Lawsuit accuses Middle East bank of stealing an Orange County entrepreneur’s technology

Farooq Bajwa still lives comfortably, up in the hills of San Juan Capistrano in a French chateau-style mansion with views of the Pacific.

But his tech company, InfoSpan, and its bustling headquarters in an Irvine office park, are long gone. These days the income from three El Pollo Loco franchises bought two decades ago helps out.

The Pakistani immigrant turned entrepreneur earned millions manufacturing computer components in the 1980s and 1990s, but he doesn’t blame the dot-com bust for his change of fortune.

Rather, he traces it back to a plan he had early last decade for a new business: a text-based payment system that could be used throughout the developing world, particularly for migrant workers to send money home.

PayPal pioneered Internet payments in 1999, but its focus was on computers. The iPhone and Square didn’t exist. In short, he had a window of opportunity just as mobile phones were starting to become a global phenomenon.

“I realized I might make a big difference in this world not only helping these underprivileged people who don’t have bank accounts, I will also be helping bring an economic revolution,” said Bajwa, 64. “I had very big dreams.”

Those dreams never materialized.

Instead, they devolved into a bitter, high-stakes lawsuit against a prominent Middle East bank, a case scheduled to be heard in July by a jury in Santa Ana federal court.

At issue is whether his SpanCash system ever delivered as promised, how much revenue it could have made and whether the bank, Emirates NBD, stole any ideas or technology after its deal to launch the system with InfoSpan collapsed. More than $550 million in damages is being sought from the bank, which disputes that the system ever worked.

InfoSpan is represented by the powerhouse law firm of Boies Schiller & Flexner — chaired by David Boies, among the country’s most well-known attorneys — while the bank hired Latham & Watkins, a large firm with offices worldwide, including in the Emirates.

“Nothing is more bitter than a failed marriage — that is often the context of a trade secrets case. It’s a relationship entered into with hope and optimism that goes sour,” said Robin Feldman, a Hastings College of the Law professor who specializes in intellectual property law and reviewed court filings by both sides.

Bajwa’s prior business, BAS Micro Inc., served the titans of the computer revolution, including Compaq, Dell and Toshiba. But for his new business, InfoSpan, Bajwa decided to target the “unbanked,” especially the 60% of adults in developing countries who don’t have bank accounts.

------------

FOR THE RECORD:

InfoSpan lawsuit: An earlier version of this story said that InfoSpan had a prior business selling computer components. In fact, a company called BAS Micro Inc. sold those components.

------------

The wealthy Persian Gulf region was of particular interest because of its reliance on 25 million foreign guest workers who do construction and other jobs. These workers usually wire home a few hundred dollars at a time to places such as India, Pakistan and Egypt. But transfer fees consumed on average nearly 8% of their payments, called remittances, according to the World Bank. Bajwa’s goal was to charge half that for online and mobile-to-mobile cash transfers.

Nothing is more bitter than a failed marriage — that is often the context of a trade secrets case. It’s a relationship entered into with hope and optimism that goes sour.

— Robin Feldman, Hastings College of the Law professor

In 2003, InfoSpan began developing SpanCash, featuring a “stored value card,” a prepaid debit card linked to a mobile phone. The idea was for an employer to load earnings onto the card that employees could use to text money.

“Our technology was [going to do] much more than what PayPal was doing,” Bajwa said. “PayPal was not sending money to your relatives or friends, or getting salaries, or paying utility bills.”

To help him out, Bajwa recruited Larry Scudder, who had built the first cable system in Saudi Arabia and later founded an Internet bill payment company in Texas catering to unbanked Americans. InfoSpan homed in on the United Arab Emirates, whose 8 million foreign residents now send $19 billion to their home countries annually.

“They were being charged tremendous amounts of money to send money home to their families, [but] everybody was getting a cellphone,” Scudder said.

Paradoxically, InfoSpan’s system required banks to make the plan work — to facilitate employers loading money onto the cards and to transmit the cash across borders. And with a bank involved, currency exchange was a built-in feature; workers paid in the Emirates’ dirham could text money to Pakistan in rupees.

In 2007, Bajwa and Scudder found a partner that seemed ideal, Emirates Bank, based in Dubai and controlled by the government’s sovereign wealth fund.

Scudder moved to Dubai and said he signed up a dozen Emirates companies and made deals with banks in Pakistan, the Philippines, India and Indonesia to receive funds.

The bank and InfoSpan forecast 1 million Emirates immigrant workers would use their cash-texting service, rather than Western Union or hawala, a traditional Middle Eastern broker-to-broker money transfer system.

“It was a lot less expensive for them to send a text,” Scudder said.

Expectations were sky-high. The lawsuit cites a study conducted by McKinsey & Co. that projected annual revenue of $3.5 billion by the deal’s fifth year, with InfoSpan receiving more than $2.8 billion in fees.

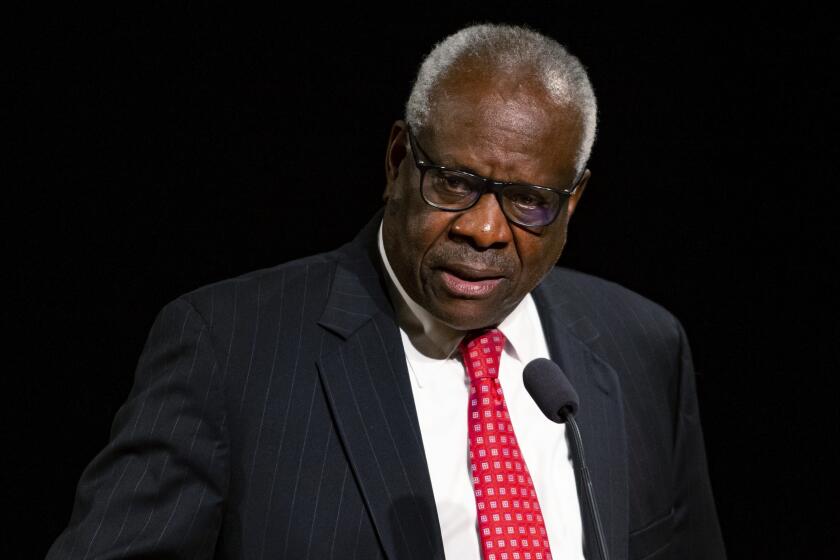

A 2007 bank news release touted a “unique global service” at “competitive rates” with a stored value card that could be recharged at hundreds of the bank’s ATMs across the Middle East. It featured a photograph of Bajwa shaking hands with a bank executive.

InfoSpan claims that it copied its source code onto servers delivered to the bank in Dubai and trained bank personnel to run the technology. The bank disputes it acquired or used SpanCash source code at any time.

InfoSpan began establishing call centers around the world, including in the Emirates, Pakistan, India and Mexico, with operators fluent in Arabic, Urdu, Hindi, Spanish and other languages, according to the company.

Bajwa and Scudder say they would go on to employ 1,500 people worldwide. Bajwa contends that the company, with support from outside investors, spent $87 million developing the business and technology.

“A majority of it was my money,” he said.

Then the relationship began to unravel. In 2008, InfoSpan alleges in the lawsuit, the bank canceled a SpanCash demonstration at an industry trade show, started touting its own future mobile cash texting service and delayed payment on $2 million in invoices.

Then, at a meeting in May 2009, a bank attorney handed Scudder a letter stating the bank was terminating the agreement because “the system is nowhere near completion.” The bank demanded the return of $1.47 million it had paid InfoSpan at that point or it would file a criminal complaint, according to a copy of the letter.

The bank followed through on that threat.

On a Sunday morning later that month, Scudder was walking through Dubai International Airport to fly to Karachi to solidify digital-cash transfer arrangements with a major Pakistani bank. When he swiped his passport at an automated station, the doors did not open.

“Next thing I know there are two very large gentlemen in military uniform standing behind me,” Scudder recalled.

The officers, he said, showed him the complaint the bank had written and sent to the police alleging that Scudder and Bajwa had committed fraud.

“I was very, very upset,” Scudder said. “They handcuffed me, and they frog-marched me through two of the three terminals to a police station in Terminal 1.”

After a brief interrogation, he was driven to the downtown Dubai police station, handcuffed to a chair for two hours and questioned again. Then he was locked in a cell with 30 other men for 19 hours until he secured his release by surrendering his passport, according to Scudder, whose account is described in the lawsuit.

Over the next six months, Bajwa tried to resolve the situation but, according to the lawsuit, was told Scudder’s passport would be released only if InfoSpan gave up ownership and control of SpanCash to the bank.

“They wanted him to give up and go away,” Scudder said. “And they thought if they held me, he would sign over the company and technology to them.”

Six months later the bank withdrew the fraud accusations and Scudder got his passport back, freeing him to leave the country. But InfoSpan’s deal was dead.

“It’s like getting pushed off a cliff,” said Dan Johnson, an early investor in InfoSpan who became its head of sales. “There was no trying to work it out with us, saying, ‘You know, we feel like you’re charging too much’ or ‘You’re taking too big a piece of the pie.’”

With millions already sunk into the project, InfoSpan and its investors didn’t have the capital to strike another deal — if they even could, he said.

“When they pulled the plug and threw Larry in jail and made these charges against us, there wasn’t a bank out there that was going to do business with us,” Johnson said.

Nor would credit card companies like VISA and MasterCard, which Bajwa said had been considering InfoSpan to support their future digital-money transfer plans.

“If you have any problem with the law, nobody wants to come close to you,” Bajwa said.

In 2011, InfoSpan sued the bank in U.S. District Court for the Central District of California alleging the bank had misappropriated trade secrets for its own profit.

No one from the bank, or any representative, would speak on the record about this case. But in court papers replying to the lawsuit, the bank’s attorneys stated that InfoSpan had never completed a working prototype and that its “platform never functioned and was not market-ready.”

Bank attorneys pointed to a 2014 deposition of former InfoSpan employee Michael Miller. According to a transcript, Miller said he had never witnessed a successful demonstration of the stored value card and was unaware of any remittance ever sent between the Emirates bank and any other bank.

“As I became more involved in the project, I realized it was less likely to succeed,” Miller said. “I had deep concerns about the abilities of the platform to actually support the product.”

InfoSpan’s lawsuit claims that its technology was tested in the presence of bank personnel and shown to work multiple times in California and the Emirates.

Feldman, the Hastings College of the Law professor, said Bajwa does not have to prove the technology was market-ready to win damages.

“Something does not have to be completed to have value. Did the bank take something of value in a way that was inappropriate?” she said.

The bank filed a motion for summary judgment, which if granted would have torpedoed InfoSpan’s lawsuit. It stated that the bank had been independently developing online and mobile products before and after it signed an agreement with InfoSpan.

It asserted that the National Bank of Dubai, one banking of two banks that merged to form Emirates NBD in 2007, had started developing its own prepaid salary card as early as 2005, but it did not include the person-to-person remittance capability for the unbanked — a distinguishing feature of InfoSpan’s promised technology.

Last May, U.S. District Judge James Selna allowed most of the case to proceed.

In his opinion, Selna found that the “allegedly striking similarities between SpanCash and MeMobile,” a digital-cash product offered by Emirates Bank, and other evidence might lead a jury to reasonably conclude the bank had used InfoSpan’s trade secrets.

But the judge found no evidence that the bank used any trade secrets to develop another product called DirectRemit, which enables account holders today to send mobile-to-mobile digital cash from the Emirates to Pakistan, the Philippines, Sri Lanka and Egypt, according to the bank’s website.

Bajwa is certain that InfoSpan could have been a major player in low-cost mobile banking, a booming industry. Digital cash remittances now exceed $600 billion a year, with 73% of the cash sent to people in developing nations, according to the World Bank.

“My real high was to do something so I can be remembered — that I brought this technology, and I helped people,” Bajwa said. “Also this was a project where we were going to make billions of dollars.”

These days, Bajwa says he is working on other technology projects and is thankful he was able to hold onto the house where he and his wife raised two sons.

But the demise of InfoSpan and the subsequent legal battle depleted his savings and precipitated battles with depression and high blood pressure.

Perhaps the deepest blow, he believes, was to his reputation.

“I want them to make us whole,” Bajwa said, “They have taken my lifelong dream away.”

Phil Hirschkorn is a New York-based journalist. Follow him on Twitter: @PHirschkorn

ALSO

Uber conquered taxis. Now it’s going after everything else

Ellen Pao’s next act targets Silicon Valley’s diversity problem

Top Tribune Publishing shareholders at odds over sale to Gannett

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.