‘Honey, you’ve been scammed,’ she was told. She lost her home of 30 years.

Barbara Barkley is 4 feet, 10 inches tall. So she designed her home in Chesapeake, Va., just for herself, with all the counters and handles lowered.

People told her the changes would make the house harder to sell, but she didn’t care.

“I planned to live there until I died,” said Barkley, 68.

Instead, she is renting a place from a relative in North Carolina. She lost her house and her savings to a group of Southern California scam artists who stole $11 million from thousands of struggling homeowners looking for help with their mortgages.

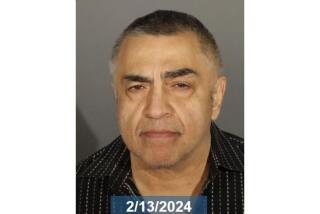

The ringleader, 42-year-old Sammy Araya of Santa Ana, was sentenced in federal court in Alexandria earlier this month to 20 years in prison. Eleven others got sentences ranging from five to 18 years.

While the court case is all but over, Barkley and other victims continue to deal with the fallout of a crime that destroyed them financially and often emotionally.

“I literally lost everything because of these people, and it’s breaking my heart,” said Barkley, a retired accountant. “I paid for it all myself, didn’t have a man to pay for it for me, and then some stranger gets to destroy it.”

The scam began in 2011 when Araya’s group started sending out mailers and put up Internet ads promising mortgage modifications under an Obama administration program meant to stem fallout from the housing crisis.

The program was real, but the offers were not. Homeowners were directed to send a cash “reinstatement” fee and then monthly “trial payments” for their new mortgage. The money, they were told, would go to the lender.

Instead, the conspirators pocketed the funds and ignored increasingly desperate calls from their customers. Barkley found out the truth when a man on a motorcycle came to paste a notice from her mortgage lender on the door warning of foreclosure. She called the company to tell it she had been sending her checks as required.

“I sent them the proof, and they said, ‘That’s not us,’” she recalled. “I called the [Federal Trade Commission] and they said, ‘Honey, you’ve been scammed.’”

Government representatives told her there was nothing they could do, and her lender wouldn’t work with her. She lost her custom-fit home of 30 years.

“He was targeting people who were first off incredibly vulnerable, and second, incredibly trusting,” Assistant U.S. Attorney Ryan Faulconer said at sentencing. The number of victims, he said, “wouldn’t fit in this courtroom or probably all of the courtrooms in this building . . . it’s staggering.”

The scam snared people across the country, although one co-conspirator said in an interview with investigators that Araya avoided California out of fear of then-Atty. Gen. Kamala D. Harris.

At least one couple got divorced from the stress of losing their home. One victim briefly was made homeless and had to put her daughter in a pediatric psychiatric unit to deal with the trauma.

Aaron Davis got pulled in as he was looking to reduce the payments on a home in Woodbridge, Va., he had been given by his ex-wife. She had been behind on the mortgage, and the basement had flooded. Davis, 64, had invested heavily in repairs. He too sent a “reinstatement fee” to the scammers and several monthly payments. They told him that he should file for bankruptcy and that the company would represent him in court. He paid to file the papers in Alexandria; they never showed.

The house is now gone, along with tools that were trapped inside when the bank seized it.

“I could’ve used that money,” he said. He and his ex-wife take care of a 28-year-old daughter with brain cancer.

If he ever gets paid back, Davis predicted, “I’ll probably be senile. I’ll think I won the lottery.”

Araya, meanwhile, lived the high life, according to testimony, frequenting strip clubs and throwing wild parties at a leased mansion in Orange County. YouTube videos from his attempt to launch an online reality TV show, “MakeItRain TV,” feature Araya showing off stacks of cash in the home’s refrigerator, luxury cars in the garage and an extensive sneaker collection in the master bedroom.

The show’s premise involved throwing wads of cash into crowds. In one episode, he performs a parody of Rebecca Black’s “Friday” called “Fly Day.”

Araya pitted teams of sellers against each other, offering Los Angeles Lakers tickets and fancy dinners to the most successful con artists. He demanded they all use aliases, and he himself deployed several names and fake accents.

When federal investigators started closing in, he repeatedly changed offices and business names, destroying computers along the way. One co-conspirator testified that Araya once used a federal complaint to roll a joint.

The scheme wound down in the summer of 2014 after search warrants were executed on connected businesses and homes. Araya allegedly went on to start another scam, fleecing several Texas businessmen out of hundreds of thousands of dollars with a fake oil investment opportunity, according to court filings.

Nine co-conspirators pleaded guilty in the mortgage scam case. Araya and two others were convicted at trial, while maintaining they were duped and wrongly blamed by the true perpetrators.

Prosecutors had wanted Araya in prison for life, warning that even as he faced trial he was working on his next scam. On the day his trial was supposed to start in February, he set up a GoFundMe page asking for donations to start a church.

In his new YouTube videos promoting the church he appeared clean-cut and serious, holding his young daughter. The revival, he said, would start the day after the trial ended.

The church slogan: “Give ‘til it hurts.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.