Column: Mountain View’s proposed ‘Google tax’ reminds us that big employers bring not just jobs, but problems

For years now, the debate about job growth in America has sounded one note: More is better, and hugely more is hugely better.

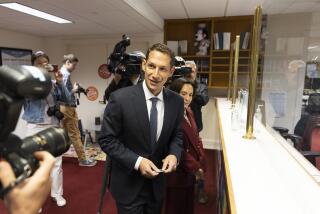

But lately, a few communities have sounded discordant notes. The latest is Mountain View, the home of Google and several other big and rapidly growing tech companies. The city’s mayor, Lenny Siegel, is proposing to place what’s known as the “Google tax” on November’s city ballot.

“I call it the perils of prosperity,” Siegel told me. “We’re blessed with too many good jobs for the housing and transportation we have.” As Mountain View’s biggest employer, Google brings about 20,000 employees into the city every working day. But it’s not the only contributor to an influx that swells the city’s population, nominally about 80,000, to about 125,000 in the daytime — Microsoft, LinkedIn and Intuit are also major employers. About 2,000 to 3,000 Google employees live in Mountain View, Siegel estimates.

Local government can’t raise money out of thin air, so who are they going to turn to?...Who seems flush other than these big giant companies?

— Urban development expert Richard Florida

That has strained the housing and transportation infrastructure of this city in the heart of Silicon Valley to the breaking point. The rents on new apartments run about $5,000 a month. Three-bedroom single-family homes of 1,500 square feet list for nearly $2 million.

The city has built a modest number of affordable housing units, but not nearly enough, and it suffers from what Siegel calls “the missing middle: teachers, plumbers, surgical technicians who make too much money to qualify for affordable housing, but not enough to live here.” Some 300 inhabited vehicles are parked on Mountain View’s streets, says Siegel, a veteran environmental advocate who joined the City Council in 2015 and is serving a one-year rotating term as mayor.

Siegel’s goal is to raise about $10 million a year by charging all but the smallest employers a tax based on full-time employees. Medium-sized companies, say between 50 and 3,000 employees, would pay the head tax on a progressive scale. Google (or Alphabet, which is the holding company for Google and a number of other enterprises) would end up paying about half the total. The money would be used to support bonds for housing and transit improvements, including an automated tram, or “guideway,” between Mountain View’s downtown transit hub and the tech employment district hugging the shore of San Francisco Bay.

Siegel says Google has been a good corporate citizen for Mountain View. The company contributes to a free community shuttle that serves the central city, for example. Google hasn’t expressed a public opinion on the measure; the company didn’t respond to a request for comment.

Other Silicon Valley communities have considered initiatives like Mountain View’s, but none has enacted anything like it. Siegel says that if Mountain View can pass its head tax, neighboring cities may fall into line.

The proposal indeed may signal a sea change in how what urbanist Richard Florida calls “superstar cities” address the inescapable costs of runaway growth. These include “gentrification, mounting inequality and acute housing unaffordability,” he says. “If we had a functioning federal government, it would help out with the social safety net. But mayors and city councils recognize that the federal government has gotten out of the business of helping. So they point the finger at big companies, and particularly big tech companies, because they’re the biggest companies in the world and the most highly valued.”

Some of those big companies, however, are pushing back. The best example comes from Seattle, where the City Council is debating whether to impose an employment head tax to address homelessness and transportation problems. The City Council could vote as soon as Monday on a plan to tax employers with at least $20 million in annual sales within the city. The tax would amount to 26 cents per employee hour, up to $500 per worker per year, with the goal of raising up to $75 million.

Seattle Mayor Jenny Durkan on Thursday countered with her own plan about half the size, capping the tax at $250 per worker and raising $40 million a year, but it was rejected Friday by a City Council committee. A majority of the council favors the original proposal, though not enough to overcome a mayoral veto.

About 585 businesses would be subject to the tax, the city estimates. But its prime target is Amazon, which with about 40,000 local workers is the largest private employer within the city limits. Amazon responded earlier this month with an announcement that it was putting a major skyscraper project in the city on hold and reconsidering plans to expand into a second building. The premises were to accommodate up to 8,000 more Amazon employees.

Around the same time, Andrew Jassy, a top Amazon executive, called the tax proposal “super dangerous for cities to implement.… What company is going to want to start — or move to or grow in — a city that penalizes them for hiring full-time employees?” Jassy said on CNBC.

Amazon may have aimed to send a signal to the cities participating in a competition to host the company’s second headquarters, which is expected to employ 50,000 workers. That’s a boon to employment statistics, but certain to drive up rents and home prices and strain even the best-developed local transit systems. But Amazon has made plain that it expects state and local tax breaks to be offered as a come-on.

“It’s hard to see how $500 a head would influence Amazon’s investment decisions,” says Greg LeRoy, executive director of Good Jobs First, which tracks state and local subsidies awarded to corporations. “But it makes a lot of sense as a hardball signal” to bidders for HQ2, Amazon’s proposed second corporate headquarters.

The regional technology industry also has launched an opposition campaign, based partially on questioning whether money for Seattle’s existing initiatives to fight homelessness and for other services has been spent wisely enough to warrant dunning tech companies for more.

“The city invests $75 million a year to house the homeless,” says Michael Schutzler, CEO of the Washington Technology Industry Association. “But nobody in city government can point to successful outcomes as a result of the spending. We’ve got more potholes, not less. We’ve got more homeless, not less. We don’t have schools improved, we don’t have roads improved.”

Yet there’s hardly room for argument that rapid growth has strained Seattle’s infrastructure and, for many residents, its standard of living. Rents and home prices are rising by 10 to 15% per year, and the average round-trip commute exceeds 54 minutes, higher than the national average and sixth highest in the nation — even ahead of Los Angeles.

Whether a head tax is the best option to raise money has been questioned in Seattle and elsewhere, in part because it comes out of total business revenue rather than as a share of profits. That makes it particularly burdensome during recessions. Chicago, for example, phased out its employee head tax in 2011, during a protracted economic slump. The levy had been in existence since 1973.

Still, interest in tying municipal revenues to employers’ impact on infrastructure is rising, if only out of a sense that they haven’t been paying their fair share. “I think we’re going to see more and more of this,” says urbanist Florida, “not only about corporate headquarters, but around universities and medical centers, where areas are getting more gentrified. Local government can’t raise money out of thin air, so who are they going to turn to? The residents are tapped out and who seems flush other than these big giant companies?”

He says that today’s big corporations, which increasingly are technology firms rather than heavy manufacturers, would be well advised to go along with the trend rather than fighting it like Amazon. “Maybe the message will get through that building the economy is not just about creating jobs for the one-third of us who can do knowledge work, but that if we want to rebuild our cities the right way, it’s in all our interests to make our cities more inclusive and more equitable.”

He sees the resistance of tech giants to contribute more to their communities as a sign of immaturity, also reflected in the tendency of firms such as Uber and Airbnb to run roughshod over local regulations. “Maybe they just believe this libertarian mythology that somehow they’re the be-all and end-all and don’t owe anyone anything,” he says. “But I think it’s going to come back to haunt them. Amazon has a great brand, but it could begin to erode in the sense of Amazon being seen as a decent company. These youthful tech companies do not realize how important local affairs and local relationships are.

“You’d wish these companies would grow up quicker,” Florida says. “But now it seems like they’re doing not only their communities great damage, but themselves.”

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik’s blog.

UPDATES:

7:33 a.m.: This post has been updated with details of Seattle Mayor Jenny Dukan’s tax proposal.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.