Column: Big businesses are adding women to their boards at a good pace; start-ups, not so much

Here’s a surprising counterfactual to the oft-voiced concerns that American corporate boards are too heavily stocked with males: In recent years, major companies have actually been recruiting many more women than men as directors.

That’s the conclusion of a recent survey by Shivaram Rajgopal of Columbia Law School and George Fleck, a boardroom recruiter for public companies. They toted up board appointments and resignations between April 1 and Sept. 24 this year. Among companies with more than $5 billion in market capitalization — encompassing virtually the entire Fortune 500 list — 57 women have been appointed to boards, but only 19 men.

“Pressure from the media and large institutional investors appears to have largely worked in such companies at addressing the gender imbalance,” Rajgopal and Fleck wrote in the Harvard Business Review. According to a database Fleck maintains at his recruitment firm covering the period of April 1 through this week, at those large companies, women have gained a net 107 board seats (that is, appointments net of resignations), while men have lost a net 30 seats.

There’s the breaking in part of getting onto boards. ... Then there is the influence part of getting women into leadership positions where real power resides.

Among newer, smaller companies, however, the news is not so good. Only 51 women have been named to boards of firms that went public from April 1 through Sept. 24, compared to 455 men. Bringing the numbers current, Fleck found that women gained a net 84 seats on newly public companies, while men gained 685.

The authors attribute that imbalance to the baked-in reality of the average company staging an initial public offering: It’s likely to be heavily funded by the venture capital community, which is widely known to be dominated by men. Since the boards of companies going public will be overstocked with their initial investors, the gender tilt of the venture community will be replicated on the company boards.

Business experts generally don’t consider that a positive trend for corporate America. “Boards with more gender diversity are more innovative, more strategically minded, and generally more effective,” Kimberly A. Whitler of the University of Virginia business school and Deborah Henretta, a former Procter & Gamble executive now serving on four public corporate boards, observed in a recent article for the MIT Sloan Management Review. They cited a 2012 study by McKinsey & Co. that found that companies in the top quartile of board diversity saw materially higher returns on shareholder equity and profit margins than those with the least diverse boards.

Fleck is optimistic that the over-representation of males on boards of newly public companies will self-correct over time, however. “As the investors cash out over the first two years,” he told me, “we’ll see more diversity on the boards. Corporate America tends to be proactive — they see the writing on the wall and they don’t want to be regulated, so they’ll just do it.”

From his standpoint, that makes political oversight unnecessary — including the law signed by California Gov. Jerry Brown in September requiring all publicly-traded companies with executive headquarters in California to have at least one woman on their board by 2020. The law tightens the mandate starting in 2022, with boards of six or more members required to have at least three female directors. The law was based on a finding that one-fourth of California’s public companies have no female directors at all and that, overall, California corporate boards have less female membership than those in the nation as a whole — 15.5% in California, compared to 21.3% of S&P 500 board seats nationwide.

“That sounds good, but it’s classic overreach and PR,” Fleck said of the California law. “The reality is that these changes are taking place in the market.” It’s also true that leading proxy advisory firms, which help big institutional investors vote on shareholder resolutions, have said that they would advise votes against managements that don’t show a commitment to board diversity.

That said, Fleck acknowledges that merely placing women in board seats isn’t the end-all of diversity. He says women will soon begin moving into positions of real power on boards, starting with chairing the key committees — compensation, audit and governance — and then deploying that experience to become independent board chairs at companies that have split the chairman and CEO roles, an increasingly common development.

Whether these trends are moving quickly enough is subject to debate. Indeed, the gains of women on corporate boards have been slowing, according to Whitler and Henretta. In 2017, they report, “the overall number of female corporate directors in the Fortune 500 actually dipped slightly.”

Like Fleck, they also pointed to the need for women to move faster into power positions on boards. Only 65 of Fortune 500 companies had female board chairs, and in nearly half those companies that was because the female chair also was CEO.

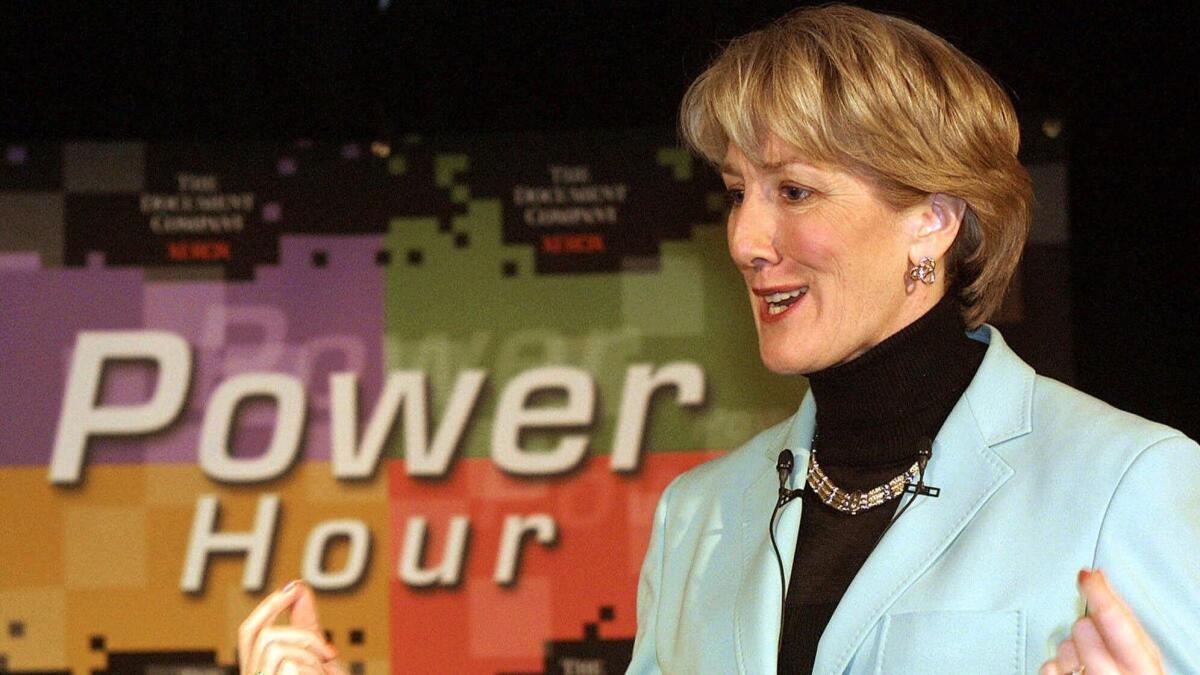

As for power positions, only 21% of corporate governance committee chairs were women in 2016, while only 18% of audit committees, 13% of compensation committees and 5% of executive committees were chaired by women. Whitler and Henretta say it’s much more common to find women chairing soft, secondary committees such as sustainability and corporate relations committees. “There’s the breaking in part of getting onto boards,” former Xerox Chair and Chief Executive Anne Mulcahy, who has served on the boards of Target (where she chaired the compensation committee) and Johnson & Johnson (where she is lead independent director), told the authors. “And then there is the influence part of getting women into leadership positions where real power resides.”

It’s also important to bear in mind that gender is not the end of the diversity story. Most discussions about board membership accept the assumption that a corporate board’s purpose is to represent the shareholders’ interests. But why should that be so, to the exclusion of stakeholders such as employees, communities, customers and suppliers?

That’s the point of the Accountable Capitalism Act proposed by Sen. Elizabeth Warren (D-Mass). Warren’s measure would require most American public companies to obtain a federal corporate charter and reserve at least 40% of their board seats to directors elected by employees. Warren’s initiative underscores the truth about corporate boards in America — things are improving, but there’s a long way to go.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik’s blog.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.