Column: A good idea from President Trump: Scrapping the debt ceiling

President Trump appears to have signed on to a very good idea: scrapping the debt ceiling.

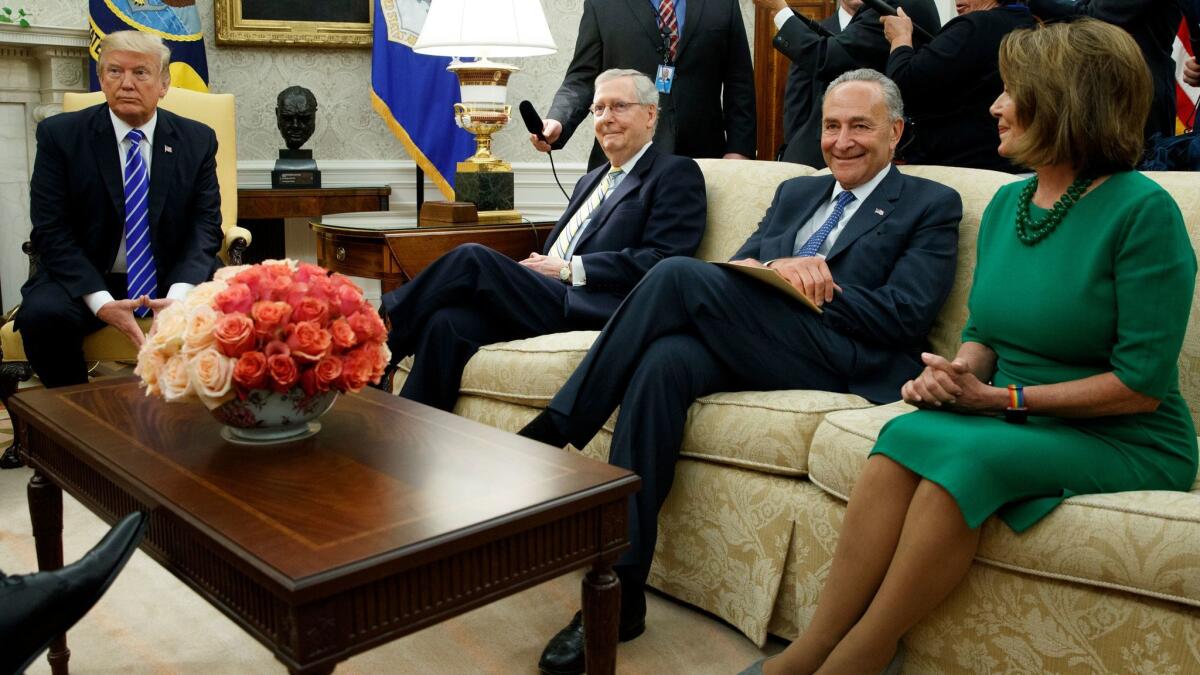

It may be unwise or premature to make too much of this, such as by heralding it as a dramatic change in approach at the White House, but numerous reports out of Washington say that during his meeting with Democratic leaders on Wednesday, Trump agreed to work toward a plan to permanently end the need for repeated votes to raise the ceiling. The century-old rule requires congressional approval to increase the government’s right to borrow money.

For most of that time the votes were routine, but in recent decades the rule has become entangled in ideological battles. On these occasions economic calamity beckons, because a failure to increase the limit when government obligations fall due threatens default, something the U.S. government has never done.

For many years people have been talking about getting rid of the debt ceiling altogether .... There are lots of good reasons to do that.

— President Trump

At the Wednesday meeting, it will be recalled, Trump pulled the carpet out from under his Republican colleagues by agreeing with Democrats to rise the debt ceiling enough to fund government borrowing through mid-December while providing an initial tranche of emergency aid for victims of Hurricane Harvey.

The move exasperated congressional Republicans no end. They had been hoping for a longer-term increase in the debt ceiling, with the goal of deferring another vote until after next year’s elections, while extracting more concessions from Democrats on government spending reductions. But it appeared to please Treasury Secretary Steven T. Mnuchin, who had been pressing for a “clean” debt ceiling increase — that is, one without politically contentious spending riders — by the end of this month.

Trump’s agreement with the Democrats only intensifies pressure on the GOP. They’ll have to deal with another debt ceiling vote at the end of the year, with the threat of a government shutdown looming if Republican leaders can’t get their extreme right wing on board to kick the can down the road again. The longer the contretemps lasts, the worse the GOP will look to voters at a time when the nation is beginning to turn its attention to the 2018 election. This is how playing politics with economic stability can bite you where it can really hurt.

At the Wednesday meeting and again in a session with his Cabinet on Thursday, Trump went further than his agreement with the Democrats. “For many years people have been talking about getting rid of the debt ceiling altogether,” he told reporters after the Cabinet meeting. “There are lots of good reasons to do that.”

Indeed there are, and we’ve reported on them for many years, including in 2011, in 2015, and again earlier this summer.

First and foremost, it’s unnecessary. The debt ceiling was crafted in 1917 to give the Treasury more authority to issue debt, not less. Before then, Congress had to vote on every proposed bond issue, which was a pain. So it gave the Treasury blanket authority, up to a point.

The idea that the limit imposes fiscal discipline on Congress is just silly. Raising the debt limit merely authorizes borrowing for debts Congress implicitly has incurred by voting to spend more than it provides for via taxes. “There’s no reason for the debt ceiling to exist as a concept,” USC tax and budget expert Ed Kleinbard told me last month. “The need to borrow follows inexorably from the spending and taxing path Congress puts us on.”

Nevertheless, the notion that the debt ceiling acts as a brake on congressional spending lives on. Just this week, House Speaker Paul D. Ryan (R-Wis.) rejected the idea of eliminating the debt ceiling. “There’s a legitimate rule for the power of the purse in Article 1 powers,” he said, “and that’s something we defend here in Congress.” No one is talking about taking away the power of the purse vested in the House — just taking access to dynamite away from lawmakers who shouldn’t be trusted with a pop gun.

That brings us to Point 2: The consequences of breaching the limit would be economically dire. It’s fashionable among ostensibly fiscal conservatives that this would be no big deal; they’re wrong.

As listed by then-Treasury Secretary Jack Lew in 2013, the consequences of wrecking the government’s unblemished record of paying its debts would include an immediate increase in the government’s borrowing costs and a plunge in the value of government securities held by individuals, pension funds and other countries. Issuance of Social Security checks, Medicare reimbursements to doctors and hospitals, paychecks to military families and vendors would be halted or cut.

Even the steps needed to defer a breach can be costly. When the nation scraped up against the debt limit for three months in 2003, the government staved off default through the early redemption of bonds owned by a civil service retirement fund. That cost the fund and its beneficiaries more than $1 billion in lost interest, the Government Accountability Office determined.

Then there’s the cost of the half-baked fiscal maneuvers often undertaken to satisfy debt-ceiling hard-liners. These include the egregious sequester, which was enacted to resolve a 2011 debt-limit standoff. The sequester was supposed to be so draconian that Congress would negotiate a budget to keep it from happening; congressional ineptitude got in the way, the sequester went into effect, and the result was the systematic impoverishment of a host of government programs, with the damage largely visited on moderate- and low-income Americans.

With the dysfunction meter on Capitol Hill and at the White House pegging out at the maximum this year, economists and fiscal experts were really sweating out the nearing of the brink. Republican conservatives seemed to be more cavalier than ever about defaulting on government debt, and the ability of adults in the White House and the halls of Congress to rein them in more doubtful than ever. Some advocates of breaching the limit were known to haunt the White House corridors, such as Budget Director Mick Mulvaney, who as a congressman from South Carolina had taken a hard line against raising the debt ceiling.

And then Trump, House Minority Leader Nancy Pelosi (D-San Francisco) and Senate Minority Leader Charles E. Schumer (D-N.Y.) pulled a rabbit out of the hat — or more precisely, pulled it out of a boiling cauldron. Whether Trump will follow through on his interest in ending the debt ceiling charade is impossible to gauge. But it would be churlish under the circumstances to reflect that his attention span isn’t long and that his explicit commitments aren’t always reflected by his actions—witness his expressions of respect for the so-called Dreamers, whose lives and futures he has upended by revoking DACA, the program that allows those brought illegally to this country as children and infants to stay in the U.S.

But let’s accept victory where we find it. Trump has got ahold of an indisputably good idea. Let’s praise him for it, and hope he sticks to it.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik’s blog.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.