Hillary Clinton had trouble explaining Obamacare to a layperson. Here’s why. [UPDATED]

During a CNN Town Hall appearance Sunday night, Hillary Clinton was presented with an Obamacare riddle. Moderator Jake Tapper introduced Teresa O'Donnell, an office coordinator from Powell, Ohio, to relate her family's health insurance problem.

Clinton did what she could to explain the pros and cons of the Affordable Care Act, which she supports and for which she has proposed several improvements. But under the circumstances her hands were mostly tied, thanks to the inherent difficulties of analyzing any family's health insurance situation in less than five minutes. Let's see how she did, anyway. We'll start with a brief video clip of the moment, courtesy of ACA expert Charles Gaba:

O'Donnell, an Obama voter, reported that under the ACA the premium bill for her family of four had "skyrocketed" from $490 a month to $1,081 a month. "I know Obama told us that we'd be paying a little more," O'Donnell said, "but doubling...more than doubling our health insurance costs has not been a 'little' more....I'm just wondering if Democrats really realize how difficult it's been on working-class Americans to finance Obamacare."

Clinton elicited a few snippets of information from O'Donnell, learning that her family has experienced "a few bouts of unemployment," had been purchasing their insurance in the individual market through a broker and still do--they haven't gone through the federal insurance marketplace, healthcare.gov, because "it was much more expensive than just purchasing private insurance from the insurance company," O'Donnell said.

In response, Clinton made three main points. First, she defended the Affordable Care Act overall: "For many, many people...there are exceptions, like what you're telling me...having the Affordable Care Act has reduced costs, has created a real guarantee of insurance, because if you had a pre-existing condition under the old system you wouldn't have gotten affordable insurance."

I know Obama told us that we'd be paying a little more, but doubling...more than doubling our health insurance costs has not been a 'little' more.

— Teresa O'Donnell, Powell, Ohio

Second, she pledged to "get the costs down." Her explanation Sunday was a tad incomplete, but judging from her own healthcare policy paper, which we discussed here, she's talking about squeezing excess costs out of the system, including by bringing down drug costs, increasing government subsidies and covering more people with them, and introducing a public option to provide more competition for commercial insurers.

Finally, she urged O'Donnell to check healthcare.gov to see if her family could get a better deal. That's crucial. Because many healthcare consumers still don't do comparison shopping via the exchanges, and end up steered--often by insurance brokers--into overpriced plans.

But the question still remains of how a family of four like O'Donnell's could face such a huge run-up in insurance costs. In truth, it's implausible. We can't say how implausible, because we don't know enough about the family's situation. But let's examine what they might find if they did engage in comparison shopping. Our analysis is based in part on Gaba's excellent rundown, and in part on our own research. We also reached out to O'Donnell, who talked with us on Tuesday evening. More on that below.

Numerous questions would need to be answered to give a full picture of the family's health insurance. These include knowing the terms of the family's old policy and those of the new. What has the family actually been paying for? "That $490/month policy might have been a so-called 'junk' policy which barely covered anything," Gaba observes. "Their new $1,081/month policy might be fantastic...or it might be skimpy with a huge deductible."

Another unknown is the time span over which the family's premiums have more than doubled. Two years? Five? Premiums in the individual market were increasing at an average of more than 10% in the years prior to the ACA exchanges, which opened for business for the 2014 plan year.

Finally, we don't know the O'Donnell family's income, or whether Teresa is eligible for health insurance at her workplace. So we can't tell if the O'Donnells are eligible for premium subsidies or, if their income is sufficiently low, cost-sharing subsidies too. We don't know if their children are eligible for coverage under the government's CHIP program, which costs them nothing and in Ohio covers children in households with incomes less than 206% of the poverty line. (For a family of four, that's $50,058 this year.) We don't know if they're victims of the "family glitch," which Clinton has pledged to fix. This is a provision that makes the entire family ineligible for subsidies if any member is eligible for employer-sponsored coverage, even if they don't take it.

[UPDATE: Here's what we now know about the O'Donnells' situation, with thanks to Mrs. O'Donnell. she and her husband are both 53, and they're covering insurance for their two children, ages 20 and 23. Their family income is high enough to render them ineligible for any Obamacare subsidies. The information she gave me diverges from some of the assumptions I made originally in assessing the family's options, which you can find below this update.

[The $490 in monthly premiums that Teresa cited in her question to Clinton dates back to 2006-2007, which means the family's premiums have risen by a total of 120% in nine or 10 years. That about matches the overall rate of premium inflation in the individual market even before enactment of the ACA, which ran 10%-12% in 2008, 2009, and 2010, according to a survey by the Commonwealth Fund. In the past, the family's plan had deductibles of $2,500 per person. There were rate increases most years, but Mrs. O'Donnell feels that they've accelerated since 2013, when the ACA's individual insurance market kicked in. The deductible now, under the plan for which they're paying $1,081 a month, is $4,000 per person.

["We were very happy" with the old plan, she told me, but she appreciates that some procedures will be covered without a co-pay under her current ACA-compliant plan, including preventive procedures such as colonoscopies, for which the family would have had to pay a fee in the past. the prospect of losing her insurance because of a medical condition or pre-existing condition--which is outlawed by the ACA--hadn't been a concern in the past. "We're a pretty healthy family," she says. There's have been bumps and bruises, but "never anything life-threatening." The O'Donnells did check out their options on healthcare.gov before buying their current plan, plugging in their income and other vital statistics; they found they could do better buying an off-exchange policy through a broker.

[It's fair to say that Teresa and her family fall into the category of consumers who may not have been disadvantaged by the Affordable Care Act, but don't feel they've gained much, either. Their income places them beyond the reach of government assistance, and on the face of it they didn't have "junk" insurance that overcharged them for minimal coverage. It's conceivable that without the ACA their costs would have risen at about the same rate they have since 2006. The consumer-protection provisions of the law might have helped if they needed them, but they were comfortable as things were. And the prospect that the ACA would dramatically control costs, much less reduce them, hasn't materialized for them.

[Their perception is that the law actually has driven up costs. "We're very surprised that it's had this kind of effect."

[Teresa thought that Clinton's reply to her question was "a little vague...She didn't admit that it's true that people in my state of affairs have a lot of bills and a lot of expenses and this is an additional cost."

[That said, she supports Hillary Clinton in the election; on Tuesday, before we talked, she voted for Clinton in the Ohio Democratic primary.]

An Ohio family shopping on the exchanges typically will find numerous choices of good healthcare plans, for less than the O'Donnells are paying. We plugged sample data for a Powell, Ohio, family into healthcare.gov to find them. In filling out the healthcare.gov application, we used a family of four with parents ages 50 and 52, teenaged kids and income of $50,000; in real life, subsidies are available for families of four with household income up to $97,200.

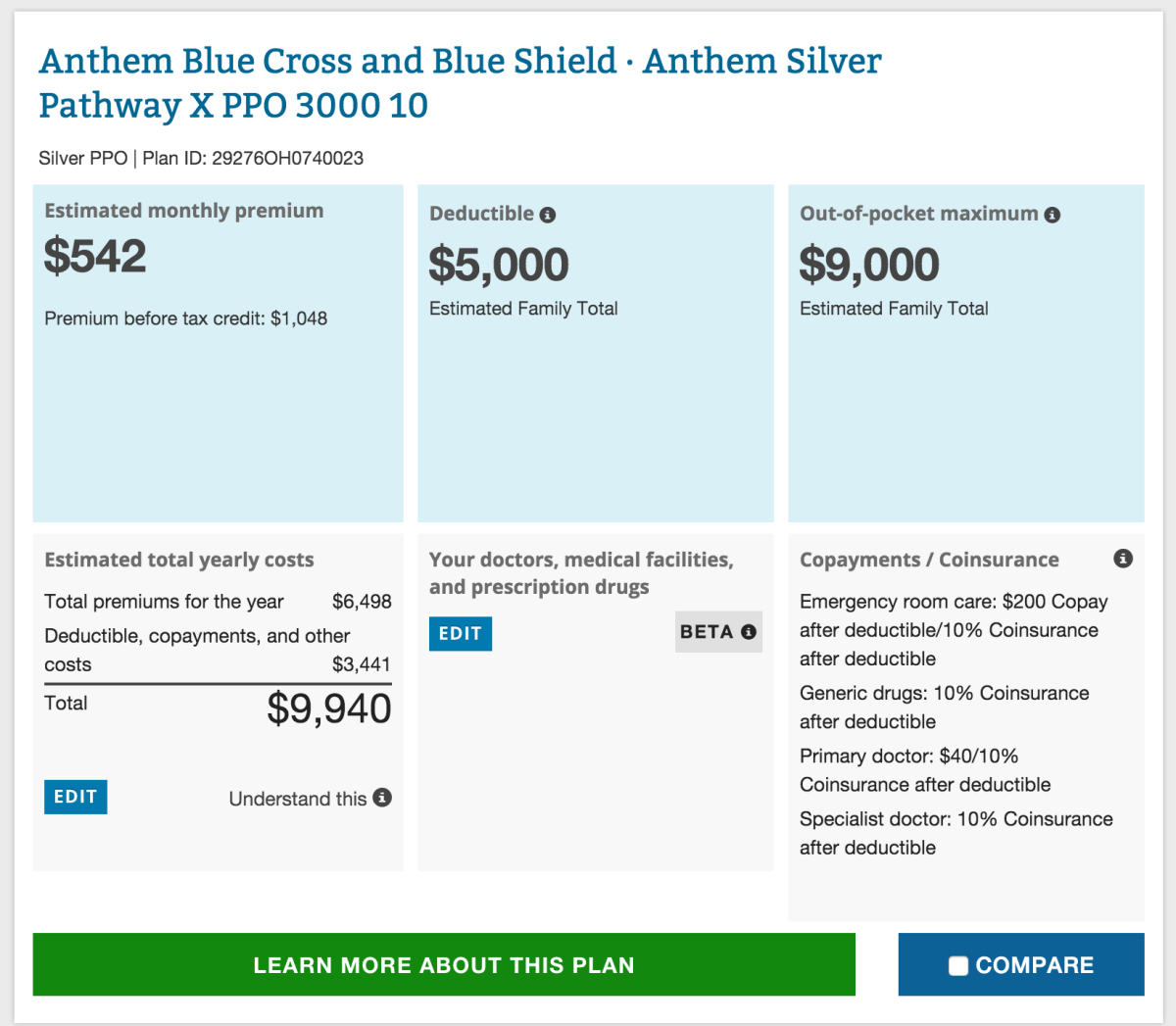

The website shows us good silver plans costing as low as $479 per month for four after subsidies, with family deductibles as low as $4,500 and out-of-pocket maximums as low as $6,000. HMO premiums were as low as $283 after subsidies. (See image above.)

Gaba observes, accurately, that "the odds of a 'working class family of four' in which both parents have had 'bouts of unemployment' having to pay over $1,000/month for a decent policy on the ACA exchange are virtually zilch." (Emphasis his.)

Clinton obviously couldn't go into any of these niceties without appearing to be unforgivably nosy, meddlesome or wonkish. But the colloquy with Mrs. O'Donnell underscored that health insurance is more complicated than most American families understood before Obamacare allowed them--or forced them, if you prefer--to balance all the choices of premiums, deductibles and out-of-pocket expenses over their kitchen tables to come up with the plan that works for them.

The ACA's adversaries, including the entire Republican lineup of presidential candidates, have seized on these complexities to argue that the entire system needs to be scrapped. But they've failed to offer alternatives that wouldn't simply ratchet the nation's insurance system to what it was before the ACA, when families could be ruthlessly overcharged for insurance that wasn't there when they needed it, or barred from any coverage at all if they had even a minor pre-existing condition. That can't legally be done any more.

That's the most important point Clinton failed to make Sunday night in trying to explain to Theresa O'Donnell and the CNN audience what's at stake in the coming election. What she should have said was: "Yes, Obamacare has its flaws. But under any of the GOP plans, you'd be lucky to have any insurance at all."

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik's blog.

MORE FROM MICHAEL HILTZIK

The latest news on 'To Kill a Mockingbird' shows how copyright law is totally broken

Tell me again how Obamacare is a 'disaster'

More signs that 'gaming' by the sick is not a problem in Obamacare

Hillary Clinton reveals her plan to revise--not repeal or replace--Obamacare

Dirty little secret: Insurers actually are making a mint from Obamacare

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.