Weinstein Co.’s future uncertain as Colony Capital deal falters

The future of Weinstein Co. has become bleaker now that the mini-studio has lost a key financial lifeline from a Los Angeles real estate billionaire.

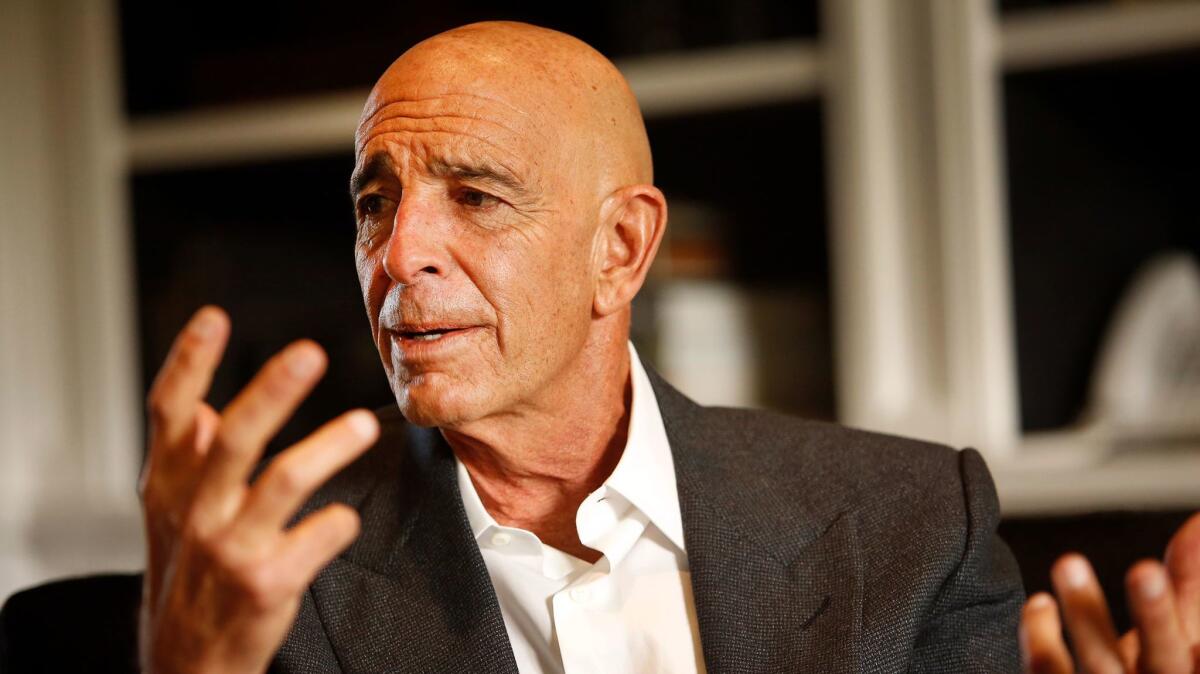

The decision by Thomas Barrack’s private equity firm Colony Capital to not supply the Harvey Weinstein-founded company with a much-needed capital infusion could hasten the company’s financial slide.

Colony may still buy all or part of Weinstein Co. But the loss of an immediate financial boost pushes the New York-based film and television company closer to bankruptcy reorganization, or a fire sale of assets, banking experts said.

“The future is muddled to bleak,” said Hal Vogel, a veteran media investor. “Essentially the problem is, you cannot produce new features without money.”

A further complication emerged Thursday when Harvey Weinstein sued his own company to obtain his email and personnel file, which he says will help defend himself against allegations of sexual abuse that led to his firing Oct. 8. The lawsuit could further delay a sale and slow the process of unwinding Weinstein’s 23% ownership in the company.

Colony was given a brief exclusive window to decide whether to buy all or some of Weinstein Co.’s assets. After that period expires next week, negotiations will be open to other bidders, under the terms of the deal.

Few, if any, investors want to do a deal that will help Weinstein financially — not even Barrack, who is negotiating to buy the firm.

“No one is interested in salvaging a company which would benefit Harvey,” the real estate tycoon said in a Wednesday interview on Bloomberg Television. In the interview he compared the studio to “a patient that’s dying on the table.”

People close to the studio said multiple parties have expressed interest. However, it’s unclear which companies would be willing to acquire a studio with such a tarnished reputation and troubled financial footing.

Traditional media companies including Santa Monica studio Lionsgate and talent firm Endeavor, which owns WME and IMG, have looked at the company and individual projects, but have opted not to buy, according to people familiar with the situation. Other logical bidders, including distributors STX Entertainment and the Orchard, are not interested, people close to the companies said.

“Nobody will touch this company with a 10-foot pole,” said Los Angeles investment banker Lloyd Greif, chief executive of Greif & Co. “Pretty soon it’s going to be on life support, and they’re going to have to make the decision of whether to pull the plug.”

Even if Colony decided to buy Weinstein Co., it probably would do so through a prepackaged bankruptcy, analysts said. One person close to the matter said Colony’s move to pull its financing could be a way to get Weinstein Co. to lower its purchase price.

Some film finance sources said they see value in certain assets of the company, including its film library and television business, which produces “Project Runway.” After all, the company produced major hits in its heyday, including “Silver Linings Playbook” and “Django Unchained.”

But one factor dissuading potential bidders is the liability they may inherit from an acquisition. This week, the New York attorney general’s office opened a civil rights investigation into the company and how it handled any allegations against its co-chairman. On Tuesday, an actress sued the company for millions of dollars, alleging executives were negligent.

The collapse of the Colony deal leaves Weinstein Co. in need of another financier, and some appear to be willing to swoop in.

New York fund manager Fortress Investment Group is already preparing a $35-million financing package to keep the studio afloat as it explores options, said a person familiar with the situation. A deal could close as soon as this week.

Fortress has experience dealing with distressed entertainment assets, including Michael Jackson’s Neverland Ranch. The hedge fund sold its loan on the pop star’s Los Olivos estate to Colony in 2008 when the property was on the verge of foreclosure.

Some financing sources speculated that another lender — such as Vine Alternative Investments or Falcon Investment Advisors — may consider providing emergency funding. Vine and Falcon bought a controlling stake in film financier and producer Village Roadshow earlier this year. Representatives of the companies did not respond to requests for comment.

Los Angeles-based private equity firm Gores Group, another usual suspect for distressed assets, is not interested, a person close to the company said.

There are other signs of financial strain at the company as it seeks a lifeboat.

Unless someone comes through with a cash infusion soon, upcoming releases including “Polaroid” will have to be delayed because the company won’t have the cash to promote the movies. Writers on some of the company’s upcoming projects said they had not been paid in recent weeks.

Filmmakers have been trying to sever ties with the studio. The producers of “Paddington 2” are hoping to find another distributor. On Wednesday, Weinstein Co. reached a deal with the filmmakers behind “Wind River” to scrub all mention of the stained distributor from the movie’s home video and streaming releases, as well as awards campaigns. Amazon has cut ties with Weinstein Co., ending a high-profile TV project with Oscar-nominated David O. Russell, while Apple scrapped a planned series about Elvis Presley.

Without the ability to release movies or attract talent, it’s hard to see a path forward for the company, Vogel said.

“They have fallen into this financial prison that is hard to escape,” he said.

UPDATES:

5:05 p.m.: This article was updated with information about potential bidders.

6:50 a.m.: This article was updated with information about Fortress Investment Group.

This article was originally published 5:55 p.m. on Oct. 25.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.