Mobile shopping is quick and convenient. So why hasn’t it killed Black Friday yet?

Two years ago on Black Friday, Justin Blankenship and his wife woke up at 4 a.m. to drive to Bed Bath & Beyond. Being first in the line, they assumed, was what it would take to get a great price on a Keurig coffee pot and Kitchen Aid mixer.

But after they realized the deals they had scoped out weren’t exactly flying off the shelves, Blankenship, 36, made the shift to mobile. This year, he’s doing his holiday shopping from his phone.

“I don’t have to fight the crowds to get the same deal,” said the minister from Purcell, Okla. “Convenience is a big part of it.”

The ease of online shopping has helped the holiday e-commerce season grow to a projected $117 billion this year, and over the last decade it has made the day of digital sales, dubbed Cyber Monday, a household term.

But now that most Americans carry a smartphone in their pocket, Cyber Monday itself is starting to seem inconvenient, if not obsolete. Why should deal-seeking shoppers hold off on online buying until they return to the office after the holiday weekend when they can make purchases on their phones as soon as — or even before — the pumpkin pie is served?

This holiday season is expected to be the first when mobile shopping visits outpace desktop e-commerce browsing, according to predictions from software firm Adobe.

The rise of mobile shopping has led retailers to start online sales even earlier to grab customers while they’re browsing, turning Black Friday and Cyber Monday into a weeks-long affair.

That, analysts say, has diminished some of the excitement around the traditional one-day shopping holiday — and it’s causing retailers to rethink how they’re approaching this critical season.

Retailers have already seen an uptick this year in e-commerce. On Thursday, online sales hit nearly $1.2 billion, a 13.6% jump compared with last year, according to Adobe. Nearly $550 million of that came from mobile devices, a huge 58.6% leap from 2015.

But mobile shopping remains a hassle in its own way. Though 53% of e-commerce visits in November and December are expected to come from mobile devices, Adobe projects they will account for only 34% of online sales.

The discrepancy is mostly due to mobile checkout experiences that remain tedious for smartphone users.

Though some retailers such as Amazon.com have worked to make the mobile purchasing process easy and convenient, customers often consider it burdensome to enter credit card information into a smartphone Web browser.

Businesses could win some over by working with payment services such as Apple Pay, Android Pay or PayPal — saving users time spent dealing with a tiny keyboard, said Brendan Miller, principal analyst at Forrester. “What we’re telling retailers is you’ve got to focus on getting that checkout experience right,” he said.

Many retailers have developed apps over the years to try to streamline the shopping process and cash in on the latest tech craze, but few prove useful. According to Adobe, users open 60% of retail apps fewer than 10 times.

Over the years, retailers have tried to adjust to the new mobile shopping habits.

Target Corp. and Wal-Mart Stores Inc. said they have redesigned their websites with a “mobile-first” mentality — making sure that the design was clean and simple to improve the shopping experience.

Last year, 70% of Wal-Mart’s traffic between Thanksgiving and Cyber Monday came from mobile devices, said Ravi Jariwala, company spokesman. In response, the Bentonville, Ark., chain gave users of its mobile app early access to its Black Friday deals.

At Target, mobile sales during Thanksgiving weekend last year jumped 200% compared with the year before, said Eddie Baeb, company spokesman.

The Minneapolis retailer has tried to boil down its mobile checkout process to “two taps” — after logging into their Target account and choosing what to purchase, customers hit a “checkout” button and then OK another prompt to place the order, Baeb said. Target is also testing Apple Pay in its mobile Web browser, a service it already includes in its app.

“Obviously, we’ve seen the ubiquity of mobile devices,” he said. “We’ve talked about it for a while as mobile being the front door for Target.”

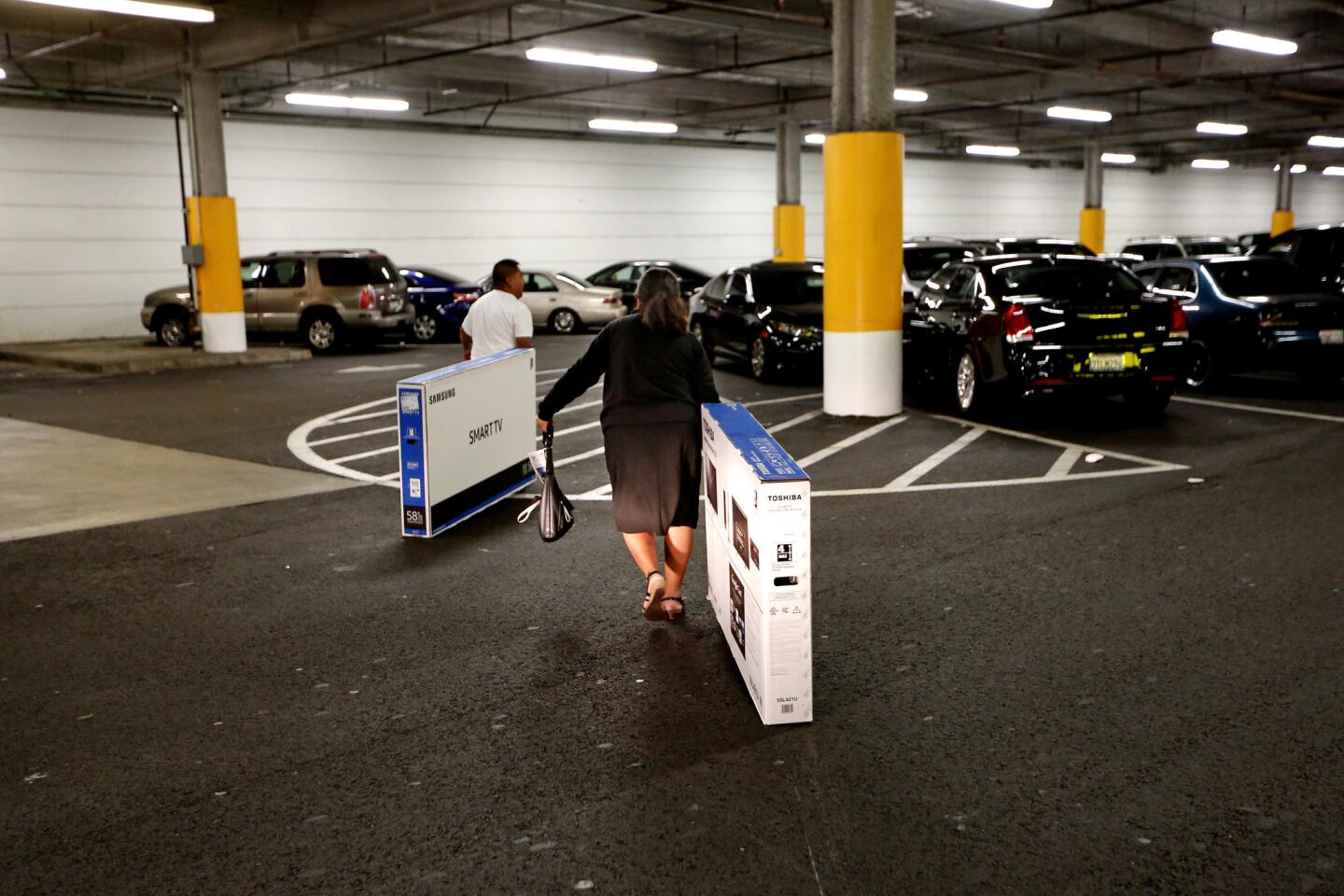

But customers like Yusuf Mansuri are still flocking to malls and big-box stores.

The 67-year-old Duarte resident went to the Wal-Mart in his hometown on Black Friday because he likes seeing the merchandise in person. “I’m a visual” person, he said. “I got to look at it. I tried online shopping but didn’t get anything.”

There’s also the collective, cultural experience of a mass-participation retail holiday, said consumer psychologist Kit Yarrow.

“No matter how accustomed people get to shopping online, Black Friday and the surrounding holidays are special because it’s not just about shopping,” said Yarrow, author of “Decoding the New Consumer Mind.” “There’s a social aspect to it that we really can’t underestimate.”

That’s what brought Fountain Valley resident Diana Tran Nguyen, 19, to South Coast Plaza on Friday morning. “I didn’t buy anything here,” she said as she scrolled Instagram from a bench outside Victoria’s Secret. “I bought everything online. I can’t deal with crowds. I just came because it’s a tradition with my friends. We do it every year.”

Such sentiments aren’t uncommon — and they can be a major factor in driving holiday weekend traffic.

“There’s still an emotional connection,” said Miller of Forrester. “People will still want to go out on Friday morning for the emotional experience.”

Times writers Shan Li, Melissa Etehad and Sonaiya Kelley contributed to this article.

For more business news, follow me @smasunaga

MORE BUSINESS NEWS

Stocks edge higher in early Black Friday trading

Under Trump, fuel economy standards for cars and trucks may be scaled back

Here’s why you might want to skip those offers for store credit cards

UPDATES:

10:05 a.m.: This post has been updated with comment from Diana Tran Nguyen.

This article was originally published at 8:25 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.