Third-quarter economic growth revised down slightly to 2% amid another tepid year of recovery

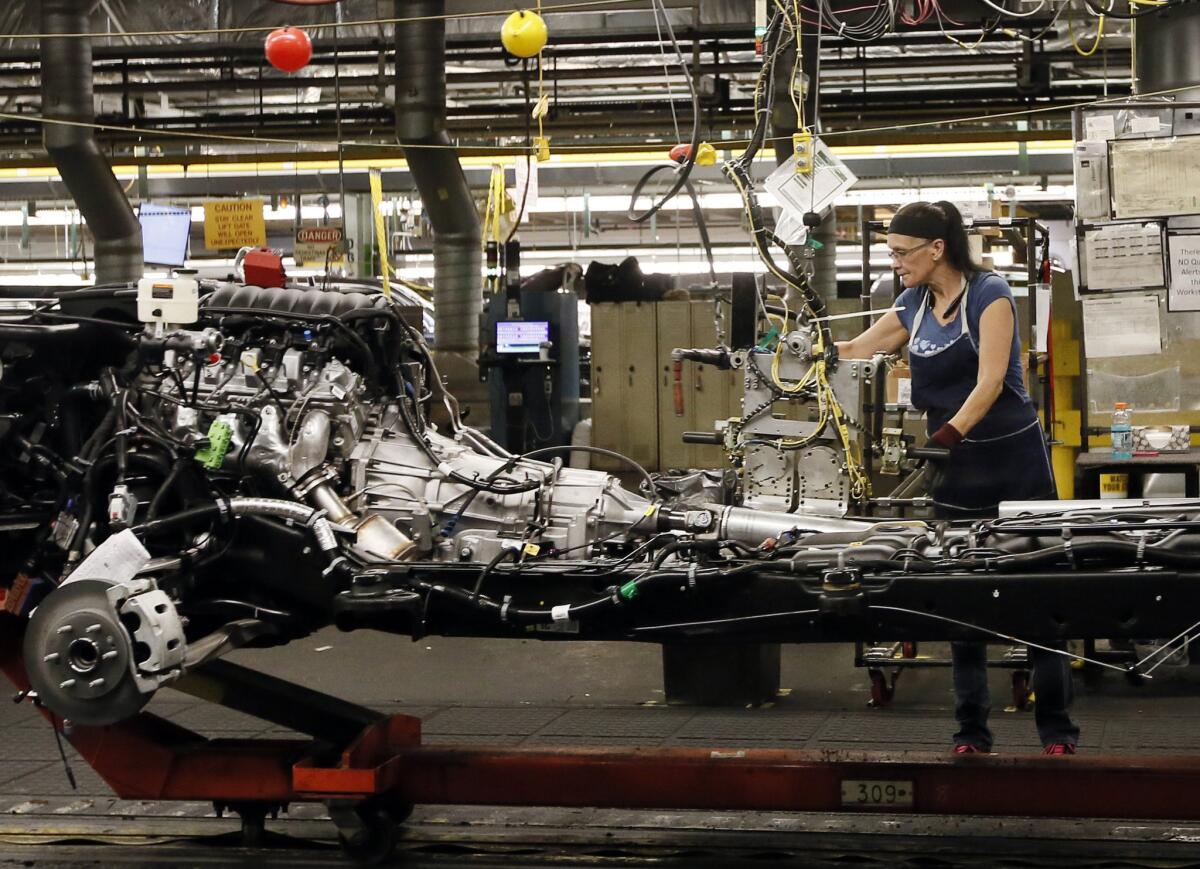

An employee works on the assembly line at the General Motors plant in Arlington, Texas, in July.

Reporting from Washington — The U.S. economy grew at a slightly slower pace in the third quarter than earlier estimated, putting the nation on track for another steady but tepid year of recovery from the Great Recession.

The Commerce Department reported Tuesday that total economic output, also known as gross domestic product, expanded at a 2% annual rate from July through September. The figure, in line with analyst expectations, was a 0.1% decline from an estimate last month.

The economy grew at a 3.9% annual rate from April through June.

But economists had forecast a steep drop-off for two reasons: Much of the second-quarter growth was catch-up after a sub-par winter, and the third quarter was weighed down by global economic troubles that roiled financial markets in August.

Tuesday’s report was the final read on third-quarter growth and was based on more complete data than the previous two Commerce Department estimates.

U.S. businesses sharply cut back on their inventories in the third quarter. The value of private inventories declined by $28 billion to $85.5 billion after increasing in the previous two quarters.

Because of the strong dollar, exports grew at just a 0.7% annual rate in the third quarter, well below the 5.1% growth the previous quarter.

A measure of business investment increased at a 2.6% annual rate in the third quarter, down from 4.1% the previous quarter.

Consumer spending was solid, expanding at a 3% annual rate. That was down from 3.6% in the previous quarter.

Consumer spending is “running fast and true” and helping boost overall economic growth, said Chris Rupkey, chief financial economist at Union Bank in New York.

Economists expect similar growth of about 2% in the fourth quarter, meaning the U.S. economy will produce another year below its historical norm.

Rupkey said 2% annual growth is “the new normal” and has been enough to fuel strong job growth in recent years.

Tuesday’s Commerce Department report validates the decision by Federal Reserve policymakers last week to raise a key short-term interest rate for the first time in nearly a decade, he said.

“The economy is better than you think,” Rupkey said.

Federal Reserve officials forecast the pace of growth to pick up next year, to 2.3%, despite the slightly higher interest rate.

The small hike in the benchmark federal funds rate, and a few more expected in 2016, could slow economic growth as the Fed tries to move toward a more normal interest rate environment after seven years of keeping the rate near zero.

Fed Chairwoman Janet L. Yellen has stressed that the interest rate, which is used to set the terms of many consumer and business loans, remains extremely low by historical standards and that monetary policy continues to provide a boost to the economy.

Follow @JimPuzzanghera on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.