Debt limit deadline is Oct. 17, Treasury secretary says

WASHINGTON -- The nation’s debt limit must be raised by Oct. 17 to avoid a potential default, Treasury Secretary Jacob J. Lew told congressional leaders Wednesday in setting a firmer deadline for lawmakers to break a stalemate.

He urged Congress to “act immediately” to raise the $16.7-trillion borrowing limit or risk “catastrophic” results. Setting a specific date could help force action by lawmakers, who often wait until the last minute on highly controversial legislation.

Last month, Lew gave a vague mid-October date for when the Treasury would run out of the so-called extraordinary measures it has been using to juggle the nation’s finances and continue borrowing after the debt limit technically was reached in May.

By the middle of October, the Treasury would have about $50 billion on hand to pay incoming bills on any given day, Lew told Congress on Aug. 26.

QUIZ: Test your knowledge about the debt limit

But in a letter Wednesday, Lew said more information about revenues allowed him to project that the Treasury would run out of borrowing authority no later than Oct. 17. And at that point, Lew estimated, the Treasury would have just $30 billion in cash.

Daily expenditures can run as high as $60 billion, he said.

“If we have insufficient cash on hand, it would be impossible for the United States of America to meet all of its obligations for the first time in our history,” Lew said.

His new estimate is in line with an analysis by the Bipartisan Policy Center that the U.S. would have to raise the debt limit between Oct. 18 and Nov. 5.

An exact deadline -- known as the X date -- is difficult to set because it is tricky to predict the amount of money coming in from tax payments and other sources on any given day, said Steve Bell, senior director of the center’s Economic Policy Project.

The White House remains at odds with congressional Republicans over raising the debt limit. That’s led to fears of a repeat of the financial market turmoil that took place in 2011 when Congress acted at the last minute to avoid a potential default -- or worse, of an actual first-ever federal default.

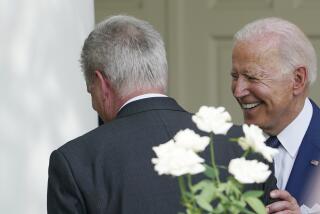

President Obama has refused to negotiate over the issue, saying the debt limit must be raised as it has been dozens of times in the past in order to pay for spending Congress has already authorized.

But many Republicans are pushing for major concessions in a debt-limit deal, including deep spending cuts. Some conservatives want to make a debt limit increase contingent on a delay or complete defunding of Obama’s healthcare reform law.

On Wednesday, Lew reiterated that the White House would not bargain for a debt limit increase.

“The president remains willing to negotiate over the future direction of fiscal policy, but he will not negotiate over whether the United States will pay its bills for past commitments,” Lew said.

Michael Steel, a spokesman for House Speaker John Boehner (R-Ohio), said the new deadline should be impetus for action. Boehner has said Republicans don’t want to force a default but that the debt limit has been used many times in the past as leverage for broader fiscal deals.

“This is another reminder that we need to work together -- soon -- on a bill that raises the debt limit and deals with causes of the debt by cutting Washington spending and increasing economic growth,” Steel said. “And it should remind President Obama that refusing to negotiate with Congress on solutions just isn’t an option.”

Some Republicans have said the federal government could avoid a default by using cash on hand to pay the interest on Treasury securities. The House passed a bill in the spring requiring such prioritization.

But Lew said Wednesday such a move would be “ill advised.”

“Any plan to prioritize some payments over others is simply default by another name,” Lew said. “The United States should never have to choose, for example, whether to pay Social Security to seniors, pay benefits to our veterans, or make payments to state and local jurisdictions and healthcare providers under Medicare and Medicaid.”

ALSO:

U.S. home price gains moderate, index shows

Online Obamacare marketplaces offer ample options, report says

Facebook’s status among investors and analysts changes: It’s a darling

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.