Long the star of L.A.’s professional and creative firms, the business district is receiving major upgrades including a new, LEED-certified office tower and a link in the city’s ongoing transit improvements.

For JMB Realty, the storyline of building the newest office tower in Century City was fraught with more plot turns and twists than a Hollywood blockbuster – fitting for a building that will serve as the headquarters for Creative Artists Agency (CAA), the largest talent agency in the entertainment industry.

“It’s been a long and winding road,” said Patrick Meara, chief operating officer for Chicago-based commercial real estate developer JMB Realty, joined onsite by Joe Harris, a vice president in the company’s asset management and development group. “In 2017, rents were going up, there was great demand and it’s hard to build on the Westside. We were reaching the conclusion of the entitlement process, and it came together at the right time,” he said.

The 37-story, 730,000-square-foot Century City Center tower project designed by Los Angeles-based architecture firm Johnson Fain will be completed in 2026 on the northeast corner of Avenue of the Stars and Constellation Boulevard in Century City. It includes four levels of underground parking and one level of parking at ground level, and a two-acre park connected to the building on the roof of the parking area. The building is being targeted for LEED Platinum certification, indicating the highest level of sustainable measures incorporated into its design and construction.

Plans for the long-vacant site at 1950 Avenue of the Stars were first proposed in 2005 and alternated between office and residential proposals for more than a decade before the official groundbreaking in 2022. With entitlement deadlines looming, JMB sought to move forward with construction in 2020, but the COVID-19 pandemic and the Hollywood writers’ strike created a sudden cliffhanger straight out of an action movie – similar to a famed film that prominently featured JMB’s nearby Fox Plaza (also designed by Johnson Fain).

Activity slowed for about a year, but when plans moved forward, the new building and its healthy and sustainable elements were even more desirable for the entertainment, legal and financial tenants that were eager to return to offices with abundant outdoor space and plentiful amenities.

The two-acre park will have meeting pavilions equipped with high-speed wireless internet and outdoor television screens for client and employee meetings and catering options available. It’s connected to a second level indoor tenant social lounge that will serve beverages and food. Other amenities include a 6,500-square-foot onsite fitness center and ground-floor retail.

“The best [tenants] have opinions that you want to address. They want to know if the indoor air is filtered and if they can take their laptop outside on a nice day, which is most days in Los Angeles.”

— Scott Johnson, principal, Johnson Fain

“If you are in a creative or service business, you have to bring in the best people to compete in that industry,” said Scott Johnson, principal at Johnson Fain and the lead architect for the tower. “The best people have opinions that you want to address. They want to know if the indoor air is filtered and that they can take their laptop outside on a nice day, which is most days in Los Angeles.”

Costs on the Rise; Builders and Investors Remain Bullish

Rents have steadily increased over the past several years in the 10-million-square foot submarket, where large tenants typically sign long-term leases. Landlords have responded by reinvesting in their properties to add amenities, such as renovated lobbies, and by offering strong tenant concession packages. Tenants are also making improvements. For example, commercial real estate firm CBRE recently opened a new, 21,000-square-foot office at 2000 Avenue of the Stars that features innovative technology and a variety of collaborative spaces.

Those tenants who signed 10- to 15-year leases with expirations in the next few years are facing significant rent increases but have very few options to move and may end up needing to renew at higher rates. Asking rates for top-tier spaces have surpassed $100 per square foot on an annual basis and peaked at about $120 per square foot annually, although concessions on typical long-term leases in the area include tenant improvement allowances that surpass $100-per-square-foot along with one month of rent abatement per year of term.

Nevertheless, Cushman & Wakefield’s landlord representation team of Eric Olofson, Pete Collins and Scott Menkus secured tenants from each of the three largest industries that collectively lease space in Century City. CAA leased 400,000 square feet in the lower portion of the building, investment firm Clearlake Capital leased the top eight floors spanning approximately 150,000 square feet and law firm Sidley Austin leased 75,000 square feet. Tenants have options for additional space and the brokers at Cushman & Wakefield noted that they are actively seeking a tenant for just one more vacant floor of the building, which encompasses approximately 20,000 square feet. Lease terms were not disclosed, but industry sources pegged the asking rates well above $100-per-square-foot on an annual basis with below average concession packages.

For CAA, the move across the street comes on the heels of its acquisition of ICM Partners, which had an office nearby. The new headquarters will bring more than 1,000 employees together under one roof, which required a larger office space than its current digs at 2000 Avenue of the Stars. CAA searched far and wide to accommodate its growing needs but found the right spot just across the street. It represents a significant transformation for a company that has additionally undergone a change of ownership, as French luxury goods billionaire Francois-Henri Pinault acquired the majority stake in the agency last year.

Global law firm Sidley Austin will move its Century City office from an adjacent building while Clearlake Capital will trade its Santa Monica headquarters near the beach for the upper eight floors of the building, which features expansive ocean views.

“It’s been the most successful lease up in Los Angeles history. The tenants saw the vision. That’s what allowed us to have so much success in pre-leasing,” said Eric Olofson, executive vice chair at Cushman & Wakefield in West Los Angeles. “This one broke all the rules because it hasn’t been built yet and hadn’t even really begun construction when these transactions were being negotiated. These tenants paid a significant premium due to the quality of the project and its abundant amenities.”

In fact, a study by commercial brokerage firm JLL that was released last month cited Avenue of the Stars in Century City as one of the top 10 office streets in the country. The report said that asking rents in Century City average $90.46-per-square-foot on an annual basis, which rivals San Francisco’s Financial District and surpasses areas such as Brickell Avenue in Miami.

The Fight to Attract and Retain Talent

Other factors driving demand are the “flight to quality” where office tenants are willing to pay higher rates for higher quality spaces in an effort to attract and retain talent. Employers want to make the office a great place to go and want to avoid mandating office attendance.

“These firms connect their reputations with their real estate,” said Scott Menkus, executive managing director at Cushman & Wakefield.

The high-end real office district benefits from the presence of the Westfield Century City Mall, which underwent a billion-dollar renovation several years ago as well as the extension of the Metro D (Purple) subway line through the Westside, including a stop in the center of Century City, but the one of the most underappreciated factors supporting office leasing in the area is one that is difficult to replicate – long-term investors who are not beholden to shareholders or stuck with financing challenges. Many of the area’s office buildings have long-term ownership that has been through several real estate cycles and doesn’t have a reactionary approach to market ebbs and flows. That stability is attractive to tenants seeking strong operators when signing long-term leases.

“Many of the landlords don’t have to contend with shareholders or lenders. The area has world-class amenities. Office buildings have gyms, coffee shops and eateries all on-site and you’ve got a market that is unplagued by other issues such as safety,” said Brian Niehaus, managing director at JLL who also represents a property in Century City. “Anyone with a lease expiring now may be stuck renewing because there’s a half-million square feet of net new requirements coming.”

A Depressed Market?

Meanwhile, much of the office market in Los Angeles and nationwide is suffering from lower occupancy and depressed asking rates.

Pre-pandemic, San Francisco had the highest lease asking rates on the West Coast due to low vacancy rates and high demand from technology companies that supported asking rates greater than $100 per square foot fullservice gross on an annual basis. However, that city’s tech industry has supported a greater amount of remote work, which has softened demand while Southern California’s strong entertainment, finance and professional services industries have supported Century City and surrounding West Los Angeles areas.

JMB secured a $575-million construction loan last year from Cale Street Partners to fund the project and hired Clark Construction to build the project. JMB declined to disclose the full project cost, but it is contributing significant equity to construction and industry sources estimate that high-end office construction would cost in excess of $1,000-per-square-foot, which puts the total project cost above $800 million. By comparison, the 52-story, one-million-square-foot 777 Tower at 777 S. Figueroa St. in Downtown Los Angeles was under contract for $145 million in March after owner Brookfield DTLA defaulted on loans related to the building.

“This building pushes the envelope of office construction in Los Angeles, not only in size and height, covering a monumental five and a half acres and reaching 569 feet tall, but also in sustainability,” said Abe Vogel, vice president of Clark Construction.

Below Deck

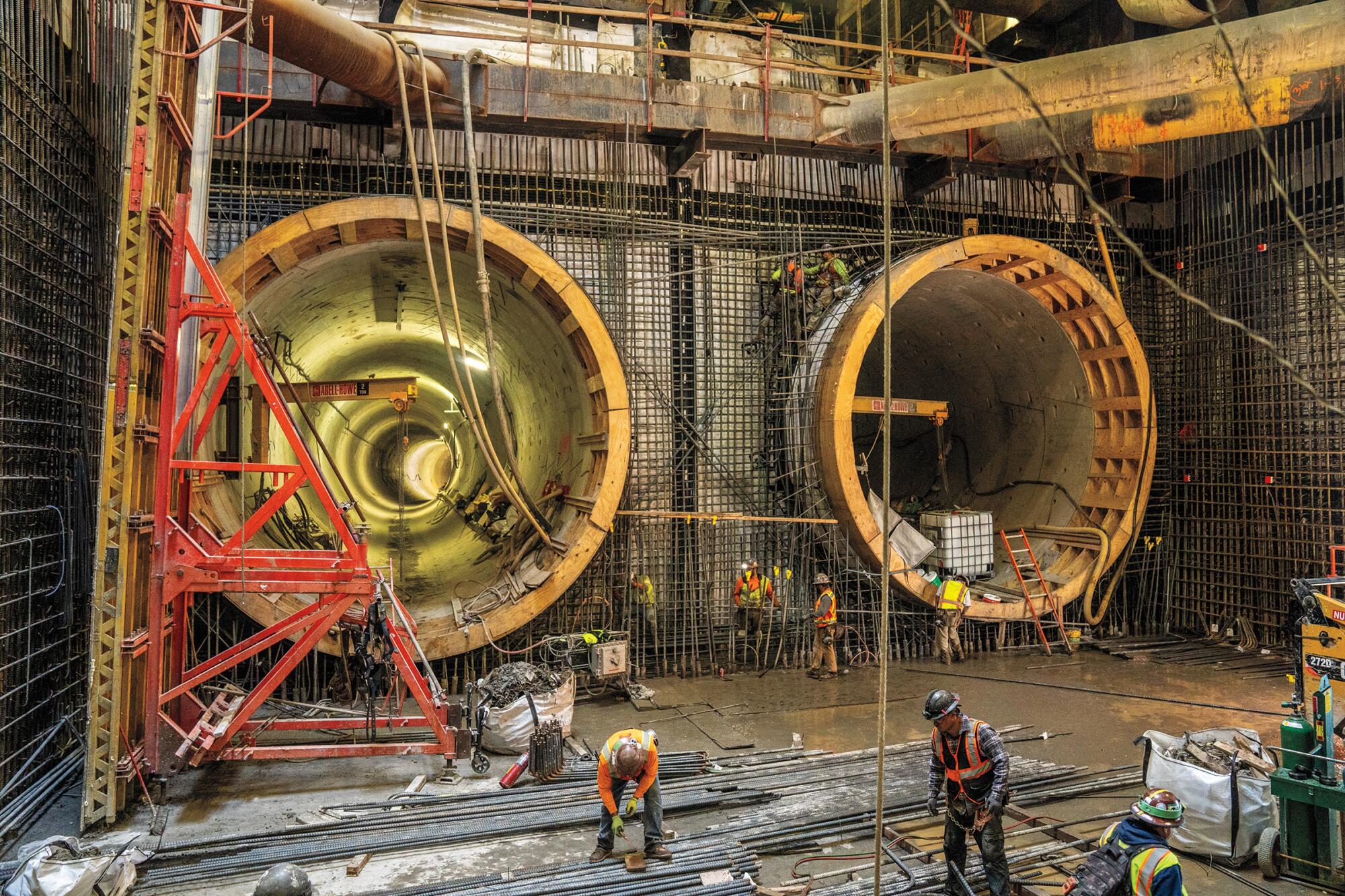

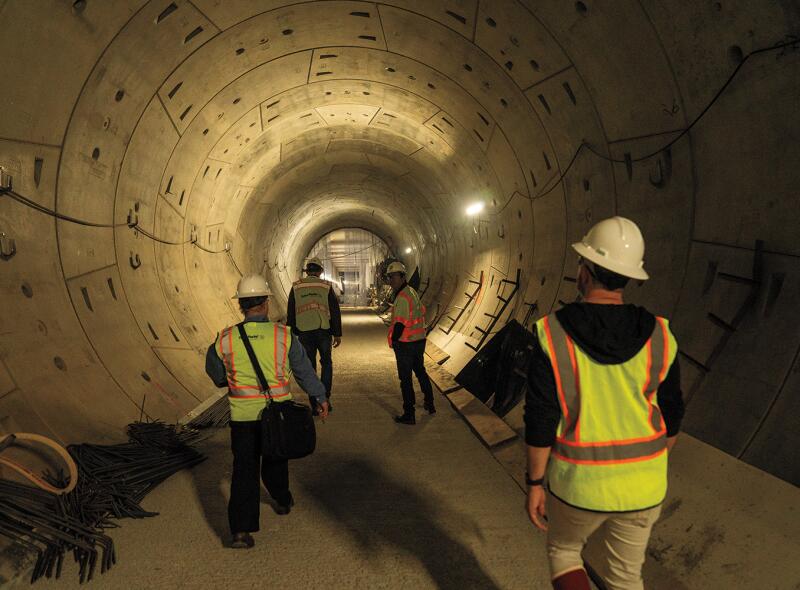

While the steel and concrete climb higher at JMB’s site, crews at Metro Los Angeles’ Century City station are busy a full 90 feet below ground working on the tunnels and platform that will connect West Los Angeles to the region’s greater rail transit system. The Century City station abuts JMB’s site and is separated by mere inches of dirt along Constellation Boulevard. Metro’s multi-billion-dollar D – Purple Line extension will be completed in three phases that will extend the subway from its current terminus at Wilshire and Western in Koreatown to the VA West Los Angeles campus just west of the 405 freeway on Wilshire Boulevard.

“Virtually every great city in the world has a subway system like this,” said Ron Tutor, chief executive of Sylmar-based infrastructure giant Tutor-Perini Corp., which is building phases two and three of the extension at a cost of nearly $3 billion combined. “It’s fun to be building it through the system all the way to the VA.”

(Photos by Varon Panganiban)

The twin tubes are waterproofed and sealed prior to laying down track. (Photos by Varon Panganiban)

Tutor has a long history of building subways in Los Angeles, and he credits work on the modern-day system that goes back decades. Tutor, now an octogenarian, announced plans to step down from his day-to-day role as chief executive and move into an executive chairman. “I’ll maintain a role of guidance and I’ll be around to make sure everything stays fine,” he said.

The bored tube leads to the Century City station, which features a train turnaround point. (Photo by Varon Panganiban)

Metro reached a major milestone last month when it completed tunneling for the D Line extension. Upcoming major components of work include building the emergency walkways alongside the tunnel and installing rail lines for the roughly nine-mile track that includes seven new stations. There is still much to complete before passengers begin making the 29-minute commute from Westwood to Downtown. Concrete loads are moving by truck through the tubes to crews who build the emergency walkways that line the route. Once that work is completed and the stations are constructed, the actual rail lines will be installed. Plans call for the final phase to be delivered to Metro by early 2027, and passengers could begin riding the train from Westwood to downtown Los Angeles by early 2028. Construction timelines were accelerated when Metro secured additional funding to push these projects ahead in anticipation of the 2028 Olympics.

“Virtually every great city in the world has a subway system like this.”

— Ron Tutor, CEO, Tutor Perini

While the Metro work is being done mostly underground and out-of-sight from the public, future tenants at JMB’s site can literally watch their future workspace being developed, sometimes from their current desks.

Westside Rising

While hugely significant, these two projects are not the only ones in progress on the city’s western end. New office construction in the area is still rare, but there have been several residential towers built over the past decade, including the towers at the Century Plaza Hotel. One new office tower has been proposed at the southern end of Avenue of the Stars. It calls for an estimated 35-story office building as part of a 1.6-million-square-foot development at the Fox Studio Lot.

Slightly farther, major nearby projects, including One Beverly Hills located a little over a mile away at the former Robinsons-May site, kicked off a $2 billion mixed-use development in February. The 17.5-acre project will offer a luxury Aman Hotel with 78 all-suite guest rooms, 255 Aman-branded residences across two luxury towers and a standalone 100,000-square-foot private Aman Club. It also includes 10 acres of open space with both public and private parks, 30,000-square-feet of commercial space and parking for 1,900 vehicles. That project is slated to open in 2027.

Those projects demonstrate the strength of the area where ownership groups can invest billions of dollars and hold projects for the long-term. For JMB’s Pat Meara, that’s all part of the plan.

“We don’t have a plan to build as cost effectively as possible to flip and sell it. We build and maintain quality buildings and take the attitude that we will own them forever,” he said.

-David Nusbaum