Tesla returns to losing money as revenue, cash and other key numbers tumble

Elon Musk envisions a glorious future when fleets of Tesla robo-taxis earn money for Tesla owners and make all other automobiles instantly obsolete. The future, he said in a presentation this week, starts next year.

So far this year, however, Tesla’s financial situation looks bleak.

The company reported Wednesday that automotive revenue in the first quarter fell 41% to $3.7 billion from $6.3 billion in the previous quarter, a far steeper drop than expected for sales of all its electric-cars — the Model S, the Model X and the Model 3.

Total sales, including Tesla energy and battery storage products, fell 38% to $4.5 billion from $7.2 billion.

The sales slump in turn slammed the company’s bottom line. The company turned unprofitable again after two rare quarters of positive earnings. The net loss was $702 million, after a $139-million profit in the previous quarter. (The first-quarter loss was close to what the company recorded in the year-earlier period — $709 million — when it was grappling with fundamental manufacturing problems.)

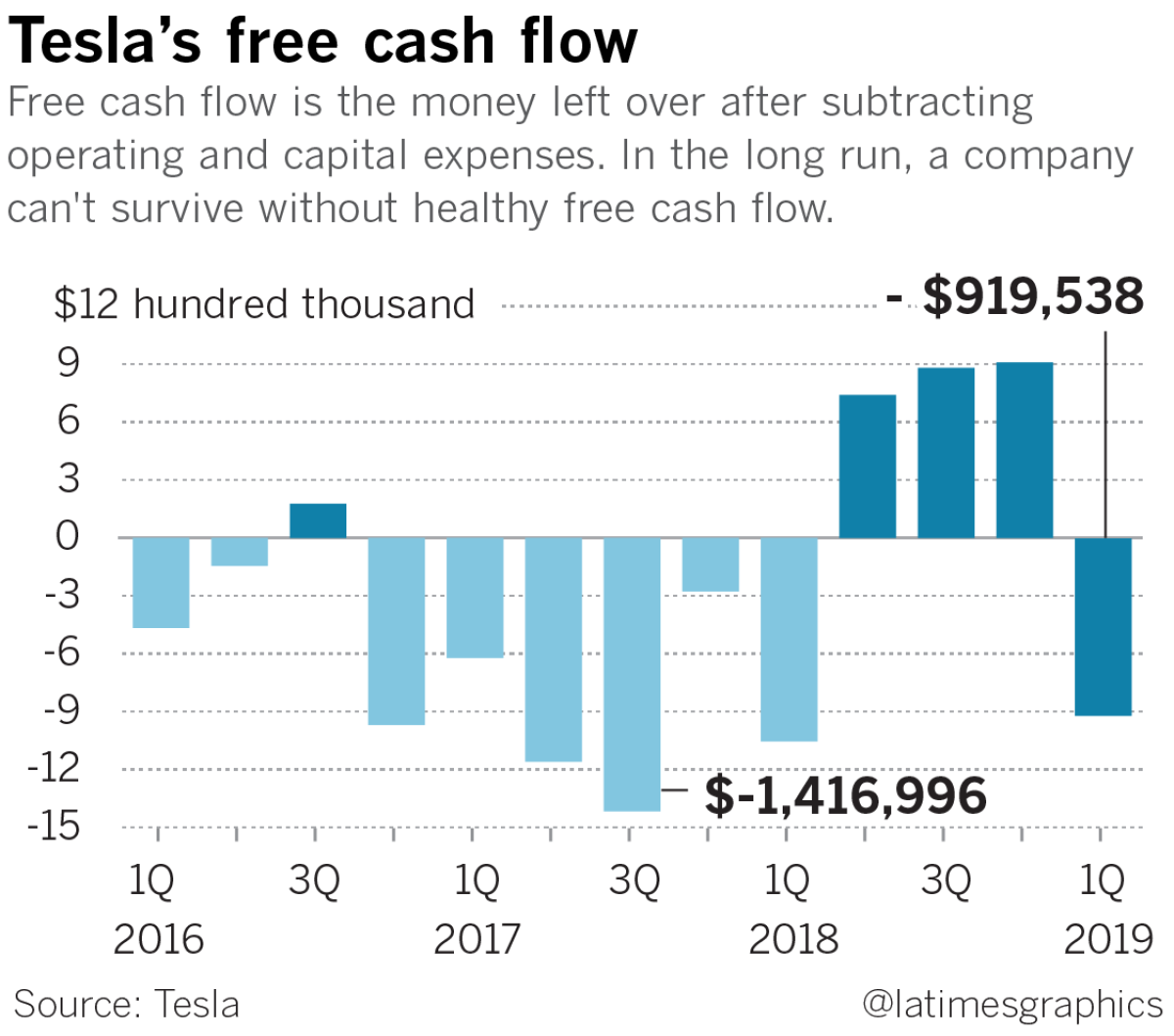

Scarce cash got even scarcer. Cash on hand dropped from $3.69 billion at the end of last quarter to $2.2 billion. That included paying off $920 million in convertible bonds.

Operating cash flow turned negative — a net $640 million going out the door over the three months versus a positive $1.23 billion in the previous period.

Tesla shares, down about 22% for the year through Wednesday’s close, were up slightly in after-hours trading Wednesday, to about $259 a share.

The quarterly results belie Musk’s goals and predictions. Last fall he told analysts he had “aspirations” that Tesla would post positive net income and cash flow “for all quarters going forward.”

As recently as January, with the decline in Tesla sales underway, Musk told analysts he was “optimistic” about a first-quarter profit. “Not by a lot, but I’m optimistic about being profitable in Q1 and for all quarters going forward,” he said then.

During a conference call with analysts, the company said production will begin on Tesla’s electric semi-truck next year. Manufacturing tooling and equipment have been ordered for the recently unveiled Model Y crossover, Musk said. The company is weighing whether to build the Y at its auto assembly plant in Fremont or at its battery plant in Nevada.

Whether Model 3 demand picks up will help determine how much capacity is available at Fremont. Asked how many customers have ordered or reserved a Model Y, Musk said the company won’t discuss reservations. “People read too much into this,” he said.

Where the money for such projects will come from is unclear. Musk was asked why he doesn’t raise money through a debt or equity sale. Musk said he’d rather focus on efficiency first. “I don’t think raising capital should be a substitute for making the company operate more effectively,” he said. “I think it’s healthy to be on a Spartan diet for a while.”

Without an infusion of equity or debt, major expansion would require healthy cash flow. But cash flow has gone negative. Capital spending, which funds assembly lines and other manufacturing operations, has been declining. It fell from $325 million in 2018’s fourth quarter to $280 million in 2019’s first quarter. The number topped $1 billion in the third quarter of 2017 and has fallen with each quarter.

Goldman Sachs analyst David Tamberrino has a “sell” recommendation on Tesla stock, with a target price of $210. In a recent note to investors, he said that “sustained positive free cash flow” that allows the company to “self-fund growth” would improve his opinion of the company’s prospects.

Asked about demand for vehicle Models S, X and 3 in the current quarter and the rest of the year, Musk sounded optimistic. But he seemed to be operating more from gut feel than whatever the company’s order book is telling him. “We are seeing demand returning to normal in Q2,” Musk said.“I don’t have a crystal ball, so it’s hard for me to say, but my impression right now is demand is strong.”

For the first quarter, total customer deposits fell to $768.3 million from $792.6 million in the previous quarter. Inventory rose from $3.1 billion in the fourth quarter to $3.8 billion in the first. Demand is not the problem, Musk told analysts; delivery problems in China and Europe caused vehicles to stack up, he said.

Until recently, many on Wall Street had predicted a great future for the Model 3. According to Musk forecasts, the company should have been selling 500,000 a year by the end of 2018, instead of the 146,000 it reported.

Production problems led to service problems and delivery problems. Now the company appears to be facing a demand problem. Tesla made slightly more Model 3s in the first quarter but delivered 20% fewer than the previous quarter. Model S and X deliveries dropped 56%.

The Model 3 costs far more than the $35,000 base car that Musk had promised and only recently put on the market. The average price of a Model 3 remains more than $50,000. The $7,500 federal tax credit for Tesla car buyers, following the terms of the program, was cut in half in January. It will be halved again in July and will disappear after Dec. 31.

The cheaper versions of the Model 3 present another problem: Can Tesla make a profit at the $35,000 price, when it’s had so much trouble making a profit with far higher average selling prices.

Most Wall Street analysts on average have soured on Tesla stock, lowering their target prices, with several suggesting that current Tesla stockholders sell now. But true believers remain, including Ark Invest, which has put a $4,000 target price on Tesla stock, with no date attached.

Musk sounded a downbeat note about Tesla’s future in a tweet Saturday, aimed at short sellers who are betting the company is grossly overvalued. “Tesla is just trying to make electric cars & solar power for a better future for all. True, we might not succeed, but why do they want us to fail?” he said.

The tweet came after Tesla won a temporary restraining order against a short seller for allegedly interfering with the filming of a Tesla running on driverless software.

On Monday, Musk laid out a scheme to deploy an app-based fleet of driverless Tesla robo-taxis by the end of next year. Tesla car owners could add their own cars to the network and share revenue with Tesla. Safety advocates and a group of competing automakers complained that the technology for driverless cars is not ready for wide-scale deployment. (Musk himself promised to send a driverless car from California to New York in 2017, but that never happened.)

The crowd-sourced, social media swarm that is betting Tesla will crash and burn »

Some stock analysts are wary of the plan, as well. “The Silicon Valley ‘move fast and break things’ approach — and I’m not just talking about Tesla — is going to encounter departments of transportation and state legislators and find out this is a lot harder than they think it’s going to be,” said Joseph Osha of JMP Securities.

Twitter: @russ1mitchell