American Apparel blames ‘rough third quarter’ on site transition

American Apparel Inc. struggled with out-of-stock items and high costs as it continued to transition to a new distribution center in La Mirada, resulting in disappointing earnings for the period ended Sept. 30.

The Los Angeles company said its revenue rose 1% to $164.5 million. But same-store sales online and in physical units open at least a year rose 2%, compared with a 20% bump over the same period last year.

And the retailer suffered a net loss of $1.5 million, or a cent per share, compared with a loss of $19 million, or 18 cents a share, a year earlier.

Excluding special items, the plunge becomes a $14.4-million, or 13-cent, tumble compared with a loss of $5.7 million, or 5 cents a share, in the third quarter of 2012.

American Apparel also noted that its earnings before interest, taxes and other factors settled at $3.8 million in the third quarter. A year earlier, the gauge registered $13.3 million.

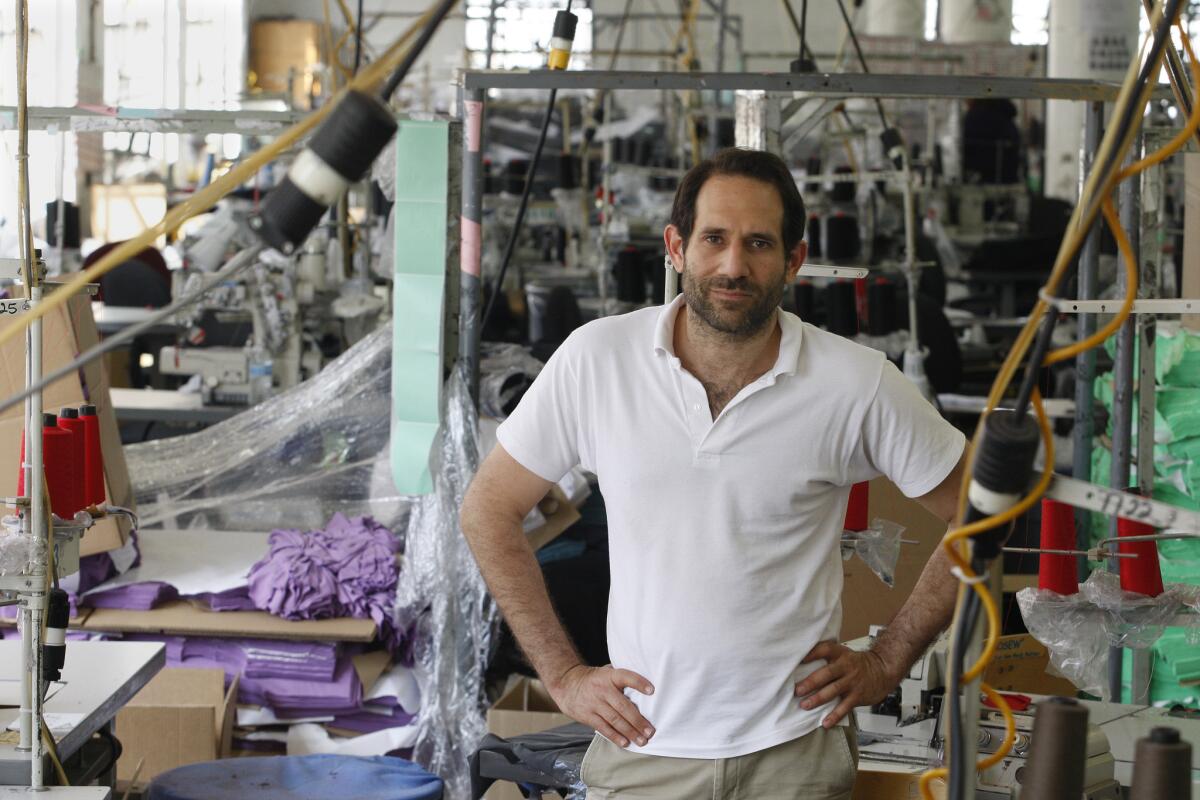

“No question we had a rough third quarter,” Chief Executive Dov Charney said in a statement.

Among the holdups: costs associated with the La Mirada move, delayed product deliveries that led to popular items being out of stock in stores, and generally “weak U.S. apparel sector demand,” he said.

American Apparel, which touts its domestic manufacturing, signed the La Mirada lease in June 2012 and began shifting shipment operations in February.

Charney emphasized, however, that “most of the challenges we have faced were primarily technically oriented and we believe these challenges are substantially behind us.”

Also Thursday afternoon, Nordstrom Inc. said its earnings slipped in its third quarter, which ended Nov. 2. Profit slipped to $137 million, or 69 cents a share, from $146 million, or 71 cents a share, from a year earlier.

The Seattle department store chain blamed its Anniversary Sale timing for same-store sales that increased just 0.1% over the period. The massive discount-fest fell in the second quarter this year, causing difficult comparisons to 2012, when it was spread over the second and third quarters.

ALSO:

Macy’s beats earnings forecasts, enters holidays optimistic

Black Friday is the busiest, but what’s the best day to holiday shop?

Wal-Mart’s pre-holiday sales disappoint: Bad omen for the economy?

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.