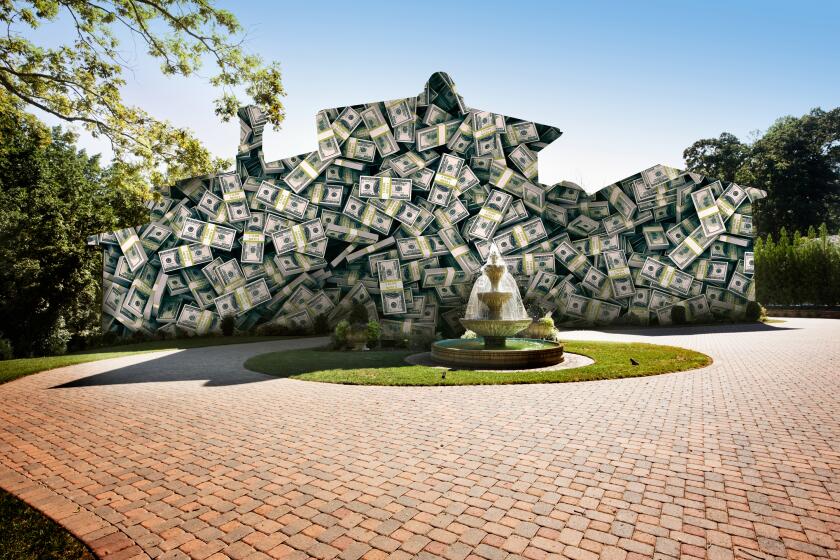

Mortgage-bond sales at highest level since June 2009

Stoked by government efforts to revive housing, sales of mortgage-backed securities rose in November to the highest level in nearly 3 1/2 years.

Nearly $176 billion in bonds backed by fixed-rate home loans were issued in November, up from $132 billion in October and the most since $229 billion were issued in June 2009, according to a report Monday in MortgageDaily.com, which cited the data firm eMBS Inc.

The mortgage bonds were backed by the Federal National Mortgage Assn., or Fannie Mae; the Federal Home Loan Mortgage Corp., or Freddie Mac; and the Government National Mortgage Assn., or Ginnie Mae.

The market for Wall Street’s private mortgage bonds imploded during the financial crisis, as high-risk loans defaulted and home prices plunged. The collapse wiped out or severely wounded onetime subprime and pick-a-pay home loan specialists such as Ameriquest Mortgage Co. of Orange and Calabasas-based Countrywide Financial Corp.

Now Fannie, Freddie and Ginnie, all government-sponsored mortgage finance companies, are the vehicles by which the mortgage lenders are removing all the long-term fixed loans that they don’t want sitting on their books.

The high volume is the result of two factors: the Federal Reserve’s success in driving down mortgage interest rates to the lowest levels on record, and a revision of the Obama administration’s Home Affordable Refinance Program, or HARP, making it easier for current but underwater borrowers to refinance their loans.

In addition to helping millions of borrowers lower their home payments, the programs have generated huge profits for the remaining big mortgage-lenders, especially San Francisco’s Wells Fargo & Co.

ALSO:

Refi rates good but could be better

Bank coffers swelling with profits from mortgage sales

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.