Disney raises the bar for CEO’s stock bonus in response to shareholders

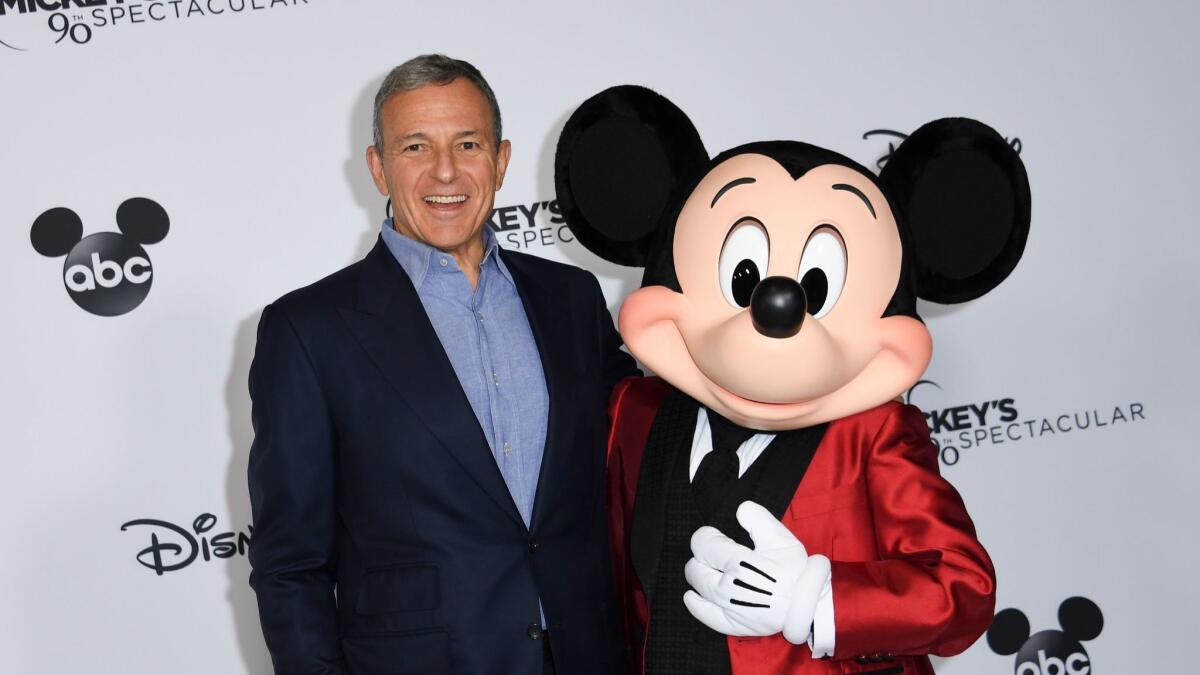

Walt Disney Co. just raised the bar for Chairman and Chief Executive Bob Iger to earn his big pay day.

Disney on Monday said it had made an agreement with Iger, 67, to change his stock-based compensation to more closely reflect the success of the Burbank media giant’s share price following its acquisition of much of 21st Century Fox Inc.

Iger last December extended his contract to 2021 to oversee the company after its $71.3-billion deal to absorb a big chunk of Rupert Murdoch’s entertainment empire, which is expected to close next year. Under terms of the contract, he is eligible to receive more than $100 million in stock units, depending on the company’s share price.

But according to the new terms, Iger will earn the full 937,599 target number of shares only if the company outperforms the bottom 65% of the firms on the Standard & Poor’s 500 stock index, Disney said in a regulatory filing. That’s up from the previous goal, which would have given Iger the full amount if the company did better than half the companies on the S&P 500.

The deal comes after the company received blowback from shareholders over compensation earlier this year. In March, a majority of shareholders voted against Disney’s compensation plan in a non-binding rebuke of the firm. Disney paid Iger $36.3 million in total compensation in fiscal 2017.

Disney’s executive pay plan was opposed by 52% of shareholders, with 44% in favor and 4% abstaining. Some proxy advisors had urged investors to vote against Disney’s executive pay plan, saying it was not sufficiently aligned with Disney’s performance.

Disney said the company and Iger reached the agreement in response to feedback from shareholders.

“The amendments to Mr. Iger’s contract establish more rigorous performance requirements for his equity award than those reflected in the original contract, further aligning Mr. Iger’s compensation with shareholder value creation,” Disney said in a statement.

The new pay agreement comes at a time of increasingly high stakes for the company, which must figure out how to integrate Fox’s entertainment assets — including its movie and TV studios, and cable networks such as FX and National Geographic — into its own business.

Disney is also placing a big bet on its upcoming subscription streaming service, dubbed Disney+, which is expected to include original content from Disney-owned studios including Lucasfilm, Marvel Studios, Pixar and Walt Disney Animation Studios. The company is also expected to invest in programming for Hulu, of which it will own 60% after the Fox deal closes.

All that increases the challenges for Disney and Iger, who is looking to establish his legacy by positioning Disney to thrive in an era of greater competition from tech companies including Netflix and Apple.

In addition to establishing the higher stock price target, Iger’s new deal makes it so he will receive fewer shares than under the previous plan if Disney’s shares do not meet certain performance levels.

For example, Iger will receive no shares if the company only outperforms the bottom 25% of the S&P 500, whereas he would have earned 343,949 shares under the previous contract terms. At the 50th percentile, he’ll take home 585,999 units, compared to 687,898 shares previously.

There’s also a serious incentive to significantly outperform the market. If Disney hits the 75th percentile, Iger will earn 125% of the targeted number of shares.

Disney’s stock price was little changed in midday trading on Wall Street, hovering at $115.15 a share on Monday. The company has delivered total shareholder return of 477% since Iger took over as chief executive in 2005, driven largely by successful acquisitions of companies such as Marvel Entertainment, Pixar Animation Studios and Lucasfilm.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.