TV antennas are making a comeback in the age of digital streaming

Karl Rudnick, a retired 69-year-old mathematician who lives in Solana Beach, Calif., recently bought a second home outside Minneapolis to be close to family members. He did not have to draw on his knowledge of advanced calculus to reject the idea of paying for two cable TV subscriptions.

“I talked to the cable companies and asked if there was a way to have one account,” Rudnick said. “There wasn’t, and all of a sudden I was looking at spending $300 a month just to have internet and TV.”

After doing some research, Rudnick decided on a throwback solution to bring down his monthly outlay without giving up the TV programming he liked. He purchased two TV antennas for about $80 each. He installed one in the attic of each house, giving him access to ABC, CBS, NBC, Fox, PBS and dozens of other broadcast channels for free. At his West Coast home, he was able to connect the antenna to the cable company’s coaxial wires.

The TV antenna is a piece of 20th century technology that evokes memories of rabbit ears placed atop the mahogany cabinet of the old Zenith in your grandparents’ living room. But Rudnick is among a growing number of consumers who are turning to over-the-air digital antennas — a one-time investment of as little as $20 — as a way to slash their monthly video subscription costs.

Research firms and electronics manufacturers say cord-cutting consumers such as Rudnick have driven up TV antenna sales and usage in recent years. These “value-conscious streamers,” as they are known in the industry, are willing to cobble together a mosaic of video sources to replace the traditional pay TV bundle, which now costs an average of $107 a month, according to a recent study by the Leichtman Research Group.

This year, 8.1 million over-the-air TV antennas will be delivered to retailers in the U.S., up 2% from last year and 8% over 2016.

This year, 8.1 million over-the-air TV antennas will be delivered to retailers in the U.S., up 2% from last year and 8% over 2016, according to the Consumer Technology Assn.

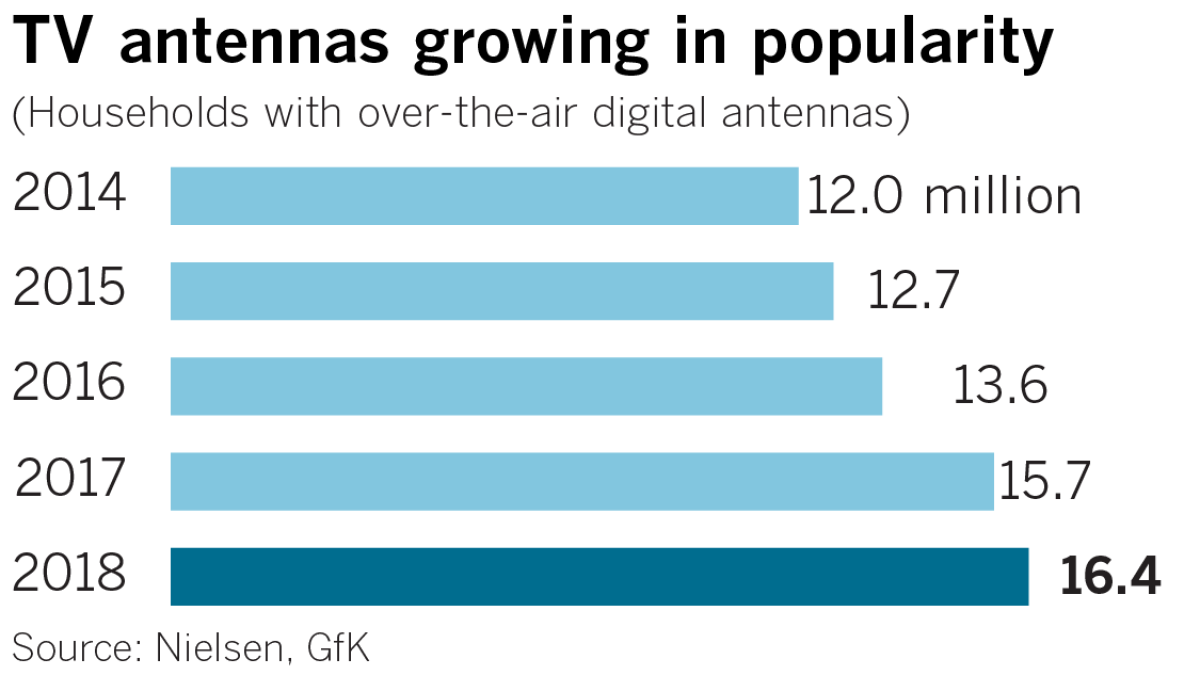

Nielsen estimates that 13.8% of U.S. homes depend on antennas to get their TV, up from 10.3% in 2014. Research firm GfK North America puts the number of over-the-air TV homes at 16.4 million.

The rapid acceleration of cord-cutting has put heavy pressure on the cable industry and media companies that own pay TV channels that depend on the steady revenue stream that subscribers provide. The number of consumers who’ve canceled traditional pay TV service is expected to climb 33% to nearly 25 million this year, according to estimates from research firm eMarketer.

Though worrisome for Hollywood, the trend has been a boon to antenna manufacturers like Channel Master. Although it does not disclose sale figures, the Chandler, Ariz.-based manufacturer has recently doubled the size of its facilities to meet demand for its products, said Joe Bingochea, the company’s president.

“The market is primed right now,” he said. “We’re trying to capitalize on it as much as we can.”

Bingochea said the average age of his customers is about 50. Many of them grew up in homes with antennas from Channel Master, one of the oldest active brand names in the consumer electronics business.

Joseph Resnick, a former merchant marine radio operator, started the company in 1949 with the $7,000 he made from selling his family’s cabbage farm in Ellenville, N.Y. — a time when fewer than a million U.S. households had television sets.

Within five years, Channel Master was selling $12 million worth of antennas as TV ownership exploded. The company was the largest seller of indoor antennas throughout the 1950s and ’60s with sleek midcentury designs and Space Age model names such as the Canaveral.

The market plummeted in the mid-1980s as consumers moved to cable and satellite to get better picture quality and then-new channels such as HBO, MTV and ESPN. This hurt Channel Master, which went through several ownership changes and a bankruptcy in the decades that followed.

But the brand name is still recognizable to older consumers, which prompted a group of private investors to acquire the company in 2012 and focus on the emerging cord-cutting market.

Channel Master offers a DVR designed to work with over-the-air antennas, as cord-cutters don’t want to give up the convenience of watching programs on their own schedule and skipping through commercials. The products also enable consumers to stream over-the-air signals to other internet-connected TV sets and digital devices in the home.

Other technology companies are courting the over-the-air users as well. This fall, Amazon rolled out the Fire TV Recast, a new version of its streaming media device that records broadcast shows when connected to an antenna. Sling Media also entered the market with an antenna-connected recorder called AirTV, and TiVo launched the Bolt OTA.

Companies targeting over-the-air viewers say the bulk of their customers are baby boomers and Gen Xers who grew up with traditional television and a cable box. Their rediscovery of free TV is largely through word of mouth, said Grant Hall, chief executive for Nuvyyo, a Canadian firm that makes Tablo, a digital video recorder for over-the-air TV antenna users.

“Typically they will go to a party and start complaining about their Comcast bill and how it’s gone up so high and getting ridiculous, and someone will say, ‘Hey, I cut the cord and I’ve got an antenna now, and I can get all these channels over the air,’” Hall said. “Most people have forgotten about over-the-air TV entirely or recall it as poor experience with ghosts and pictures fading in and out.”

But the quality of over-the-air broadcasting improved dramatically in 2009 when TV stations made a government-mandated switch to high-definition digital transmissions, offering higher-resolution images and more channels.

“Once viewers learn everything is different now and the picture is actually better than cable and satellite — and best of all it’s free — they become converts,” Hall said. He declined to disclose sales figures but said his company’s growth rate has been in line with the popularity of streaming.

The Consumer Technology Assn. has estimated that consumers will spend $13.4 billion on streaming video subscription services in 2018, a 42% increase over last year.

Rudnick’s over-the-air TV viewing supplements the programming he watches through streaming. He uses his broadband internet connections (around $60 a month for each home) for online services such Netflix and Amazon Prime Video. Until recently, he also subscribed to Sling TV’s streaming video service so he could watch pay channels such as ESPN, the NBC Sports Network, Fox Sports and the Golf Channel (he’s switched to YouTube TV). He also has a Channel Master DVR to record over-the-air shows.

The way I stay plugged into this is through talking to young people. I don’t know anyone under 35 who pays for a cable TV subscription.

— Karl Rudnick

“My yoga instructor’s husband turned me on to Sling TV, and they switched over to YouTube TV,” Rudnick said. “The way I stay plugged into this is through talking to young people. I don’t know anyone under 35 who pays for a cable TV subscription.”

One industry that is not aggressively promoting this trend is the TV station business, even though broadcasters have been losing audiences to streaming competitors like Netflix. Station ownership groups and the media conglomerates get a cut of pay TV subscriber fees, giving them little incentive to promote over-the-air antenna use.

Consumers largely have to depend on manufacturer websites or blogs such as Cordcutters.com to learn which channels are available over the air in their area and which antenna is right for them.

“We do a terrible job of explaining that your local stations are available over the air for free,” said Neal Sabin, vice chairman of Weigel Broadcasting, a Chicago-based TV station group. “Part of the reason is it’s a double-edged sword. Every time someone cuts the cord and puts up an antenna, it’s lost revenue for us and the cable company.”

Though antennas are enjoying a comeback, analysts do not see over-the-air becoming a preferred option in the new TV landscape. Millennials have not taken to the old-school technology as they are content to stream video on their digital devices.

“They are digital natives,” said Steve Koenig, vice president of research for the Consumer Technology Assn. “People lead increasingly itinerant lifestyles and they expect access to video content wherever they are on whatever device they have in front of them. With over-the-air, you are pretty much sitting on the couch in front of your TV.”

There are also limitations to what broadcast TV offers. Major sports teams have most of their games committed to regional sports channels still dependent on the hefty revenue they receive from cable providers. Rabid local fans of the New York Yankees or the Los Angeles Lakers need a subscription to catch every game.

Billy Nayden, an analyst for the research firm Parks Associates, said the TV antenna resurgence is a byproduct of consumers feeling overwhelmed by the many viewing platforms available. Some are even suffering from what he calls “subscriber fatigue.”

“I can’t tell you how many people that we know in everyday life who ask, ‘You’re in this industry — how do I cut the cord?’” Nayden said. “Interestingly it’s not an easy answer. ‘Do you watch live TV? Do you care about news? Do you care about sports?’ There is no one clean answer for everyone. It’s a bit of a mix, and antennas are a part of that.”

Rudnick acknowledges there is some inconvenience that comes with using an antenna in combination with other devices to replace the cable box. “My wife became frustrated with it,” he said. “We went out and got a really good universal remote.”

Twitter: @SteveBattaglio

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.