Column: Tesla hype watch: You know the Model 3 doesn’t exist yet, right?

With his bravura introduction of the Tesla Motors Model 3 on Thursday, company founder Elon Musk cemented his reputation as the business world's most outstanding showman since Steve Jobs.

Musk had auto industry experts, investment analysts and would-be buyers of the ostensibly mass-market $35,000 electric vehicle slavering over the car's design and specs — and the company's future —in part by announcing that as of Friday, at least 180,000 potential customers already had plunked down deposits of $1,000 each to reserve the car.

Tesla shares, which may rank as Musk's most creative product, opened Friday at $244.82, up 6.5% from Thursday's close (though it had given up about half of that gain by midday). Friday's action followed a mind-bending 60% run-up dating back to Feb. 10, when Tesla posted a disappointing loss but Musk somehow charmed investors into accepting his promise of profits to come soon and his optimism about the coming unveiling of the Model 3.

They should all take a deep breath.

Tesla unveils the Model 3, and the world will never be the same.

— Brad Reed, BGR.com

First of all, the Model 3 doesn't exist yet, neither in a final production version or actually in production. Nor will it be reaching the road any time soon. During the introductory event Thursday, Musk said he felt "fairly confident" that deliveries would start by the end of 2017. But no guarantees.

If the Model 3 misses its deadline, it wouldn't be the first Tesla product to do so. As my colleague Charles Fleming has reported, "Tesla's exotic 'falcon wing' Model X had production difficulties that delayed its delivery more than 18 months."

That was an $80,000 car on a limited production schedule; the Model 3 is pitched as a mass-market car helping to fulfill the company's production goal of 500,000 vehicles per year by 2020.

The Model 3 embodies Tesla's greatest potential, and also a mortal risk.

Nevertheless, Tesla admirers were quick to proclaim the Model 3 a triumph. "The world will never be the same," declared technology blog BGR.com. Even staid Bloomberg concluded that "Tesla's Model 3 lives up to the hype." Perhaps the most wildly optimistic judgment came from venture investor David Pakman of Venrock, who calculated in a tweet Friday that based on 200,000 pre-orders, if 70% actually buy the car, Tesla "sold $4.9B of cars in the last 24 hours."

Well, no. Those $1,000 deposits are refundable at the customer's demand at any time before the cars actually go into production. They're not sales by any stretch of the imagination, just refundable reservation fees. If anything, they're callable-on-demand interest-free loans, which is how Tesla books such arrangements in its financial reports, under "liabilities."

There are lots of other under-appreciated issues swirling around Tesla in general and the Model 3 in particular. Here's a rundown of some of the most important.

1. Musk's claims about the Model 3's performance and specification may be merely aspirational. The entrepreneur says the Model 3 will have an EPA-rated range of 215 miles on a charge, will go from 0-60 mph in a snappy less than six seconds ("We don't make slow cars," Musk told his invitation-only audience), will come with autopilot and quick-charging capabilities as standard equipment and will seat five people comfortably.

Many observers accepted these as established specifications, but of course the car is still in development, which means they may be goals, not achievements. The production model may fall short or, if Musk insists on the plans being met, get delayed until they can be.

Join the conversation on Facebook >>

2. Previous Tesla models have been plagued with quality problems. Auto aficionados were swept away by the Model 3 prototypes' styling, but there have been gaps — gulfs, even — between the design and styles of Tesla's previous production cars and their ability to hold together in the real world.

Consumer Reports stated last year that the company's $70,000 Model S was showing "a worse-than-average overall problem rate," and identified the main problem areas as its "drivetrain, power equipment, charging equipment, giant iPad-like center console, and body and sunroof squeaks, rattles, and leaks." Some features even got worse in the 2015 model compared to 2014, including "the climate control, steering, and suspension systems." The publication noted that "complaints about the drive system have also increased as the cars have aged — specifically for the 2013 model, which was the car’s first full model year."

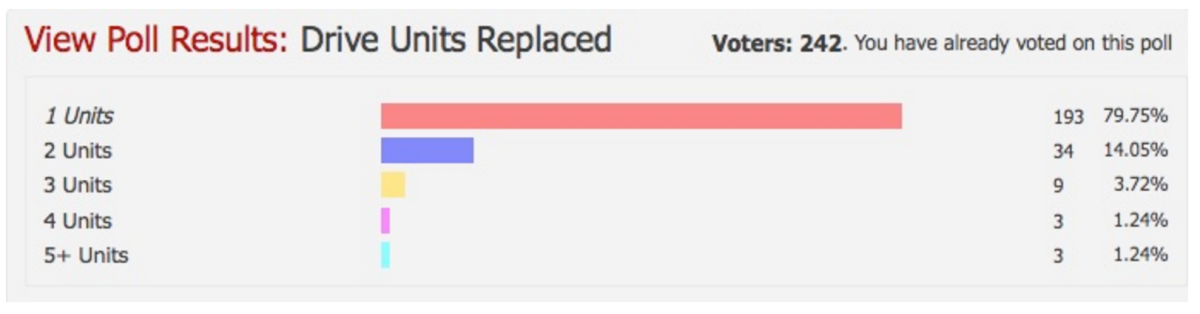

Complaints about the vehicle's drive units have become legion; the Teslarati fan website in November reported a poll showing that of Model S owners who had their drive units replaced — in many cases because of proactive action by the manufacturer — 20% required multiple replacements. Edmunds.com wrapped up its experience with these ailments in a 2014 road report.

3. Customers may not be eligible for tax credits. Among the forces behind the acceptance of electric cars are government credits, including an IRS credit of up to $7,500 for Tesla vehicles such as the Model 3. The problem is that those credits start to disappear once a manufacturer has delivered 200,000 electric vehicles. That may well happen before the first Model 3's are placed in customers' hands; given Tesla's production forecasts for its Model X and Model S luxury cars, it's almost certain to happen very soon after Model 3 deliveries start. So calculations that the real list price of the new car is a competitive $27,500 rather than $35,000 may be way off.

That's important because ...

4. Competing all-electric vehicles will be reaching the market before the Model 3. Musk and his Tesla evangelism deserve some credit for promoting the electric car as a potential set of wheels for mainstream buyers. But this was more relevant years ago, before legacy American carmakers caught the EV bug. GM, for instance, is poised to start delivering its all-electric Chevy Bolt by the end of this year, with a rated range of more than 200 miles. The Bolt will list at $30,000 after the tax credit, which makes it look a tad more expensive than the Model 3. But according to GM, it will be on the market at least a year earlier.

5. Tesla's financial health is questionable. The biggest single question about the Model 3 is whether its manufacturer will last long enough to get the car to market?

In strictly financial terms, Tesla Motors operates on the dollar equivalent of fumes. Its last quarterly report, released Feb. 10 for the three months ended Dec. 31, marked its eleventh straight quarter of losses, and widening losses at that. Investors had been expecting, finally, a profitable quarter. Nevertheless, they bid up the stock the next day, based largely on Musk's infectious optimism. The extent to which Tesla's stock price rides on faith in Musk's vision and operational skills rather than on profit-and-loss statements can be seen from its extraordinarily volatile stock chart.

A hard look at Tesla's underlying financials shows the company to be an investment only for those with strong stomachs. According to its annual report, Tesla roared through its cash last year to the tune of more than $700 million, leaving it with less than $1.2 billion cash on hand when Musk was projecting $1.5 billion in capital expenditures on the horizon.

As is shown by the analysts' face-off above, broadcast by CNBC on March 28, anyone expecting Tesla to survive must place great faith in its ability to ramp up production of the Model 3 without cannibalizing sales and leases of its more expensive luxury models. Analyst Colin Langan of UBS, a Tesla bear, argues that the run-up in shares since early February encompassed "a lot of bullish expectations for the Model 3 that I don't know the stock will live up to." (His price target is $120, a roughly 50% drop from here.)

Musk's production forecast, he notes, implies a pace that would put Tesla on the same level as BMW and Mercedes. "That's a pretty high bar for them to reach, and meanwhile there's a lot of competition."

See the most-read stories this hour >>

It's plain that Tesla will have to dredge up new financing sometime soon. If its shares remain at their current lofty valuation, the company would have an easier time floating a new stock offering to raise money. But Tesla is perched on a tightrope. If something goes wrong — whether a production pothole or a sudden cooling of investor faith in Musk's story —the company doesn't have much of a financial cushion.

Still, what's clear from the carnival-level excitement generated by the unveiling of the Model 3 this week is that Tesla hype is a potent force. It may not matter that the product causing all the excitement is, at this moment, largely virtual. As Edward Niedermeyer of the Daily Beast observes: "Of course, nobody lines up to buy any product they’ve never seen before out of pure reason."

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik's blog.

MORE ON TESLA

With Model 3, it's make or break for Tesla

Tesla Model 3 pre-orders hit 180,000 as Elon Musk wows fans

Tesla stock surges on Model 3 unveiling but U.S. stocks mostly lower

UPDATES:

12:05 p.m.: This post has been updated to clarify the results of a poll of Tesla owners on drive unit replacements.