lawmakers said that “could result in stifling innovation and competition and rolling back the expanded access to capital that small businesses enjoy through online lending platforms.”

Last year, California regulators began their own inquiry into the industry.

MORE FROM BUSINESS

Nazarian’s SBE agrees to buy Morgans Hotel Group

El Segundo office campus sells for more than $300 million

Why Uber and Lyft aren’t looking to tech to solve their fingerprint problem

Follow @JimPuzzanghera on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.