Column: A cowed IRS gives a green light to more secret money in politics

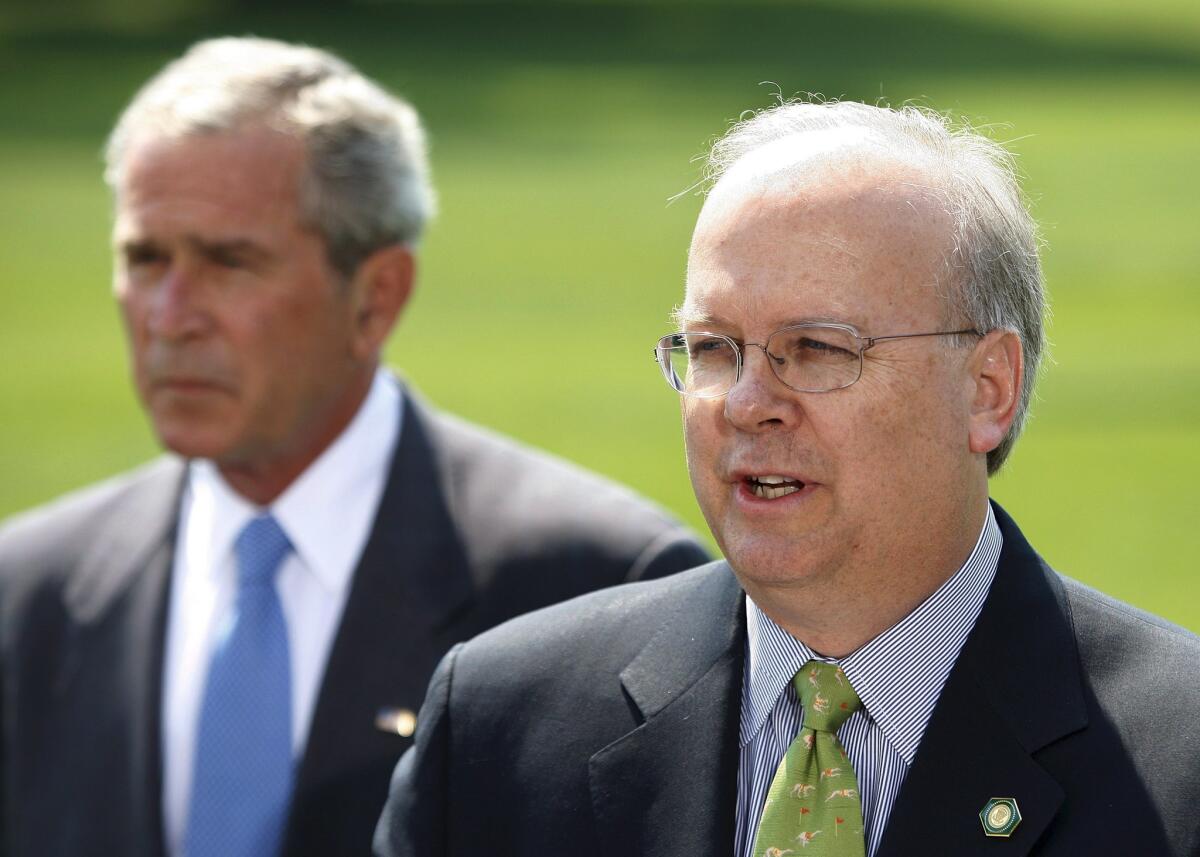

Master of social welfare: Karl Rove (R), seen here with his protege President George W. Bush in 2007. Rove’s political campaign group recently earned a tax exemption from the IRS.

In one of the more craven and inexplicable government rulings of recent years, the Internal Revenue Service has decided that Karl Rove’s Crossroads GPS political fundraising organization is a “social welfare” group mostly operating outside of politics.

The ruling allows Crossroads GPS, like the other 501(c)4 nonprofit organizations whose ranks it has now joined, to keep its donors secret. We can’t put the consequences more succinctly than Rick Hasen, the election-law expert at UC Irvine, who wrote on The Times’ op-ed page Thursday: “Finding out which plutocrats, corporations and interest groups are bankrolling American elections is only going to get harder.”

Finding out which plutocrats, corporations and interest groups are bankrolling American elections is only going to get harder.

— Election law expert Richard L. Hasen of UC Irvine

Hasen called the IRS ruling “a decision that will hurt our democracy.” He might have said that it’s not our democracy any longer. It belongs to Rove and his (secret) donors from the ranks of the affluent.

The IRS actually certified Crossroads GPS as a tax-exempt 501(c)4 organization back in November, but kept its decision quiet, like a 6-year-old forgetting to tell mom and dad that he’s smashed their precious vase. It was discovered and revealed Tuesday by the Center for Responsive Politics, which observed that the ruling gives “an air of legitimacy to the more than $330 million that Crossroads GPS has raised and spent over the years, most of it on election-related ads and candidate support.”

We’ve been tracking the exploitation of 501(c)4 groups since 2012, so a recap is in order. The story encompasses years of IRS tolerance of flagrant lawbreaking by politically-motivated non-profits and the ginned-up IRS “scandal” of 2013. The drive to give these groups a pass on illicit political spending even infected the December 2015 federal budget deal, into which lawmakers slipped a provision forbidding the IRS to clarify the rules.

No wonder that the agency was so cowed that it treated Rove’s fund-raising machine as the equivalent of a community theater group.

You can think of the C4 loophole as an analogue to the infamous 2010 Supreme Court Citizen United ruling, which took the leash off campaign spending by corporations; it’s just another route for the wealthy to get their way in elections. The more they can do so, the less likely reform will become.

By law, 501(c)4 groups--the title denotes a section of the tax code--are supposed to devote themselves exclusively to “social welfare” purposes, which the IRS traditionally defined as education and activism related to the common good and civic betterment. The exemplary C4 is a volunteer fire department or homeowners association.

C4’s aren’t supposed to get directly involved with election campaigns or electioneer for candidates. But they’re also allowed to keep their donors confidential. So it was only a matter of time before political strategists, who also wish to keep their donors confidential, found ways to stretch the rules. under pressure, the IRS eventually agreed that if a C4 devoted at least 51% of its spending to social welfare, the rest was wide open.

For Crossroads and other such groups, that wasn’t good enough. They pressured the IRS to redefine political spending as social welfare spending, in its way. That yielded the Alice-in-Wonderland ruling on Crossroads GPS.

As the Center for Responsive Politics has documented, Crossroads GPS lawyers applied relentless pressure on the IRS. The agency at first dismissed the organization’s “social welfare” claim.

“The agency pointed out that all but one of the group’s television ads ran within an 11-week pre-election window in 2010,” CRP relates. “GPS claimed that some of those ads were educational, encouraging support for a particular bill in Congress — but the IRS said the spots were ‘focused on criticizing the identified candidate and provided no information about the legislation other than the bill number, which was provided as text (but not in audio) at the very end of the advertisement.’” The IRS found only one ad that year that could be viewed as permissible “issue advocacy” rather than impermissible politics, and it only accounted for 2% of GPS spending that year.

But GPS insisted that the IRS judgments were merely subjective. There were no bright lines, no solid metrics, so who was to say what was or wasn’t “social Welfare” advocacy?

Indeed, that’s a known flaw in an IRS policy that relies on find judgments about the nature of politics and sets an arbitrary 51% threshold. Many in the IRS undoubtedly would prefer to have hard-and-fast rules to avoid such protracted debates. But Congress, whose members on both sides of the aisle benefit from C4 donations, prefers to leave them murky.

Any inclination the IRS might have had to enforce the rules it had was destroyed by the 2013 “scandal,” which erupted after conservative C4s complained that they had been singled out for IRS scrutiny. Cue Rep. Darrell Issa, R-Vista, who launched an investigation aimed at proving that the agency used an ideological test to examine C4 applications. As it turned out, that was completely untrue: the applications for tax-exempt status of only 10 C4s were rejected by the IRS between 2010 and 2014. They included six groups that trained Democratic women in how to run for office, and a seventh that politicked on behalf of former Sen. Blanche Lincoln, D-Ark.

The harvest of all this is the IRS ruling on Crossroads GPS and its $330 million in mostly political spending over the years. Groups on both the right and left, supporting Republicans and Democrats, have exploited the C4 loophole, but conservative groups handily outraise progressive groups, and over the last three election cycles Crossroads GPS has consistently topped them all. The figures for the current cycle culminating in November’s election are just beginning to come in, but it’s a safe bet that Crossroads will be at or near the top of the heap again.

Hasen predicted in his Times op-ed that the latest IRS ruling “is likely to open the door to more shadow super PACs set up as nondisclosing social welfare groups.” Corporations were still shy about making political donations in the open, but the IRS has given a green light to doing so in secret, via a C4. The Securities and Exchange Commission has been working on a rule requiring public disclosure of corporate political donations, but the same budget bill that hogtied the IRS on C4 regulations also barred the SEC from finalizing or implementing any such rule.

Hasen notes that these problems can be fixed by a law forcing all political contributions to be disclosed, no matter how and to whom they’re made. But he’s toying with us: Congress doesn’t have any inclination to cut off its own money spigots that way. And as the torrent of money in politics gets bigger, the chances of electing anyone who sees things differently get much, much smaller.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see our Facebook page, or email [email protected].

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.