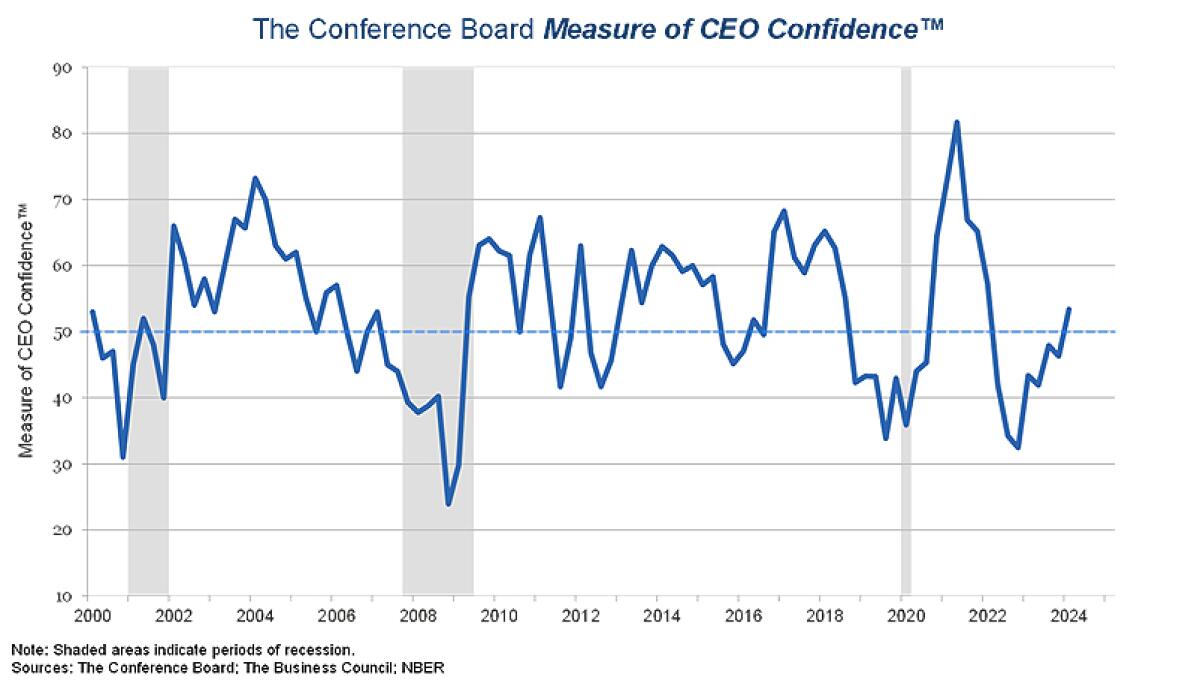

CEO Confidence Improved in Q1 2024 For the First Time in Two Years

The Conference Board “Measure of CEO Confidence” report in collaboration with The Business Council improved to 53 in Q1 2024, up from 46 in the fourth quarter of 2023. The Measure is now above 50, a reading that suggests CEOs have become optimistic about what’s ahead for the economy. Importantly, this is the first time optimism has prevailed in the Measure since Q1 2022. (A reading above 50 reflects more positive than negative responses.) A total of 138 CEOs participated in the Q1 survey, which was fielded from January 16-29.

CEOs’ views of current economic conditions improved markedly. In the Q1 survey, 32% of CEOs reported general economic conditions to be better than they were six months ago, up from just 18% in Q4 of last year. Just 22% said conditions were worse, down from 32% in Q4. Similarly, future expectations strengthened: 36% of CEOs in Q1 expect general economic conditions to improve over the next six months, up from 19% last quarter. Moreover, only 27% expect conditions to worsen, down significantly from 47%.

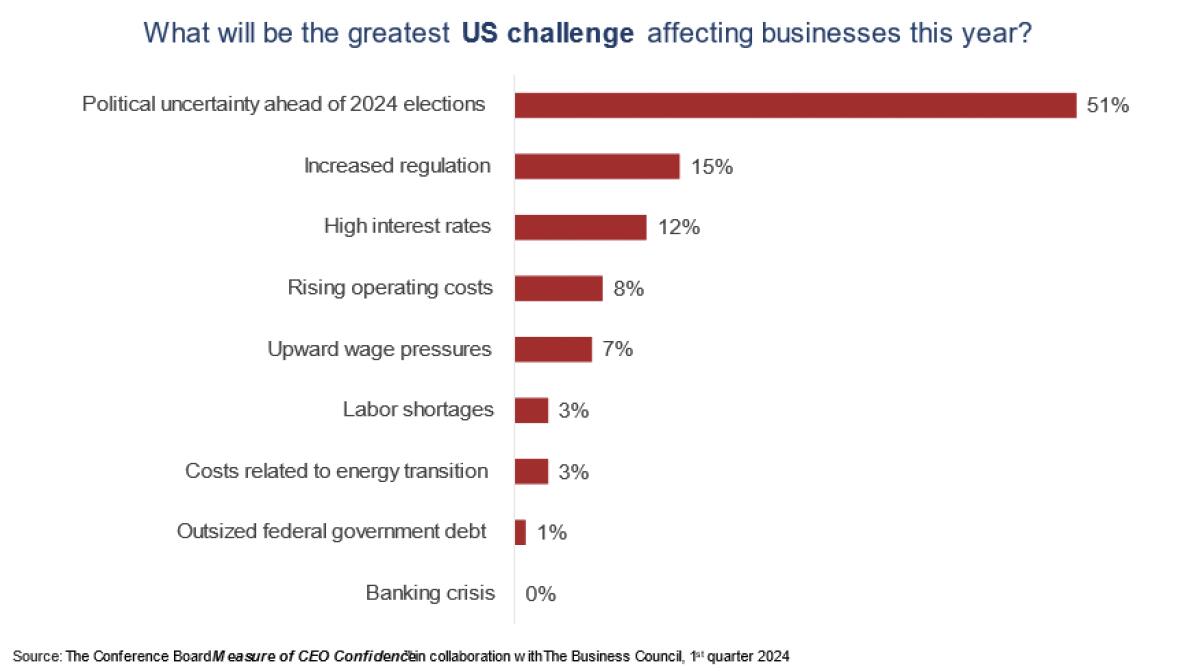

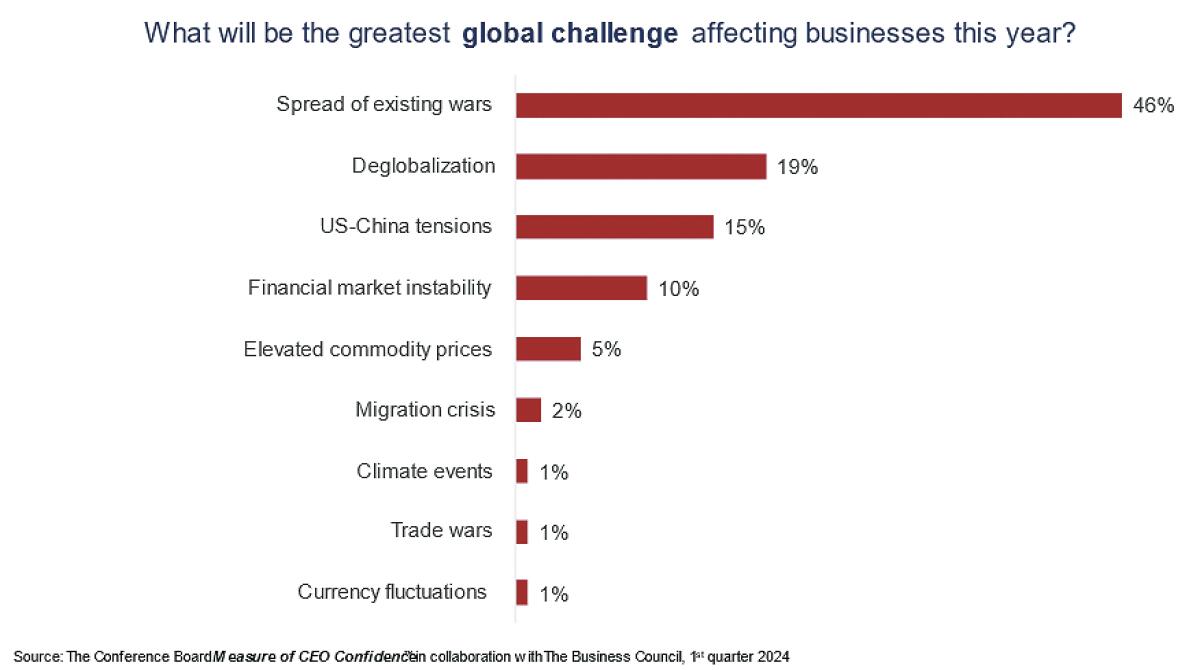

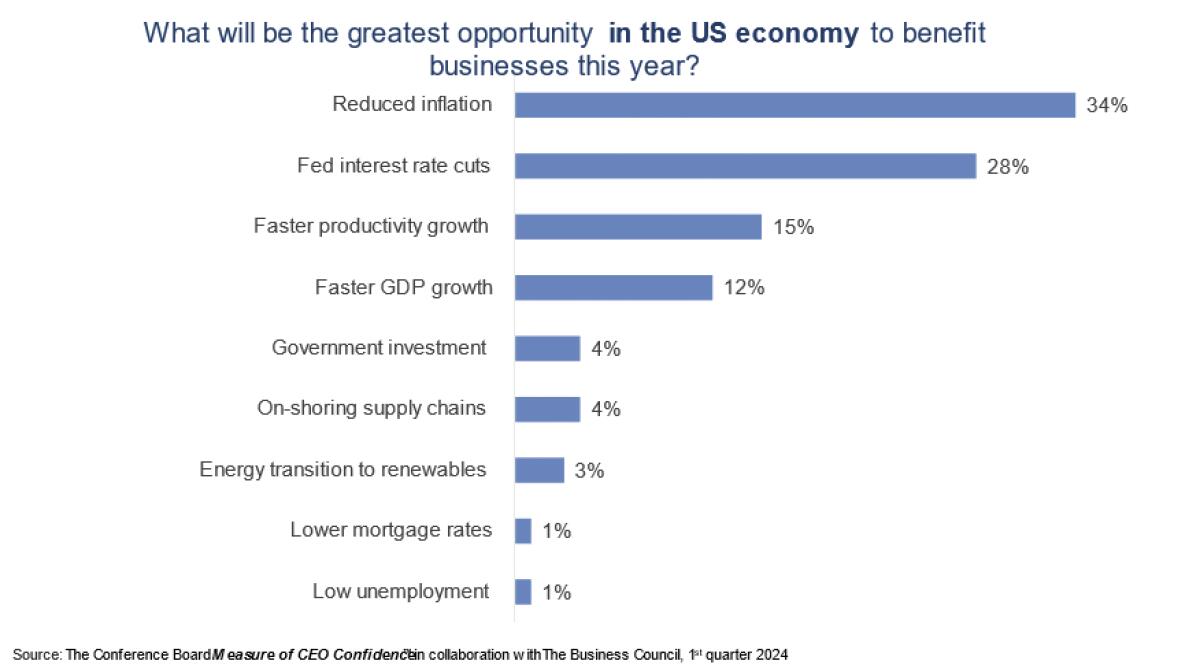

CEO expectations for conditions in their own industry followed a similar upward trend. “CEOs are feeling better about the economy, but remain cautious about risks ahead,” said Roger W. Ferguson, Jr., vice chairman of The Business Council and Trustee of The Conference Board. “In supplemental questions asked this quarter, CEOs overwhelmingly identified political uncertainty ahead of U.S. elections (51%) as the greatest U.S. challenge affecting businesses in 2024. Meanwhile, CEOs said the greatest global challenge affecting businesses this year is the spread of existing wars (46%). Deglobalization (19%) and U.S.-China tensions (15%) were also concerns. On the positive side, CEOs cited reduced inflation (34%) and Federal Reserve interest rate cuts (28%) as top U.S. developments that might benefit businesses.”

“The significant labor hoarding that occurred over much of 2023 showed some sign of letting up in Q1 2024,” said Dana M. Peterson, chief economist of The Conference Board. “While 35% of CEOs said they expect to expand their workforce over the next 12 months, down slightly from 38% in Q4 2023, 23% expect to lay off workers, up significantly from 13% last quarter. The proportion of CEOs anticipating little change in their workforce stood at 42%, down from 49%. Meanwhile, the degree of difficulty attracting qualified workers and CEOs’ plans on wage increases were little changed in Q1 compared to last quarter.”

Current Conditions

CEOs’ assessment of general economic conditions improved markedly in Q1:

• 32% of CEOs said economic conditions were better compared to six months ago, up from 18% in Q4.

• 22% said conditions were worse, down from 32% in Q4.

CEOs also assessed conditions in their own industries to be substantially improved in Q1: • 31% of CEOs said conditions in their industries were better compared to six months ago, up from 27%.

• 25% said conditions in their own industries were worse, down from 37% in Q4.

Future Conditions

CEOs’ expectations about the short-term economic outlook improved in Q1:

• 36% of CEOs expect economic conditions to improve over the next six months, up from 19%.

• 27% expect conditions to worsen, down significantly from 47%.

CEOs’ expectations for short-term prospects in their own industries were also more optimistic in Q1:

• 39% of CEOs expect conditions in their own industry to improve over the next six months, up from 26% in Q4.

• 20% expect conditions to worsen, down from 29% in Q4.

Employment, Recruiting, Wages and Capital Spending

• Employment: 35% of CEOs expect to expand their workforce over the next 12 months, down only slightly from 38% in Q4. However, 23% of CEOs expect a reduction in their workforce, up from 13%.

• Hiring Qualified People: 31% of CEOs report some problems attracting qualified workers, but only in key areas, similar to the 32% in Q4. Only 15% report serious and/or widespread problems attracting qualified

• Wages: 72% of CEOs expect to increase wages by 3% or more over the next year, virtually unchanged from 71% in Q4.

• Capital Spending: Most CEOs are not planning to revise capital spending plans (59%). 28% of CEOs expect their capital budgets to increase over the next year, a slight uptick from 27% last quarter.

U.S. Challenges for Business in 2024

CEOs cite political uncertainty ahead of the 2024 elections as the main challenge affecting business this year.

Global Challenges for Business in 2024

The spread of existing wars was seen as the greatest global challenge for businesses this year, with deglobalization and U.S.-China tensions as distant runners-up.

U.S. Opportunities in 2024

CEOs look forward to reduced inflation and Fed interest rate cuts in the year ahead.

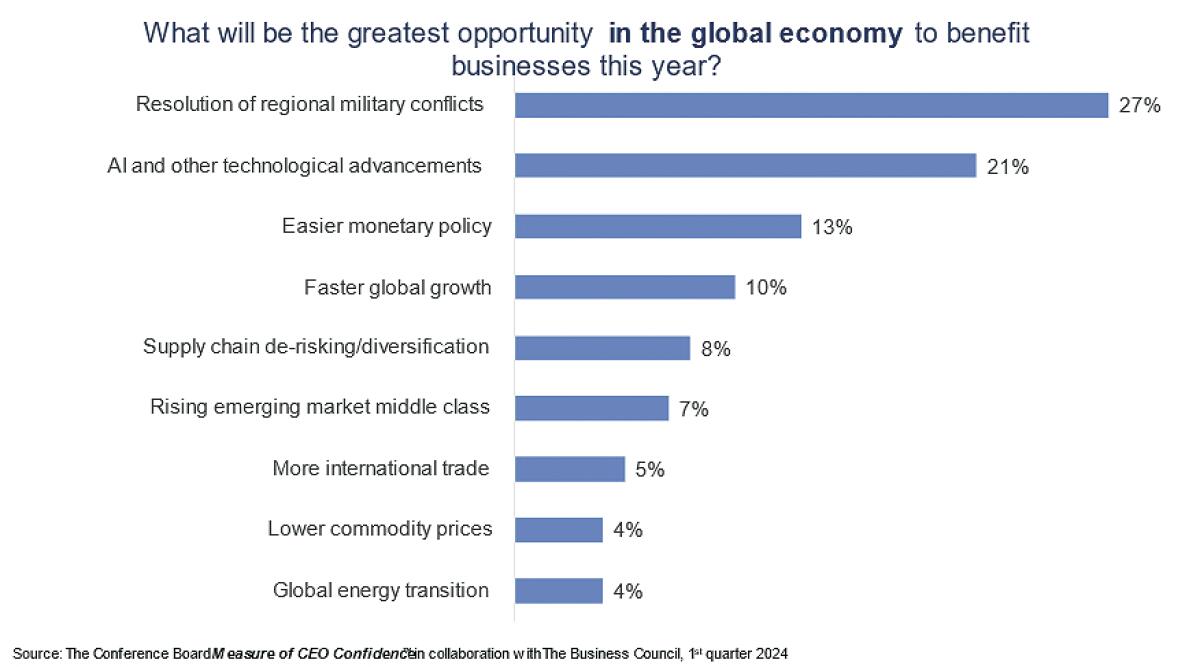

Global Opportunities in 2024

The resolution of regional military conflicts was the greatest global opportunity for this year, followed by AI and other technological advancements.