Treasury warns default could cause worse financial crisis than 2008

WASHINGTON -- A federal government default caused by a failure to raise the debt limit could trigger a worse financial crisis than in 2008, the Treasury Department said Thursday in a report designed to pressure Congress to act before the Oct. 17 deadline.

“A default would be unprecedented and has the potential to be catastrophic: credit markets could freeze, the value of the dollar could plummet, U.S. interest rates could skyrocket, the negative spillovers could reverberate around the world, and there might be a financial crisis and recession that could echo the events of 2008 or worse,” Treasury said in the six-page report on the potential effects of a debt ceiling showdown on the economy.

Even the growing prospect of a default amid political bickering in Washington is harmful to the still-fragile economy, said Treasury Secretary Jacob J. Lew.

QUIZ: Test your knowledge about the debt limit

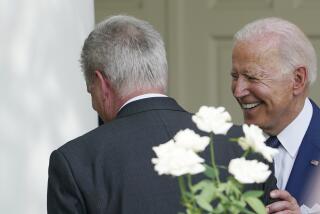

A stalemate on fiscal issues between President Obama and congressional Republicans has led to a partial government shutdown and caused worries that the $16.7-trillion debt limit won’t be raised in time to ensure the Treasury has enough money to pay the nation’s bills.

After meeting with Obama Wednesday, Goldman Sachs Chief Executive Lloyd Blankfein and Bank of America Chief Executive Brian Moynihan warned of the severe economic consequences of a default.

The federal government has never defaulted on its payments, so the closest historical comparison is the debt limit fight in 2011, the Treasury report said. That was resolved at the last minute but led to a sharp drop in financial markets and consumer and business confidence.

Credit rating company Standard & Poor’s said the brinkmanship was a major factor in its decision at the time to downgrade the U.S. AAA rating -- the first downgrade in the nation’s history.

“As we saw two years ago, prolonged uncertainty over whether our nation will pay its bills in full and on time hurts our economy,” Lew said.

“Postponing a debt ceiling increase to the very last minute is exactly what our economy does not need – a self-inflicted wound harming families and businesses,” he said. “Our nation has worked hard to recover from the 2008 financial crisis, and Congress must act now to lift the debt ceiling before that recovery is put in jeopardy.”

House Speaker John Boehner (R-Ohio) has said a debt-limit hike must include spending or fiscal reforms at least equal to the amount of the increase. Obama has said he will not negotiate on the debt limit because Congress has the responsibility to pay for spending it already authorized.

The federal government is spending less money because of the partial shutdown. But that won’t delay the Oct. 17 deadline unless the shutdown is lengthy, senior Treasury officials said.

On that date, the U.S. will be at risk fo default because it will be out of borrowing authority and only have $30 billion on hand to pay bills that could be as much as $60 billion on any given day. It’s unclear when an actual default would take place after that date.

But Obama administration officials have warned that just getting close to that date could spook financial markets and cause damage to a tepid economic recovery already dealing with the effects of the shutdown.

The report noted that private economists have estimated a week-long shutdown could reduce economic output by about 0.25 percentage points, with a longer shutdown having a greater effect.

“If such projections prove accurate, the weaker-than-expected economic expansion would be even more susceptible to the adverse effects from a debt ceiling impasse than prior to the shutdown,” the report said.

The shutdown and concerns about a default haven’t yet caused a sharp market sell-off. But the report said that yields on U.S. Treasury bills that mature at the end of October are higher than those maturing just before or after Oct. 17, indicating some investor concern that those won’t be repaid.

ALSO:

Holiday sales are projected to rise 3.9%

Wells Fargo is accused of bogging down mortgage modifications

End of Silk Road for drug users as FBI shuts down illicit website

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.